Overview

The objective of the User Guide is to

provide a step-by-step description of the new system flow with various screen

prints.

Please refer to the Arkansas Enterprise User

Guide, Volume 1, Section 1.1

Please refer to the Arkansas Enterprise User

Guide, Volume 1, Section 1.1.1.1

IFTA processing includes the following Supplements:

|

Supplement

|

Abbreviation

|

|

New Account

|

AAC

|

|

Renew License

|

RWC

|

|

Duplicate License

|

DUL

|

|

Additional Decals

|

ADC

|

|

Reinstatement

|

REI

|

|

Change License

Details

|

CFN

|

|

Continue License

|

AFL

|

Additional IFTA transactions include the

following:

·

Tax Returns

·

Tax Return Audits

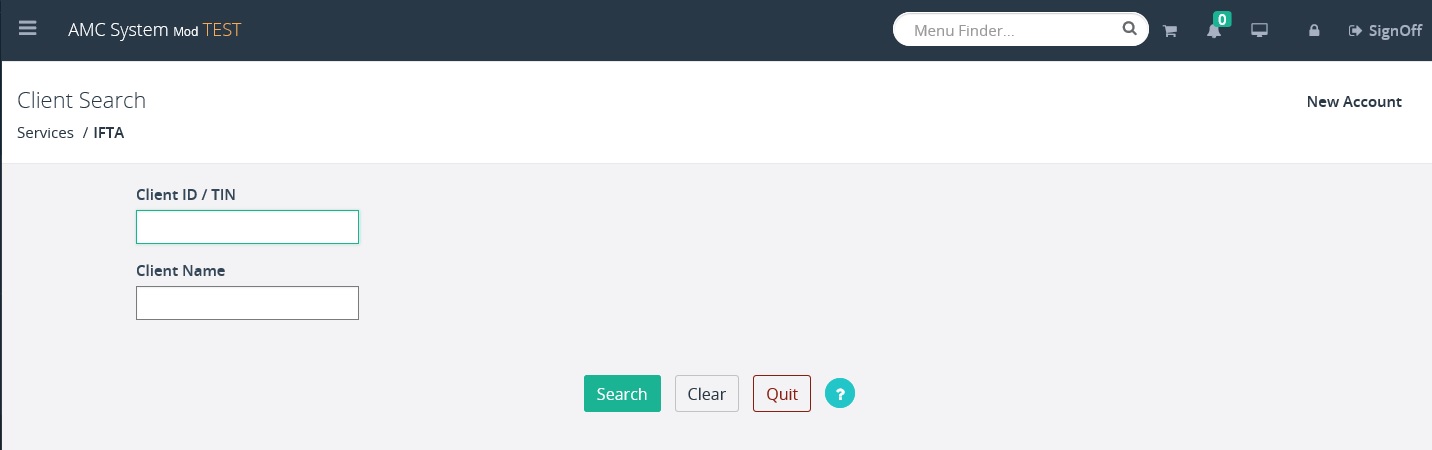

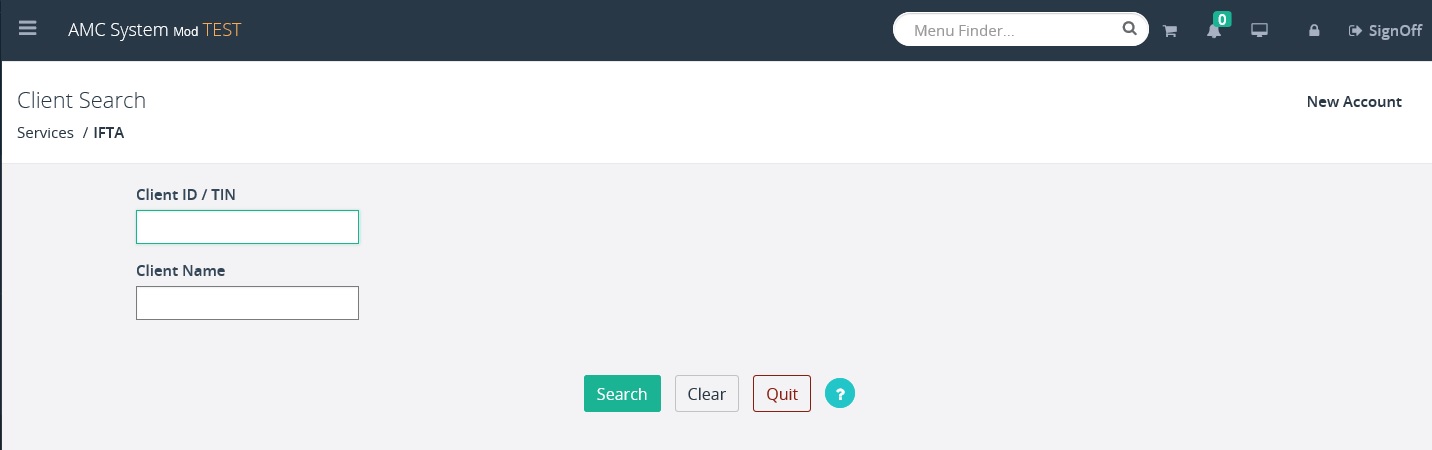

To create a new license, a client record should be created and

verified first. To begin the transaction, the user must provide the Client No. or TIN. The client information will be searched on the

provided information, if a client record is found the process will continue. If a matching

client record is not found an error message will be displayed notifying the user a client record does not exist and must be

created.

Follow the steps below to create a new IFTA Account:

- Select IFTA under the

SERVICES header on the left column of the screen

- From the IFTA Menu, select

NEW ACCOUNT from the ACCOUNT menu tile

- On the Client Search screen,

enter either the Client ID/TIN or the Client Name

- Select SEARCH to display the

IFTA Account screen

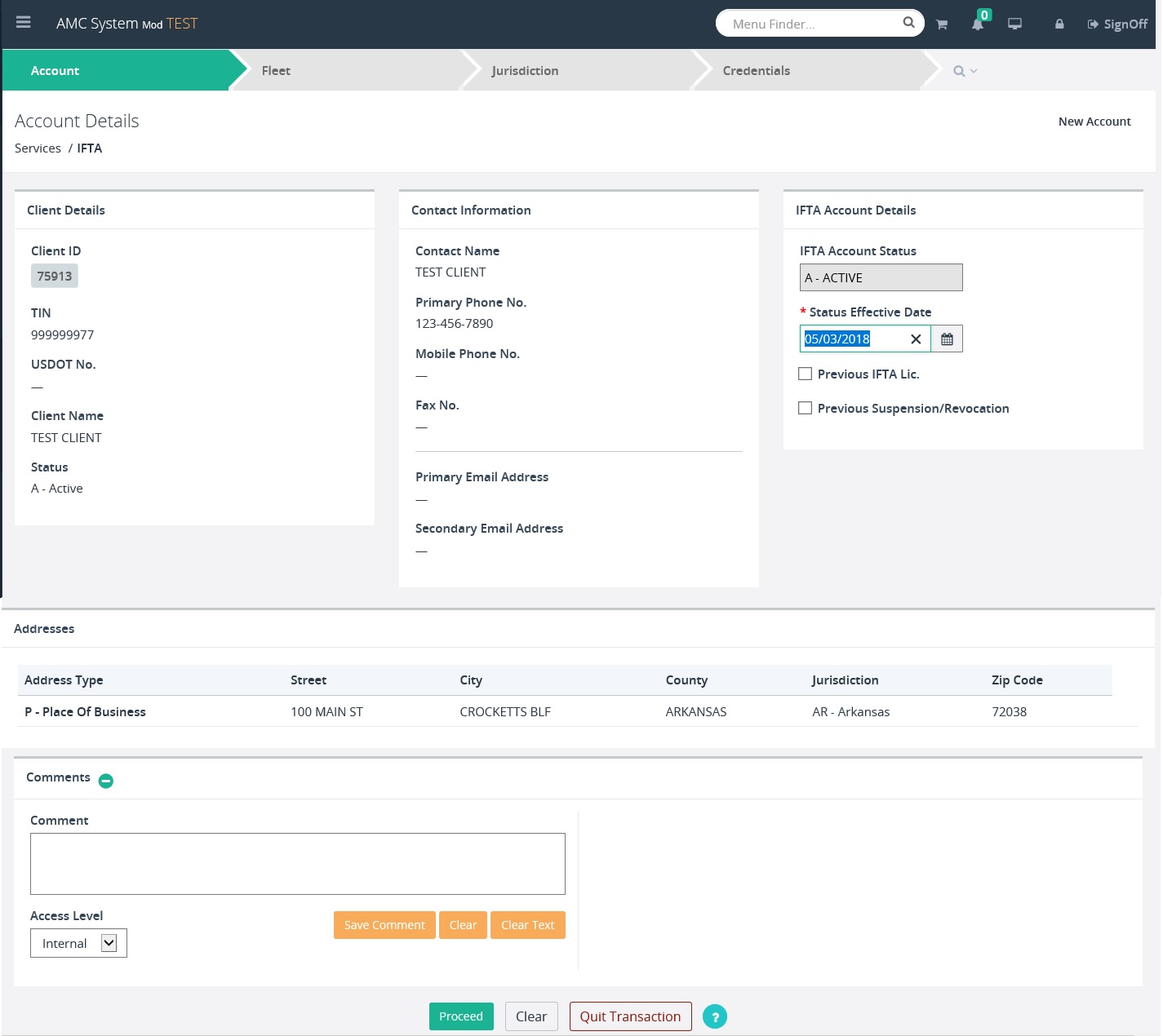

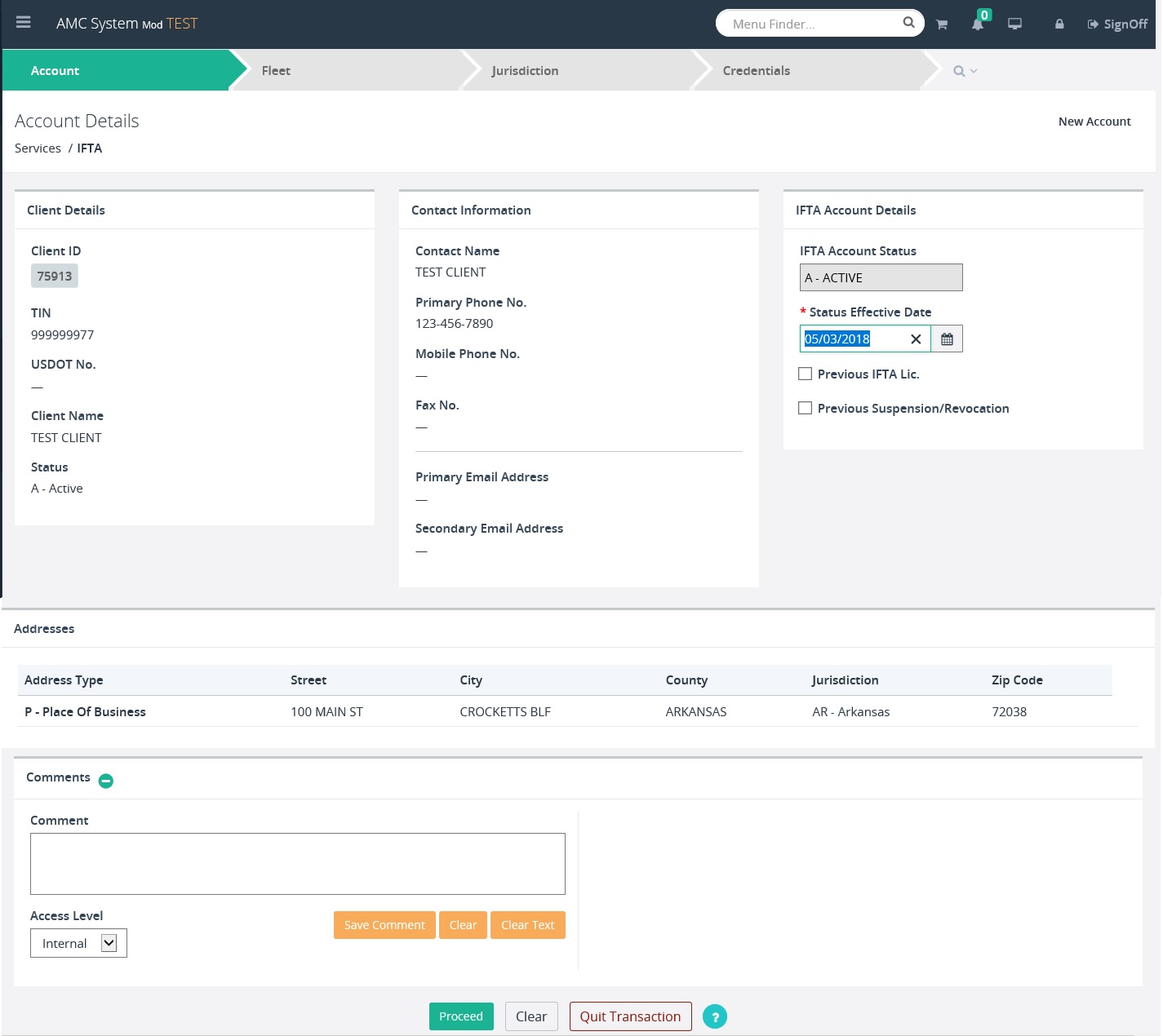

A new IFTA account can only be

established if owner information exists on the Client account. The IFTA account profile must be established using the Account Detail

Screen.

The Client Details and Contact Information

fields populate from the information in the Client record and the user cannot change

this information.

· Customer Details

o

Client ID

o

TIN

o

USDOT No.

o

Client Name

o

Customer Status

· Address Details

o

Physical Address

o

Mailing Address (if provided)

· Contact Information

o

Contact Name

o

Primary Phone No.

o

Mobile Phone No. (if provided)

o

Fax No. (if provided)

o

Email

· IFTA Account Details

o

IFTA Account Status – is defaulted to ACTIVE and

the user cannot change it

o

Status Effective Date – is defaulted to the

current date and can be changed

o

Comments – The user clicks the plus (+) or minus

(-) icon to expand this section and add free-form comments in this area. After

adding text to the comments box, the user must click on the SAVE COMMENT button

to save the comment in the account record

NOTE: The “Allow Delete” checkbox is defaulted to checked, and the

user can uncheck it if the comment should not be deleted at any future point.

Click the PROCEED button to execute the application’s

edits and display the validation screen.

The validation screen will be displayed showing the user a

consolidated view of the Account information. If the user determines some of

the information needs to be corrected, they can select BACK and the system will

display the Account screen again. The user can make the required changes and select

CONFIRM.

After CONFIRM is selected on the validation screen, the

IFTA account information will be saved to the database and the License Detail screen will be displayed..

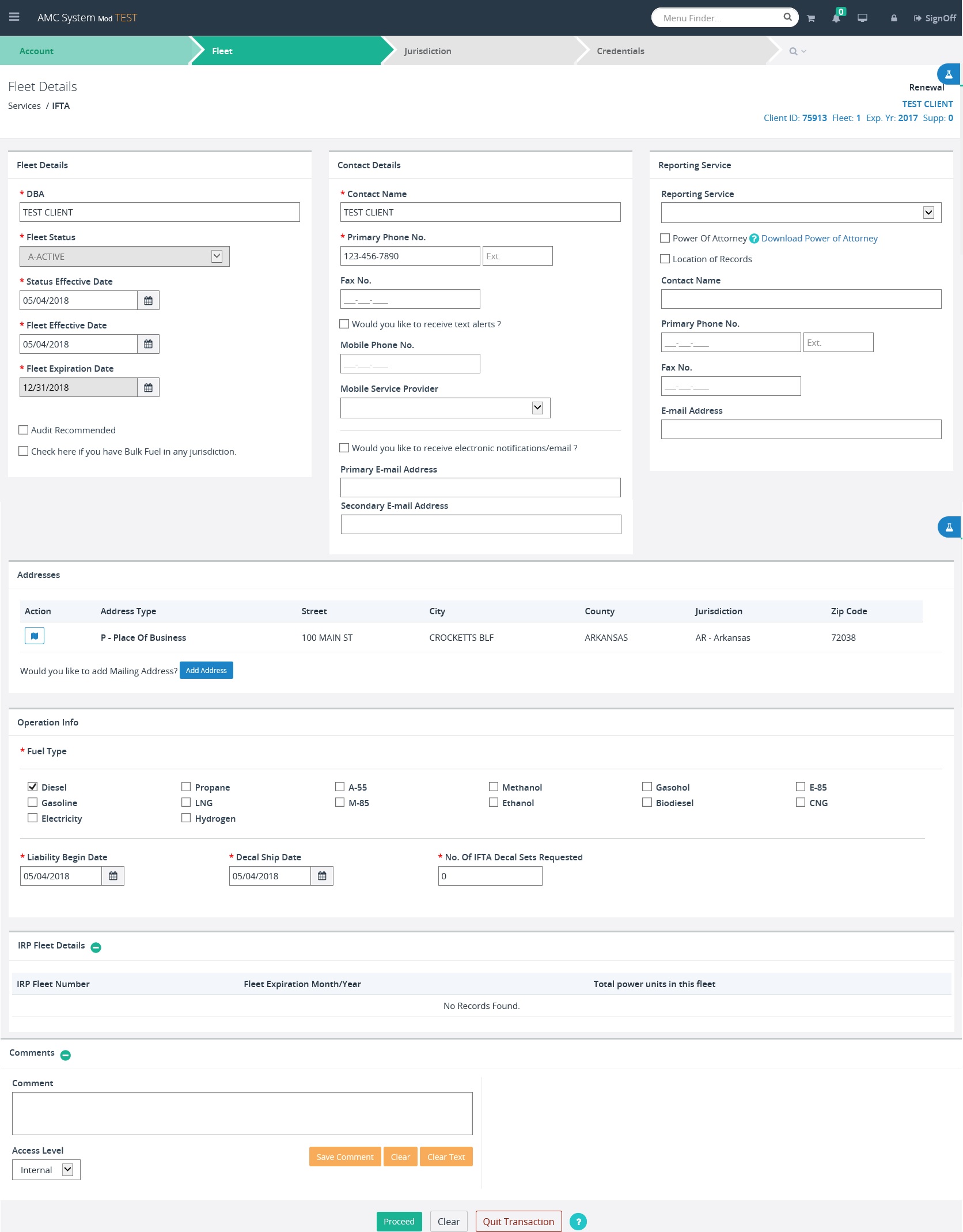

1.3.1.2 Add Fleet

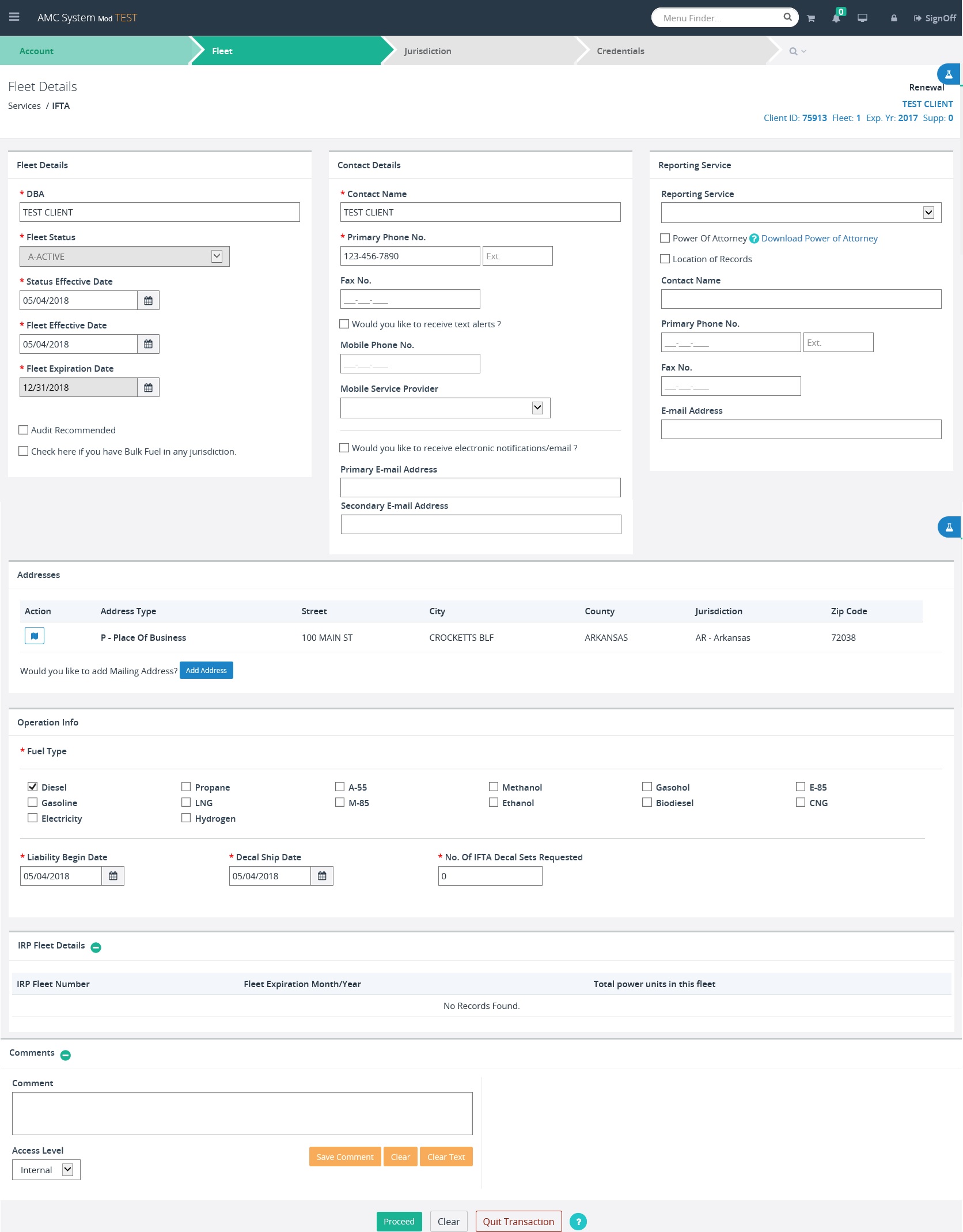

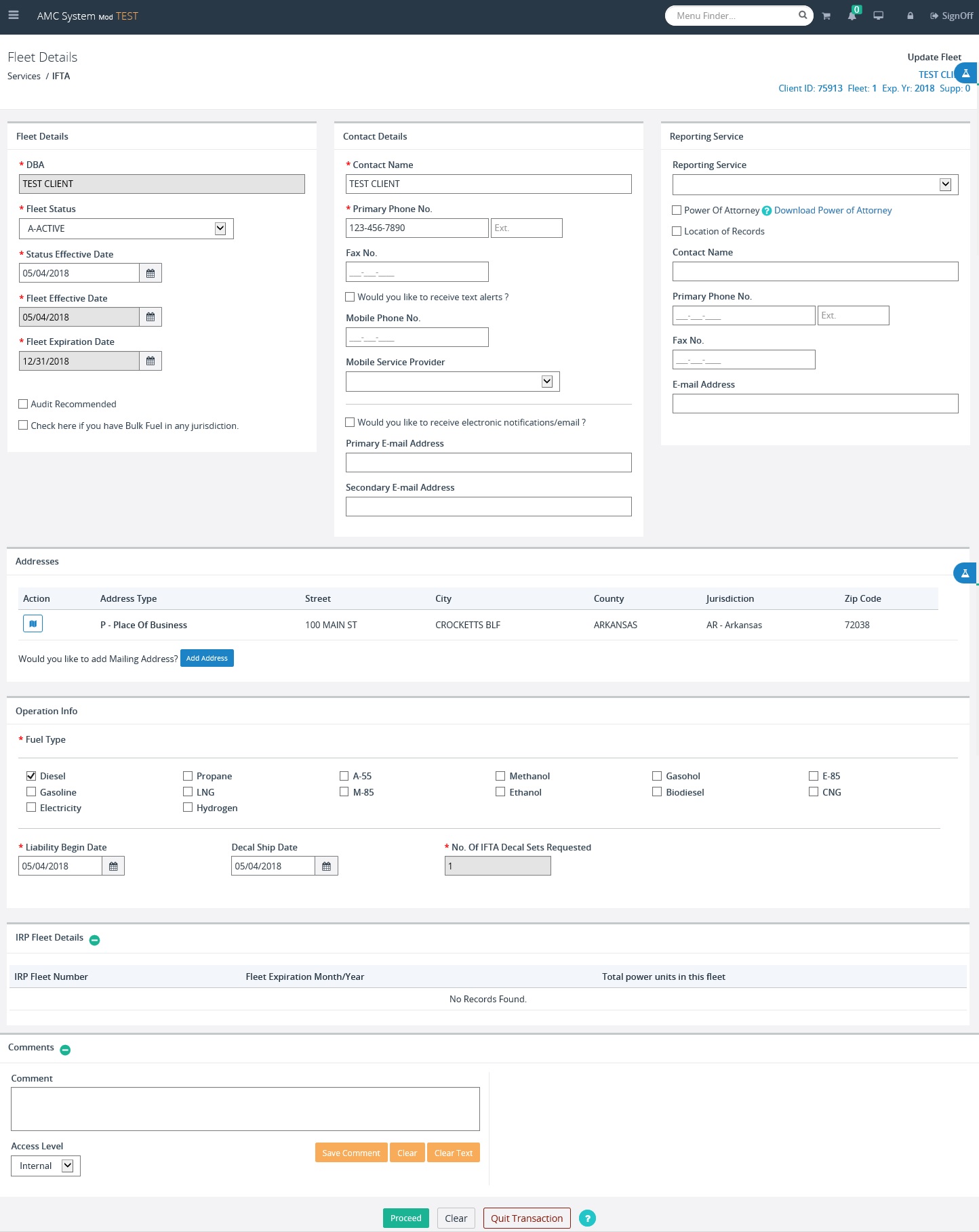

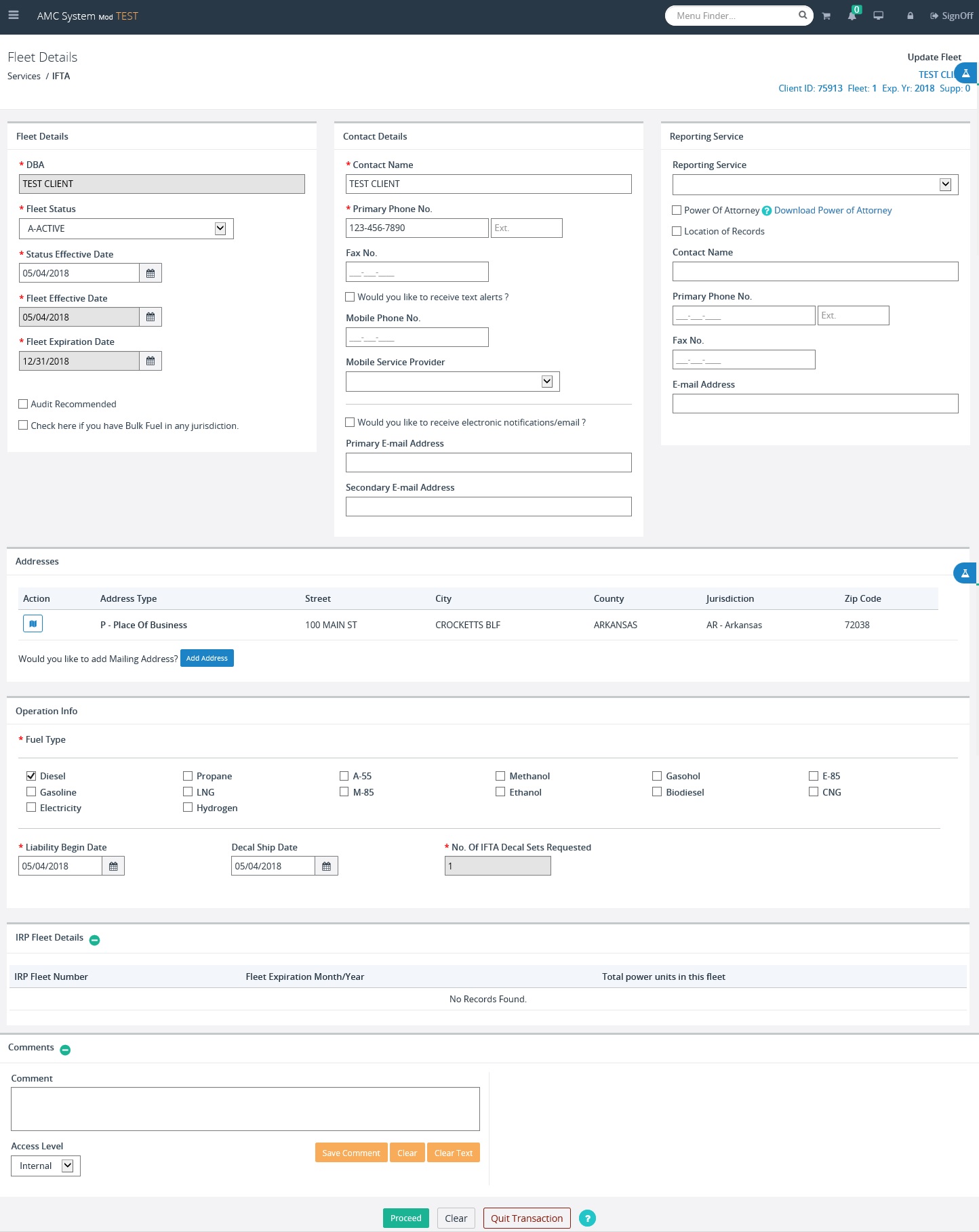

The Fleet Detail screen will pull

information from the client screen and default the status to “A-Active”. A red

asterisk indicates mandatory fields “*”.

The following fields cannot be changed on the fleet details screen. If

changes are required, the user must make the necessary changes at the Client

level.

- Client Name

- Legal Name

- Fleet Status

- Fleet Expiration Date

The following information is defaulted

from the account information,

if it was populated and may be changed:

· DBA

· Contact Name

· Primary Phone NO.

· Mobile Phone number

· Mobile Service Provider

· Fax No

· Reporting Service Information

· Place of Business address (can be edited but not deleted)

· Mailing address can be updated or deleted

The Fleet Details screen provides the user a snapshot

of any available IRP account(s) and fleet(s) associated to this customer to

assist in the issuance of IFTA decals.

Complete the Operation Info by selecting the

following:

- Fuel Type

- Liability Begin Date – Defauts to today’s date

but can be changed

- Decal Ship Dated – Defaults to today’s date but

can be changed

- No of IFTA Vehicles – enter a value

- No. of IFTA Decal sets requested – enter a value

Comments – Use the plus (+) or minus (-) icon to

expand and close this section and add free-form comments in this area. Select

the SAVE COMMENT button to apply comments to the record, select the Access

Level and indicate whether the comment can be deleted by checking/unchecking

the Allow Delete checkbox. Enter comments as necessary.

·

After you have entered the information, click

the PROCEED button on the command line and the system will perform edits to ensure

that you have entered all the mandatory fields and that they are correct to the

extent possible. The validation screen will display, click CONFIRM to continue

the transaction

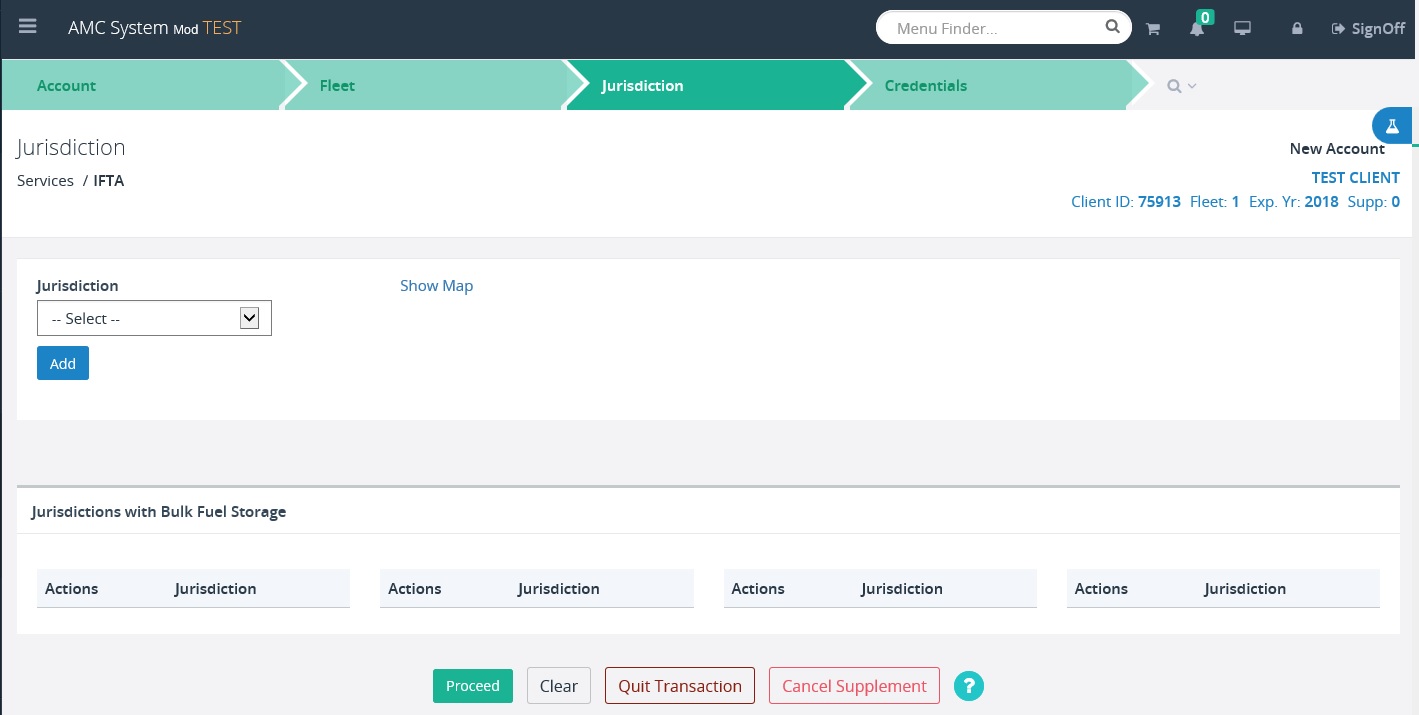

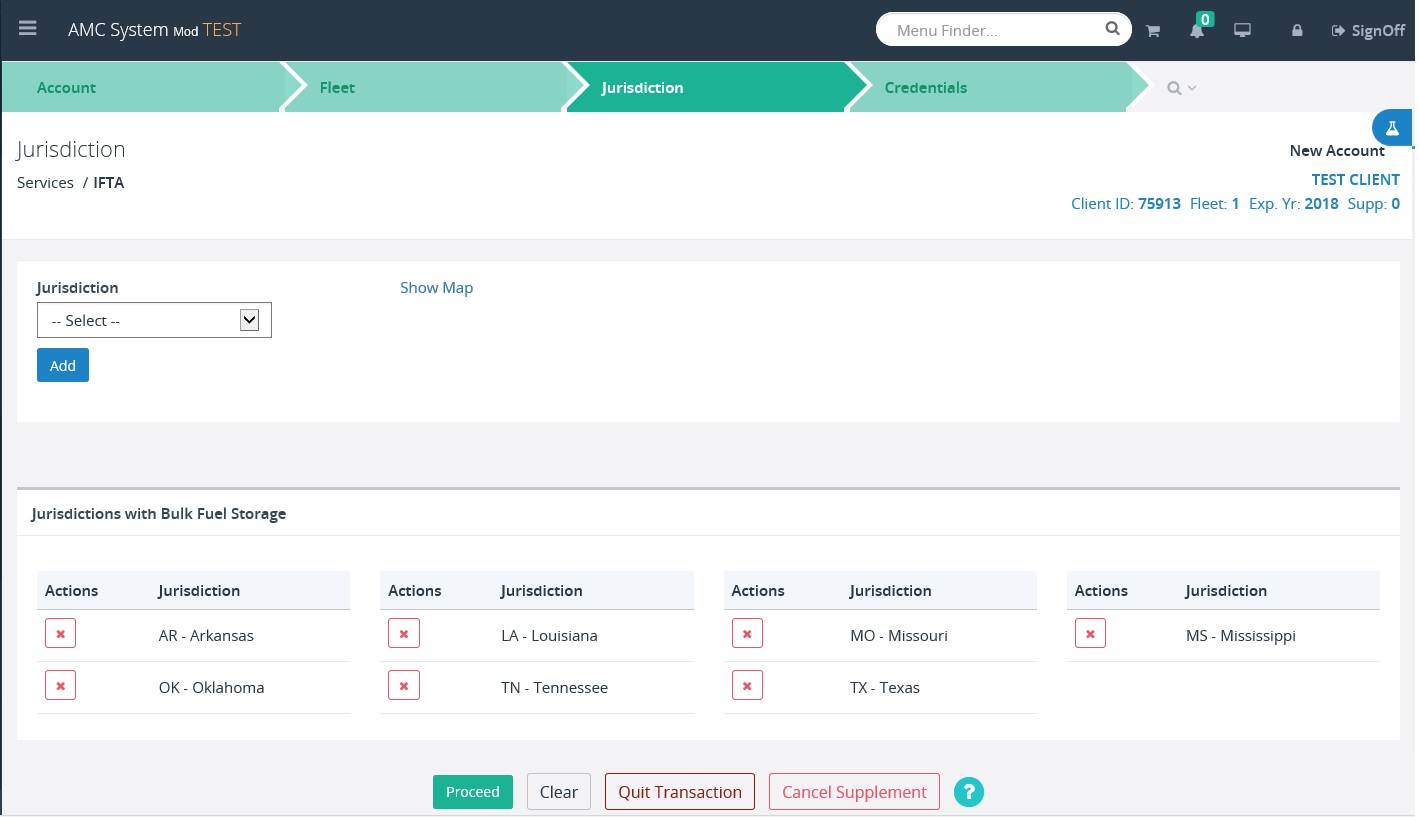

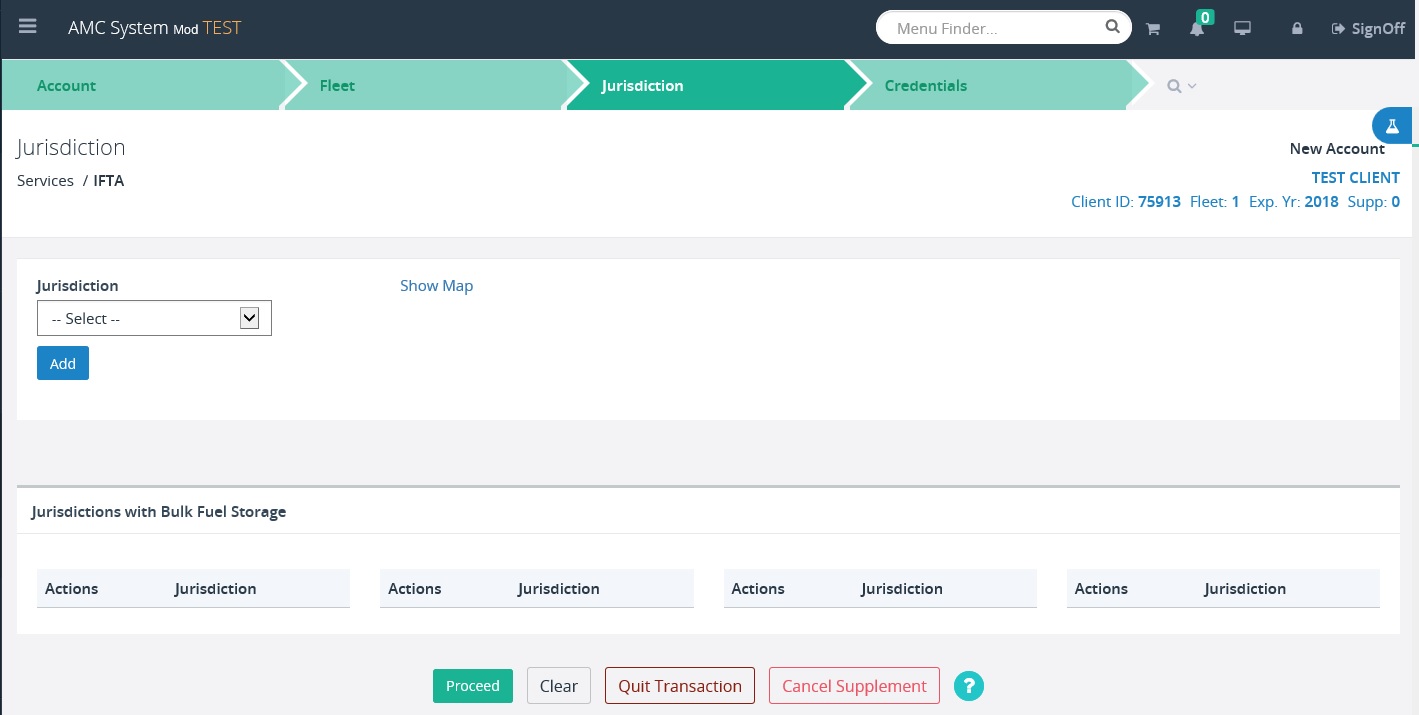

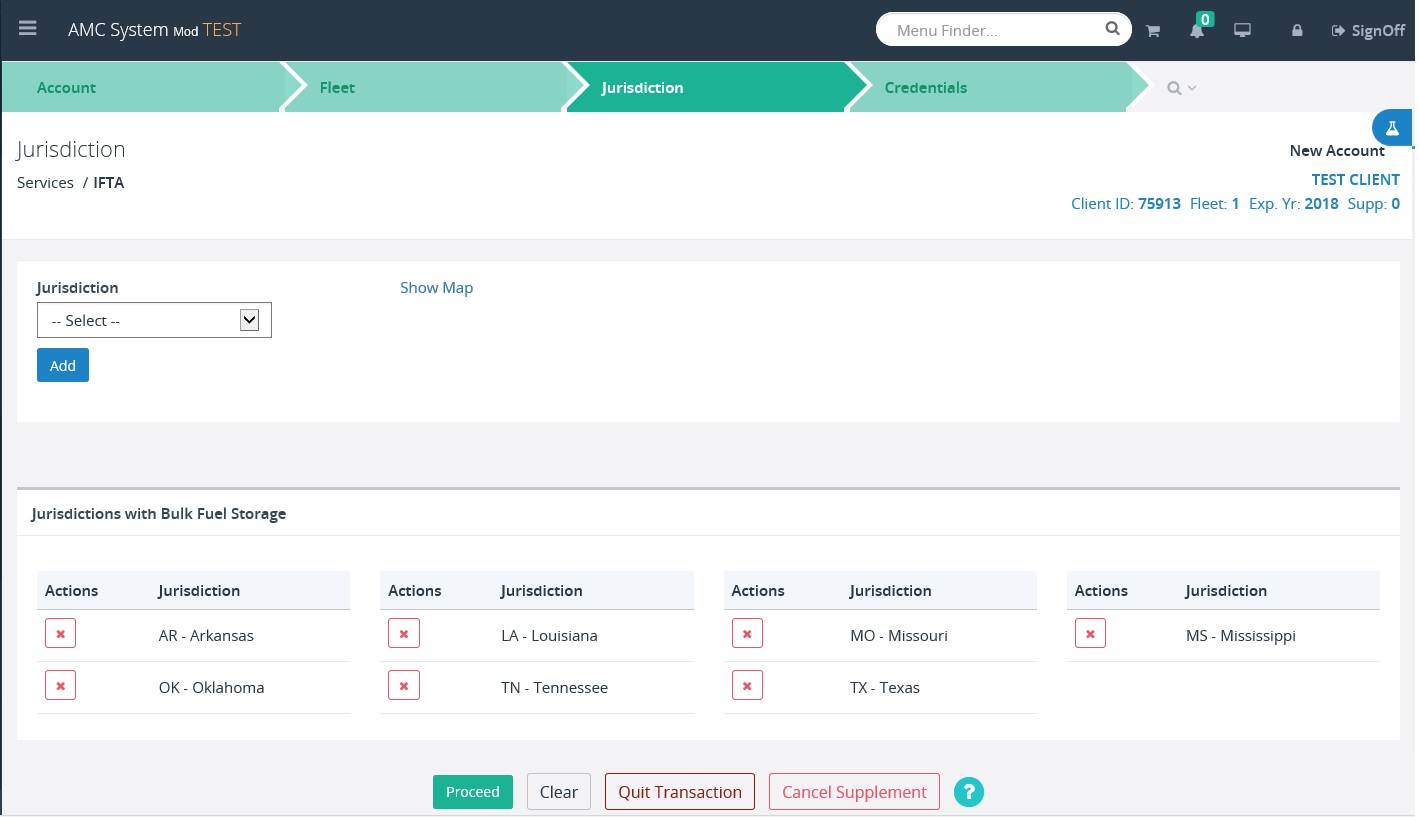

1.3.1.3 Jurisdiction

The Jurisdiction screen contains a list of

all jurisdictions where a customer has Bulk fuel storage.

To add additional jurisdictions, perform the

following steps:

- To select a

jurisdiction from the map:

o Select the Show Map link to display the map

o Select the appropriate jurisdiction which will be

added to the jurisdictional field

- To select a

jurisdiction, from the Jurisdiction List dropdown:

o Click in the Jurisdiction field to display a

list of jurisdictions

o The jurisdiction dropdown contains a list of

individual jurisdictions as well as groups of jurisdictions

- Select the ADD

button to include the jurisdiction(s) to the list

To remove a jurisdiction(s) that was added by

mistake:

- Check the

checkbox associated with the jurisdiction and it will be removed

To start over with the selection of

jurisdictions, select CLEAR on the command line

- All jurisdictions

will be removed

To stop the entry of the renewal without losing

the Account and License Details information

- Select QUIT

TRANSACTION

- The user will be

able to access the account and fleet information that have been entered

through the Continue/Payment – Search Supplement functionality

o This process will be covered in the Continue/Payment

section of this manual

To cancel the fleet for any reason, select

CANCEL SUPPLEMENT

- The system will

display a message asking the user to confirm the cancellation request

- After confirming

the cancellation, the user will be returned to the IFTA Application level menu

- A message will

display to let the user know the Fleet has been successfully cancelled

Select PROCEED to display the Jurisdiction verification

screen

Select CONFIRM from the Jurisdiction verification

screen to display the Credential Details screen

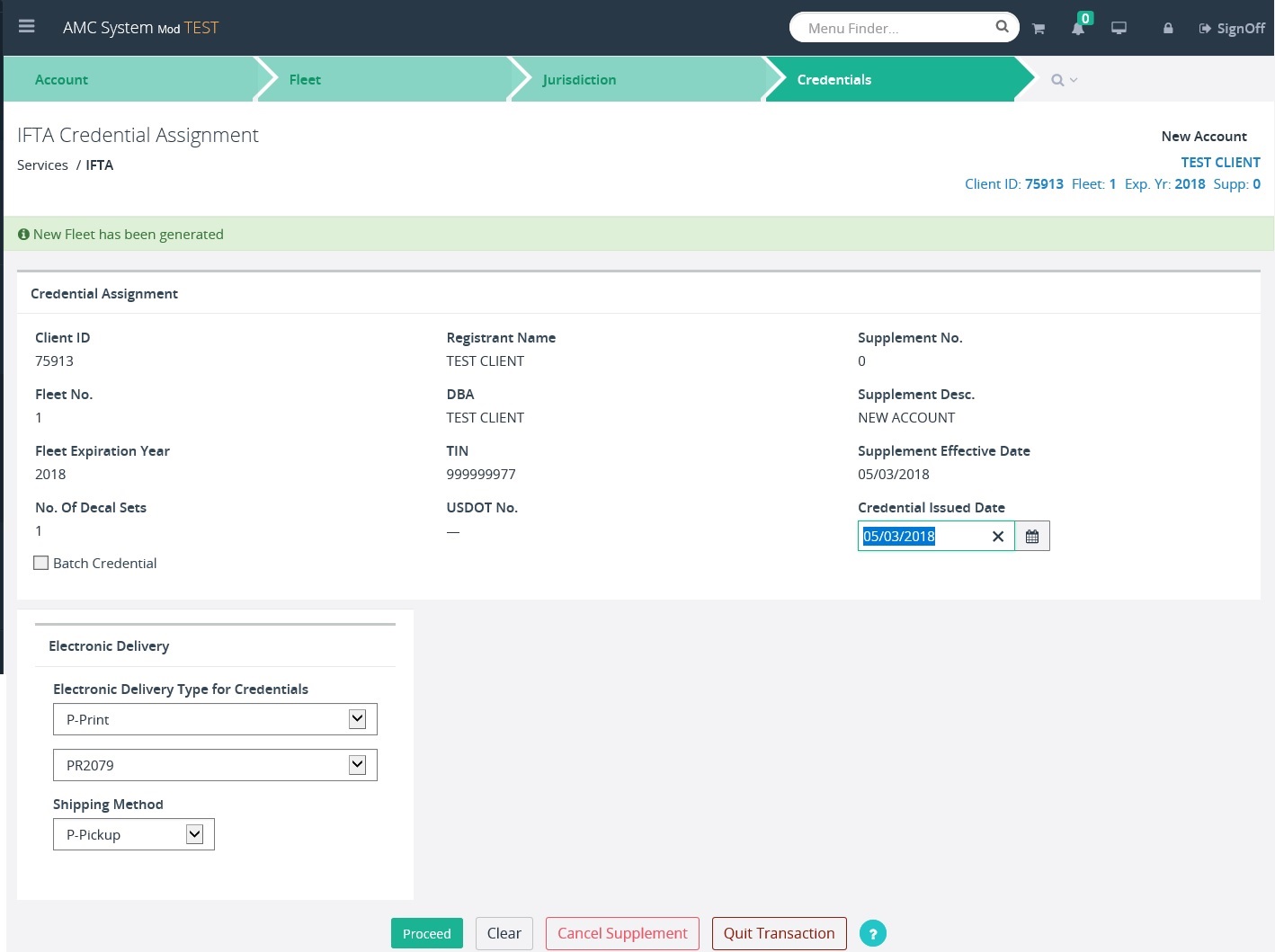

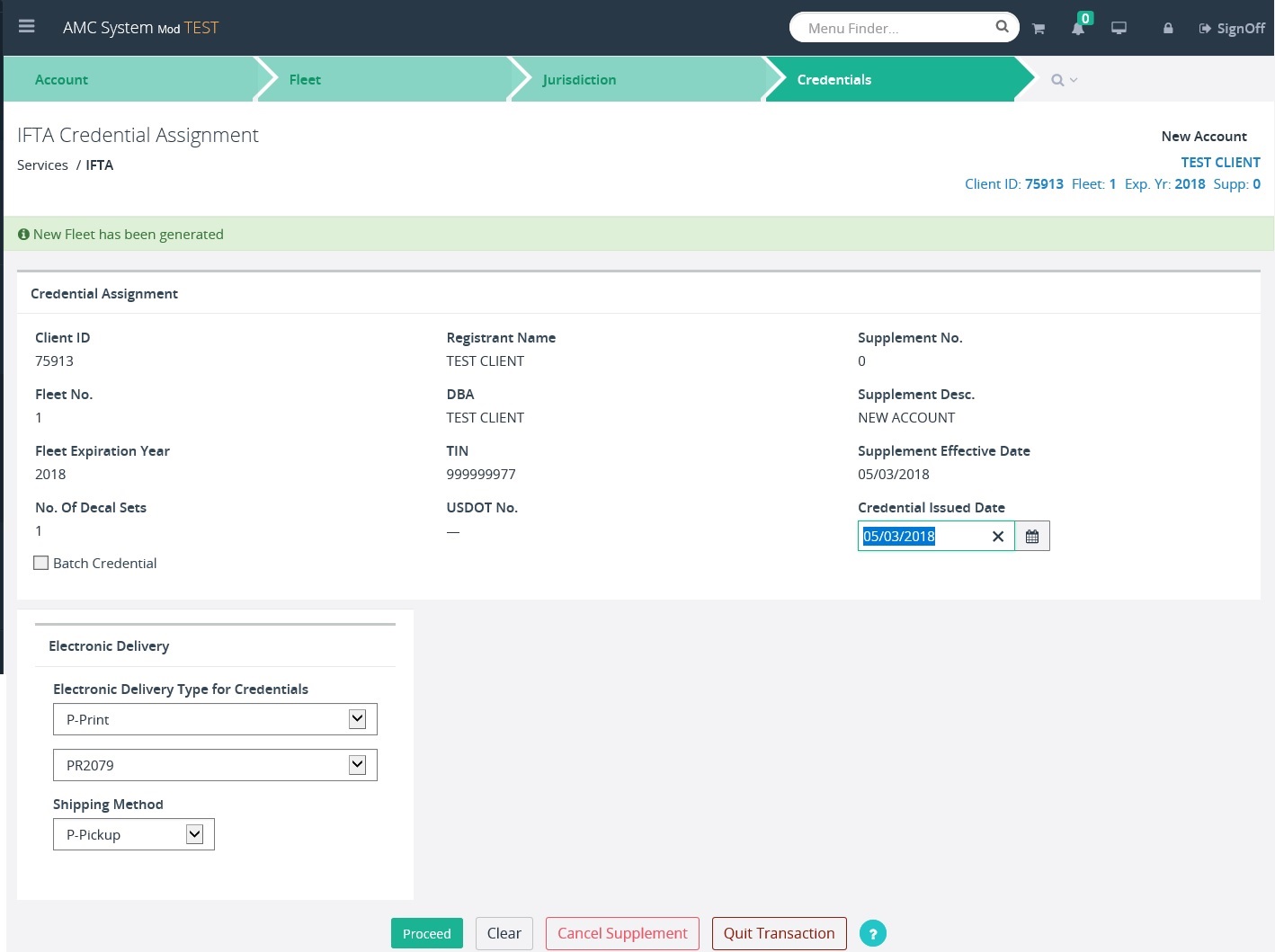

Proceed from the Credentials page will generate the following documents.

- IFTA License

- 30 Day IFTA Temp Permit

- Shipping Document displaying the decal

number(s)

1.3.2 Renew Fleet

IFTA licenses must be renewed annually and are valid for the

calendar year January 1 through December 31. Renewal Notices and decal

applications are sent to active carriers during the month of November.

Renewals will not be allowed if:

- There are past due,

non-filed, or outstanding balances on tax returns on the existing license

· License status is

not Active

The current IFTA license information will

be populated with the existing values from the previous year except for the DBA

If changes are required for the client name or other client information, the

user should change them by updating the Client account information at the

Enterprise application level.

- The Fleet Details screen provides the

user a snapshot of the existing IFTA account and fleet information as well

as any available IRP account(s) and fleet(s) associated to this customer

to assist in the issuance of IFTA decals.

- Verify the information and Select PROCEED

from the Fleet Details screen and verification screen to move to the

Renewal Jurisdiction screen

Note: The system

will check the IFTA license account and if there is cause to deny the renewal,

a letter will be generated with the reasons for the IFTA renewal denial.

Once the user has made any necessary

updates to the IFTA Fleet screen in the IFTA Renewal transaction, the supplement

will go directly to the Billing screen.

The user can click on the Jurisdiction tab

at the top of the screen to make any necessary jurisdiction changes on this

screen as indicated in the New Carrier Account Process (See 1.3.1.3)

Once all the jurisdiction information is

updated, select the PROCEED button to move to the Credential assignment.

1.3.3

Supplement Functions

The various supplement transactions can

be accessed by selecting the associated option within the Supplements menu tile

on the IFTA Application main menu screen, with the exception of the Change

Fleet supplement which is located within the Fleet menu tile. IFTA

supplements include the following:

·

Additional / Replacement Decals

·

Change Fleet

·

Issue Temp Permit

·

Decal Correction

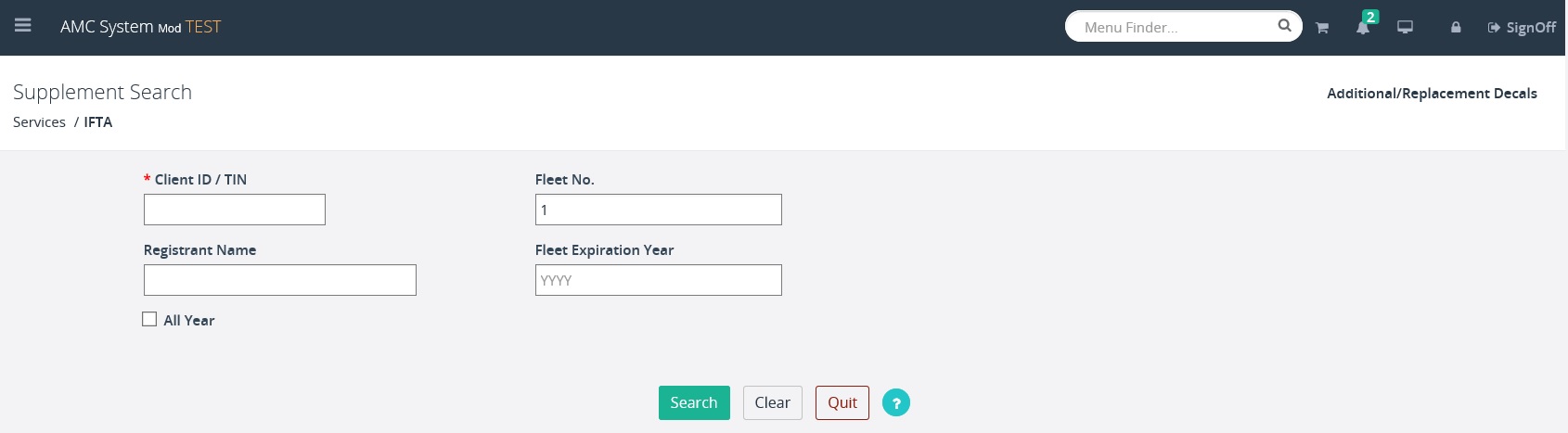

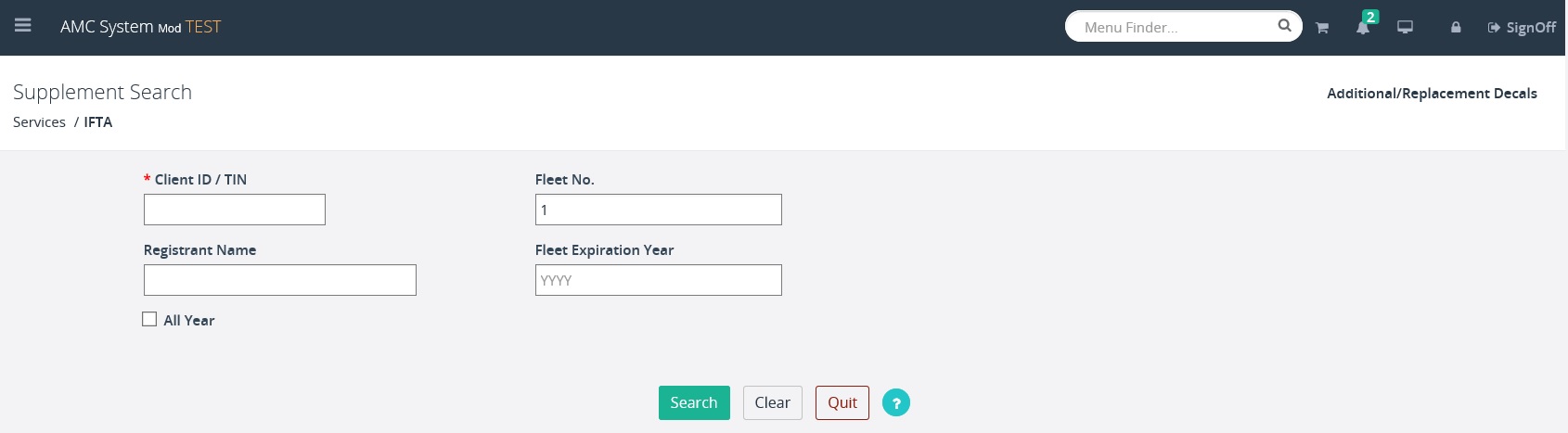

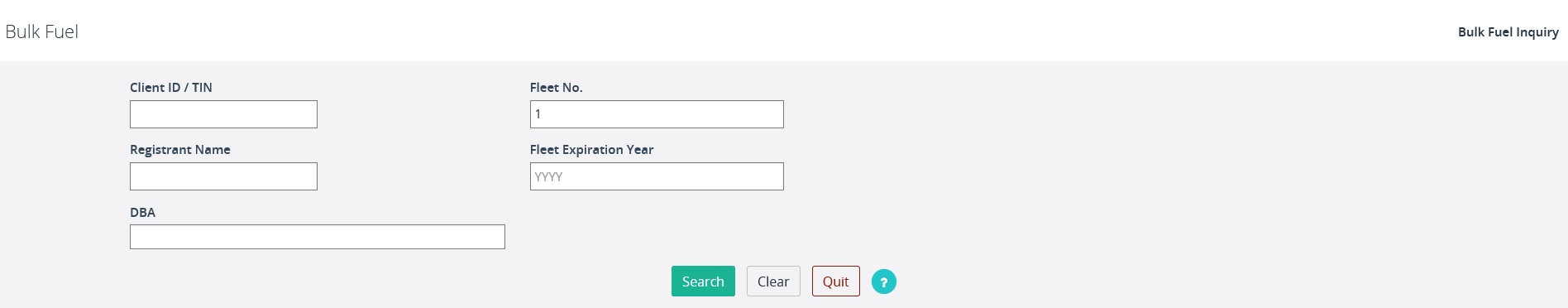

The user will click the desired

supplement option and then a supplement search screen will appear. The initial

supplement search screen is common among all the available supplements with the

Supplement Type appearing at the upper right corner of the screen. The common

search fields include, Client ID / TIN, Registrants Name, Fleet No., and Fleet

Expiration Year.

issue additional decals, do the following:

·

Select ADDITIONAL / REPLACEMENT DECALS from the

SUPPLEMENTS menu tile at the IFTA application level menu

·

Enter at a minimum the Client ID/TIN and Select PROCEED to display the account

·

The IFTA account status must be Active. If the

IFTA account is not active (closed or revoked), a message will inform any user

of the condition and issue a hard stop.

- Decal information will be provided to the

Clearinghouse

Throughout the year the carrier may need to change IFTA license

information and receive a new license. The changes may include DBA, addresses,

and fuel types. As a result of this supplement, a new license will be issued.

If the Client Name TIN, or USDOT No. require changes, the updates

must be made at the Enterprise / Client level, prior to creating the Change

License Details supplement

To process a Change Fleet supplement, perform the following steps:

·

Select CHANGE FLEET from the FLEET menu tile at

the IFTA application level menu

- Enter at a minimum the Client

ID/TIN and select SEARCH

o

Select PROCEED to display the Account Details

screen

- Update the appropriate

information

- Select PROCEED to display the

Account Details verification screen

- Verify the license

information and select CONFIRM to display the Fleet Details screen

- Make any necessary updates

and provide any required information not already filled in then select

PROCEED to view the verification screen

- Select CONFIRM to apply the

changes and proceed to the Billing screen

- Jurisdiction screen – The

supplement bypasses this screen but if required, the use can click the

Jurisdiction tab at the top of the screen to make any updates and proceed

forward

- At the Billing Screen update

the document information and select the CALCULATE BILL button to generate

the invoice.

- Select the Credential

Assignment Type information and Electronic Delivery method then select

PROCEED

- Verify the IFTA Payment

Detail information and select either PAY NOW or ADD TO CART

- Since the Change Fleet

supplement has no fees attached, the user will be directed to select the

CONTINUE PAYMENT option and the payment entry details will be disabled.

- Select CONFIRM to complete

the supplement

A new license and a shipping document may be

generated based upon the Electronic Delivery Type.

If AMCS has determined that an IFTA

customer qualifies for decal refund, this supplement is used.

An IFTA license will not be issued upon the

completion of this supplement.

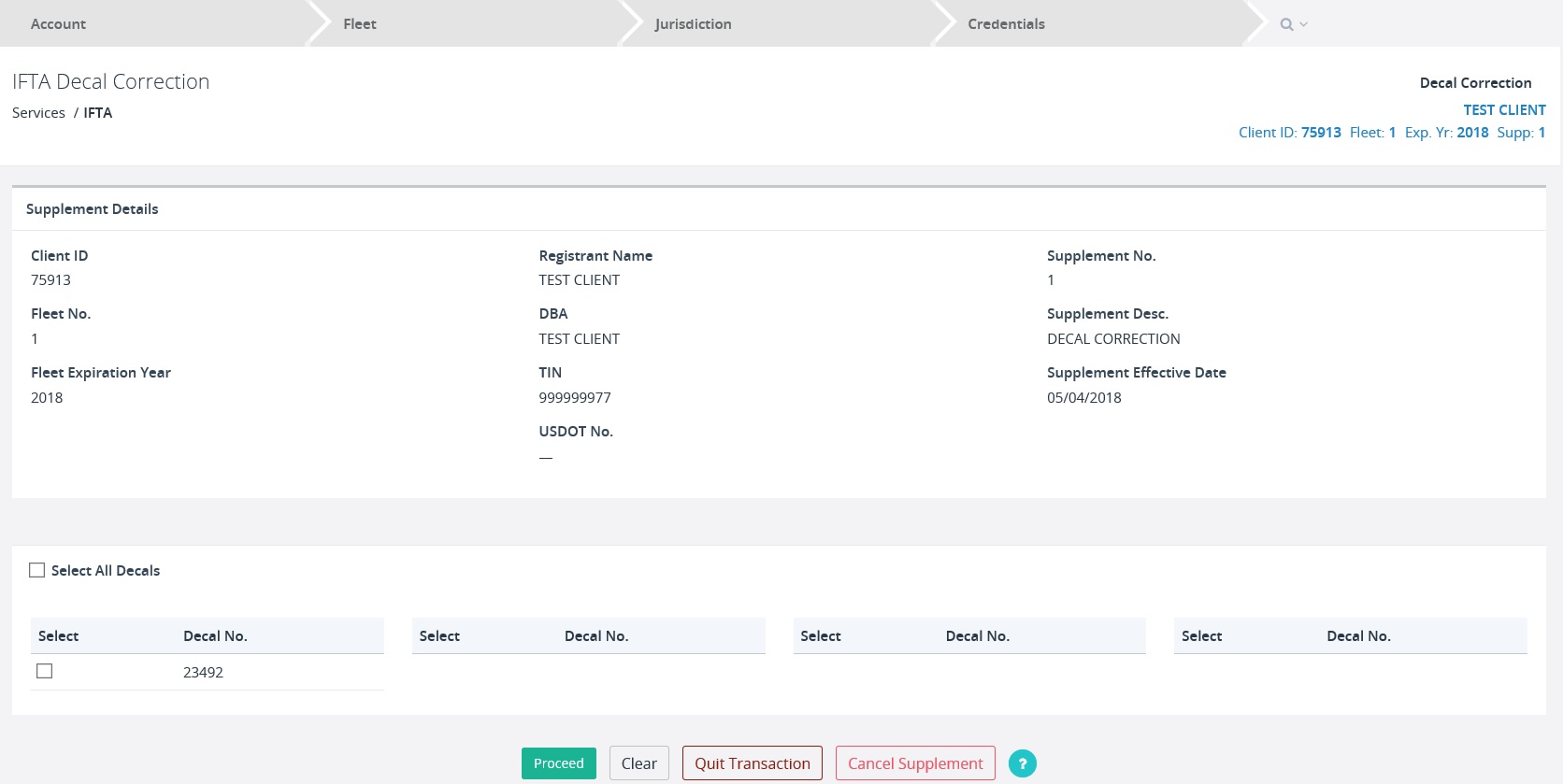

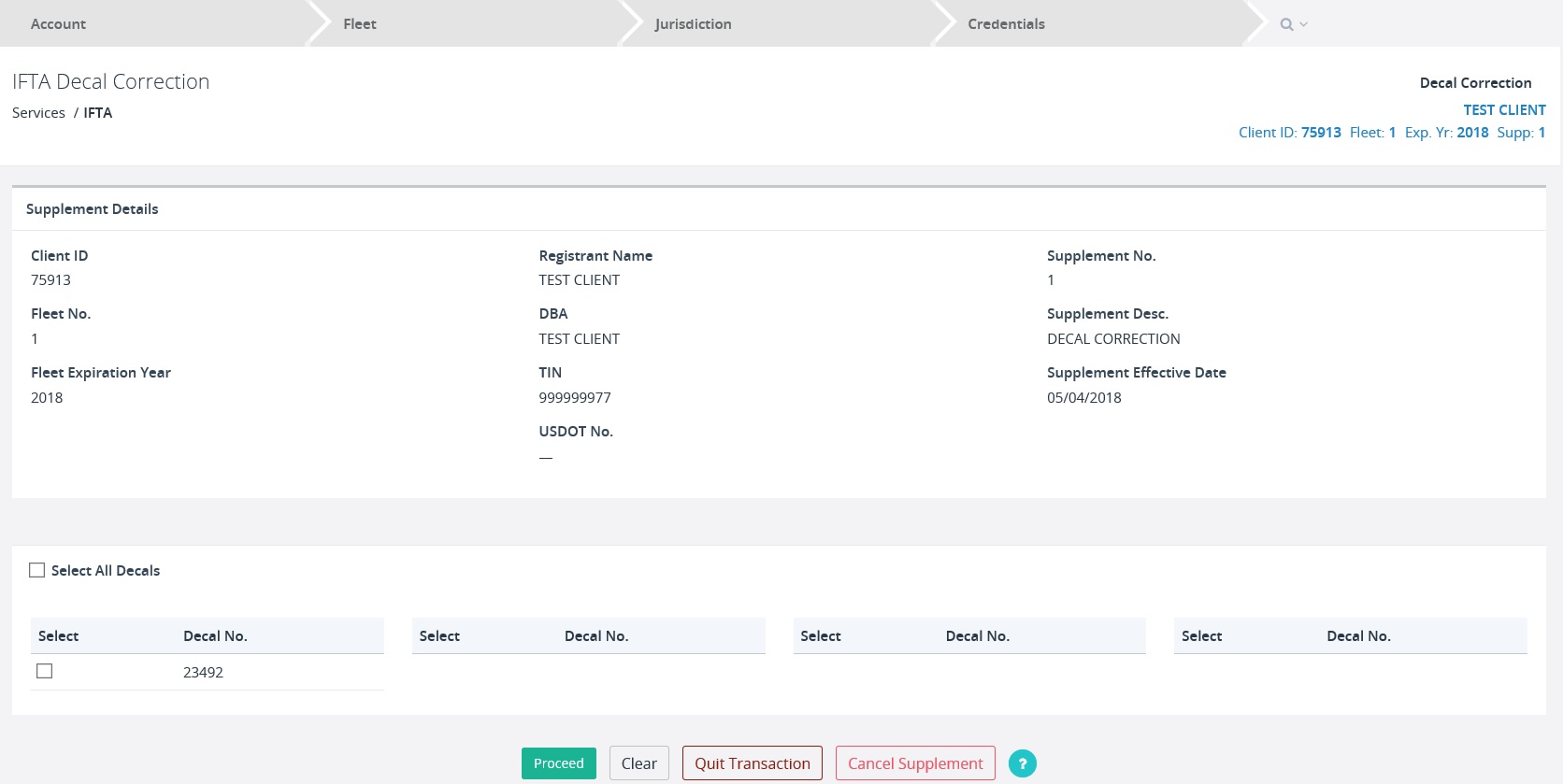

To complete the decal correction supplement, perform the following

steps:

·

Select Decal Correction from the SUPPLEMENTS

menu tile at the IFTA application level menu.

- Enter at a minimum the Client

ID / TIN

- Select SEARCH to display the account and select

the supplement

- Select the decal to be removed from the

fleet and proceed from the page.

- Select CONFIRM at the verification screen

to proceed to the Billing screen

- No fee is due and refund is created, so

continue through to the supplement and finish the payment to remove decal

from the fleet.

1.3.4

Continue/Payment

The Continue/Payment

transaction works to allow a user to continue a transaction already in progress

and allows a user to:

·

Quit in the middle of a transaction without

losing the information processed to that point

·

Access unfinished supplement transactions at the

point where the last logical piece of work has been completed

·

To continue processing a tax return, Select TAX

RETURN from the CONTINUE/PAYMENT menu tile, then:

o

Enter the Client ID / TIN and return year and

quarter if available - (additional search fields are available for use)

o

Click the SEARCH button to display a list of

available tax return options

§ If

only one tax return exits, the system will automatically continue to the tax

return details

§ If

multiple tax return options exist, a list of tax returns will display and the

user will select the desired tax return to continue processing

For IFTA, Continue

/ Payment includes the following options:

- Search

Supplement

- Tax Return

·

Audit Return

A

user will not be able to continue a transaction using the Continue / Payment

option if the account/license status is in cancelled or revoked status.

To

continue a supplement already started but not completed, do the following:

·

Select SEARCH SUPPLEMENT from the

CONTINUE/PAYMENT menu tile

·

Enter the required Client ID/TIN and any

additional search fields if known

·

Click the SEARCH button

The

system will retrieve the supplement from the last logical step saved when the

user quit the supplement. Continue the supplement through completion or select

the CANCEL SUPPLEMENT if so desired.

To

continue a tax return already started but not completed, do the following:

·

Select TAX RETURN from the CONTINUE/PAYMENT menu

tile

·

Enter at least one of the search fields –

provide the Client ID / TIN, return year and return quarter to narrow the

search

·

Click the SEARCH button to continue the tax

return

To

continue an audit tax return started but not completed, do the following:

·

Select AUDIT RETURN from the CONTINUE/PAYMENT

menu tile

·

Enter the required Client ID/TIN and any

additional search fields if known to narrow the search

·

Click the SEARCH button

The

system will retrieve the audit tax return from the last logical step saved when

the user quit the supplement. Continue the audit tax return through to

completion.

IFTA (Quarterly Tax Return form) will be

generated via a batch process prior to quarter end for each active customer. A

separate return will be generated for each fuel type and the appropriate tax

rates will be pre-populated on the form. The customer should return the

completed form prior to the quarterly due date to prevent interest and penalty

charges.

- Tax returns are due the last

day of the following month of the quarter end

o

1st quarter (January – March) are due

April 30 of the given year

o

2nd quarter (April – June) are due

July 31 of the given year

o

3rd quarter (July – September) are

due Oct 31 of the given year

o

4th quarter (October – December) are

due Jan 31 of the following year

- If the due date falls on a Saturday,

Sunday or holiday, the return final filing date is the following business

day

- Quarterly tax reports must be

filed on time even though no operations happened during the reporting

period

- Reports also must be filed even

if there is no out-of-state activity for the reporting period. The base

jurisdiction distance and fuel purchased must be reported

Returns are subdivided into four

categories:

o

The initial entry of a quarterly return

o

Once the original return has been completed

through the post payment process, any changes requested by the client results

in an amended return

o

If a return requires a change based upon a AMCS

error, a correction can be made to the return. This transaction is normally

done after transmittal of the information to the other jurisdictions.

o

As part of the audit process, each return that

is included within the audit timeframe will be included in the audit.

Incomplete returns can be accessed through

the CONTINUE / PAYMENT menu option.

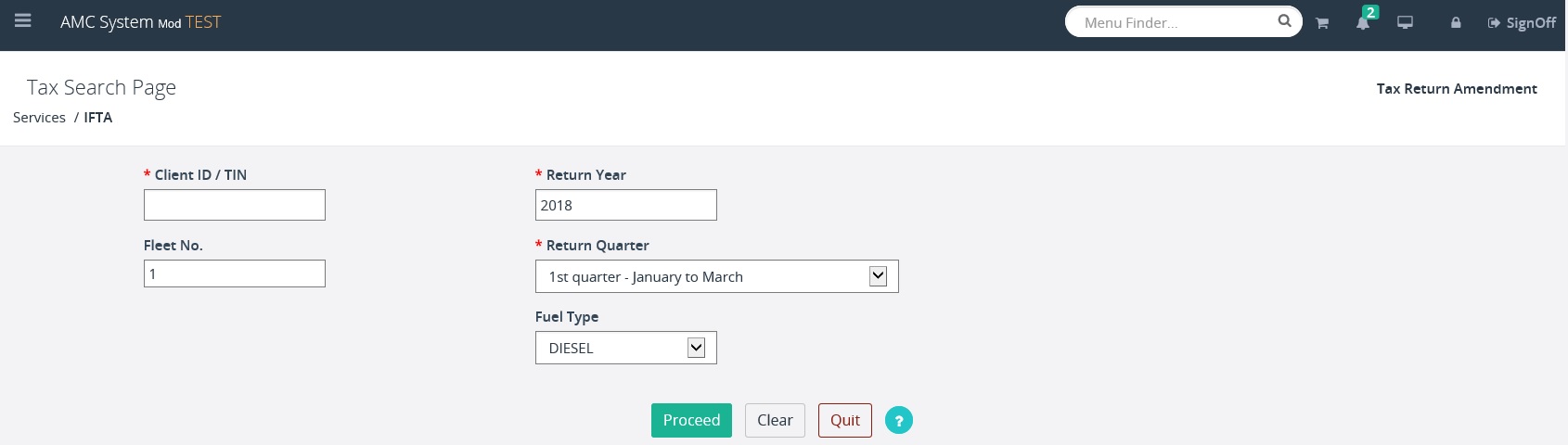

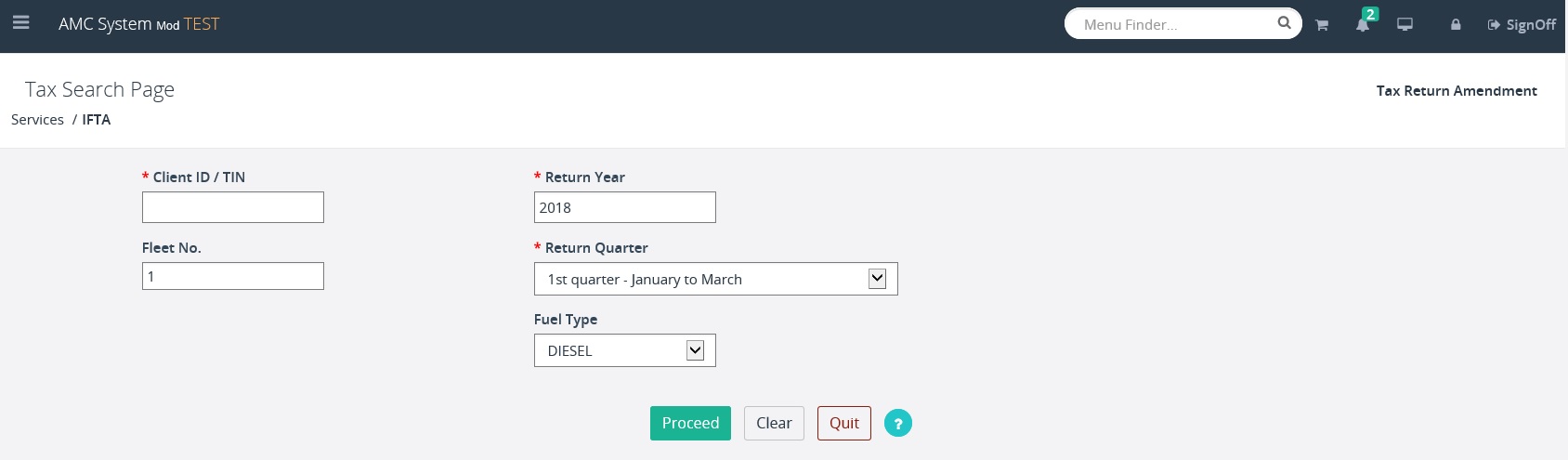

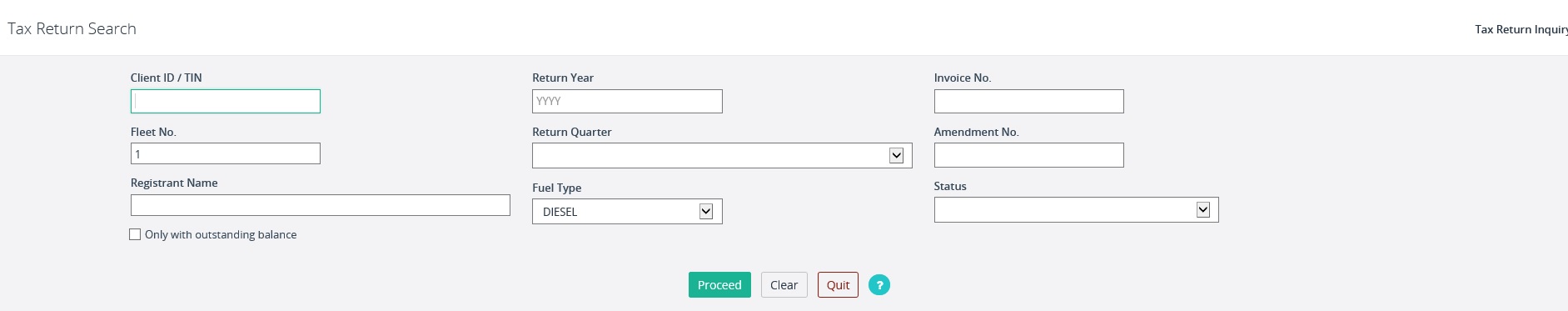

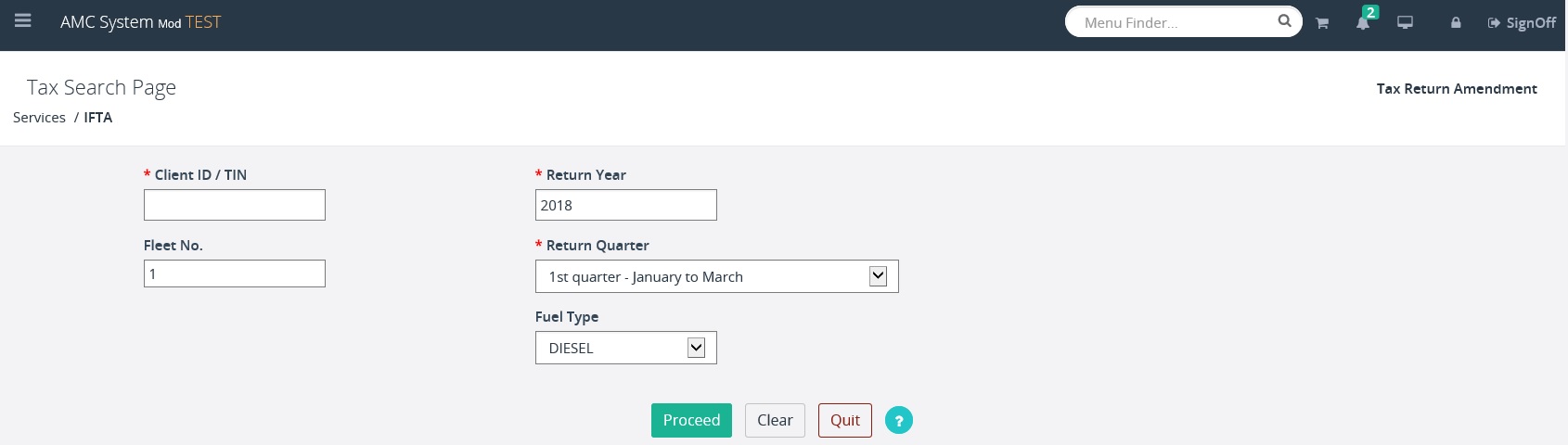

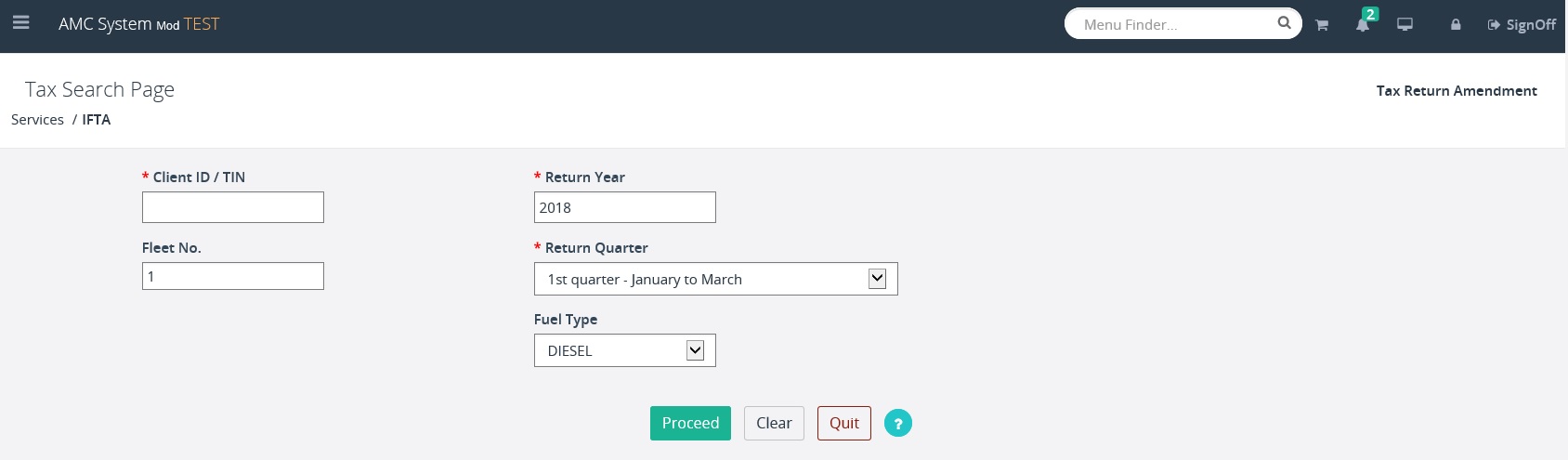

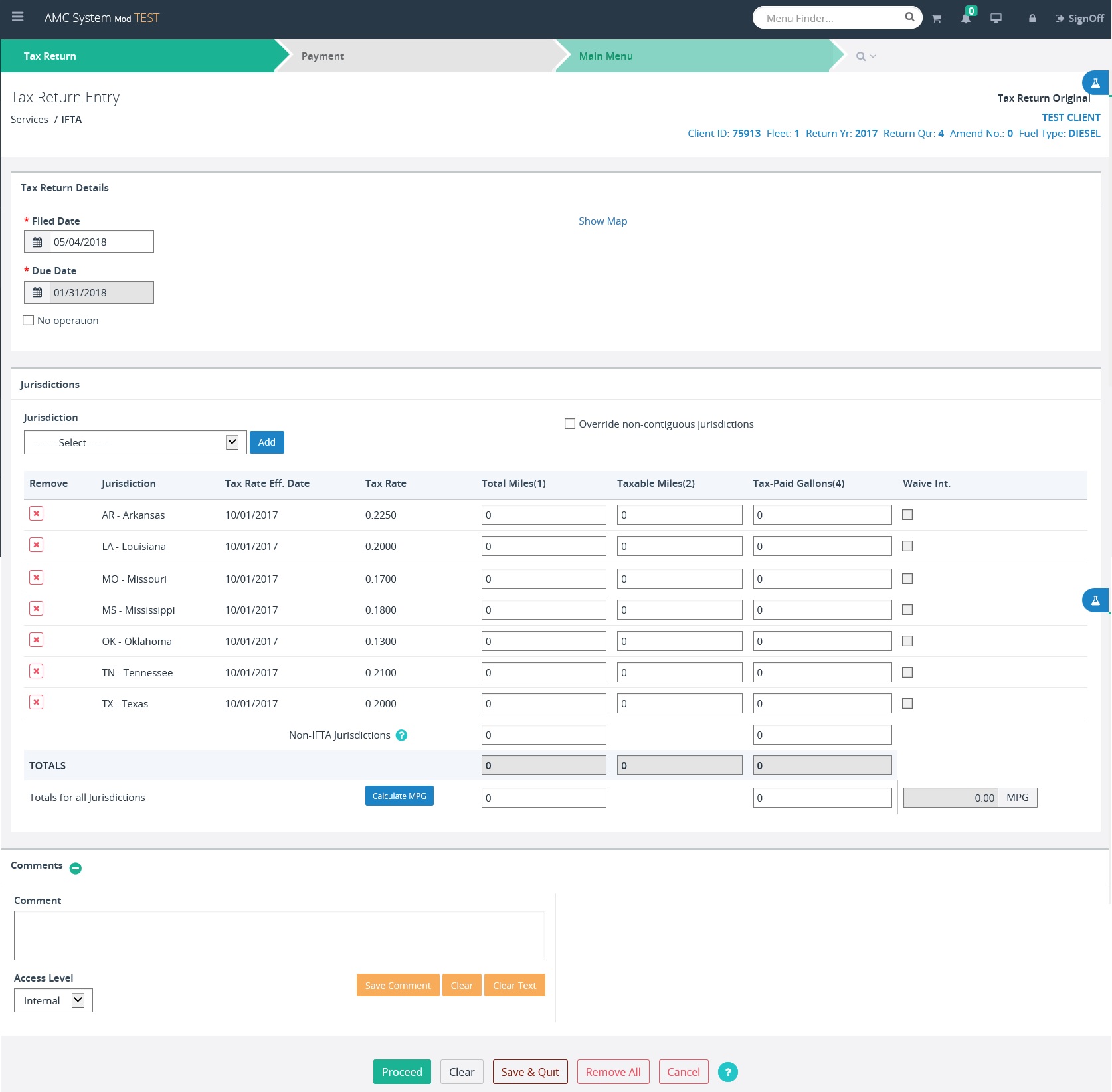

Follow the steps below to enter an Original Tax Return:

- From the IFTA application

level menu, select FILE/AMEND RETURN from the TAX RETURN menu tile

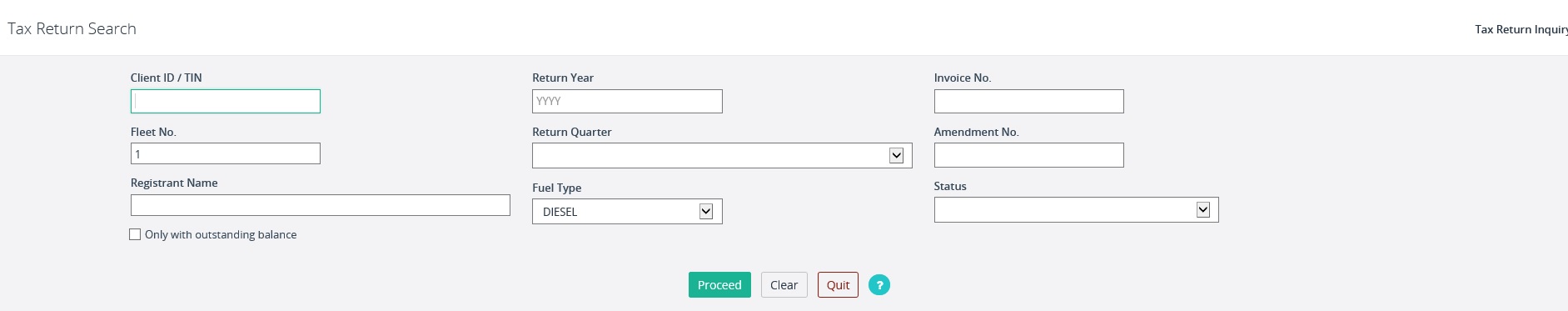

- On the Tax Return Search

screen, enter the required fields including:

- The Client ID or the TIN

(Tax Identification number)

- Fleet No.

- Return Year

- Return Quarter (use the

drop down to select the quarter)

- Select the appropriate Fuel Type

- Select PROCEED to display the Tax Return

screen

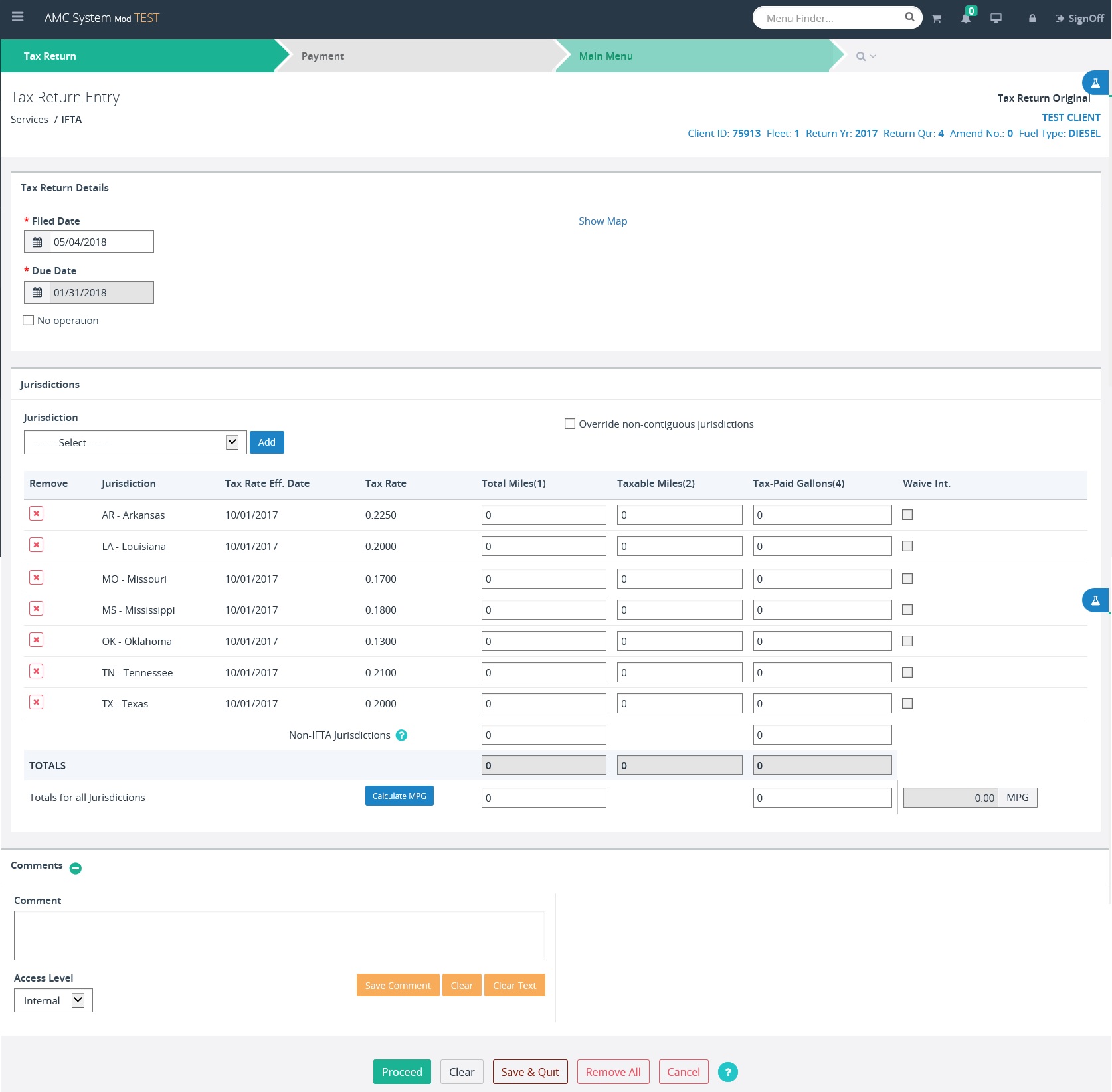

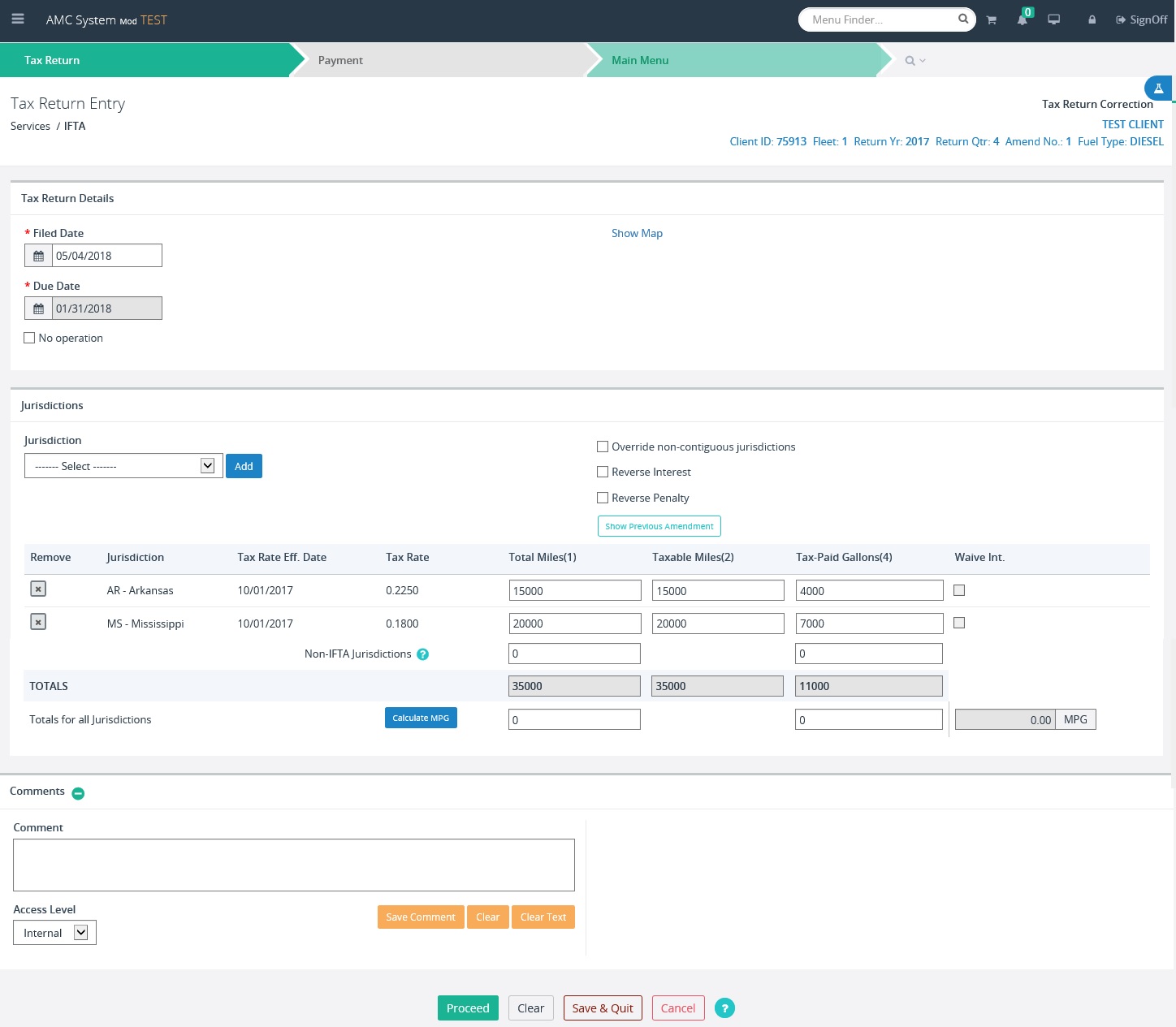

The system will display the Tax Return

entry screen with the IFTA account details displayed at the upper right corner.

For an original return the Amendment No. is always zero

- Enter the Filed Date for the tax return

being entered (this defaults to today’s date and can be changed)

- The Due Date is auto-populated to the end

of the month in which the tax return is due and cannot be changed

- If the customer is an

existing customer with a previously filed return, the Tax Return screen

will display a list of jurisdictions that were included on the previous

return.

- If the customer has never

filed a tax return, the user will need to select the appropriate

jurisdictions

- To add individual

jurisdictions to the list:

o

Select the jurisdiction from the jurisdiction

dropdown or select the Show Map link and select the appropriate jurisdiction on

the map

o

Select ADD

- To add multiple jurisdictions

o

Select one of the following options from the

jurisdiction dropdown:

§

All US Jurisdictions

§

All IFTA Jurisdictions

§

Surrounding Jurisdictions

·

The base jurisdiction as well as immediate

surrounding (AB, BC, ID, MT, ND, SD, SK, WY)

§

Previous Quarter Jurisdictions

o

Select ADD

§

Each jurisdiction will display in the list of

jurisdictions

·

If applicable, additional lines will be included

for jurisdictions with surcharges or if a jurisdiction has had a rate change

during the quarter

§

Miles and volume will be entered separately for

each jurisdiction

- To delete one or more

jurisdictions from the list

o

Click the delete icon  associated with the jurisdiction(s) and

the jurisdiction will be removed from the list

associated with the jurisdiction(s) and

the jurisdiction will be removed from the list

- For all jurisdictions within

the list that have not been updated

o

Enter the total miles and total paid volumes for

each jurisdiction that was previously populated

§

The taxable miles will default to the total

miles

- If the jurisdiction has a

surcharge rate (i.e. IN, KY and VA), a separate line will appear

displaying the effective date and rate. The miles and volume are not

entered for the surcharge line

·

If a jurisdictions rate changes during the

quarter (split rates), a separate line will appear for each effective date and

rate. The miles and volume must be entered for each line based upon travel

between the effective date and the next effective date or end of the quarter

·

In some extreme situations (i.e. floods), the

tax rate table will indicate that interest is being waived for a particular

jurisdiction for a given year, quarter and fuel type. In this situation the

Waived Int. checkbox will automatically be checked next to the jurisdiction

Miles in Non IFTA jurisdictions

- One entry will be made to capture

the total miles traveled in non-IFTA jurisdiction rounded to the nearest

whole mile

Return Details section

The Return Details section balances the miles and volume provided

by the customer on Schedule A and the miles and volume that were entered by

jurisdiction from Schedule B. This process will also calculate the MPG to

compare to the MPG that was calculated by the customer as part of Schedule A

- Enter the Total Miles and Total

Tax-Paid Volume from Schedule A of the tax return

o

The total miles should include the Non IFTA

miles

·

Select CALCULATE

o

The MPG will be calculated based upon the Total

Miles and Volume entered

o

The Total Miles and Tax-Paid Volume columns will

be totaled for all jurisdictions. This information will be used to compare to

the totals that were entered from Schedule A

A comment field is available for any notes that may be required.

This field will be available for internal as well as external users. Note: A

comment is required by external users if they have an MPG of less than 4 and

more than 15.

The following buttons provide additional functionality:

·

CANCEL

o

The tax return transaction will be completely

cancelled

·

CLEAR

o

All values entered from the last time the screen

was accessed will be deleted

§

Initial access to the screen, the jurisdiction

list will return to the previous quarter’s list

§

If the return had been saved and accessed

through Continue/Payment, the screen will be refreshed to the values that were

saved at the time the user selected Save & Quit

·

SAVE & QUIT

o

The return information is saved

o

The user is returned to the IFTA Application level

menu

o

The return can be accessed through Continue/Payment

to complete the return

·

REMOVE ALL

o

Removes all the jurisdictions listed and any

data already entered

·

PROCEED

o

The total miles and volume that were entered

will be compared to the totals calculated by the system including Non IFTA

jurisdictions mileage

o

If an error is identified a message will display

at the top of the screen

o

If no errors are identified, the Tax Return

Payment Details screen will display

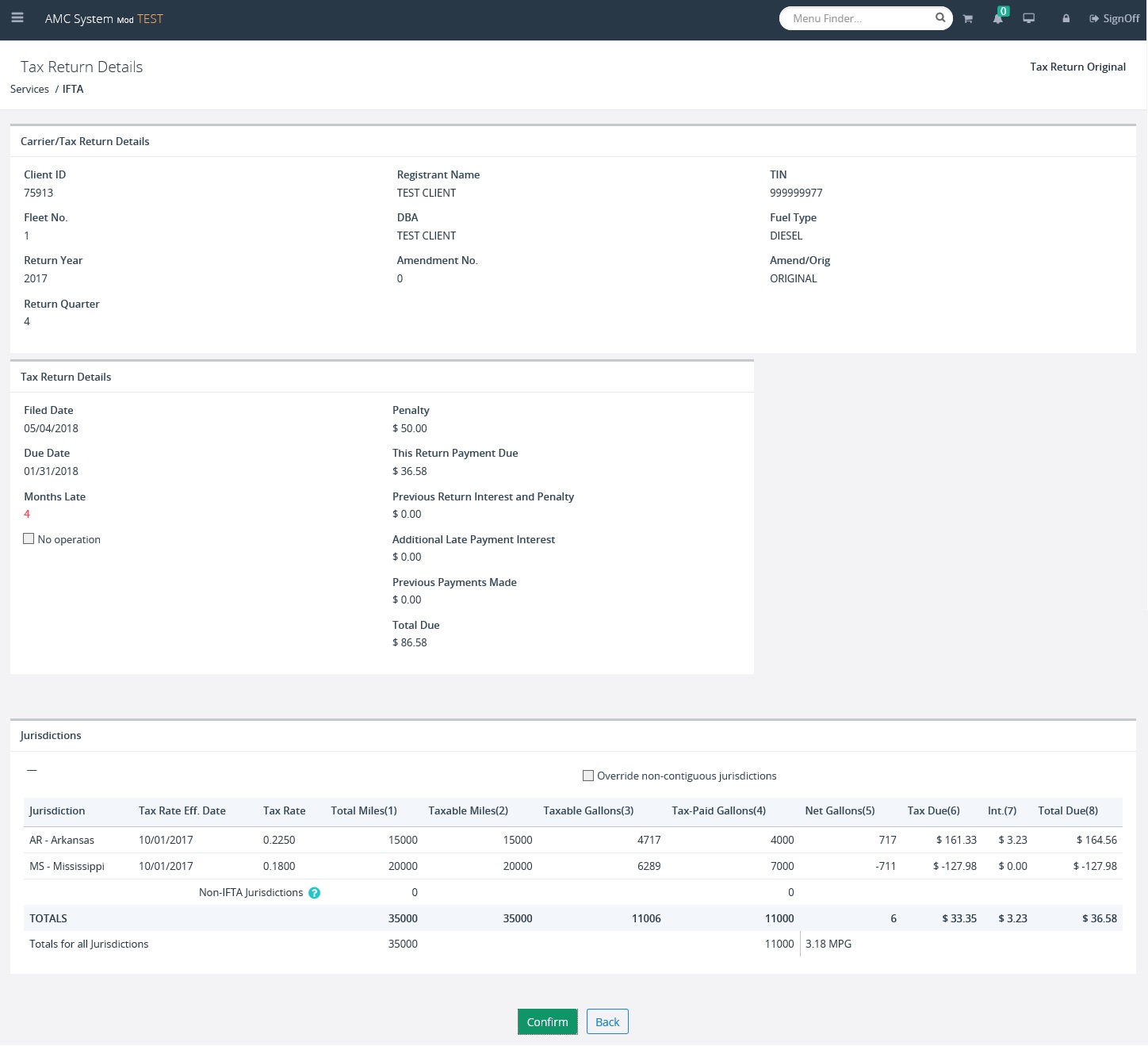

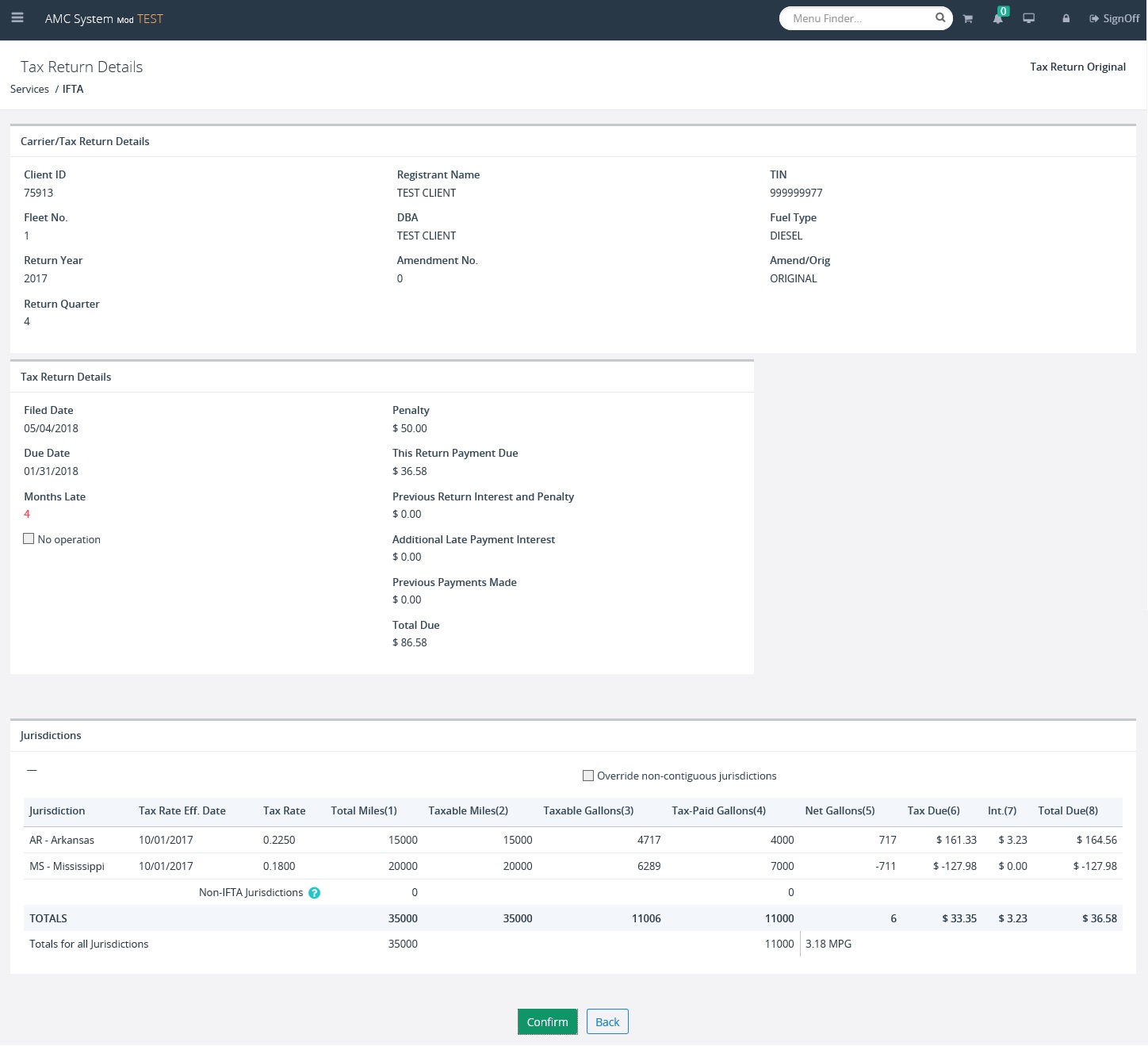

After

all tax return information is entered (Total Miles, Tax Paid Volume, etc.)

select PROCEED and the system will display the verification screen. On the

Verification screen the system performs some initial calculations and displays:

- Whether the tax return is

late and if so, by how many months

- Any Penalties due

- Initial amount due by the

client or refund owed to the client

- Any previous payment made

- Verify all information

entered is correct then select the CONFIRM button to proceed to the Payment

Screen

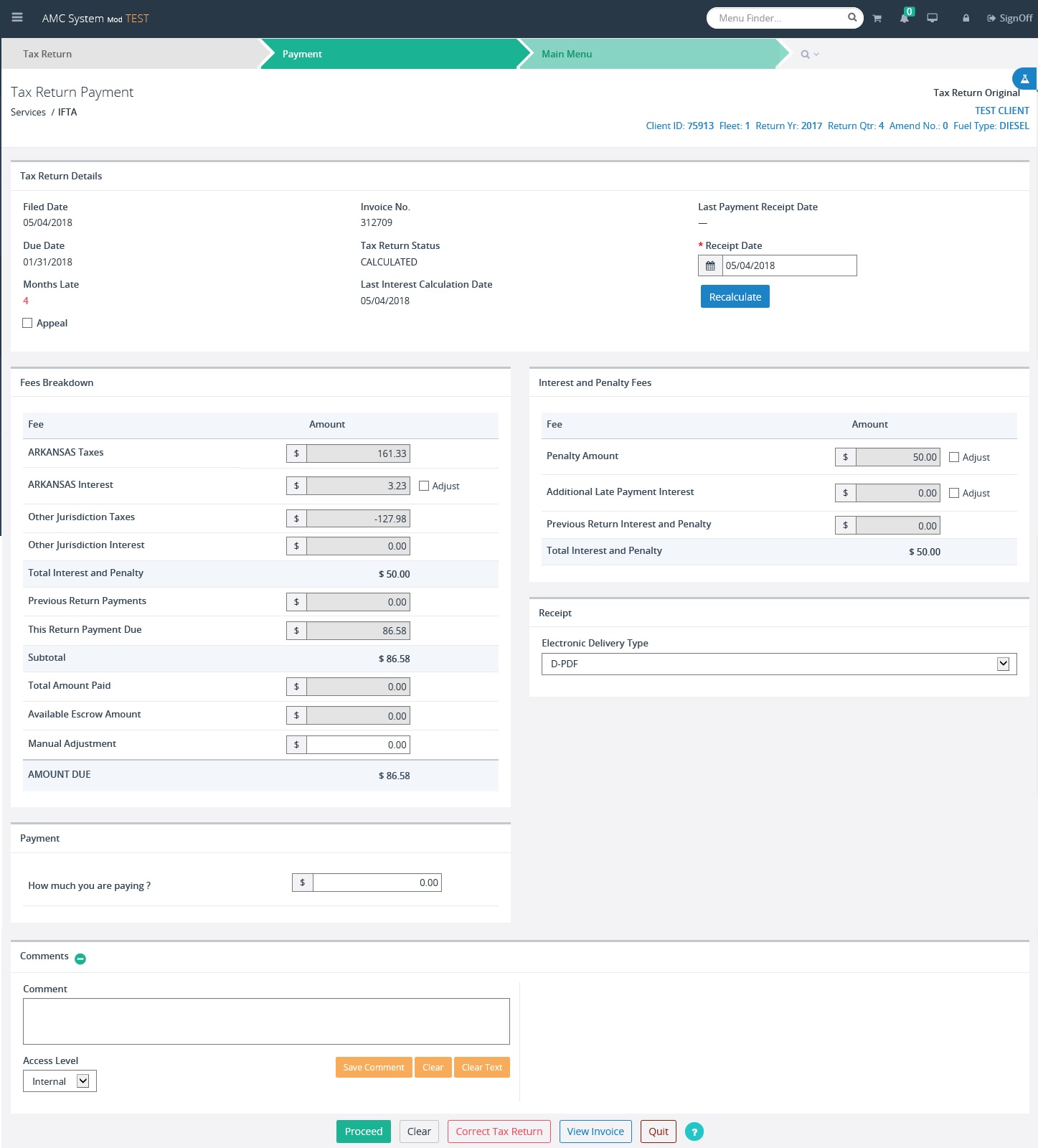

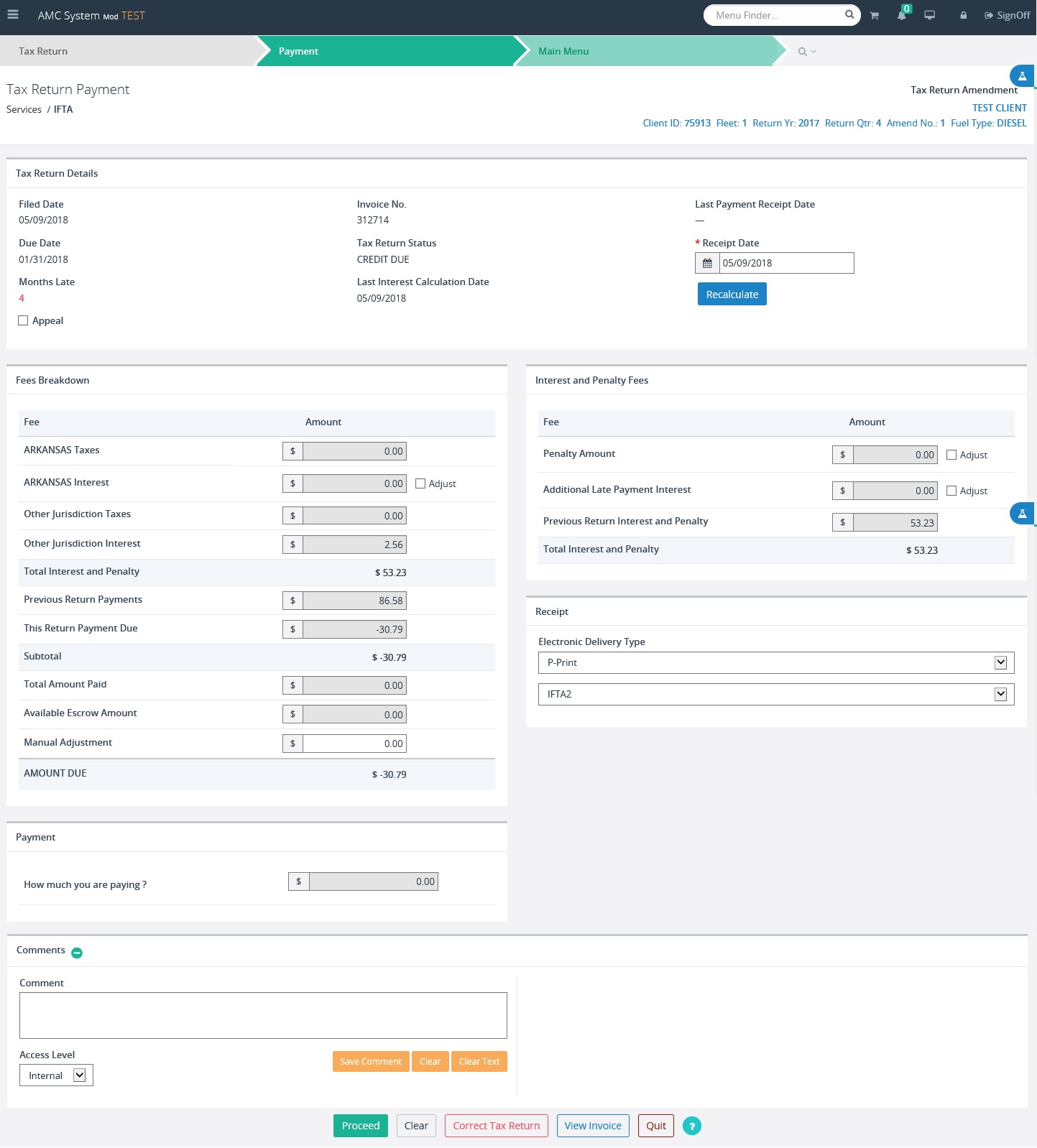

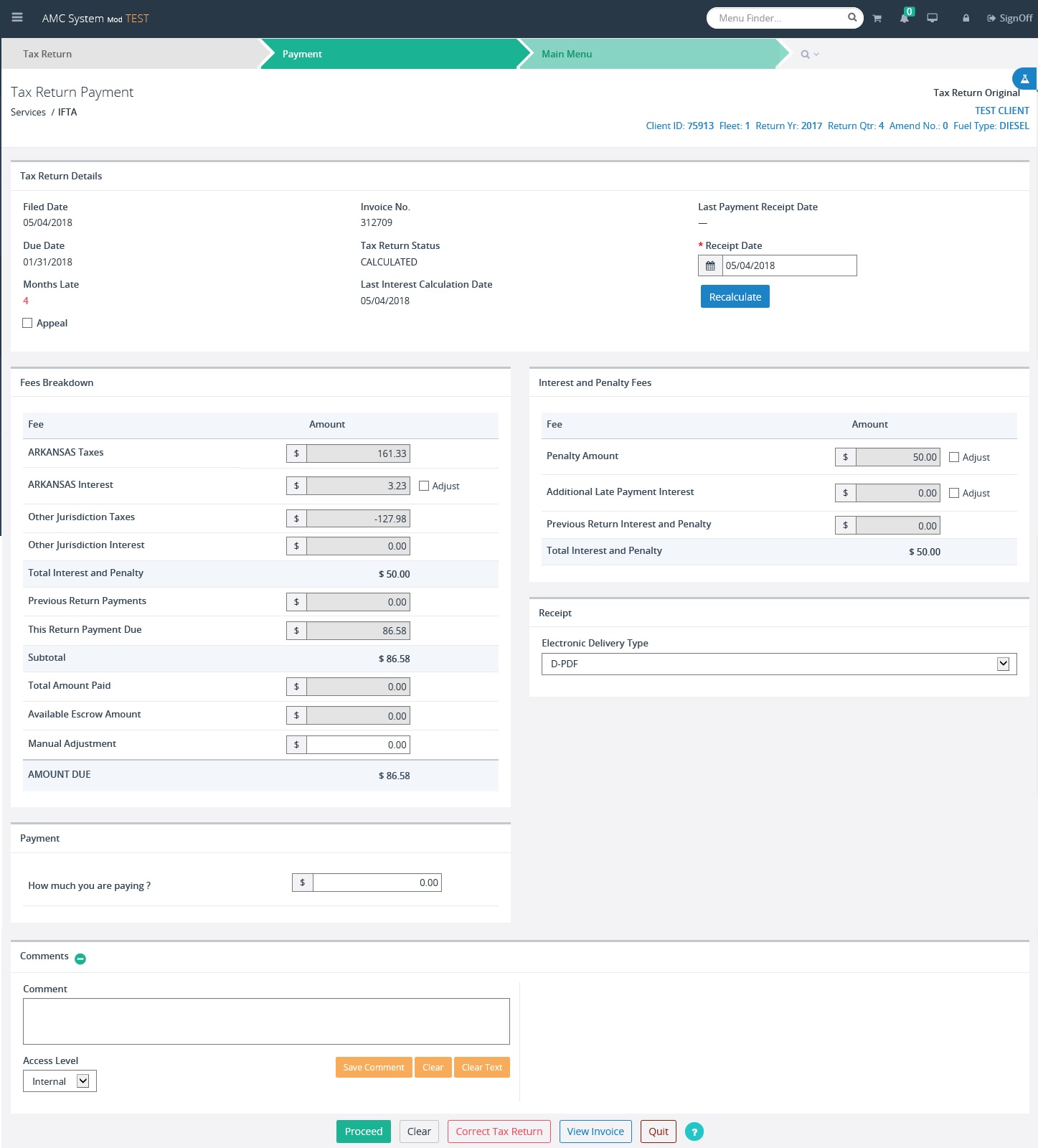

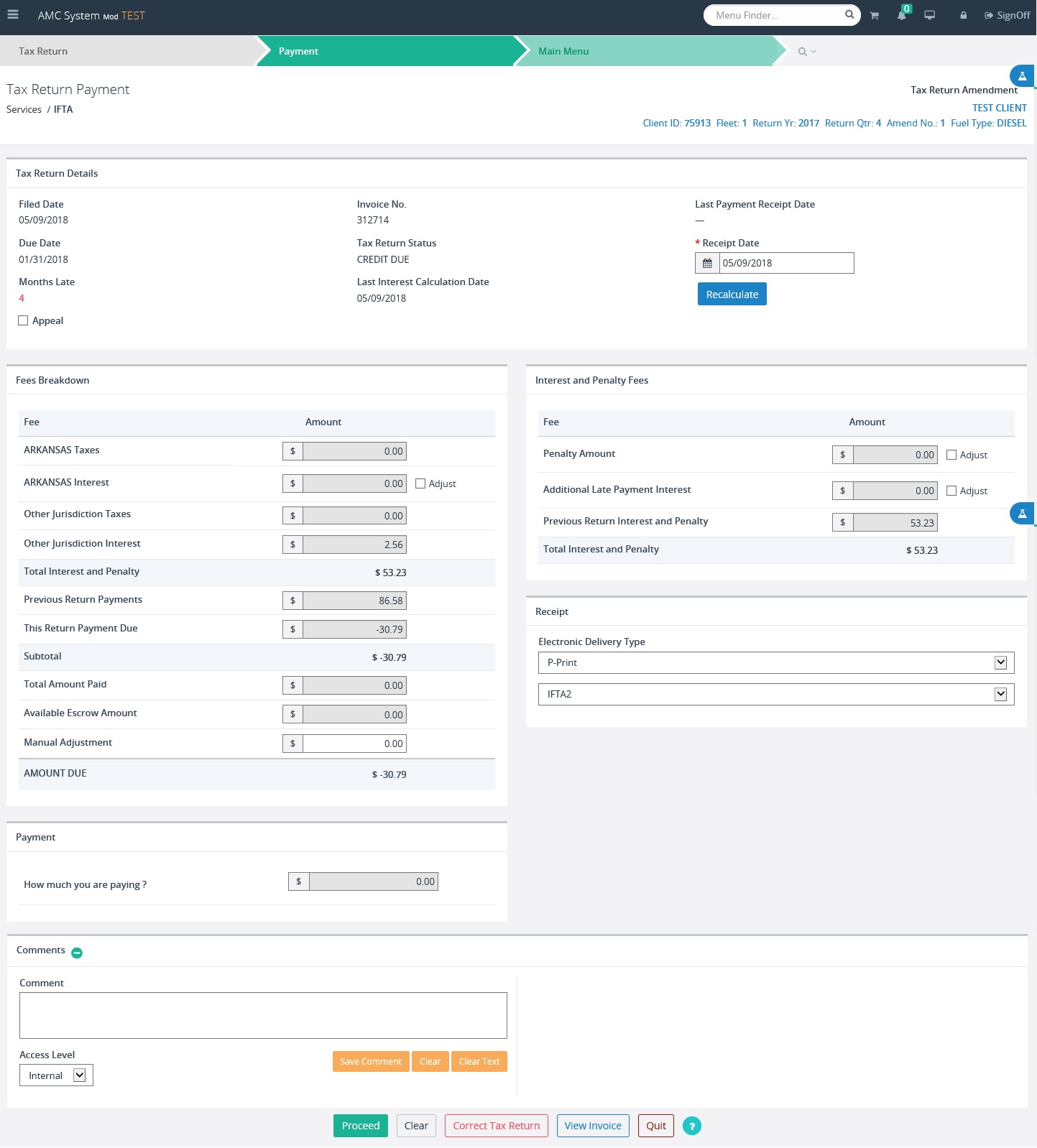

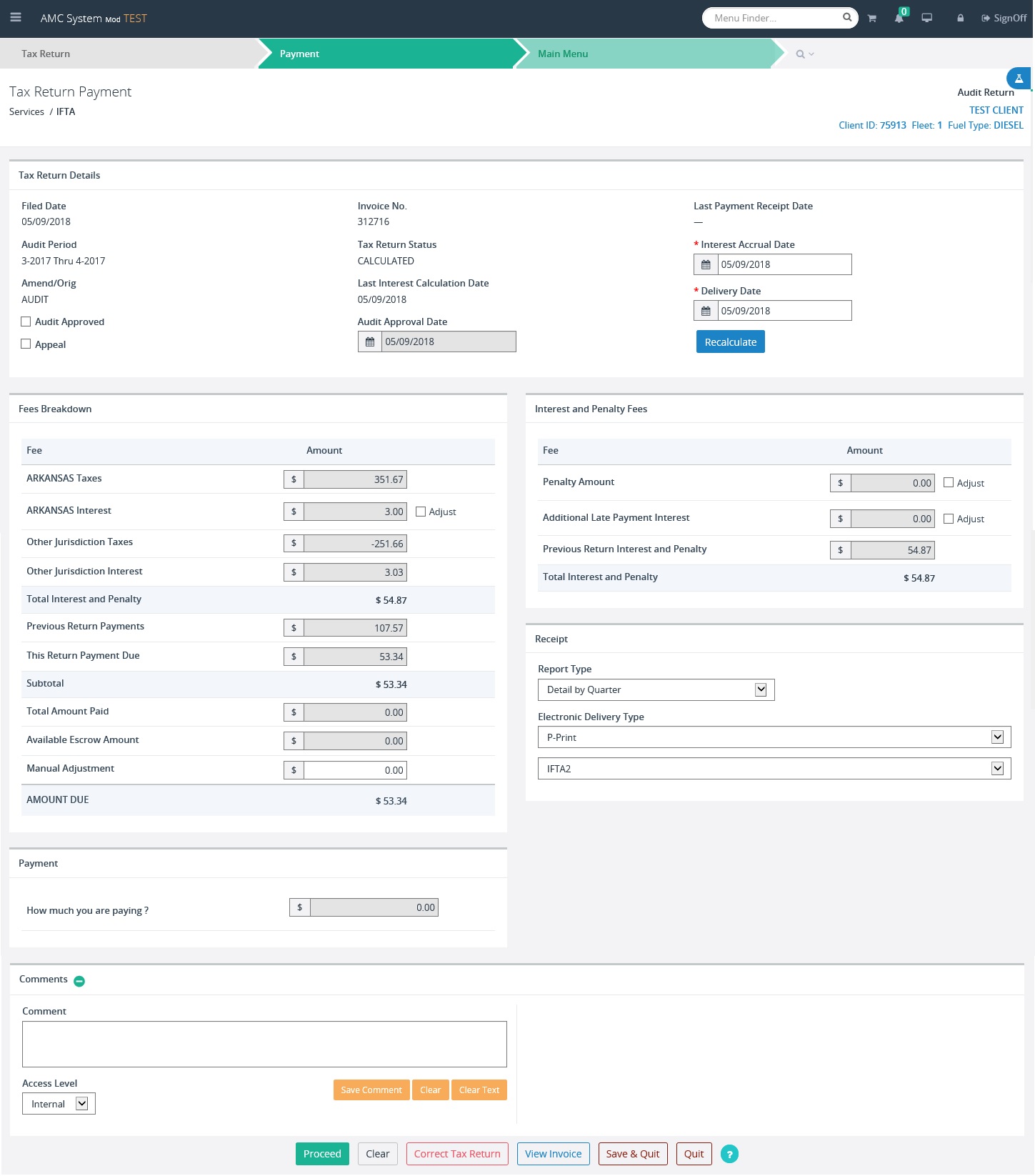

Tax Return Payment Details screen

- Provides a summary of the tax return

- Allows an authorized user to override/adjust

interest and penalty if it meets AMCS business rules prior to completing

the transaction

- Allows partial payment, if the return was mailed

and the customer miscalculated the return amount and the amount paid is

less than the Tax Return Amount due

Review and make any necessary adjustments

to the Tax Return Payment Details screen or return to the actual Tax Return to

make detailed corrections

- The payment Receipt Date defaults to today’s

date and can be changed

- AR interest and the late filing penalty can be

waived by checking the appropriate Adjust checkbox(s). This should only

be done in accordance with AMCS business rules

- Manual Adjustment amount field is provide to

authorized users and should only be used in accordance with AMCS business

rules

- Select the appropriate Electronic Delivery Type

- How much are you paying?

o

This field will only display if the net due is

greater than zero

§

If the customer’s payment matches or is greater

than the net due, no entry is required

o

If the customer’s payment is less than the net

due, enter the amount of the payment

The following buttons provide processing alternatives:

o

The tax return details will be displayed online,

if payment is not being made at this time, the user can print the return as the

invoice for the customer

o

If the receipt date has been changed or interest

or penalty has been waived, the user must recalculate the return to generate

the correct net due

o

To correct a return prior to making the payment,

select CORRECT TAX RETURN, the Tax Return detail screen will display. Make the

necessary corrections and continue as before

o

The screen will be refreshed

o

To save the return without making the payment.

The transaction can be accessed through Continue/Payment

o

To continue with the payment process and display

the Payment Details Verification screen

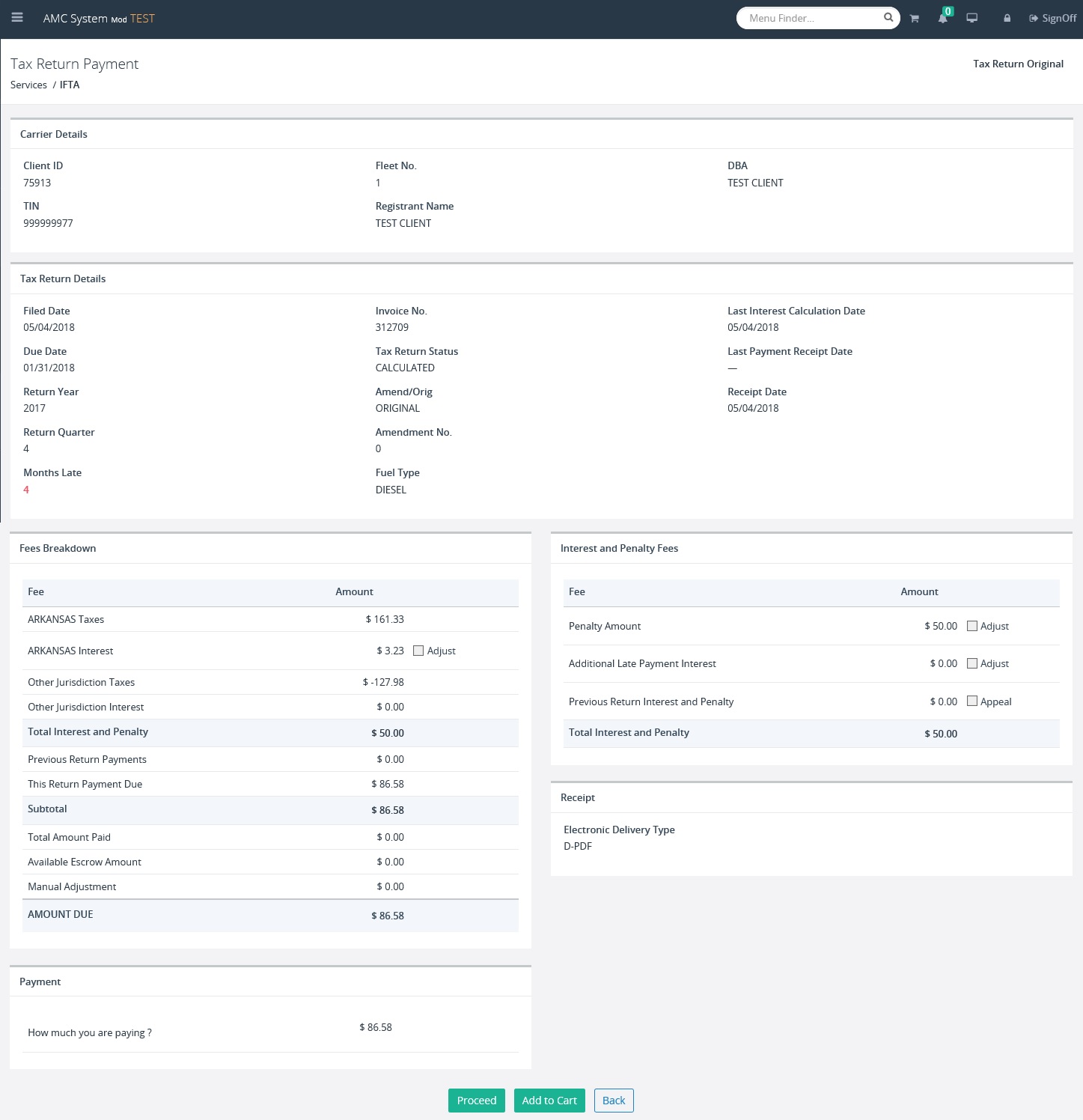

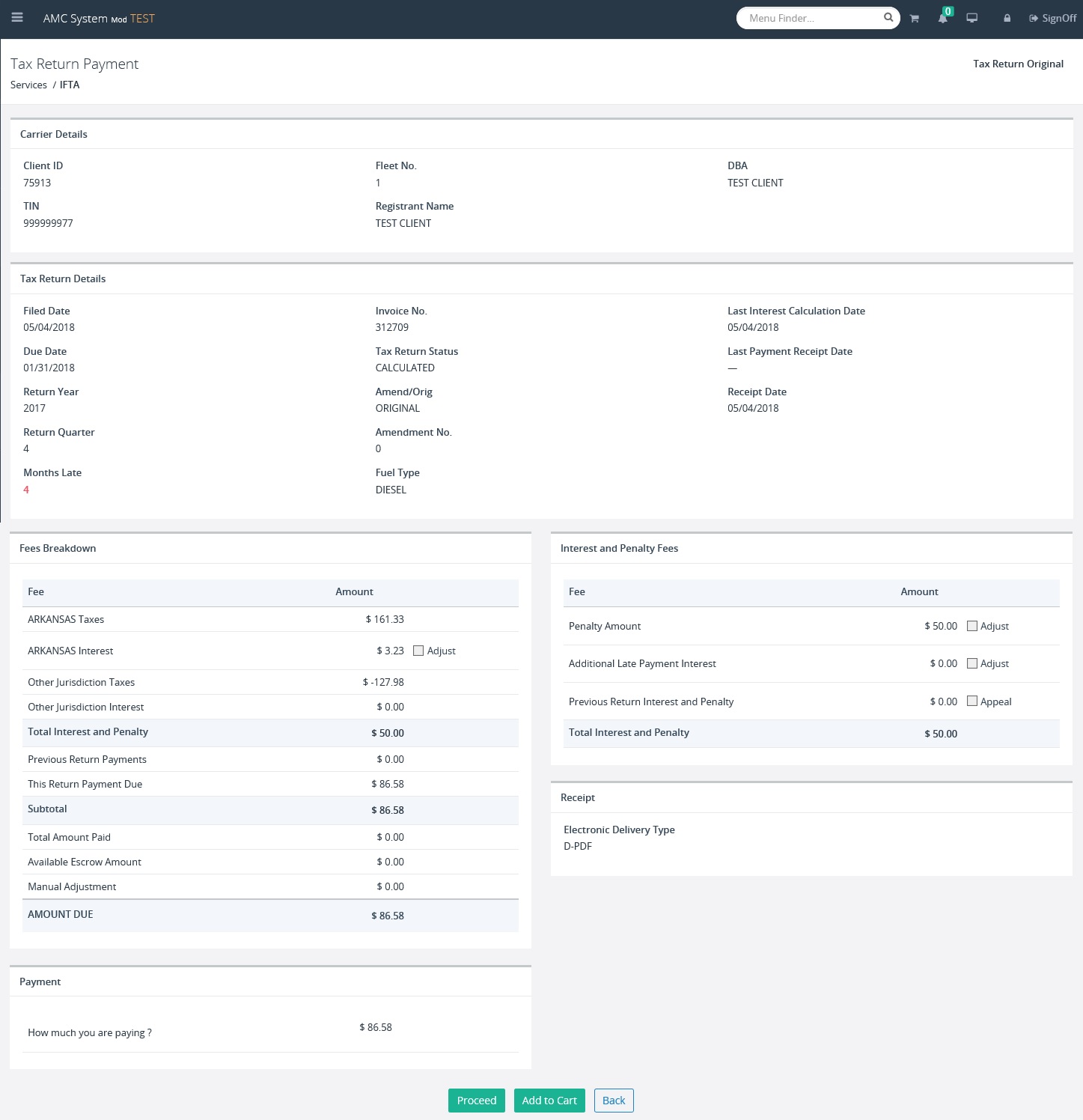

Tax Return Payment Details Verification

screen

The verification screen provides the user

with a final review of the information prior to:

- Completing the transaction in the case of a zero net due or a

refund due to the customer based upon the fee calculation

- In the case of a net due greater than zero, proceeding with the

payment process.

If the Actual Payment amount field was not

entered on the Tax Return Payment Details, it will default to the net due and

display on the verification screen

The user has multiple options from this

screen:

o

If based on the total miles and volume that

were entered and calculated for columns D and G and Non IFTA jurisdictions

mileage, the total due amount is 0 or the customer is due a refund, this

option will appear

o

Selecting the COMPLETE RETURN button allows the

users to complete the Tax Return and bypass the payment screen

o

Returns the user to the Tax Return Payment

Details screen, At this point the user can choose to correct the tax return by

selecting CORRECT TAX RETURN, waiving interest or penalty, if necessary, or

change the receipt date and recalculating the fee using RECALCULATE, which may

have an impact on the calculation of interest and penalty

o

This function is used when additional AMCS

transactions are to be included within a single payment. This process is

covered in more detail in the Enterprise manual

o

If the net due is zero

§

The IFTA tax return and payment receipt will be

generated based upon the Electronic Delivery Method chosen

§

The IFTA Application Level menu will be

displayed with a message identifying the account no, return year, quarter,

amendment no, and fuel type that was completed

o

If the net due is less than zero

§

The IFTA tax return and payment receipt will be

generated based upon the Electronic Delivery Method chosen

§

The IFTA Application Level menu will be

displayed with a message identifying the account no, license year, quarter,

amendment no, and fuel type that was completed

§

Also a refund transaction will be generated in

AMCS

·

If the refund is less than $5.00 the refund

status will automatically be updated to Denied

·

If the refund is 5.00 or greater the refund

status will be set to Pending

o

If the net due is greater than zero, the Payment

Details screen will display

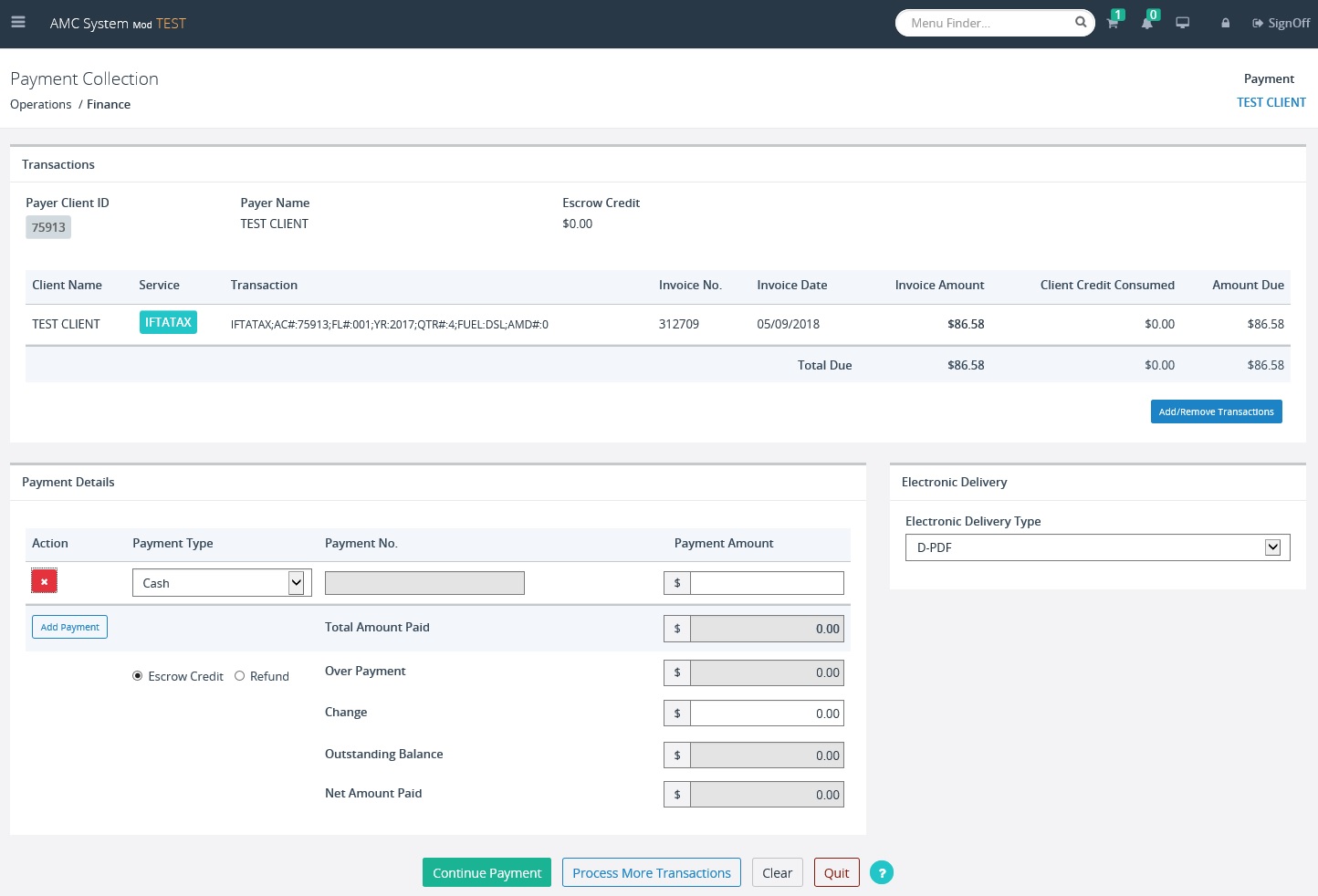

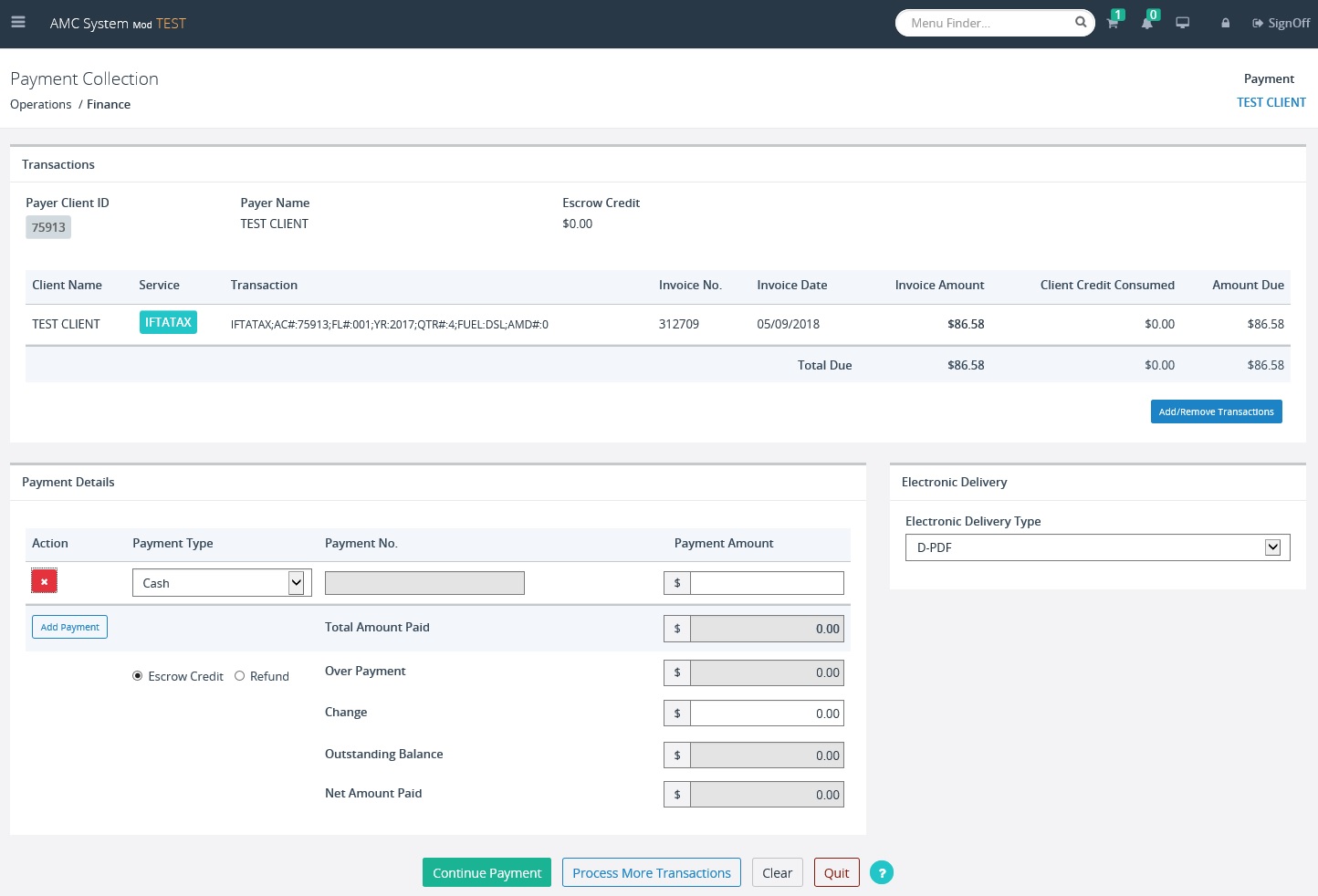

Payment Process for a single tax return

The Payment Collection screen will display once the user selects

PROCEED on the Tax Return Payment Details Verification screen

- Verify the

invoice information

o

The transaction description will include the IFTA

account number, fleet number, return year and quarter, fuel type, and amendment

no

o

The amount due should be equal to the actual

payment amount from the Tax Return Details Verification screen. This amount

will be the amount of the tax return if a full payment is being made or the

partial payment amount that was entered by the user

- If the information is

incorrect, select the QUIT button and use the Cart Payment option within

the Finance menu, then:

o Click the REMOVE FROM CART button

o After the system confirms the transaction has been removed from the

cart, click the Quit button

o From the IFTA level menu, select the TAX RETURN option from the

CONTINUE/PAYMENT menu tile

o Enter the required information to select the appropriate account,

then click the CORRECT TAX RETURN button to return to the tax return and make

the necessary changes

- If the

information is correct

o Verify the Electronic Delivery Type

o Select CONTINUE PAYMENT, the verification screen will display

Payment Process for Multiple Tax Returns

The user will select ADD TO CART on the Tax

Return Payment Details Verification screen for each return. The returns could

be for different quarters or for different fuel types for the same quarter.

To access the transactions for payment:

- Select CART PAYMENT from the PAYMENT menu

tile on the Finance level menu

- The Payment Details screen will automatically display with the

returns that were assigned to the Cart Payment function based upon the

user’s id. Only one Client’s transactions can be made with the same

payment

- Verify the

invoice information, a separate line will be displayed for each return

o

The invoice description will include the IFTA

account number, fleet number, return year and quarter, amendment no and fuel

type

o

The amount will equal to the actual payment

amount from the Tax Return Details Verification screen. This amount will be

the amount of the tax return if a full payment is being made or the partial

payment amount that was entered by the user

o The net due will be the total of all returns listed on the screen

- If the information is

incorrect and you need to remove the transaction from the cart, check the

REMOVE FROM CART button

o To correct the return prior to making the payment

§ Select

QUIT

§ Return

to the tax return through Continue/Payment and use the CORRECT TAX RETURN button

to make the necessary changes

§ Select

PROCEED then ADD TO CART on the Tax Return Payment Details screen

§ Return

to the Finance level menu and select CART PAYMENT from the PAYMENT menu tile.

The transactions should appear in the cart, so select PAY NOW then CONFIRM to

continue with the payment.

- If the

information is correct

o Verify the Electronic Delivery Type

o Select CONTINUE PAYMENT - the the verification screen will display

o Select PAY to complete the payment

If a carrier had no operations for the

quarter, they are still responsible for reporting this information.

To record a No Operations return, perform

the following steps:

- Check the No Operation checkbox on the Tax Return entry screen

- Select PROCEED to display the Tax Return

verification screen

- Review Return information

o

If the information is incorrect, select BACK to

return to the Tax Return screen

o

If the information is correct, Select PROCEED to

display the Tax Return Payment Details screen

Payment Details

Penalty charges may apply for a no

operation return if the return is not filed timely, which will be calculated

based upon the Payment Receipt Date. This field will default to the Postmarked

Date from the Tax Return screen

If the tax return is past due, penalty may

be due. This process is discussed later in this process.

- Select the appropriate Electronic Delivery Type

(PDF, Email or Print)

- Select PROCEED to display the Payment Details

verification screen

o

Note: The View Invoice, Recalculate, and Correct

Tax Return buttons will be discussed within the Quarterly Tax Return section

- Select CONFIRM on the Payment Details

verification screen

o

The following is generated based upon the

Electronic Delivery Type selected

§

Quarterly Tax Return Invoice

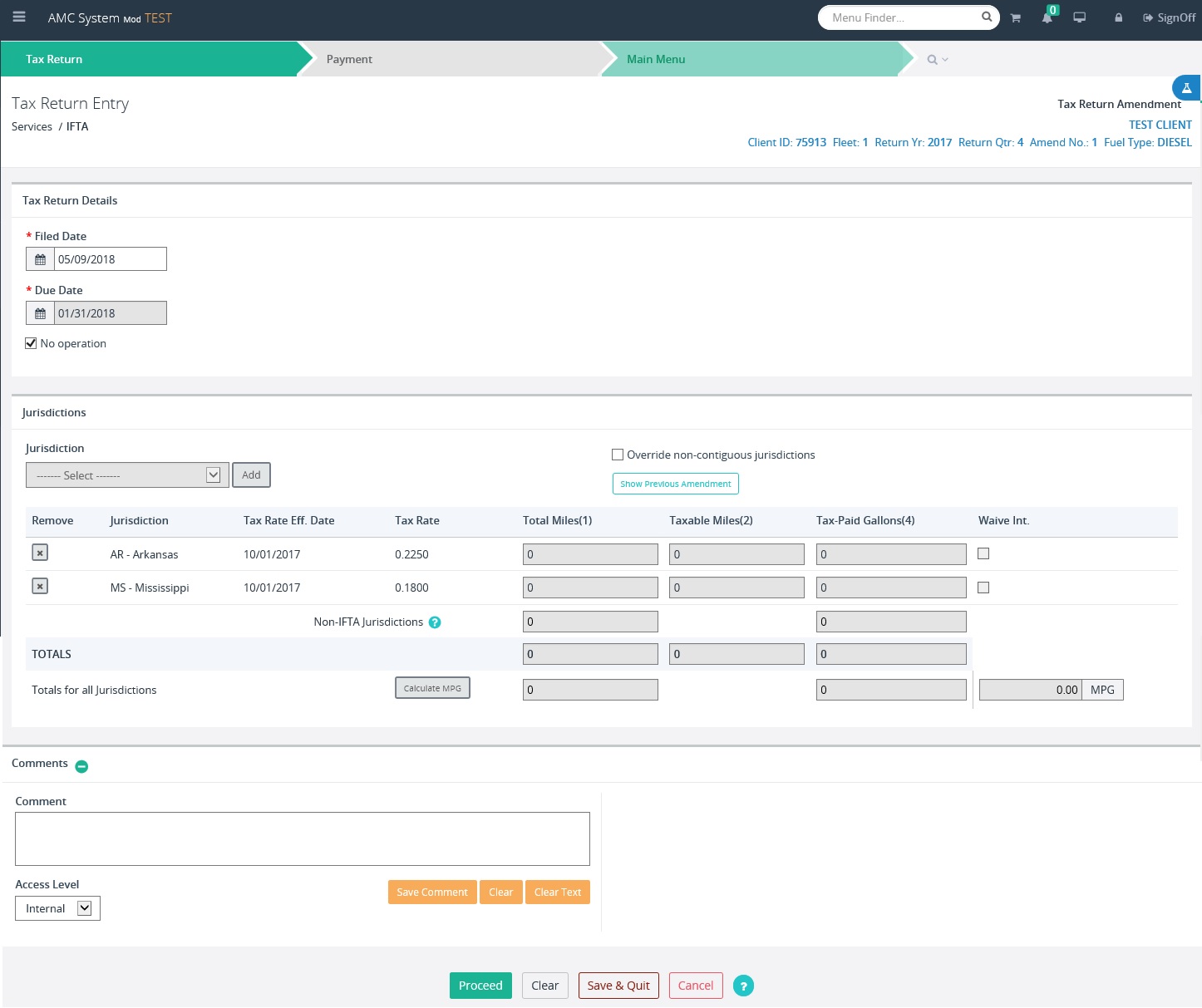

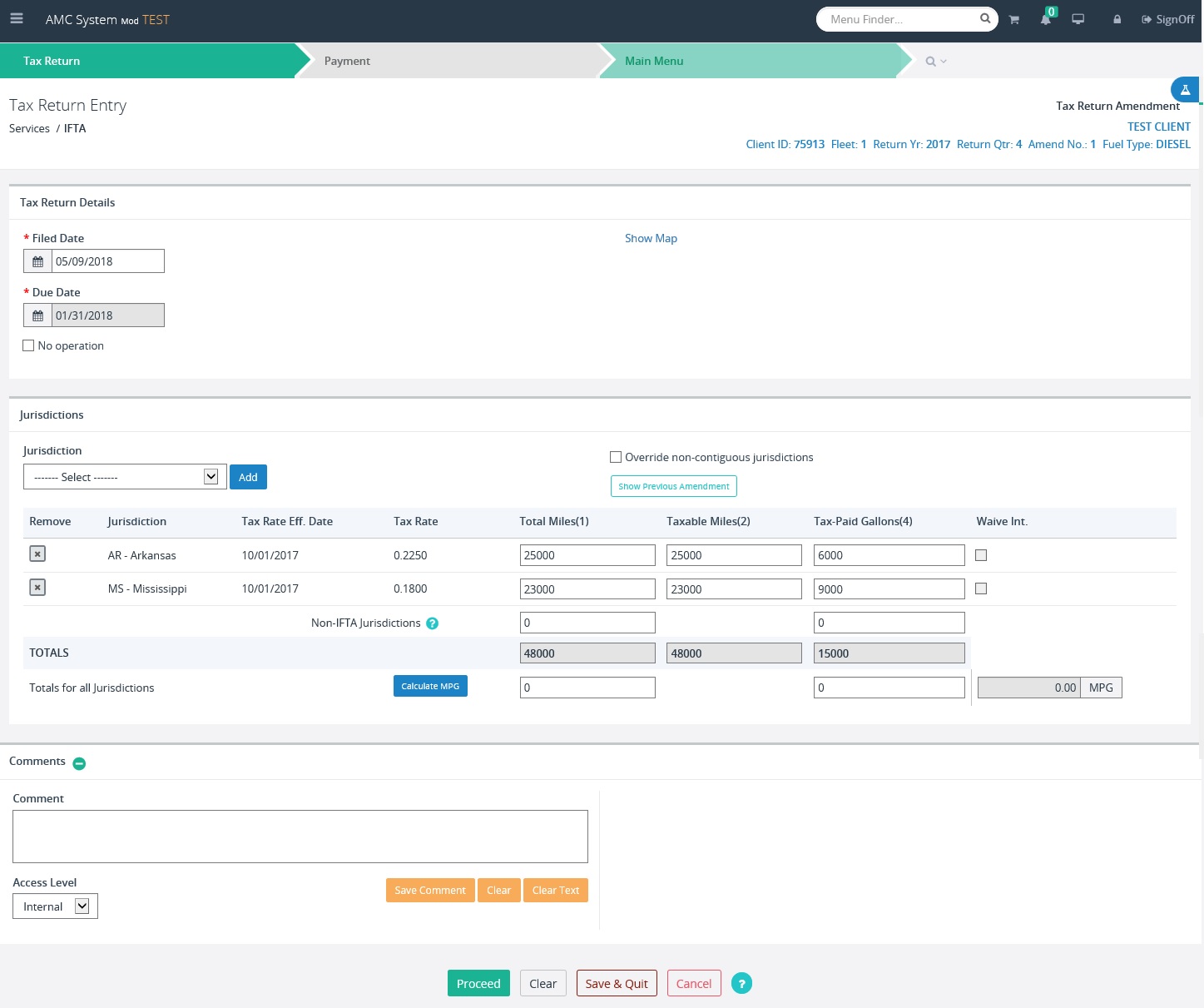

IFTA carriers can amend any tax return filed within the last 3 years

or 12 quarters. Many of the business rules for original tax returns apply to

the amended tax returns. When an amended tax return is being filed, the

previous return (usually the original) entry fields will be shown for reference.

Once information is updated, a user can select the SHOW PREVIOUS AMENDMENT

button to display the previous return entries below the newly entered totals.

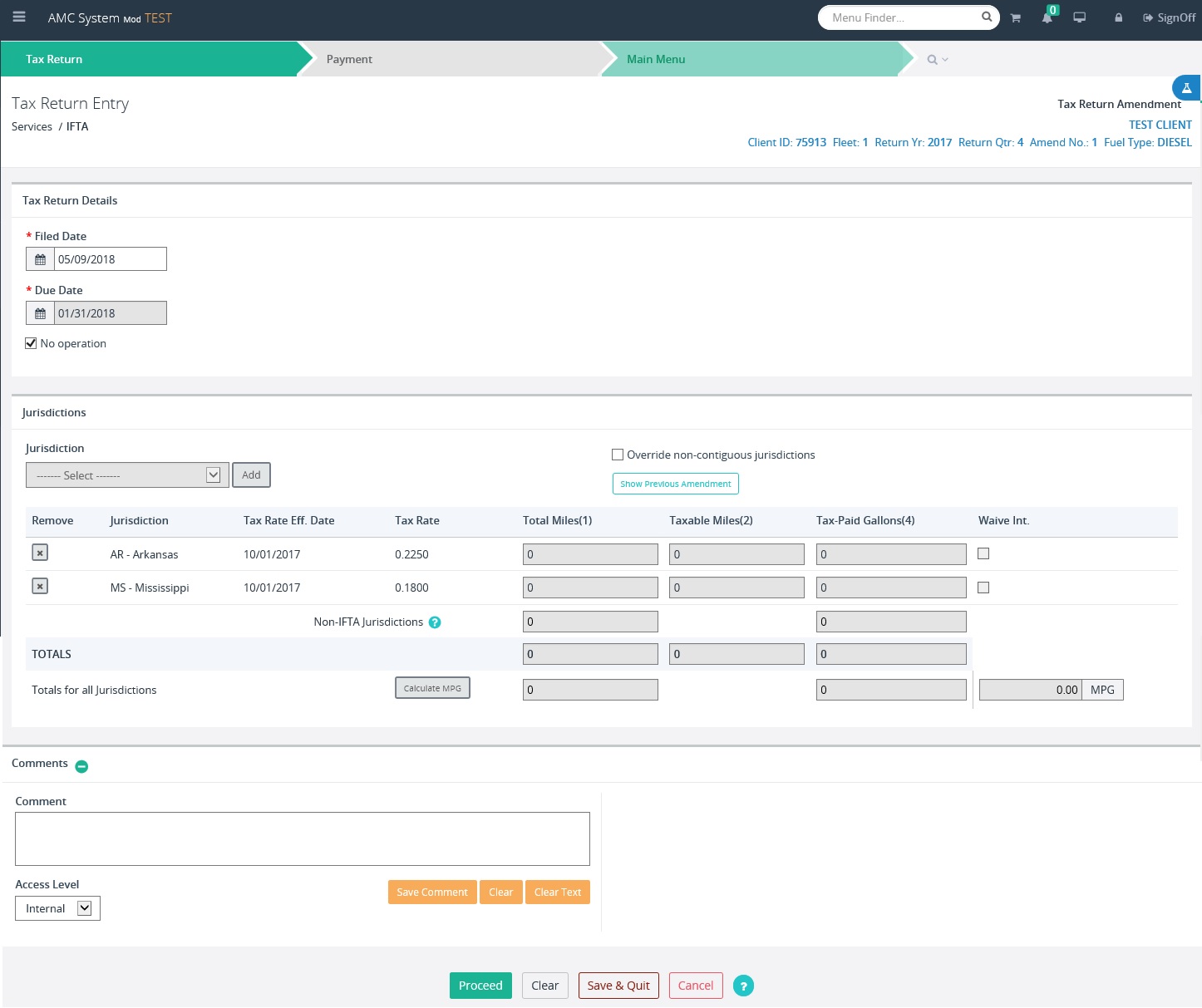

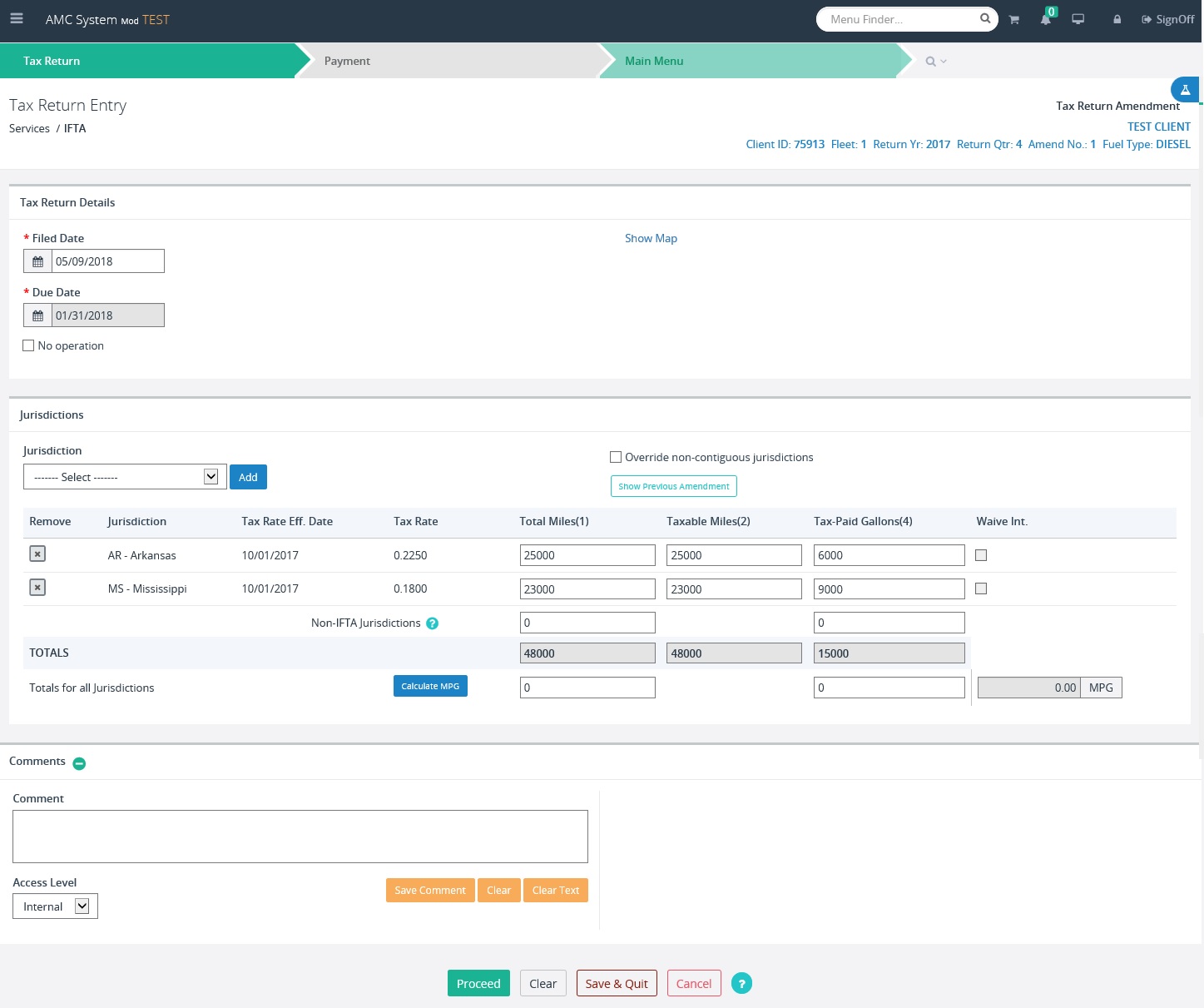

Follow the steps below to enter an Amended Tax Return:

- From the IFTA application

level menu, select FILE/AMEND RETURN from the TAX RETURN menu tile

- On the Tax Return Search

screen, enter the Client ID or the TIN (Tax Identification number)

- Select the appropriate Fleet

No., Return Year, Return Quarter, and Fuel Type

- Select PROCEED

o

If a return has not been entered, the return

will be considered an original tax return

o

If the original return has been entered but not

paid, a message will display indicating that the return is available through Continue/Payments

for updates

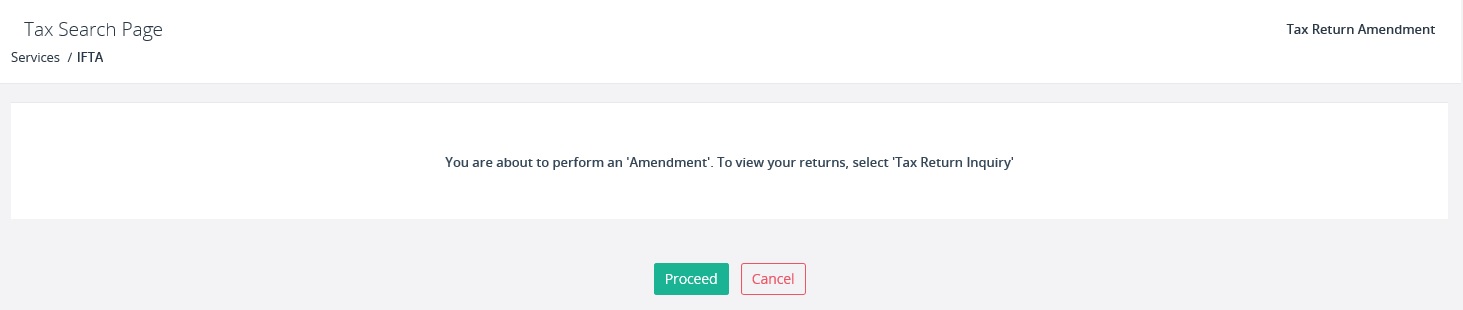

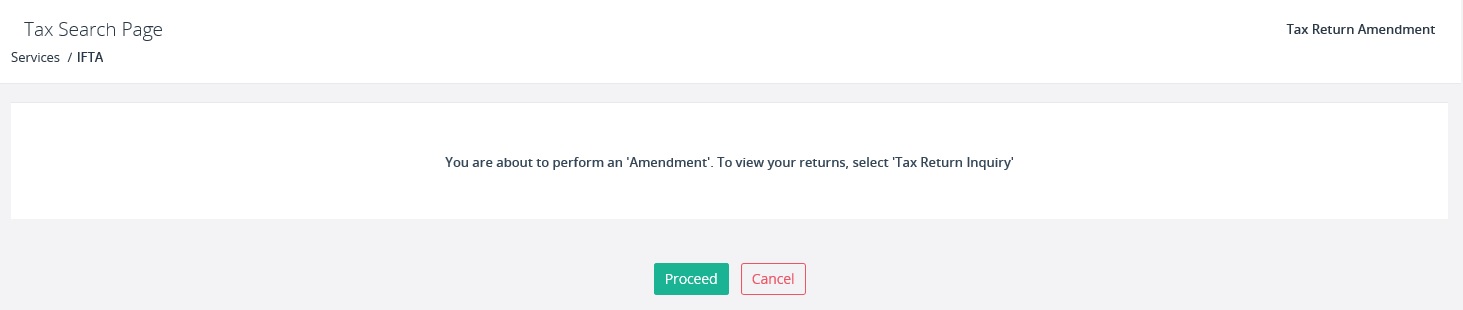

o

If a return has been entered and paid, the

following message will display to verify that the user is attempting to amend a

return that has been completed

- Select CANCEL, if the return

is not considered an amendment

- Select PROCEED, to continue

the transaction as an amended return

o

The Tax Return screen will display with the

following information:

§

The Amendment No. will be updated to the next

amendment number. Originals are amendment number 0 and each amendment after is

incremented by one.

§

The supplement name at the upper right corner

will display Tax Return Amendment The Miles and Volume fields will be

pre-populated with the previous return’s values (normally the original)

- Update the Total Miles and Tax Paid Volume in accordance with

the amendment

- Jurisdictions may be added following the instructions from the

original tax return

- To remove a jurisdiction that was entered on the previous

return, enter zero in the total mile, total taxable miles and tax paid

volume.

- Follow the same steps taken with an original return to display

the Tax Return Details Verification screen

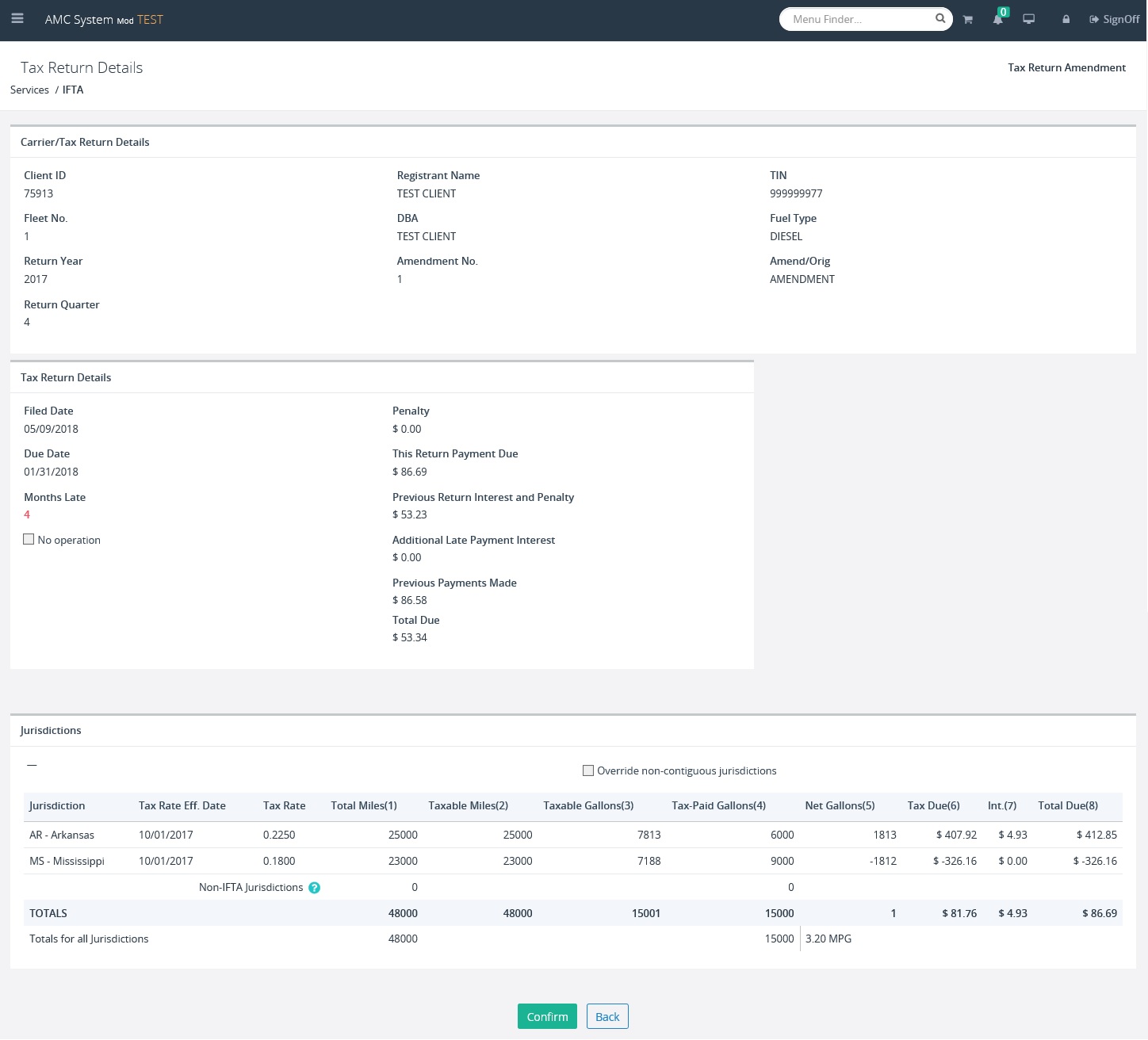

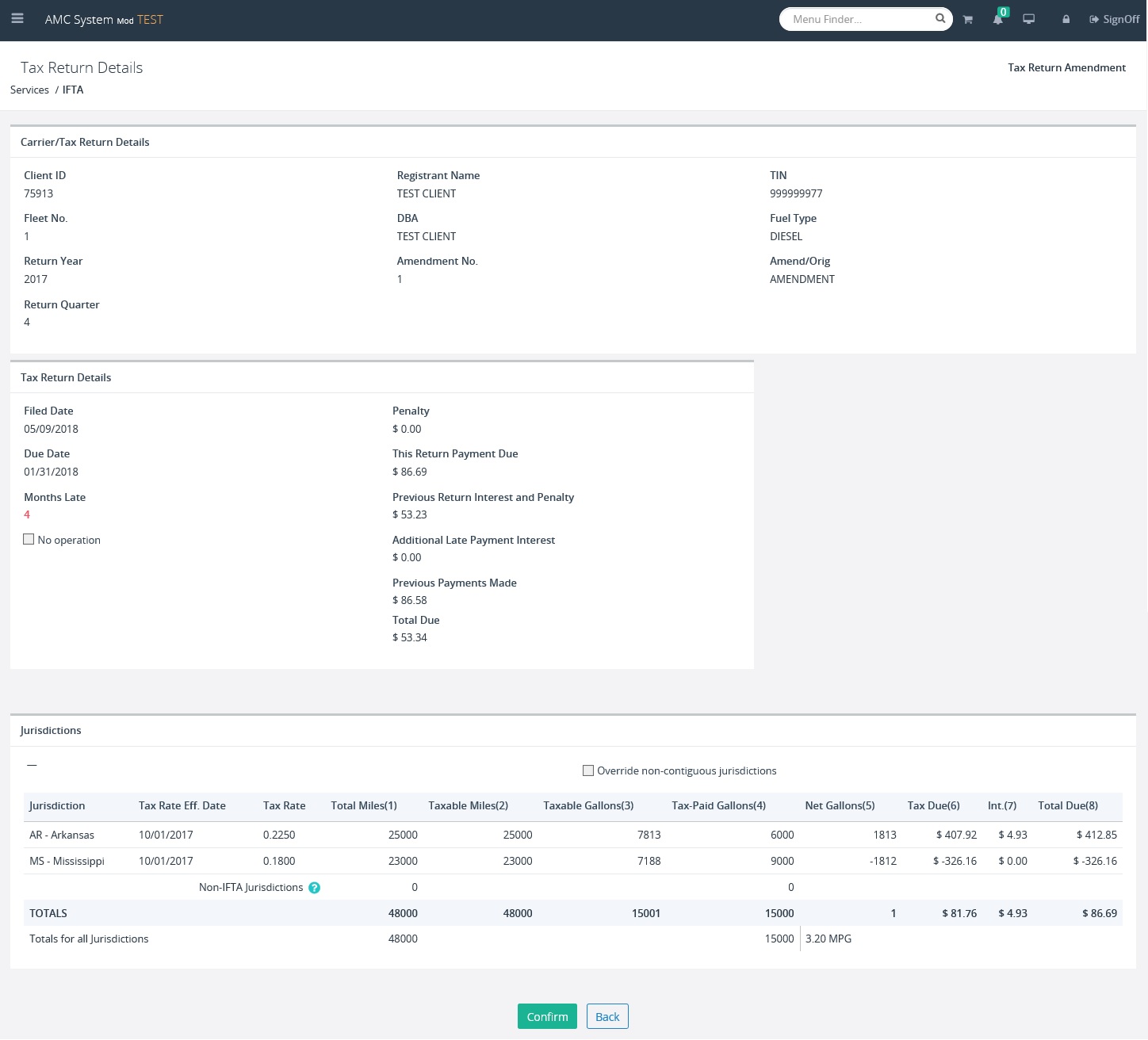

The Tax Return

verification screen will display the amendments to the return as well as

calculate the fees.

The Return

Details section displays the penalty due for the amendment, if applicable, the return

amount, previously paid return interest and penalty, additional interest for

the amendment, previous payments and the total net due associated with the

amendment.

The amendment

may result in additional fees or a refund to the customer.

Review the results and continue processing

the amended return as you would an original return.

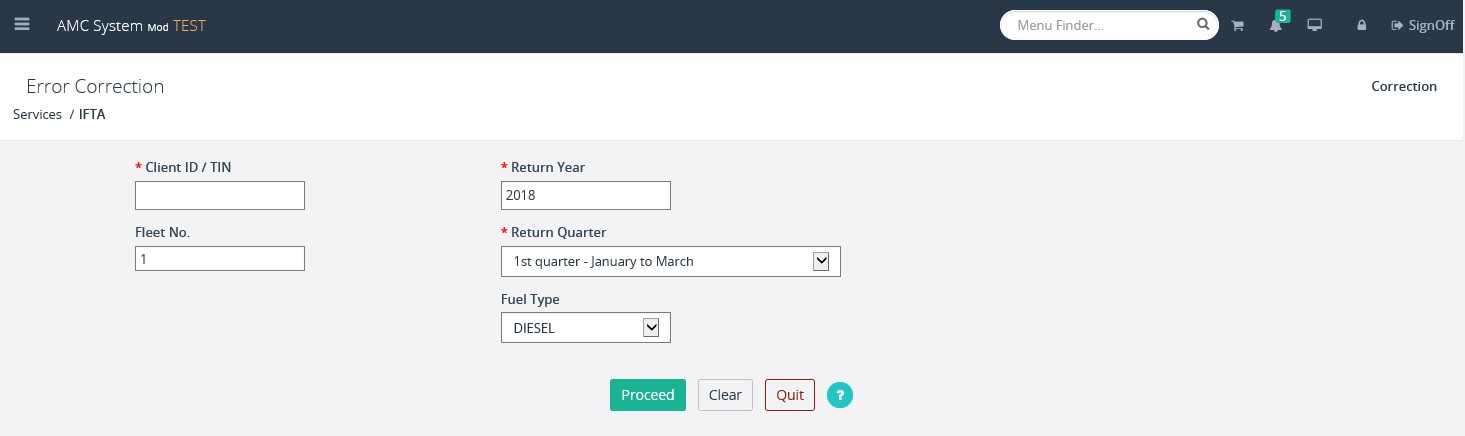

Sometimes errors are made when tax returns are entered and are not

realized until after the return has been transmitted. If an internal user has

made the error, this process will provide a way to file a special amendment,

which allows the internal users to reverse penalty, and interest that was

charged incorrectly as well as make any other changes to the return for the

carrier. If the external user caused the error, the regular amendment process

should be used.

The following

are examples of errors that qualify as corrections vs. an amendment

- Internal user enters an

incorrect jurisdiction(s)

- Internal user enters incorrect postmark date

so penalty and interest were calculated that should not have been

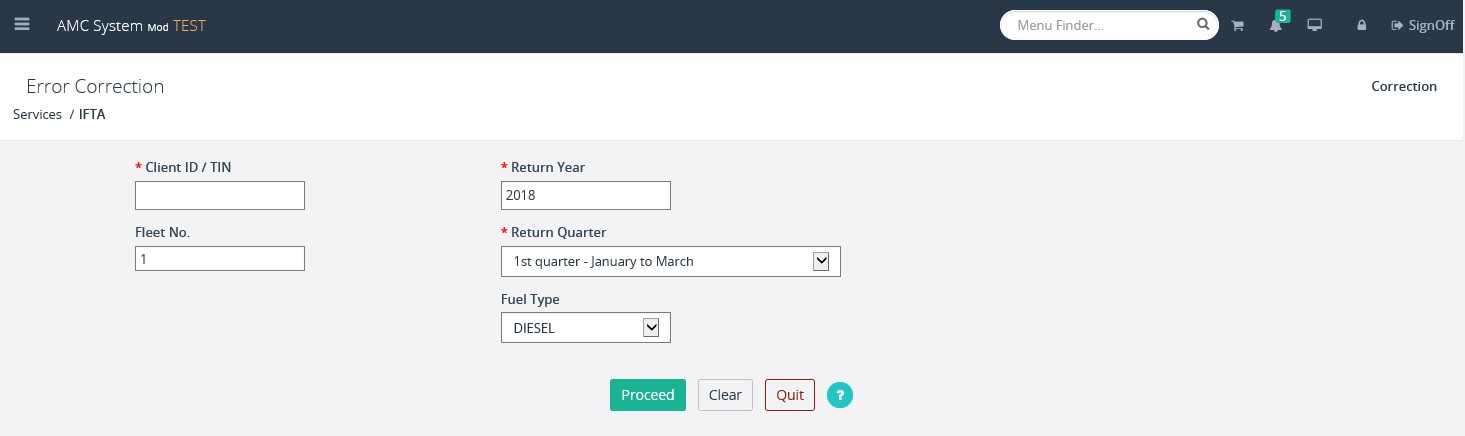

To perform a correction on a tax return

that has already been transmitted, do the following:

- From the IFTA level menu, select

CORRECTION from the TAX RETURN menu tile

- Enter the required search fields (Client

ID/TIN, Fleet No., Return Year, Return Quarter)

- Select PROCEED

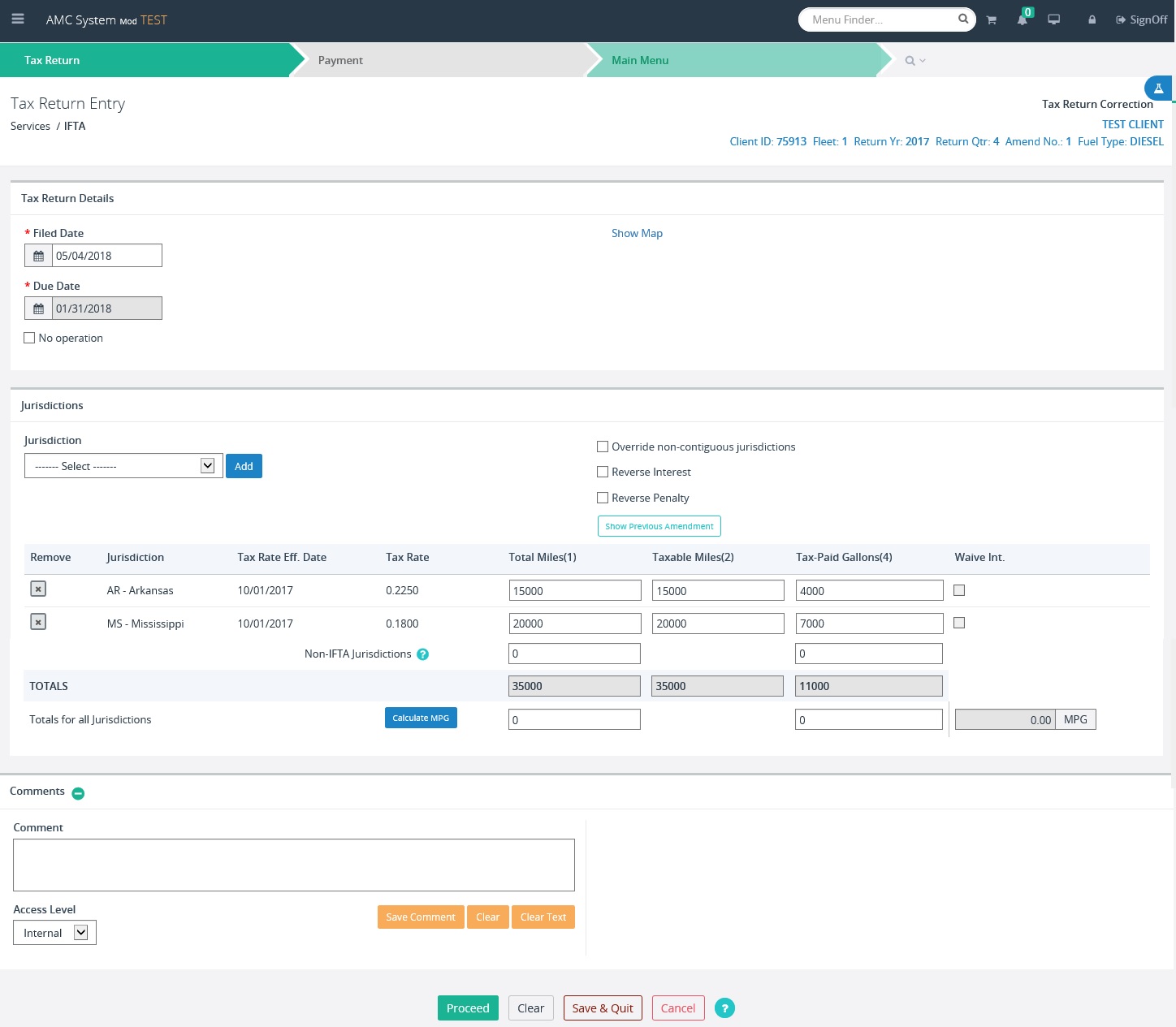

The system will return the requested tax

return information and provide to ability to:

- Update the Total Miles, Taxable Miles,

and Tax-Paid Volume columns

- Reverse any penalty or interest by selecting

the appropriate check box(es)

After the corrections are made to the tax

return, select PROCEED to complete the transaction as you would a normal tax

return.

To

generate a tax return the user will perform the following steps:

· Select TAX RETURN INQUIRY at the TAX RETURN menu tile

· At a minimum one search criteria must be entered and it is usually

the Client ID / TIN prior to selecting SEARCH

· The grid displays the search results based on the search criteria

entered. If more than one tax return exists, the user will be provided a list

of results. Select the view icon for the desired tax return to be viewed.

o

If more than one tax return is displayed, paging

is available on the screen. If more than one page of results are found, the buttons

at the bottom right of the list will be enabled and allow the user to navigate

by clicking the First, Previous, (Page Number), Next or Last.

The system will provide the facility to

maintain the account information outside of the supplement processing.

Perform the following steps to update

account information without generating a supplement.

· From the IFTA application level menu, select UPDATE ACCOUNT from the

ACCOUNT menu tile

· From the Customer Search screen, enter the following:

o

The Client ID/TIN or Client Name

o

Select SEARCH to display the Update Account Details

screen

Changes to the Client Details information

must first be made to the Client Account at the Enterprise Level. The user will

be able to:

·

Update Account Status and add an Effective Date

·

Add Previous IFTA License information

·

Add Previous Suspension/Revocations

·

Comments (add/delete – if available)

To complete the

update, perform the following steps:

- Select PROCEED,

to display the Account verification screen

- Verify the

account information

·

Select CONFIRM, the user will be returned to the IFTA Application level menu

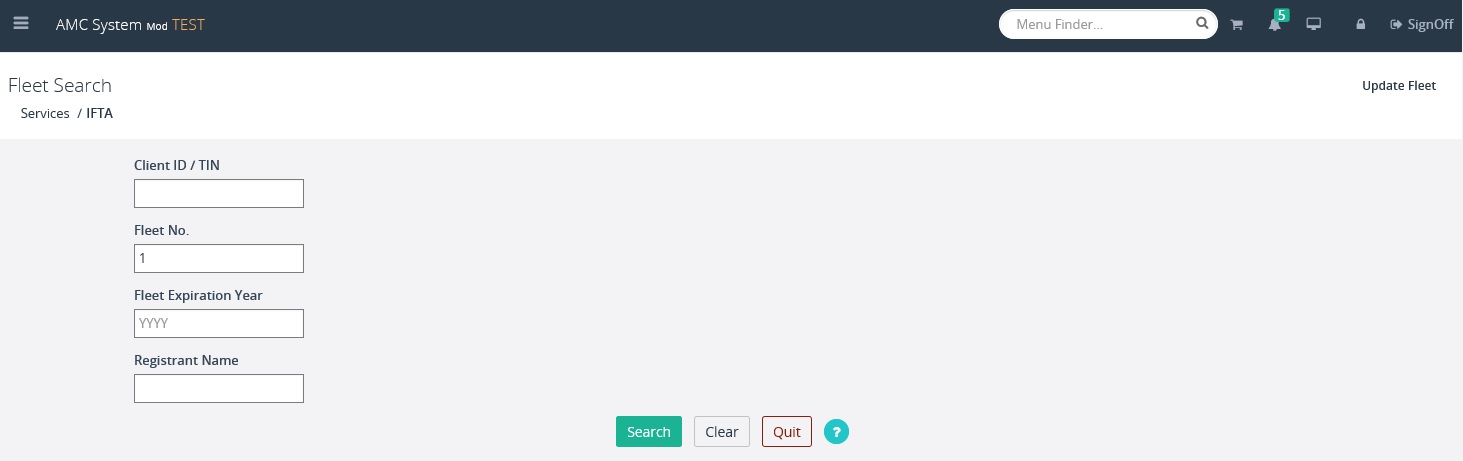

1.3.6.2 Update

IFTA Fleet

The system will

provide the facility to maintain the fleet information outside of the

supplement processing. Perform the following steps to update

fleet information without generating a supplement. The IFTA License will not be

generated.

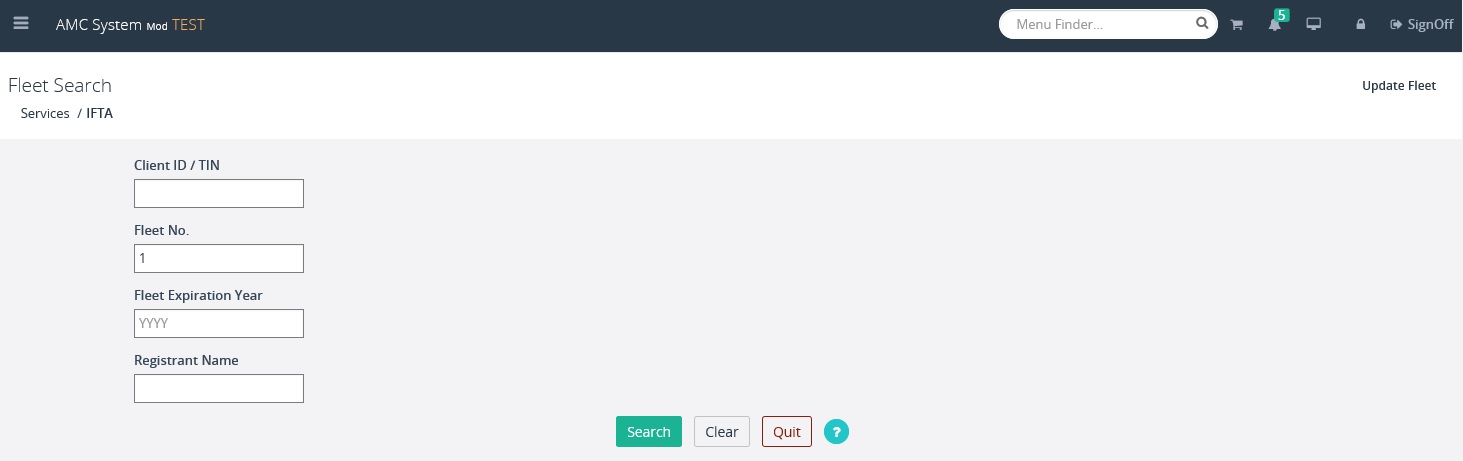

- From the IFTA application

level menu, select UPDATE FLEET from the FLEET menu tile

- From the Fleet Search

screen, enter the following:

o

Enter appropriate data in any of the available

search fields, those primarily used include, Client ID/TIN, Fleet No. or Fleet

Expiration Year.

o

Select SEARCH to display the Fleet Details

screen

In addition to the status, additional fleet

information can be changed such as Contact information, Mailing and Shipping

Address, Reporting Service information and Fuel Type.

Additional

information can be changed by authorized internal users, including:

· Fleet Status and Status effective date

· Fleet comments

· Liability date

· Power of Attorney information

1.3.7 Additional Payment Processing

The AMCS system provides an additional payment-processing

capabilities for IFTA returns.

- The ability to post a partial payment for a tax return if the

customer mailed in the return and miscalculated the amount due

If a partial payment has already been made

for a tax return, the user will access the return through CONTINUE/PAYMENT to

post the additional payment amount. The return status is partially paid. The

customer would have received and outstanding balance letter.

- Click the TAX RETURN at the

CONTINUE/PAYMENT menu tile at the IFTA application menu to display the Tax

Return Payment Details screen

- Once a partial payment has been made,

the invoice cannot be cancelled. The CORRECT TAX RETURN option will not

be enabled for this tax return.

- Complete the payment process as you would

a normal payment.

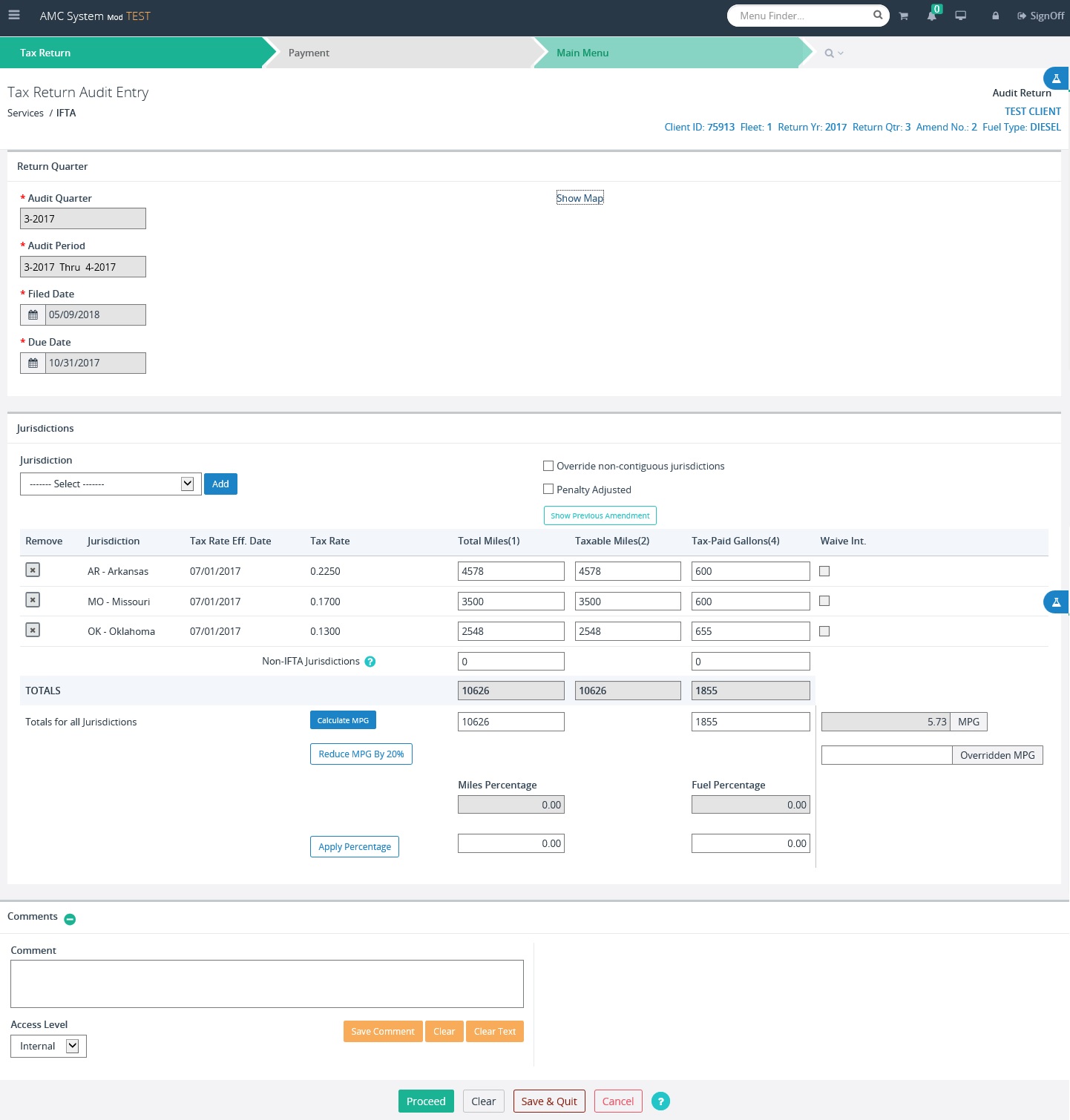

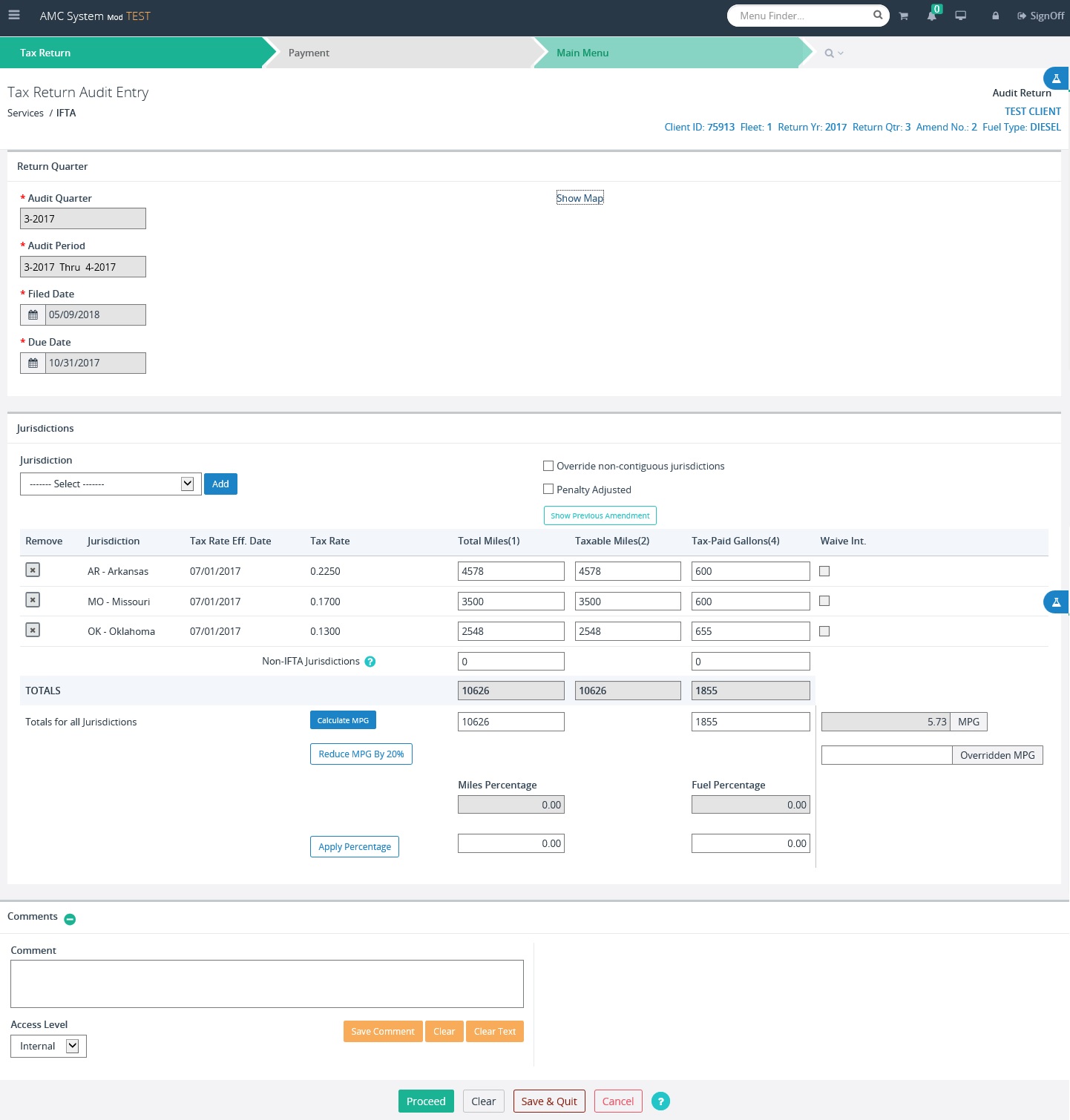

To enter an IFTA audit, select AUDIT RETURN from the AUDIT menu tile

at the IFTA application level menu.

Perform the following steps to complete the entry of audit results:

- On the Tax Return Audit Search

screen, enter the Client ID/ TIN, Fleet No., Fuel Type, Auditor Name,

Delivery Date, Interest Accrual Date, Starting and Ending Quarter and Year).

Interest accrual date will be the date used to calculate interest and

penalty due for the audit.

- Select SEARCH to display the Tax Return

screen

·

The Tax Return screen is similar to an amended

tax return, the Amendment No. is incremented by one and the Amend/Orig. field

displays as “Audit”

·

In the Jurisdiction Details section, the Miles

and Tax Paid Volume fields are automatically populated with the latest return

for the quarter and available to be changed.

- Click the SHOW PREVIOUS AMENDMENT button to display the

previous totals entered as you enter the updated values for comparison

·

Complete the return with the audited results as

you would an amended return. Enter the Total Miles and Volume and select

CALCULATE. This will calculate the MPG and generate totals for each column.

·

Also check the Waive Int. checkbox, if it meets AMCS’s

business rules not to charge a penalty

- Select PROCEED to calculate the audit fees, interest, and

penalty and display the Tax Return verification screen

- Make sure to review the audit results,

MPG and the amount due

- Select BACK, if adjustments need to be

made

- Select PROCEED to continue with the next

tax return

- Repeat the same process for each return

included in the audit

- If more than one return has been entered

and the auditor decides to cancel the audit

o

Each quarter is cancelled separately. Starting

with the second quarter of the audit the CANCEL button changes to CANCEL QTR

- If the auditor needs to stop entry of the

audit but does not want to cancel, the QUIT/SAVE button will save the

information that has been entered and the audit can be accessed again by

selecting AUDIT RETURN from the CONTINUE/PAYMENT menu tile.

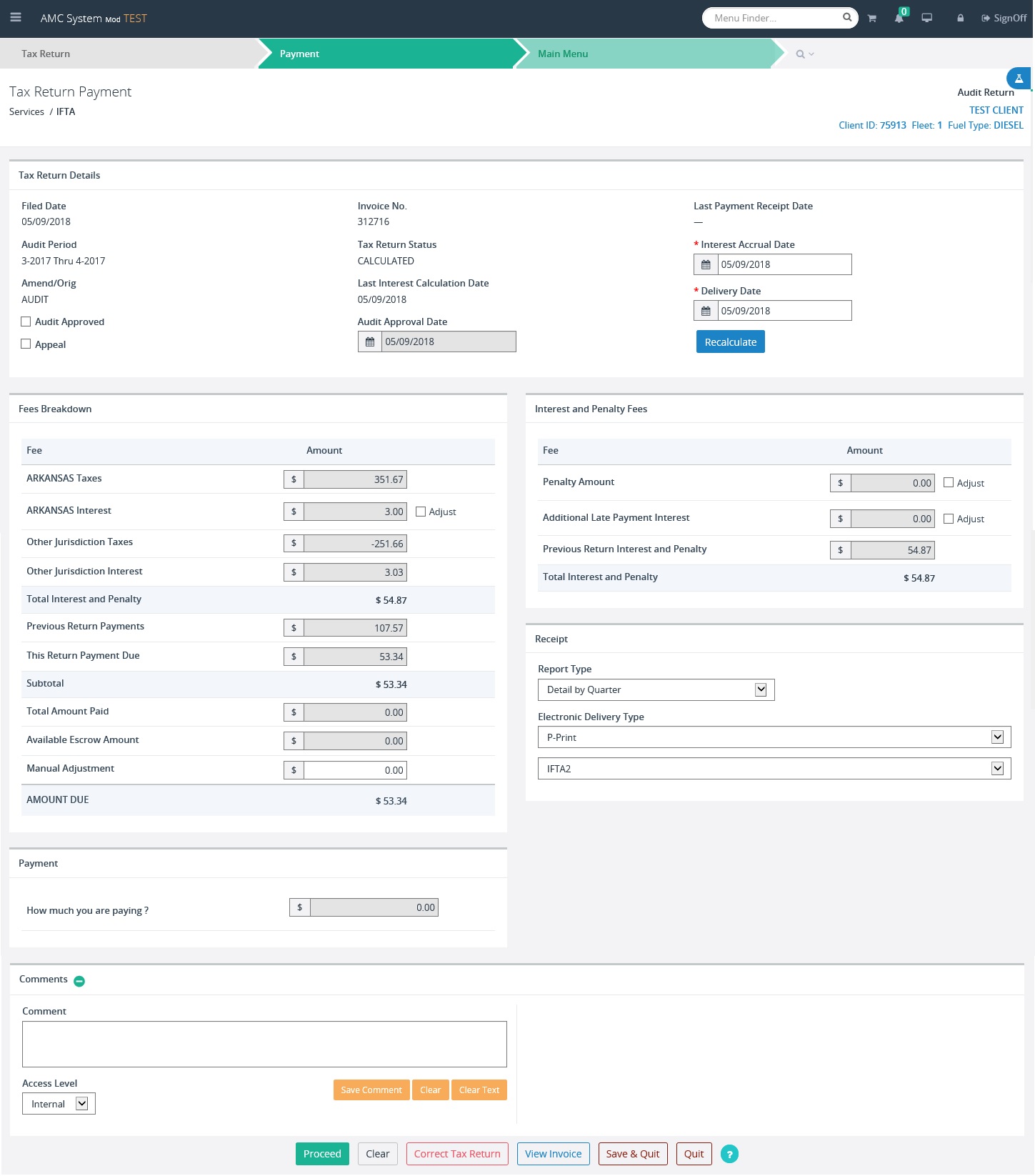

Audit Payment Details screen

After the entry of the last quarter

included in the audit, the Tax Return Payment Details screen will display with

the fees due or owed to the customer based upon the calculation of all returns

To correct a return within the audit,

perform the following steps:

- Select the CORRECT TAX RETURN button

o

The screen will display the first return within

the audit

§

If changes are not required, select PROCEED on

the Tax Return screen, verify the results, select CONFIRM on the Tax Return

verification screen to display the next return

§

If changes are required, make the necessary

changes, select PROCEED to display the Tax Return verification screen, verify

the results and select CONFIRM to display the next return

§

Repeat the process until the Tax Return Payment

Details screen is displayed

The auditor should perform the following

steps to provide a proposed invoice to the customer and close the audit

transaction:

- Verify the information is correct on the

Tax Return Payment Details screen

- Select the invoice/report type – the

first page of each type is the same

- Select VIEW INVOICE

- Print the first page of the invoice to

give to the customer

- Select QUIT

Audit Review and Adjustments

- The audit manager will be able to access

the audit through the AUDIT RETURN option within the CONTINUE/PAYMENT menu

tile

- Updates can be made if necessary by

following the same steps for correcting the audited returns

- Based upon AMCS business rules the

Interest Accrual Date can be adjusted

o

Select the RECALCULATE button to the left of

this field to generate the correct interest and penalty

- Once the audit is approved, update the

Invoice/Report Type

- Select VIEW INVOICE

Payment/Refund Process

The payment/refund process is the same as

it is for all returns with the exception that the audit must be paid in full.

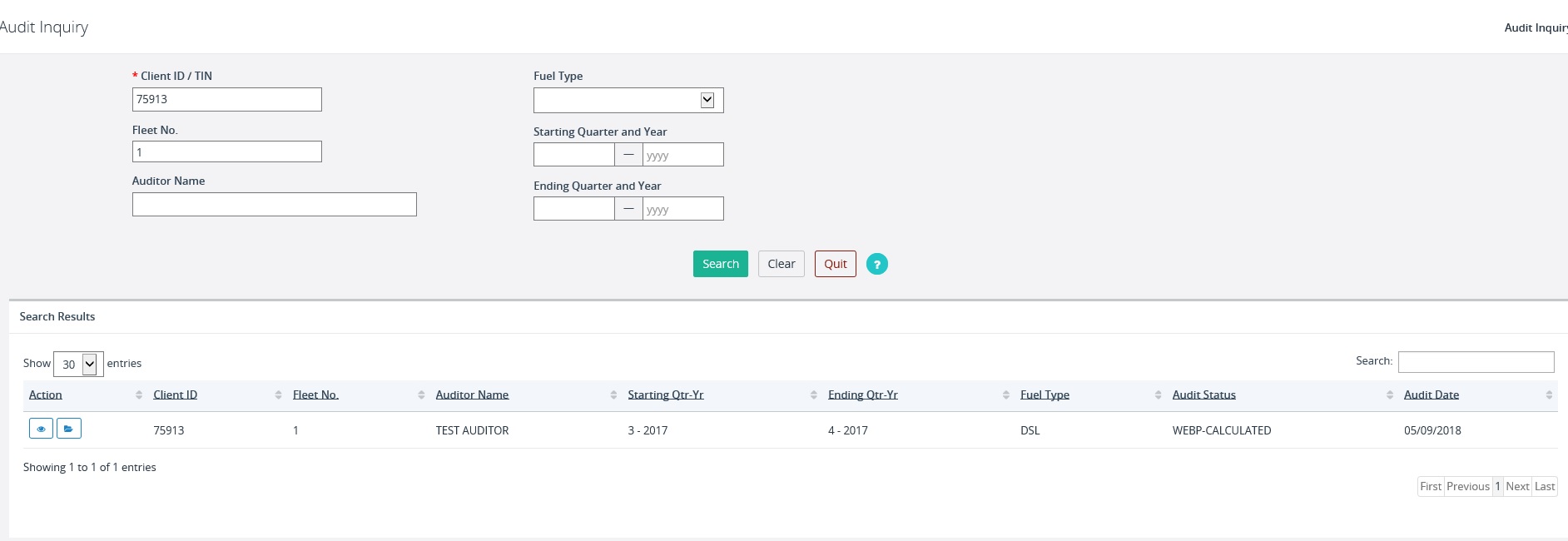

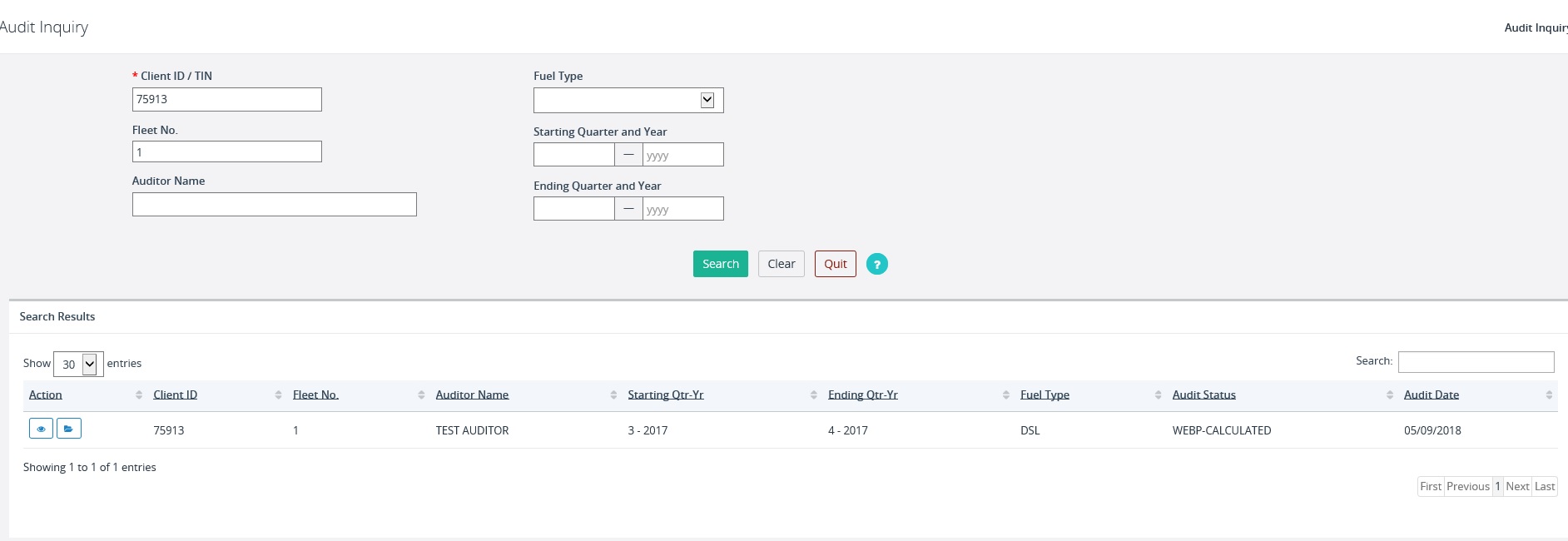

Users can inquiry on an audit by performing

the following steps:

- From the IFTA application level menu, select AUDIT INQUIRY from

the AUDIT menu tile to display an inquiry pop-up screen

- Enter at a minimum the required Client ID/TIN – the user can

enter additional search criteria to narrow the search

- Select SEARCH to display the search

results

- Click the view icon to the left of the Client ID in the grid to

display the Audit Tax Return details

- Use the scroll bar on the left side of the inquiry screen to

display additional information

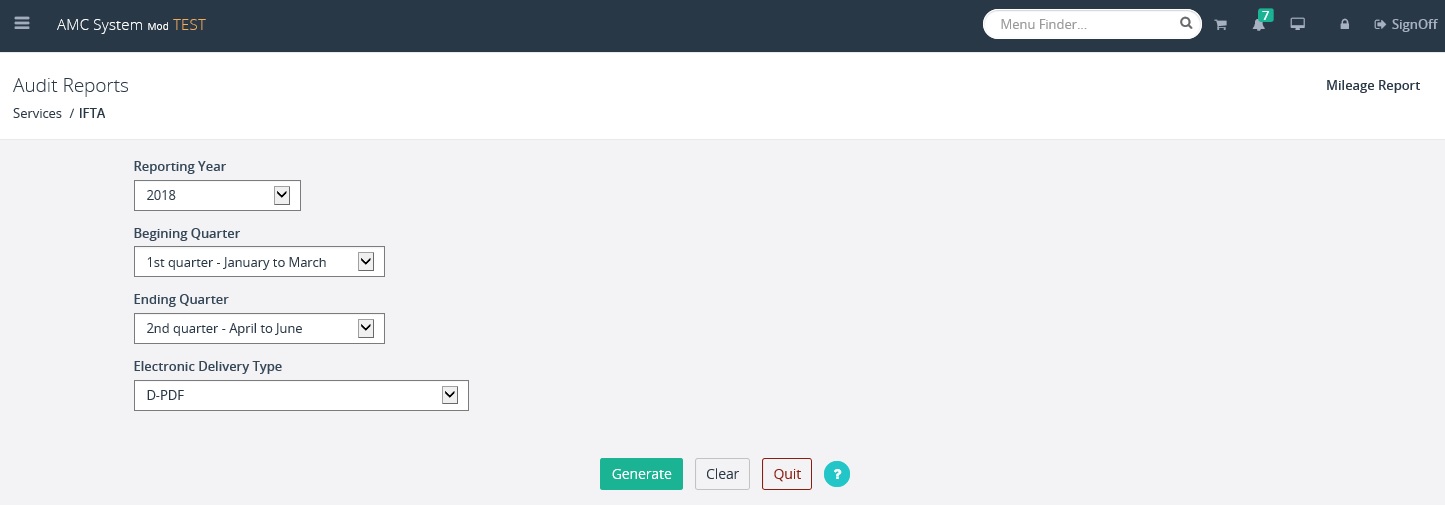

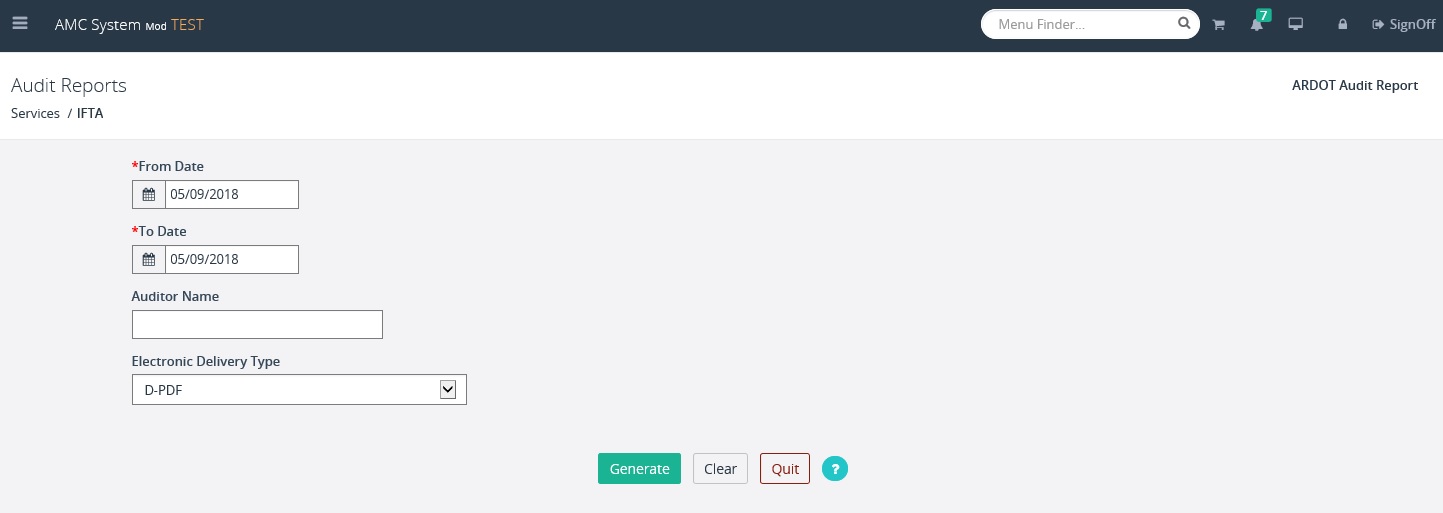

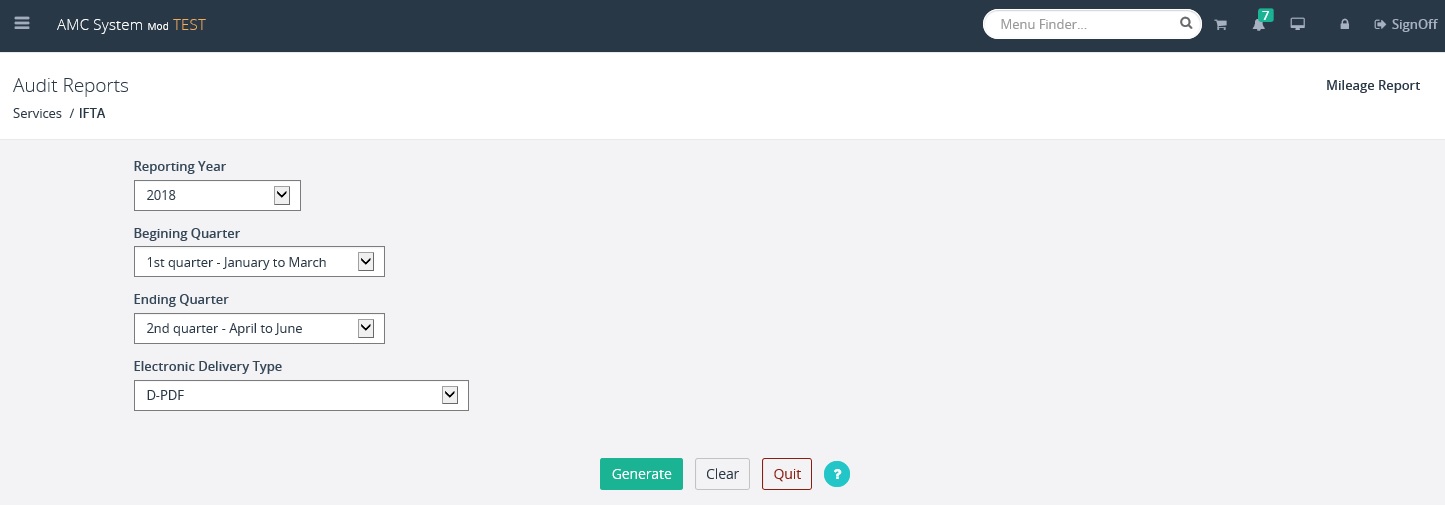

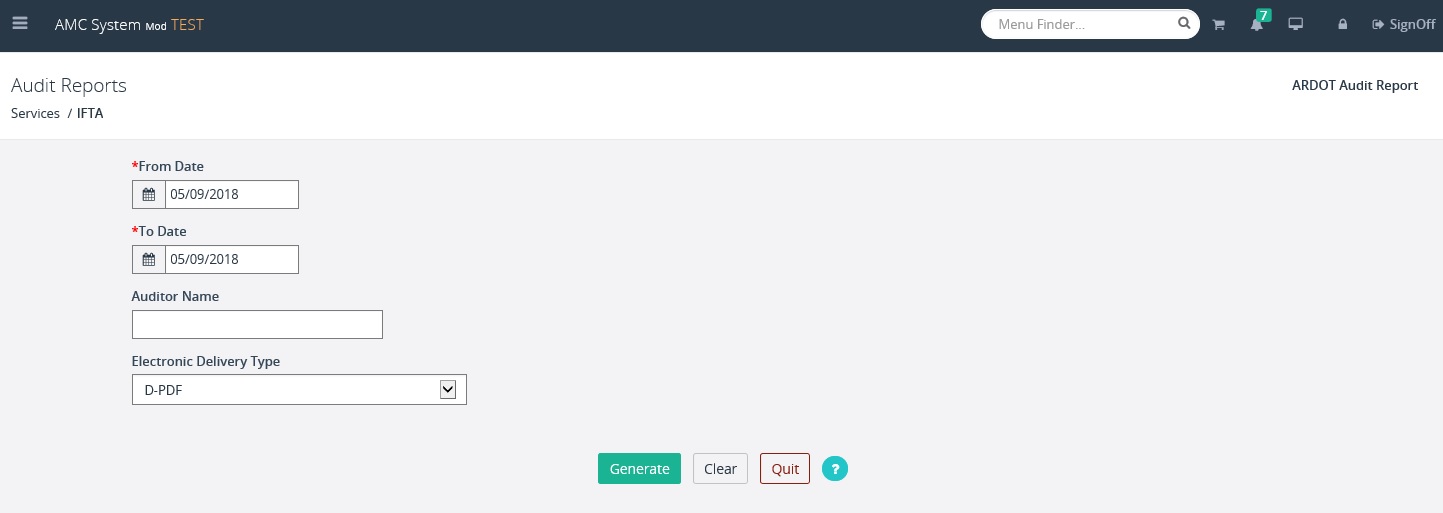

The AMCS system provides a number of

reports . The following is a list of available audit

reports available by selecting the appropriate report options from the AUDIT

REPORTS menu tile on the IFTA application level menu

- County Decals

- County Volume

- County Miles

- Taxable Miles

- Mileage Report

- ARDOT Audit Report

Depending on the report selected, a number

of search fields will be displayed and/or required to generate the report.

Enter the search criteria required or available and then click the GENERATE

button to produce the report.

County Decals

County Volume

County Miles

Taxable Miles

Mileage Report

ARDOT Audit Report

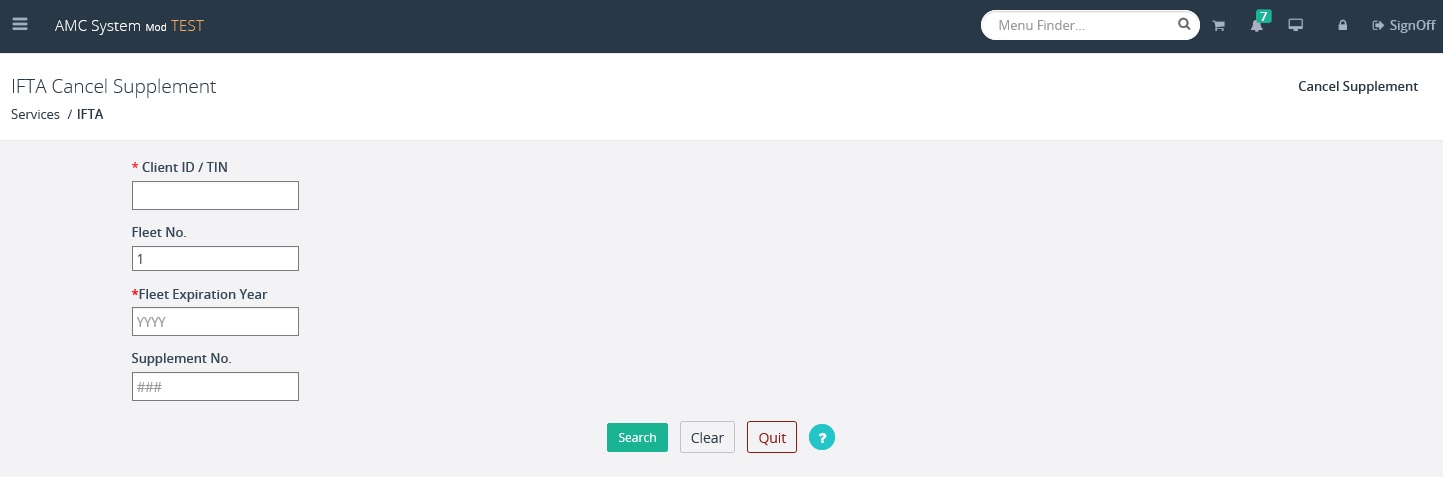

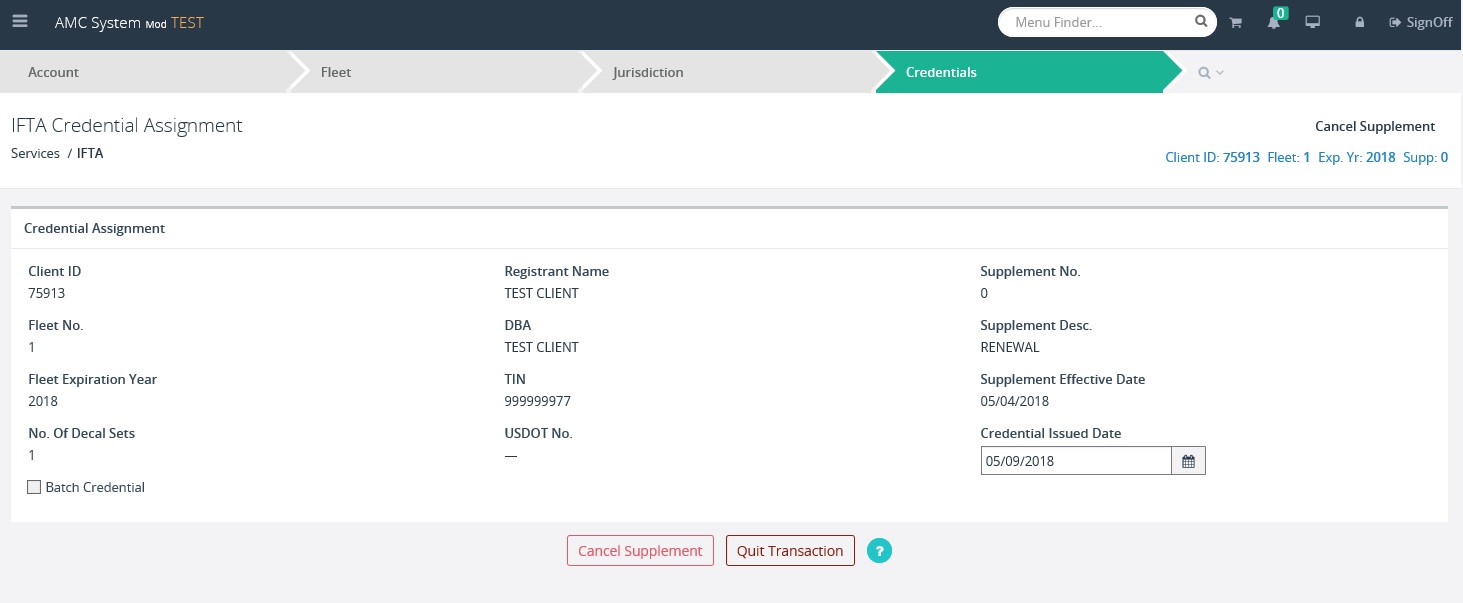

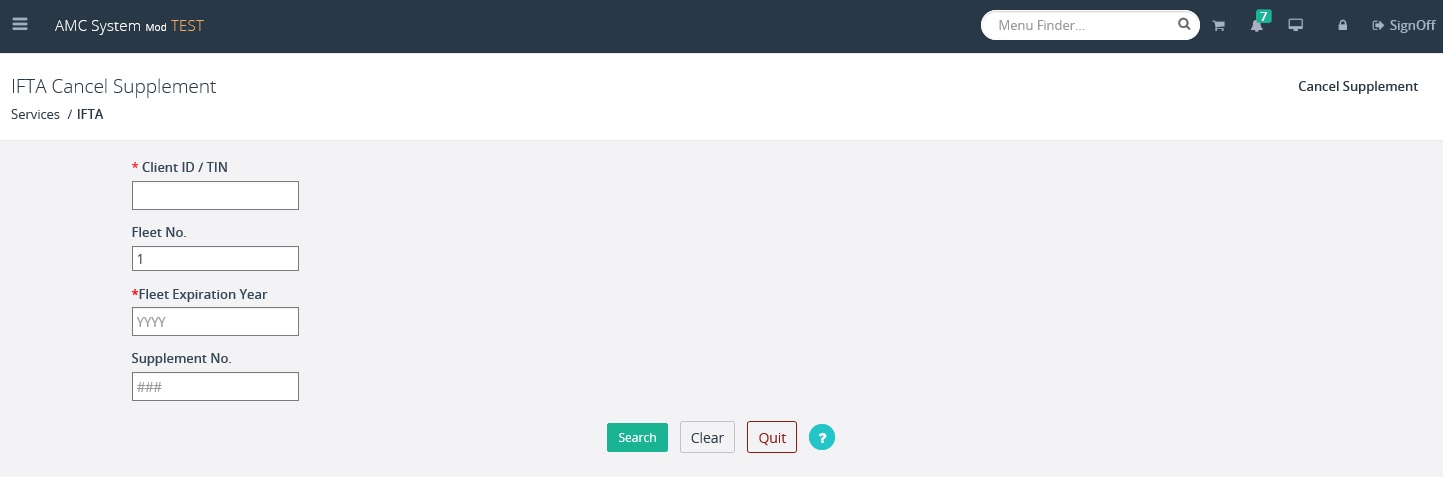

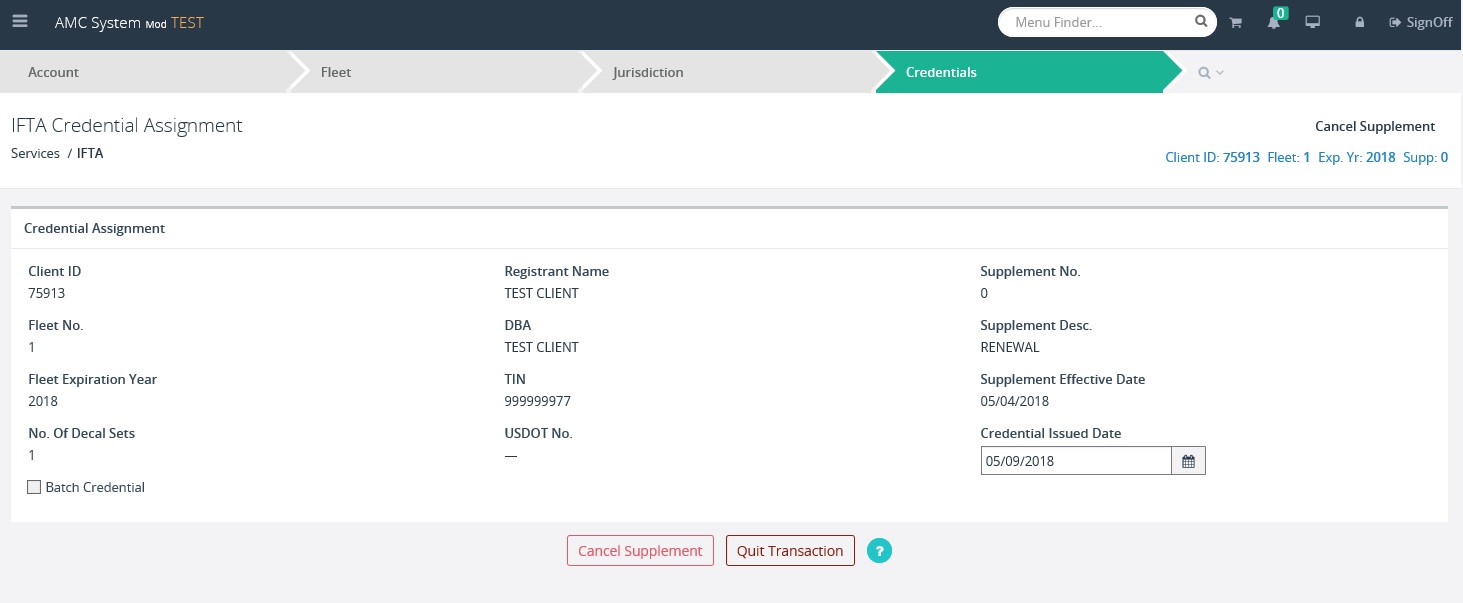

To cancel an IFTA supplement payment, do

the following:

- From the IFTA application main menu, select CANCEL SUPPLEMENT PAYMENT

from the TRANSACTION CANCEL menu tile

- Enter at a minimum the required Client ID/TIN, Fleet No. and

Fleet Expiration Year; Supplement No. can also be used to search

- Select SEARCH to display the available

supplements in a grid

- Click the SELECT TO CANCEL button to the left of the Client ID

for the supplement to be cancelled

- Select OK to confirm the cancellation

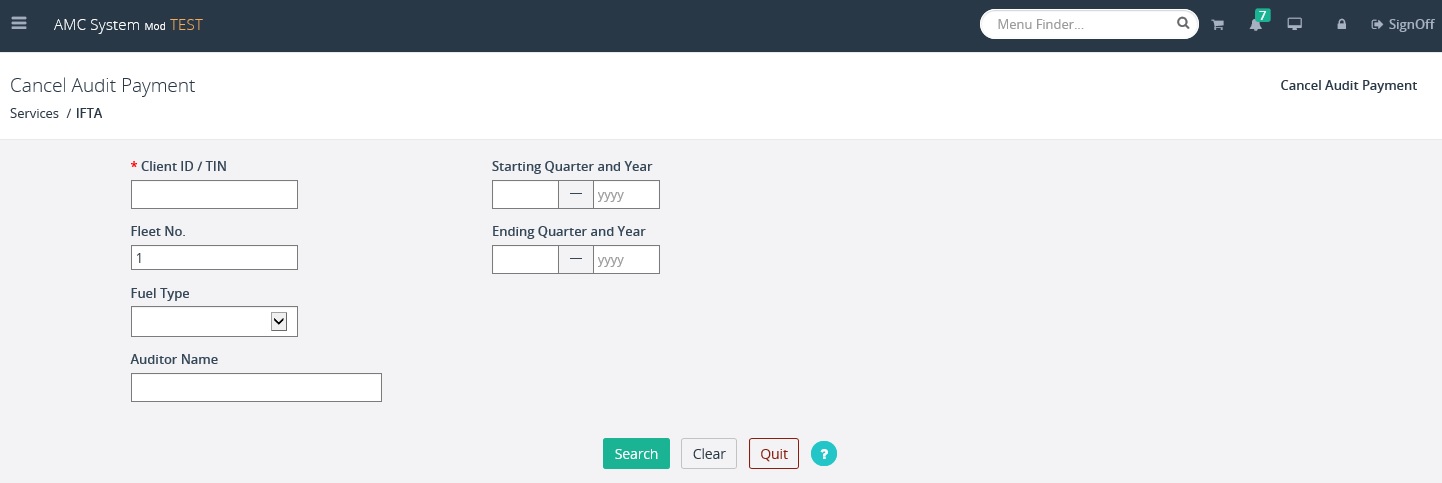

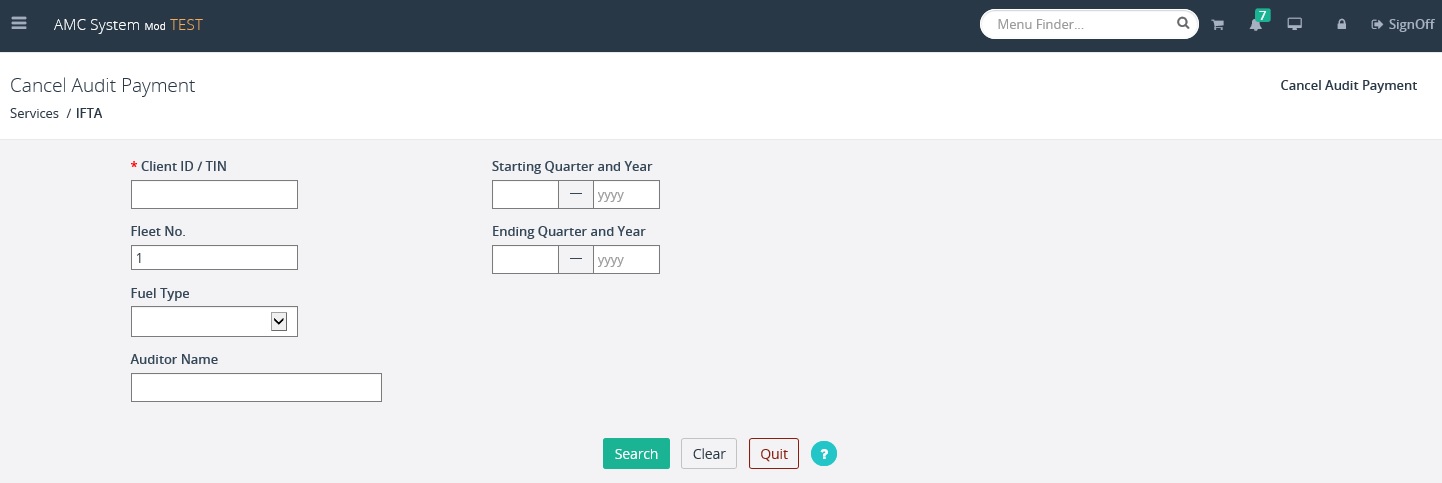

To cancel an IFTA audit payment, do the

following:

- From the IFTA application main menu, select CANCEL AUDIT

PAYMENT from the TRANSACTION CANCEL menu tile

- Enter at a minimum the required Client ID/TIN and provide

additional search criteria to narrow the search (Fleet No., Fuel Type,

Auditor Name, Starting and Ending Quarter and Year)

- Select SEARCH to display the available

supplements in a grid

- Click the SELECT TO CANCEL button to the left of the Client ID

for the supplement to be cancelled and confirm the cancellation

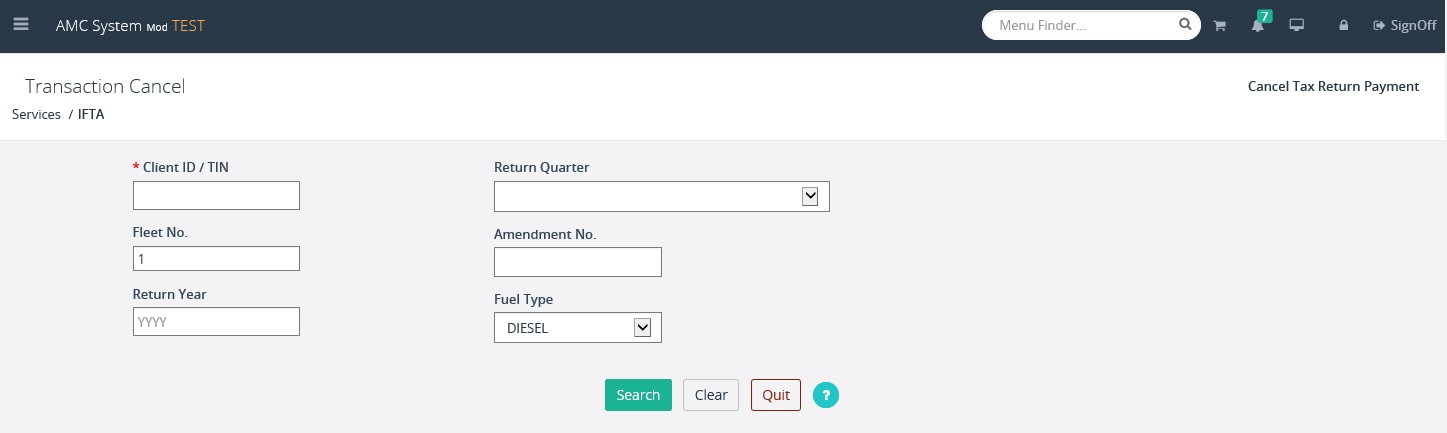

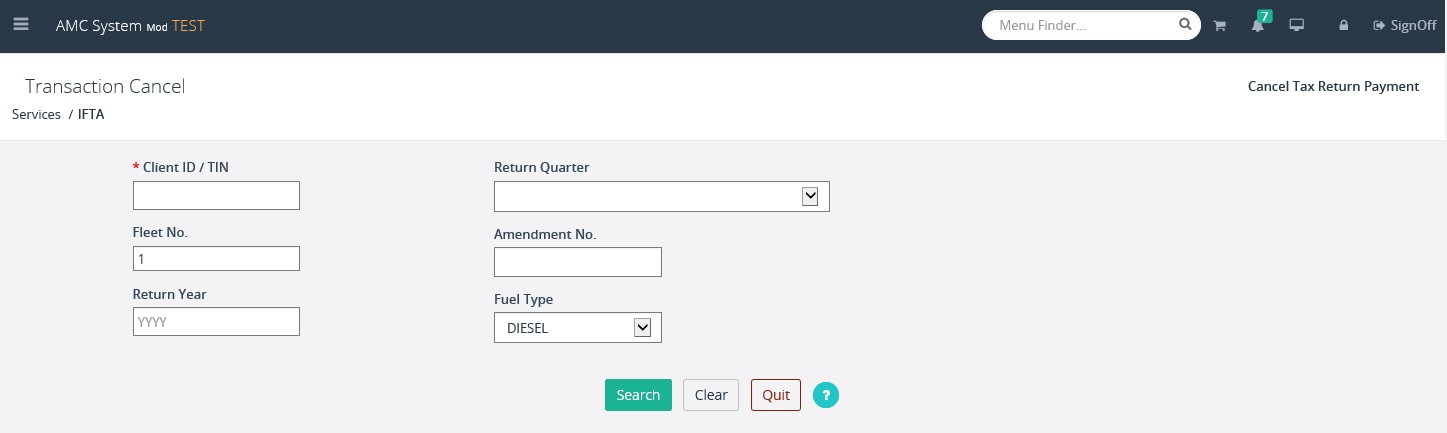

To cancel an IFTA tax return payment, do

the following:

- From the IFTA application main menu, select CANCEL TAX RETURN

PAYMENT from the TRANSACTION CANCEL menu tile

- Enter at a minimum the required Client ID/TIN and provide

additional search criteria to narrow the search (Fleet No., Return Year,

Return Quarter, Amendment No., Fuel Type)

- Select PROCEED to display the available

supplements in a grid

- Click the SELECT TO CANCEL button to the left of the Client ID

for the supplement to be cancelled and confirm the cancellation

The system will provide the user with the

capability to perform inquiries on all of the IFTA related information using

the tree structure. The various inquiry options are available in the

corresponding menu tiles at the IFTA application level menu. Below is a list

of available inquiries from the IFTA application level menu.

·

From the Account menu tile:

o

Account Inquiry

·

From the Tax Return menu tile:

o

Tax Return Inquiry

·

From the License menu tile:

o

License Inquiry

·

From the Audit menu tile:

o

Audit Inquiry

·

From the Inquiries menu tile:

o

Fleet Inquiry

o

Jurisdiction Inquiry

o

Supplement Inquiry

o

Temp Permit Inquiry

o

Tax Rates Inquiry

o

Interest Rates Inquiry

To generate an inquiry related to a specific account or tax return,

the user will perform the following steps:

· At a minimum one search criteria must be entered and it is usually

the Client ID / TIN prior to selecting SEARCH

· The grid displays the search results based on the search criteria

entered

· Paging is available on the screen. If more than one page of results

are found, the buttons at the bottom right of the list will be enabled and

allow the user to navigate by clicking the First, Previous, (Page Number), Next

or Last.

To view the structure of the entire

account, click the folder icon  to the left of the

Client ID in the grid.

to the left of the

Client ID in the grid.

· The account structure will appear on the left side of the result

screen including all License years as well as tax returns filed within the license

year.

·

Each level with a “+” can be expanded

or if a “-“ is displayed can be collapsed

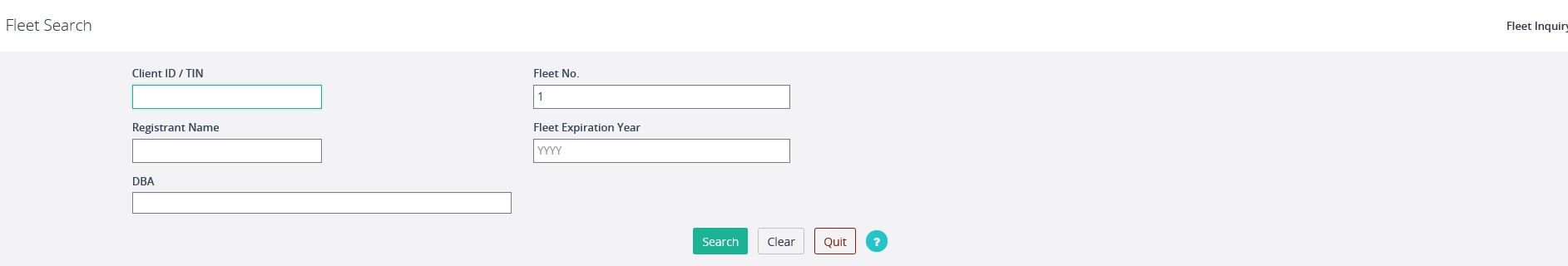

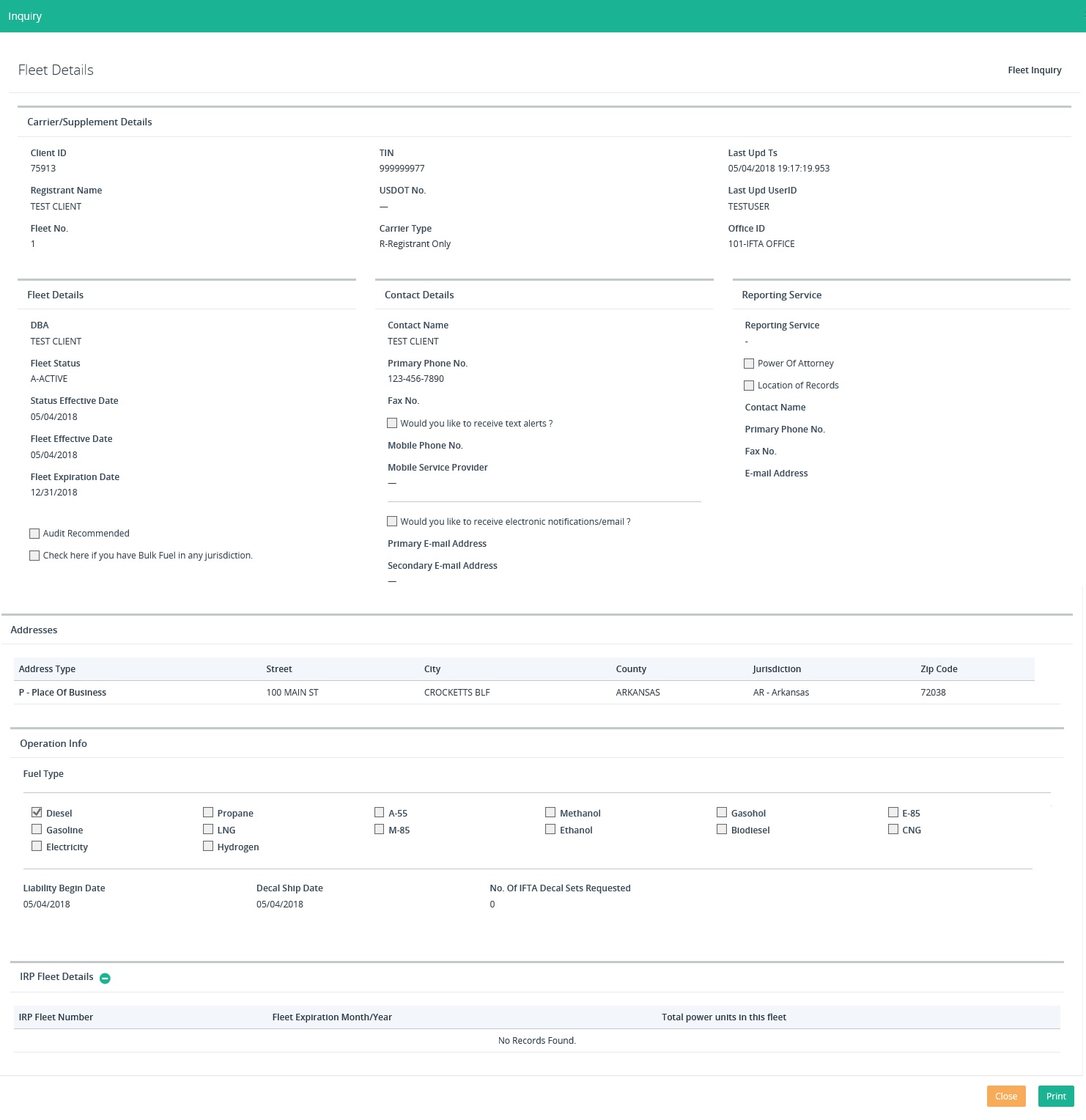

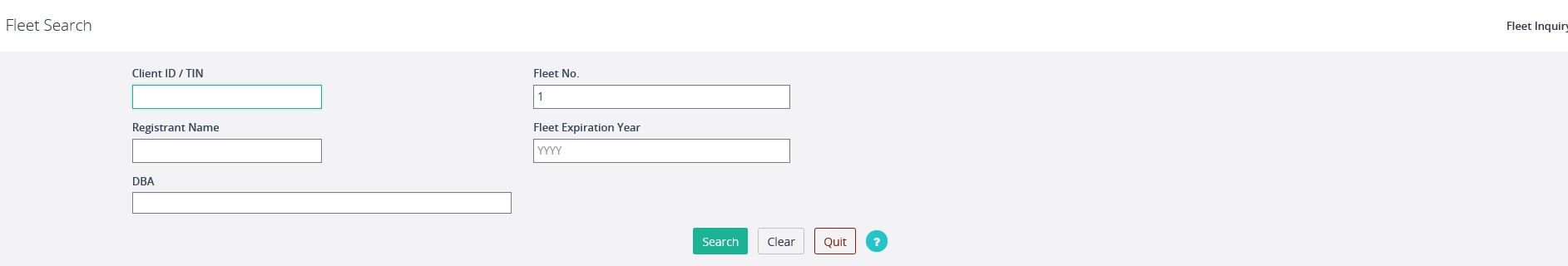

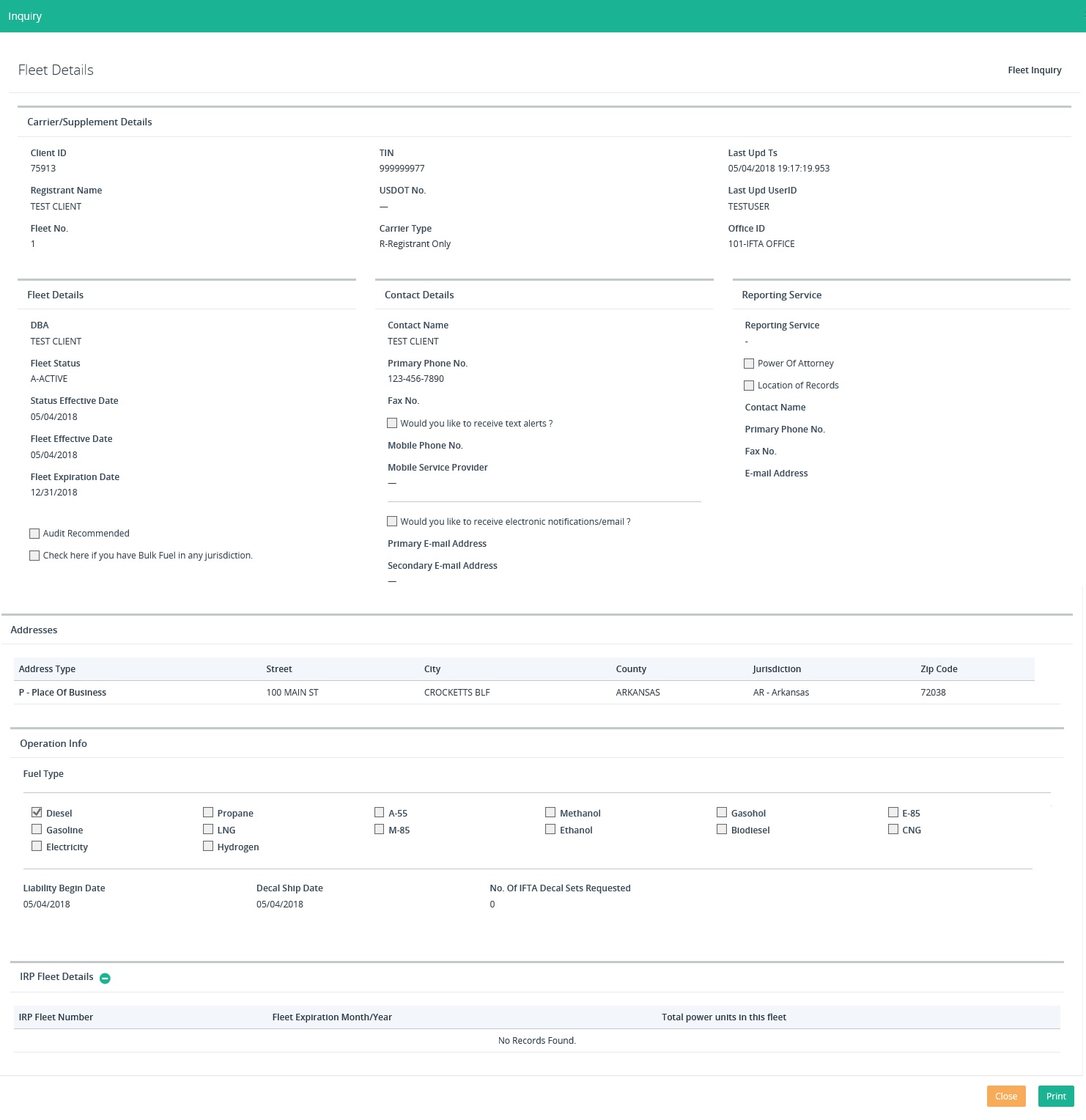

To perform a fleet inquiry,

perform the following steps:

·

Select FLEET from the INQUIRIES menu tile at the

IFTA application level menu

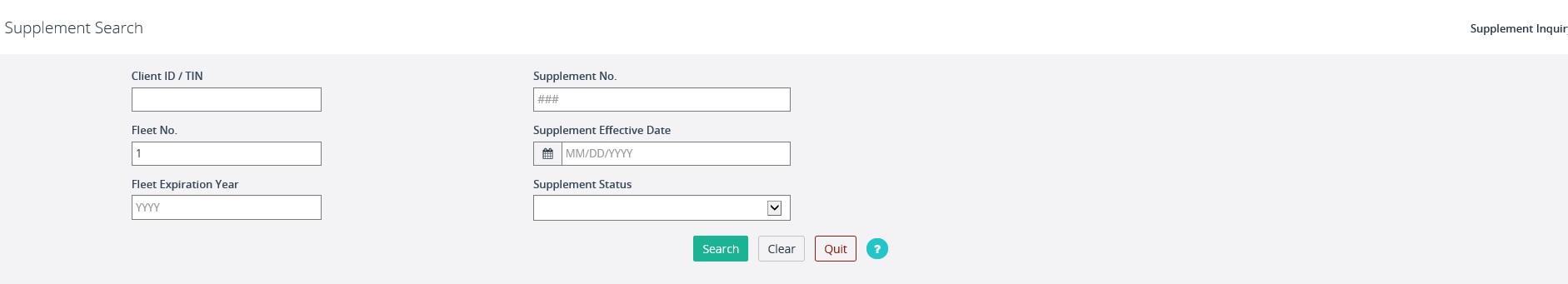

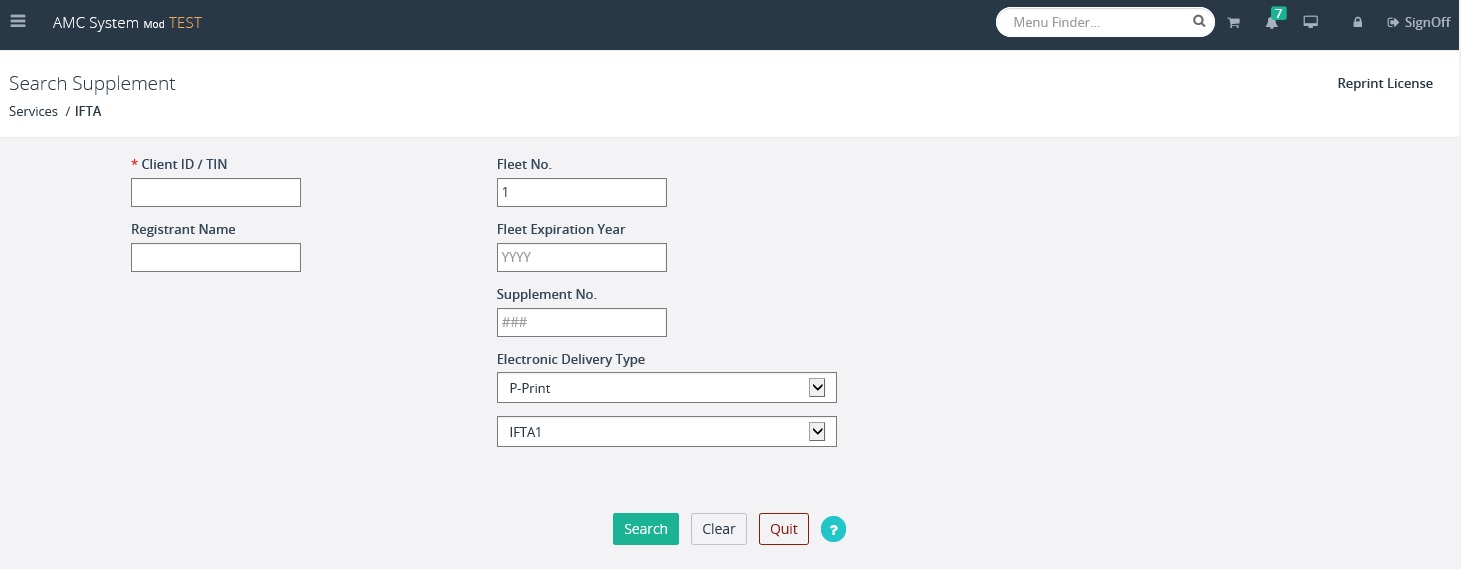

·

At the Fleet Search inquiry pop-up screen, enter

at least one search criteria and then click SEARCH

Depending on the search

criteria entered the system will return matching records. Each entry will have

a view icon  and a folder icon

and a folder icon  .

.

·

Click the view icon and the system will open a

pop-up screen with the Fleet details for the selected account

·

Select the PRINT button to print the fleet detail

information

·

Select the CLOSE button to close fleet detail pop-up

·

Select QUIT to return to the IFTA level menu to

CLEAR to enter new data and perform another search

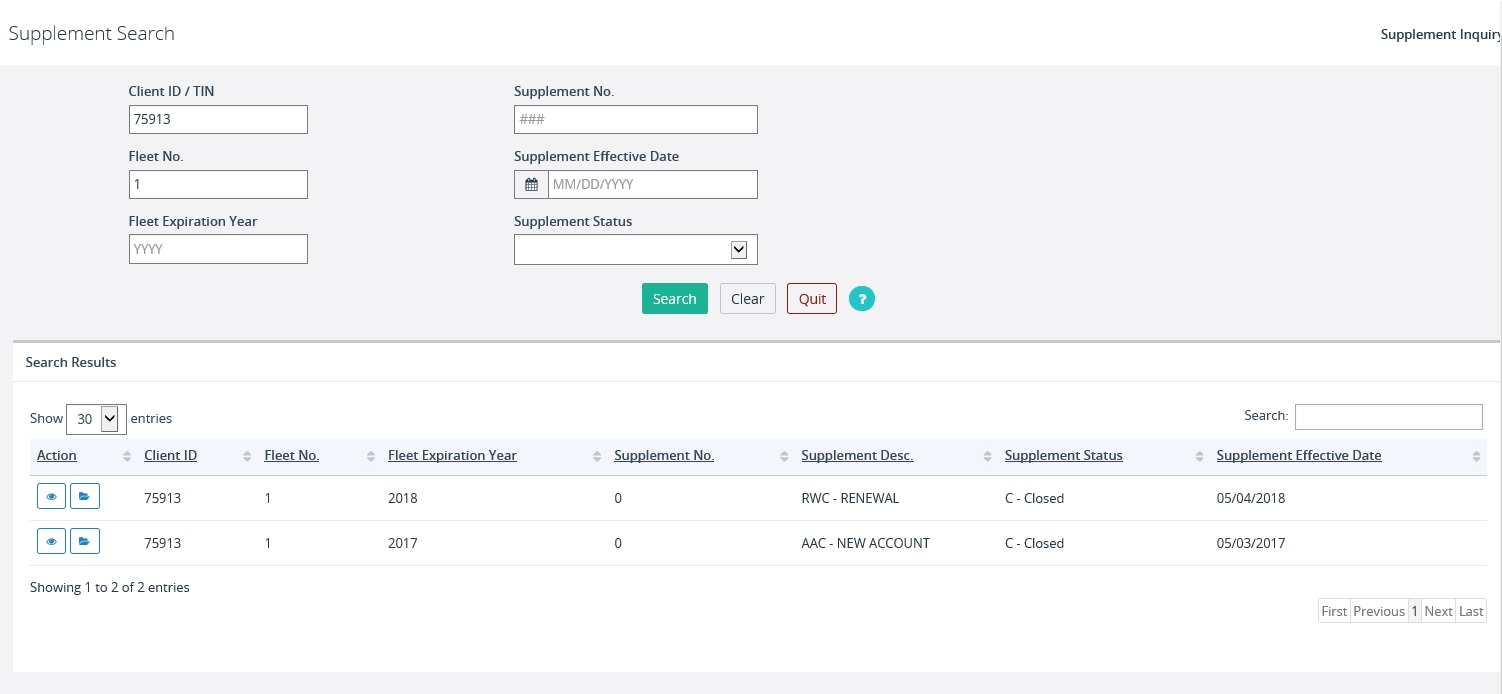

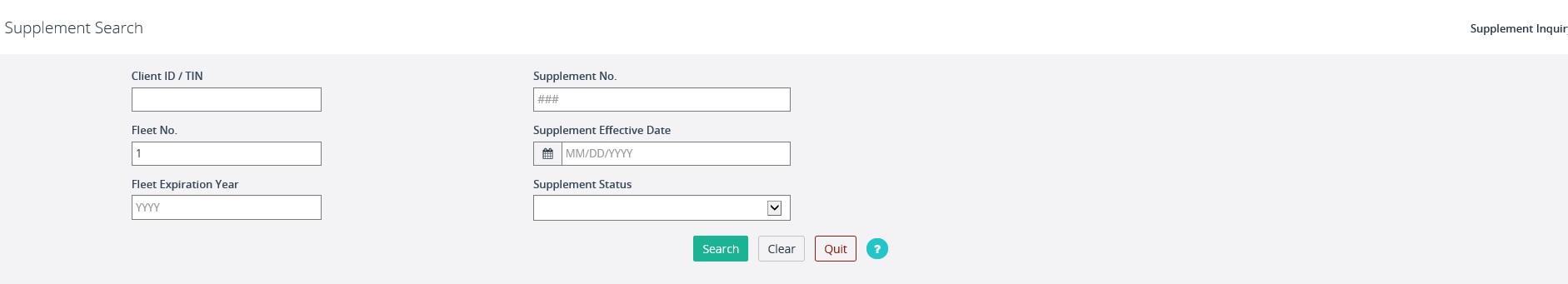

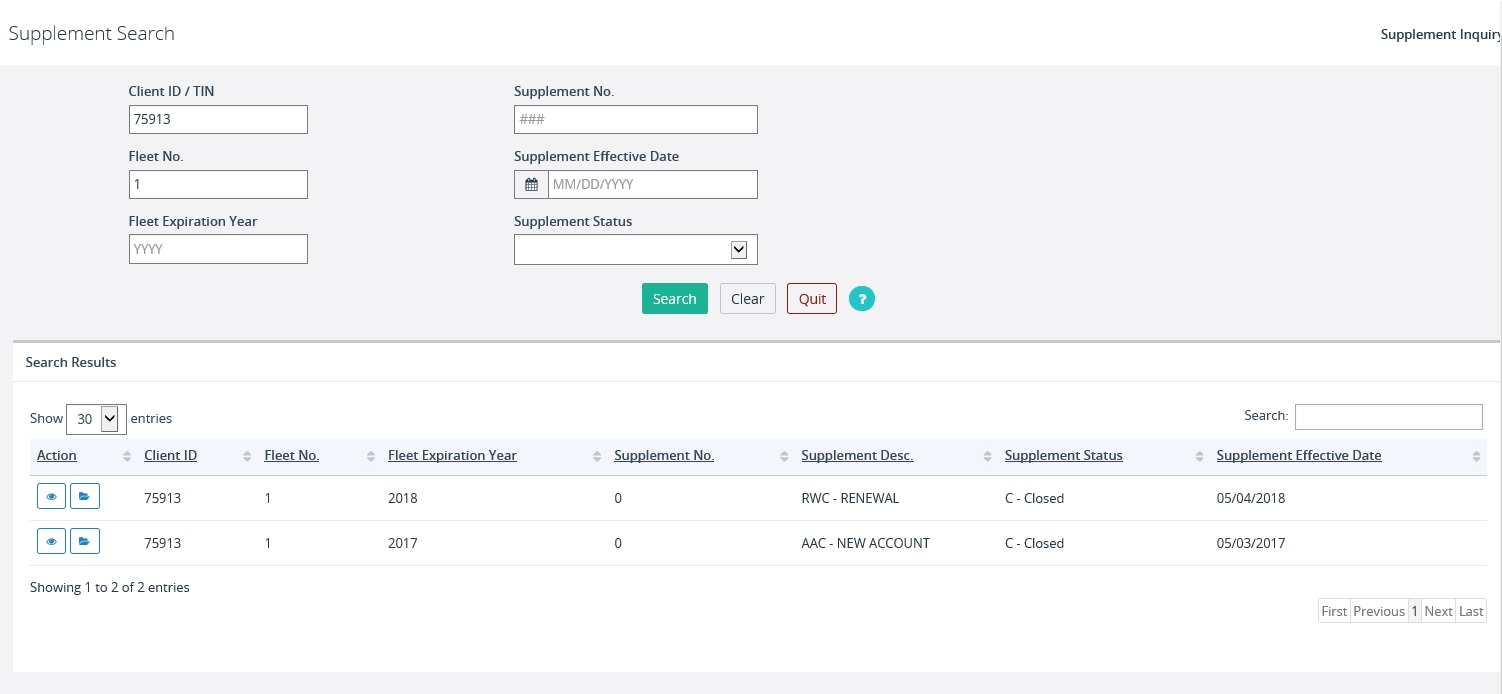

To perform a supplement

inquiry, perform the following steps:

·

Select SUPPLEMENT from the INQUIRIES menu tile

at the IFTA application level menu

·

At the Supplement Search inquiry pop-up screen,

enter at least one search criteria and then click SEARCH

o

Enter additional search criteria to narrow the

search

Depending on the search

criteria entered the system will return matching records. Each entry will have

a view icon  and a folder icon

and a folder icon  .

.

·

Click the view icon and the system will open a

pop-up screen with the Supplement details for the selected account

·

Select the PRINT button to print the supplement

detail information

·

Select the CLOSE button to close supplement

detail pop-up

·

Select QUIT to return to the IFTA level menu to

CLEAR to enter new data and perform another search

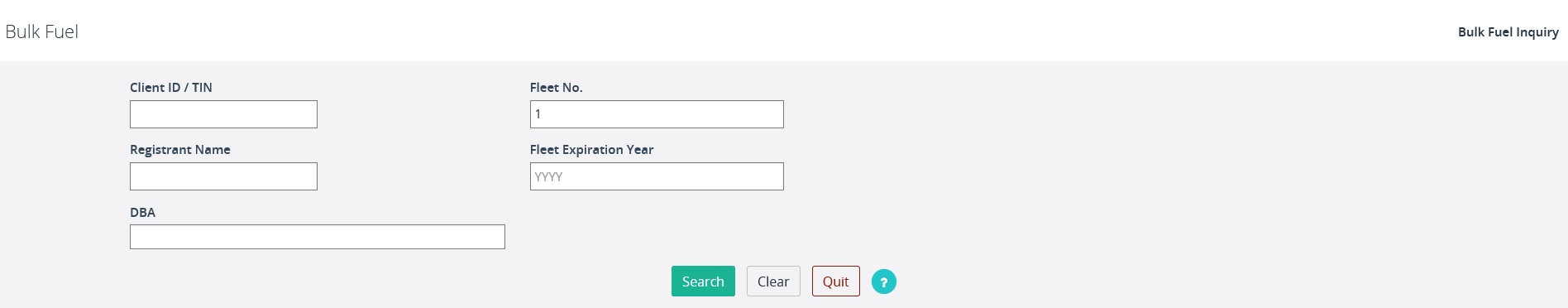

To perform a

Jurisdiction inquiry, perform the following steps:

·

Select Bulk Fuel from the INQUIRIES menu tile

at the IFTA application level menu

·

At the Bulk Fuel Search inquiry pop-up screen,

enter at least one search criteria and then click SEARCH

Depending on the search

criteria entered the system will return matching records. Each entry will have

a view icon  and a folder icon

and a folder icon  .

.

·

Click the view icon and the system will open a

pop-up screen with the Jurisdiction details for the selected account

·

Select the PRINT button to print the jurisdiction

detail information

·

Select the CLOSE button to close jurisdiction

pop-up

·

Select QUIT to return to the IFTA level menu or

CLEAR to enter new data and perform another search

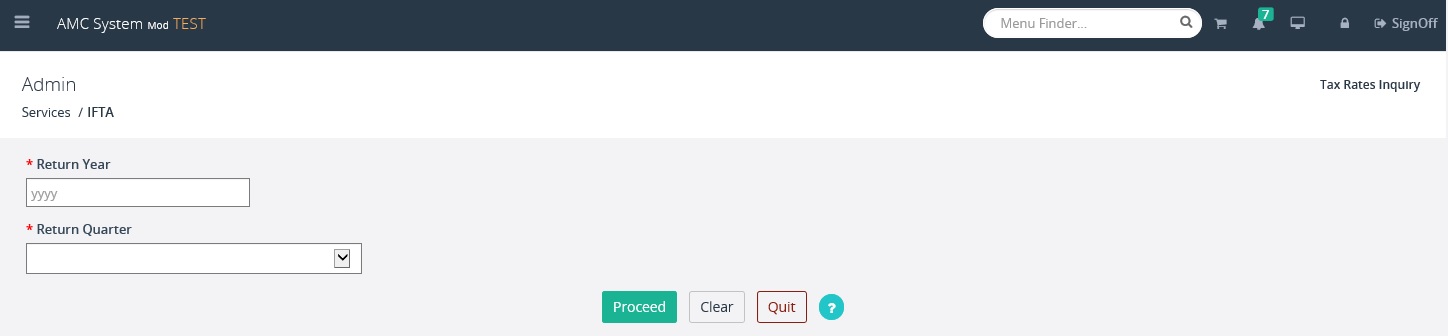

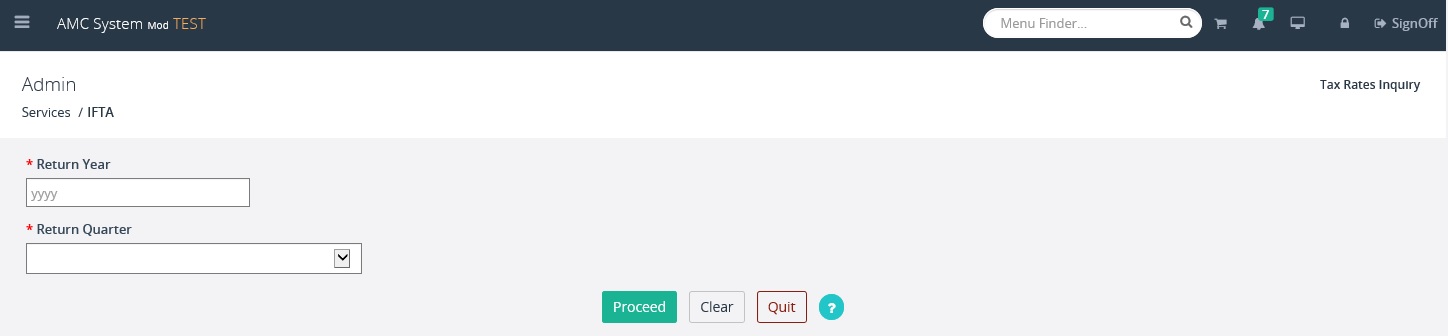

To perform a tax rate

inquiry, perform the following steps:

·

Select MORE within the INQUIRIES menu tile to

reveal the TAX RATES INQUIRY option, then select it

·

On the Tax Rates Inquiry screen, enter the

required Return Year and Return Quarter in the appropriate fields

·

Click the PROCEED button

The system will display a listing by

jurisdiction tax rates for the quarter and year entered

Authorized users will have the ability to

print or export the data.

·

Scroll to the bottom of the tax rate listing and

select the appropriate button

o

CSV

o

Excel

o

Print

·

Follow the prompts to save or open files

depending on the selection made

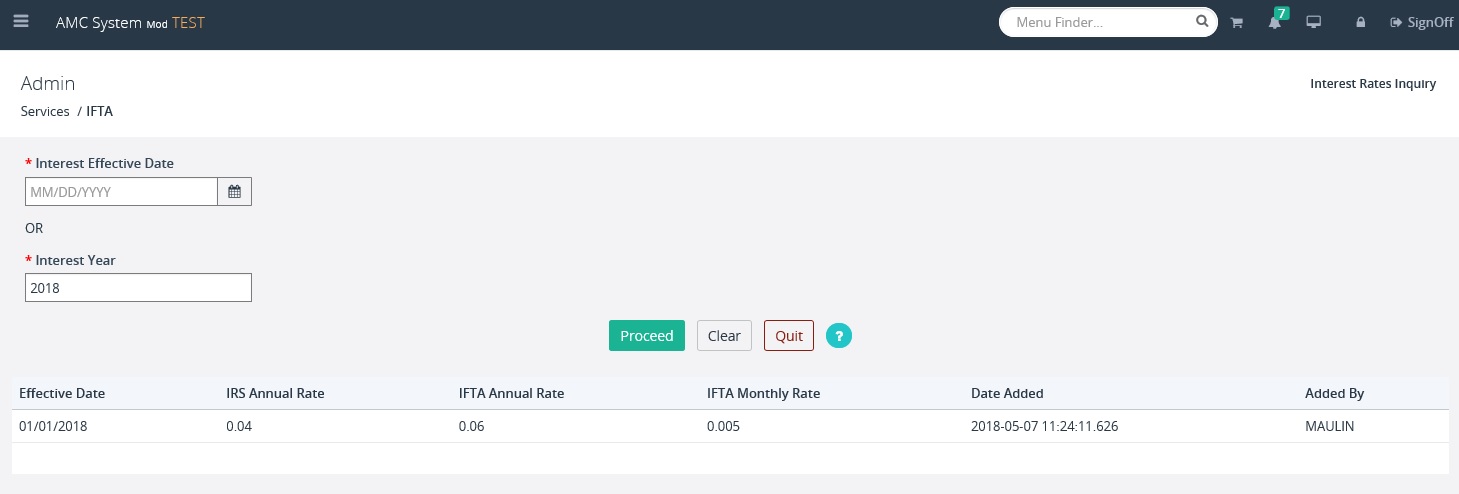

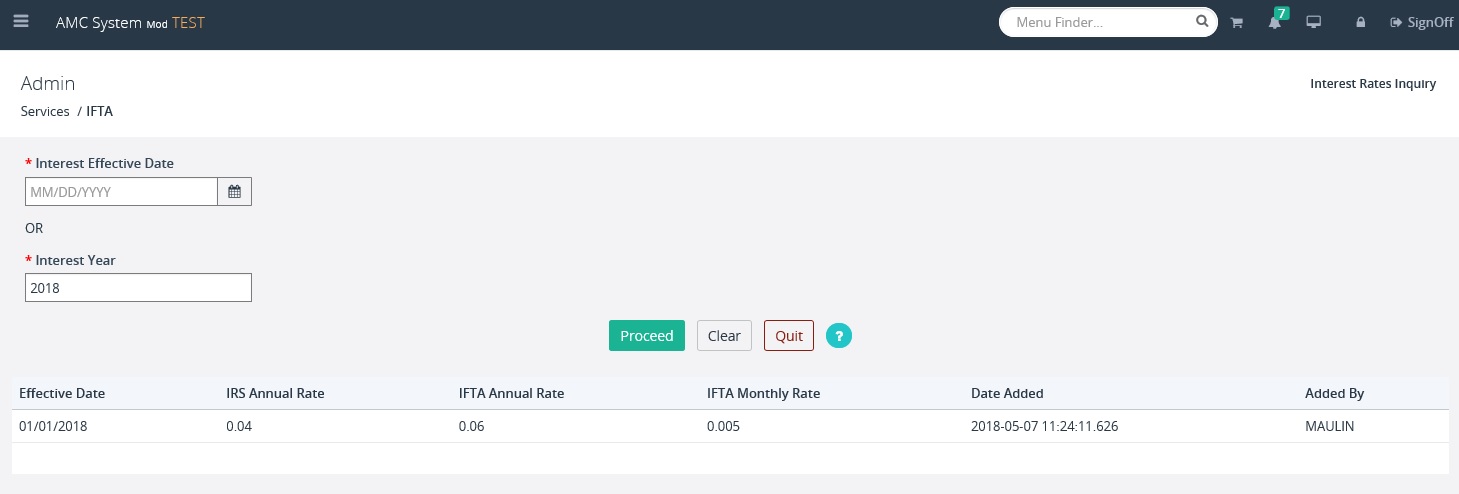

To perform an interest

rate inquiry, perform the following steps:

·

Select MORE within the INQUIRIES menu tile to

reveal the INTEREST RATES INQUIRY option, then select it

·

On the Interest Rates Inquiry screen, enter the

required Interest Effective Date or the Interest Year

·

Click the PROCEED button

The system will display the entry that

matches the search criteria used

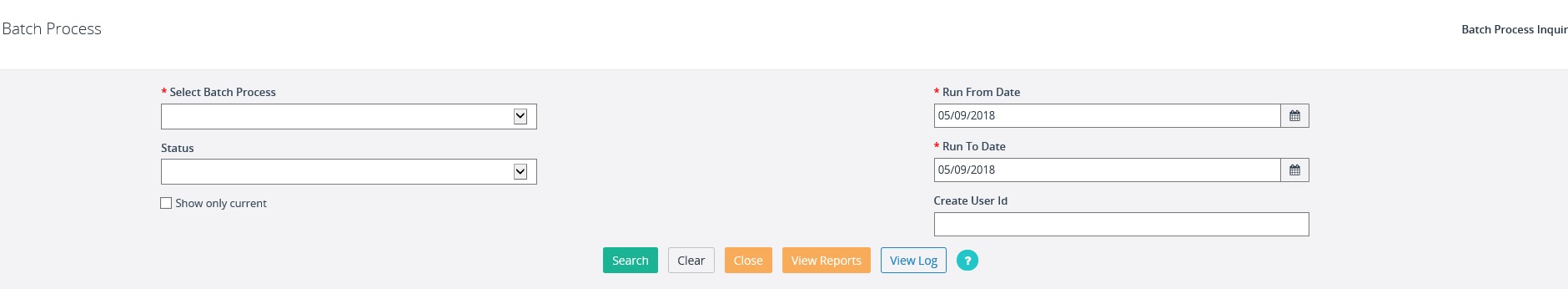

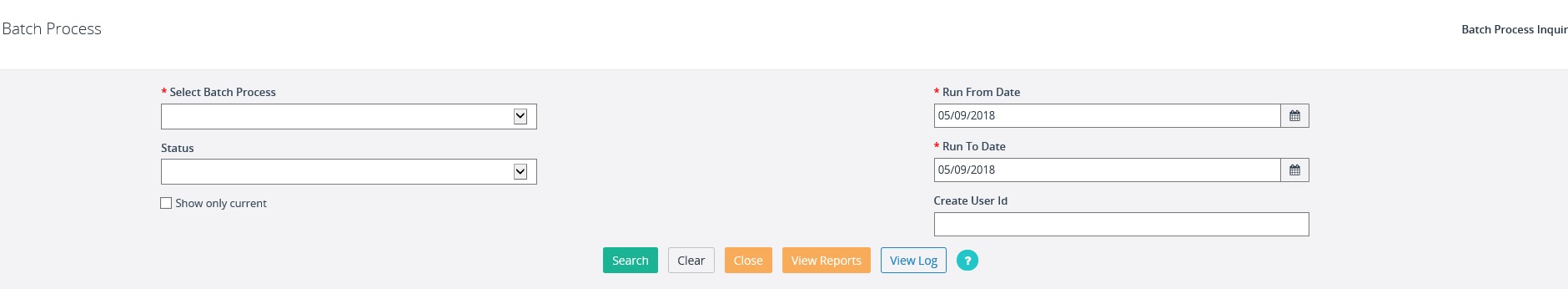

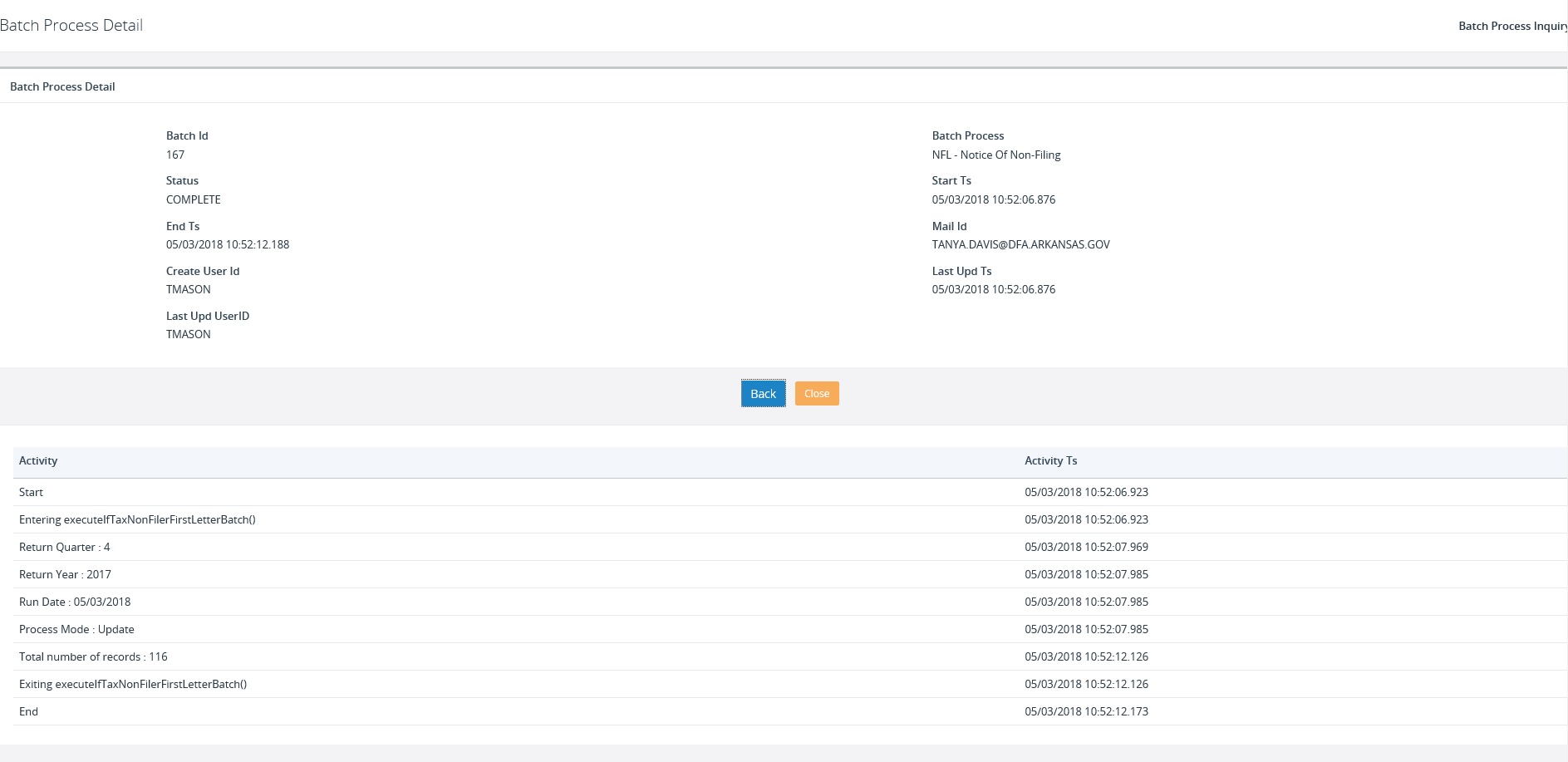

A user can inquiry on any of the batch

processes and check their status. To do this perform the following steps:

·

Click the BATCH INQUIRY button to open a Batch

Process Inquiry pop-up screen

·

Select the batch process using the drop down

·

Select or enter a date range (system defaults to

today’s date)

·

A user can either select a specific status to

view, or leave the Status field blank to view all batch jobs for that batch

process type selected.

·

Click the SEARCH button to display a list of

batch jobs that match the search criteria

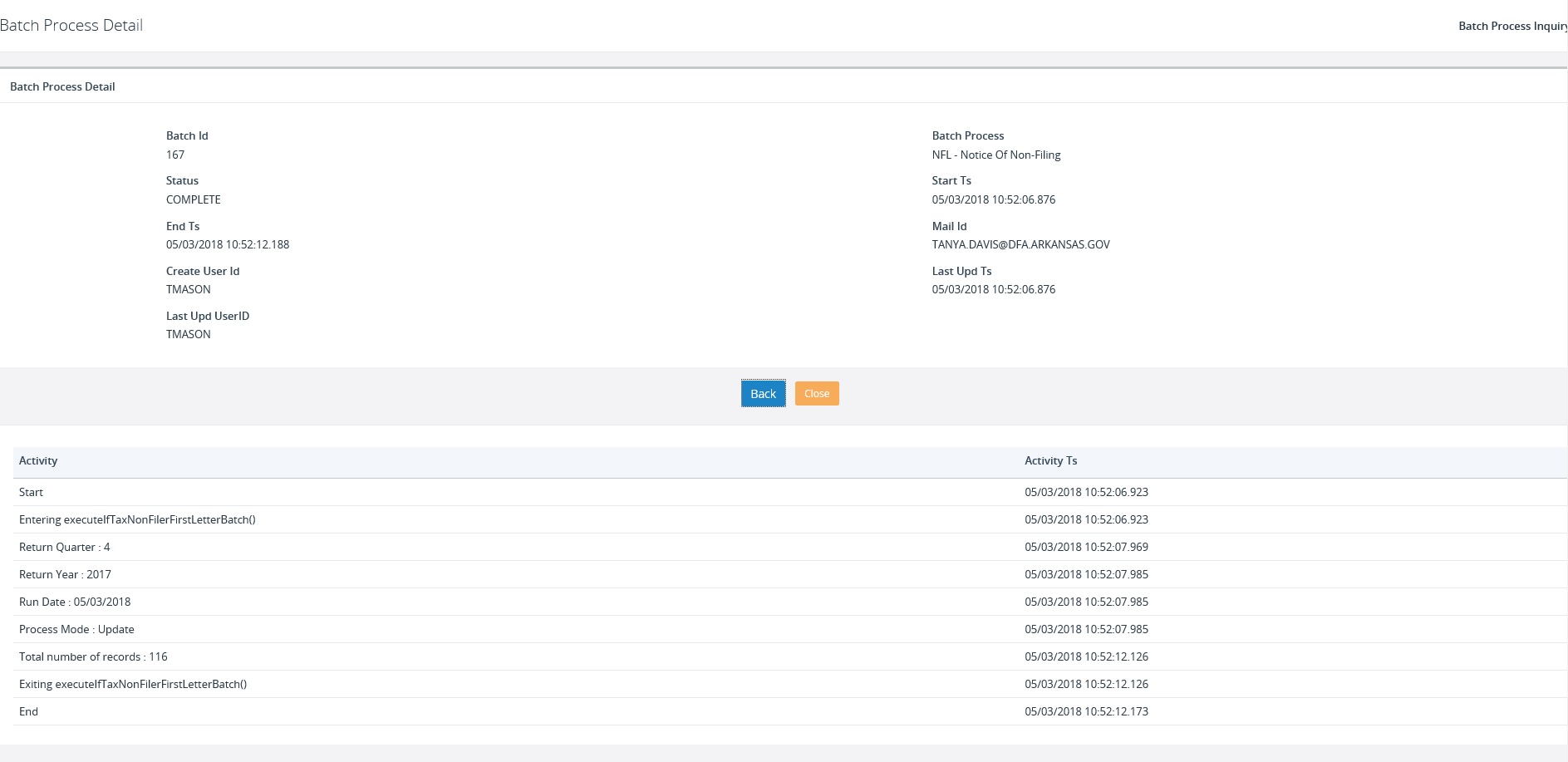

To obtain further details about the batch

process, click the Batch ID link for the specific batch job to be viewed.

A user can select the VIEW REPORTS button

to display a list of reports available for viewing or the VIEW LOG button to

display a list of the logs for each batch process executed.

The system provides the ability to reprint

the items listed below:

o

Reprint of a filed tax return for a specific

customer, year and quarter

- Decals

- Blank Quarterly Tax Return

o

The return will be for a specific year and

quarter

o

The return can be printed without customer

information or for a specific customer

o

The return will include all of the jurisdictions

and associated rates

o

A blank renewal notice or a renewal notice for a

specific customer

- Shipping Document

- Audit Invoice

o

Reprint of invoice for an audit that has been

created

- Notice of Quarterly Tax Return

- Letters

- Invoice

- Permit

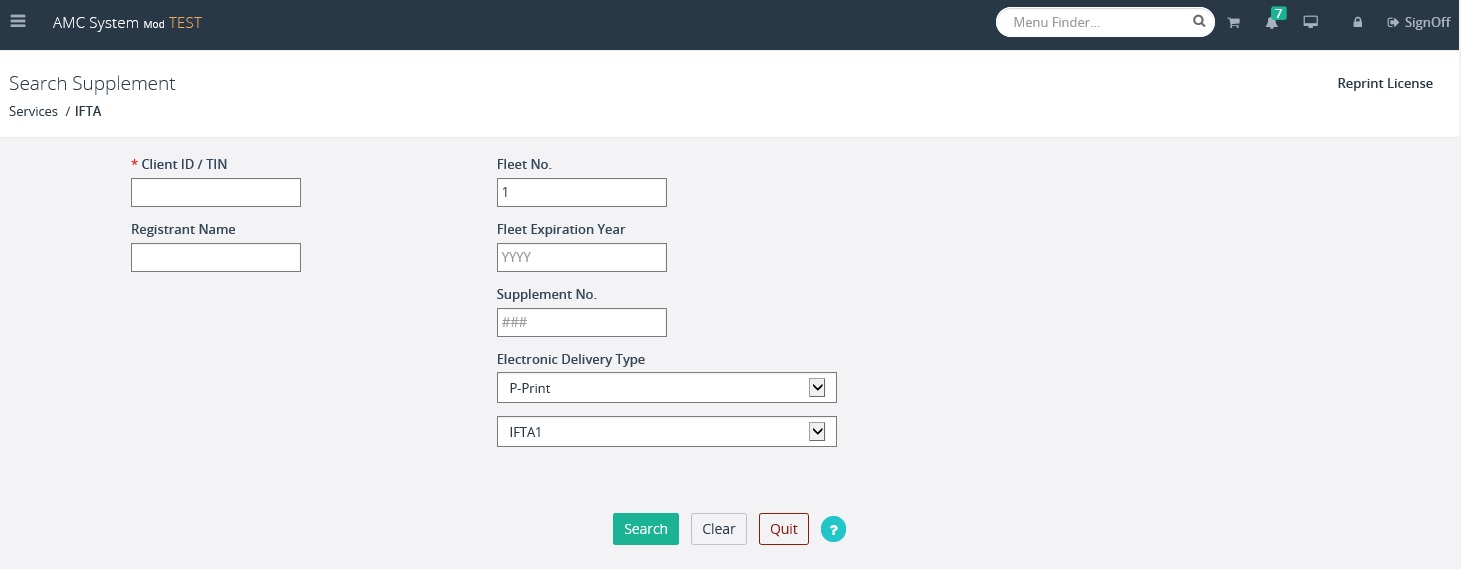

To perform a reprint function, select one

of the reprint options listed above from the REPRINT menu tile at the IFTA level

menu, enter the appropriate search criteria and select SEARCH.

1.3.11.1 Reprint License

To reprint an IFTA license do the

following:

· Select LICENSE from the REPRINT menu tile at the IFTA application

level menu

· Enter at a minimum the Client ID/ TIN – Registrant Name, Fleet No.,

Fleet Expiration Year and Supplement No. are also available search fields

· Select the ELECTRONIC DELIVERY TYPE from the drop down

· Select SEARCH to display a list of search results then click the print

icon of the account for which the license is to be generated

To reprint quarterly tax returns perform

the following steps:

· Select TAX RETURN from the REPRINT menu tile at the IFTA application

level menu

· Enter at a minimum the Client ID/ TIN. – Additional fields such as

Fleet No., Return Year, Return Quarter, Fuel Type and Amendment No. are also available

to narrow the search

· Select the ELECTRONIC DELIVERY TYPE from the drop down

· Select SEARCH to display a list of search results then click the print

icon of the account for which the tax return is to be generated

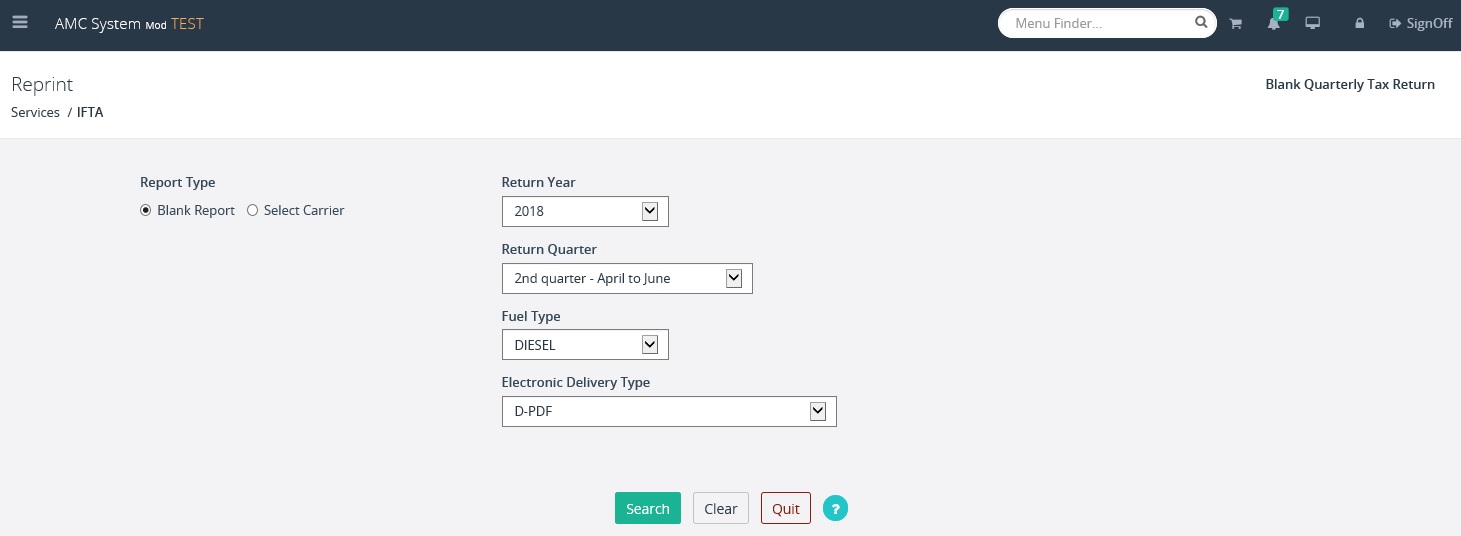

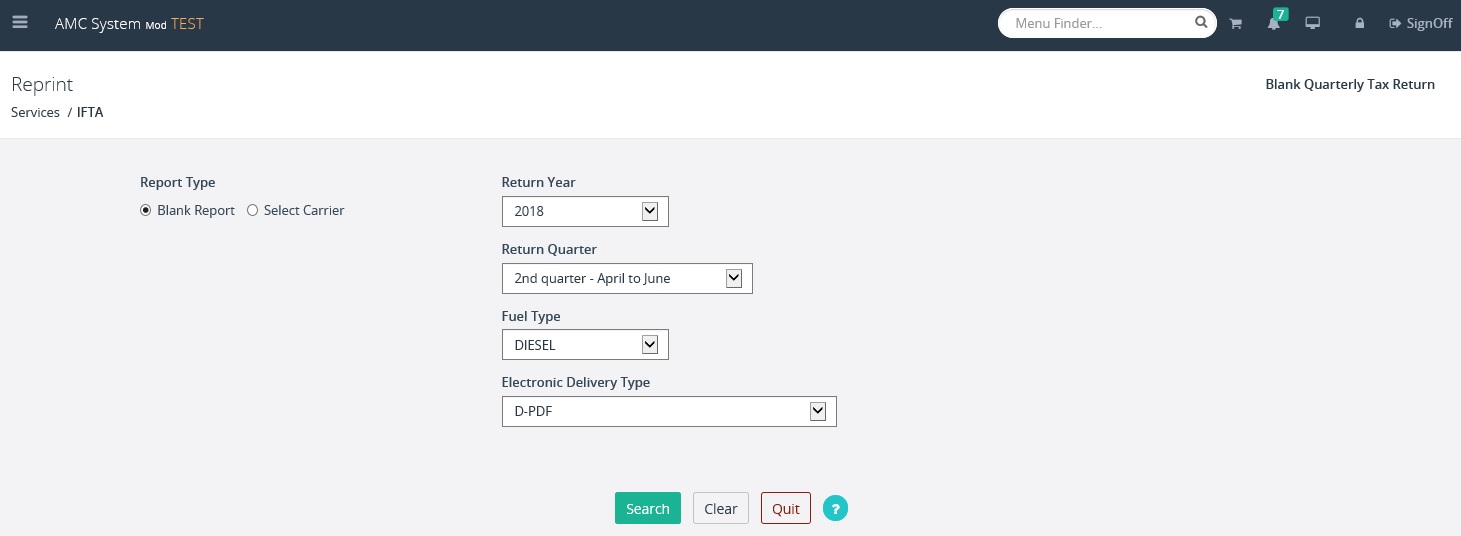

To reprint a Blank Quarterly Tax Return,

do the following:

· Select BLANK QUARTERLY TAX RETURN from the REPRINT menu tile at the IFTA

application level menu

· Select the type of blank return to be printed

o

Blank Report – Will print a blank report with no

carrier mailing information

o

Select Carrier – Will print a blank report with

the selected carrier’s address information

· Enter the Client ID/ TIN and Fleet No. (required for a Carrier blank

quarterly tax return), Return Year, Return Quarter and Fuel Type using the drop

down list

· Select the ELECTRONIC DELIVERY TYPE from the drop down

· Select SEARCH to generate the blank quarterly tax return for the

desired account

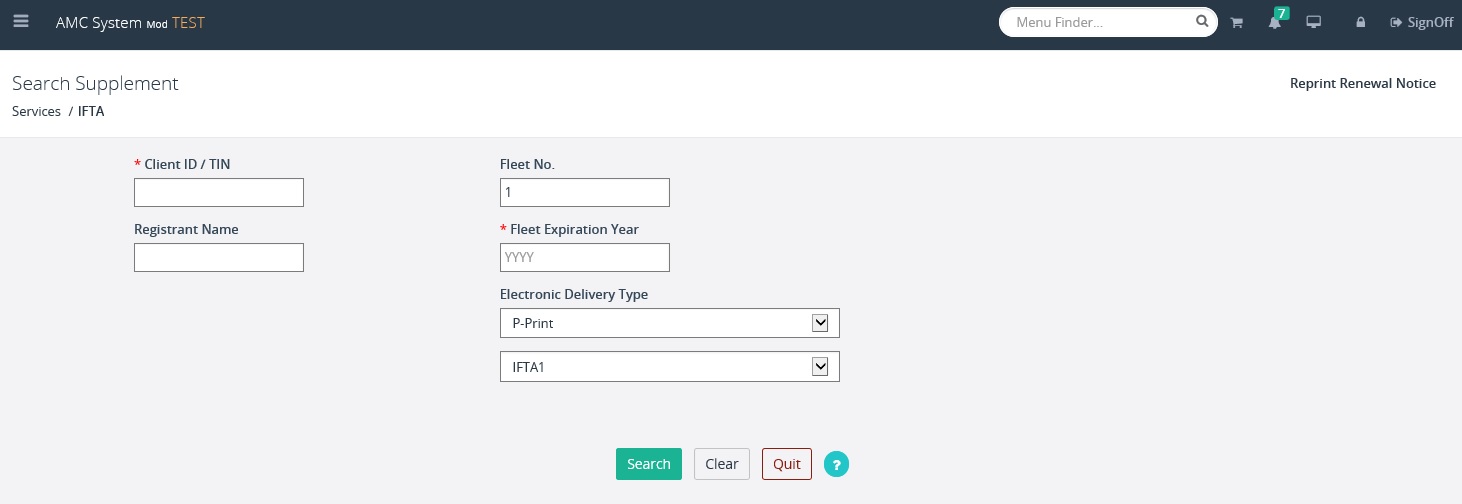

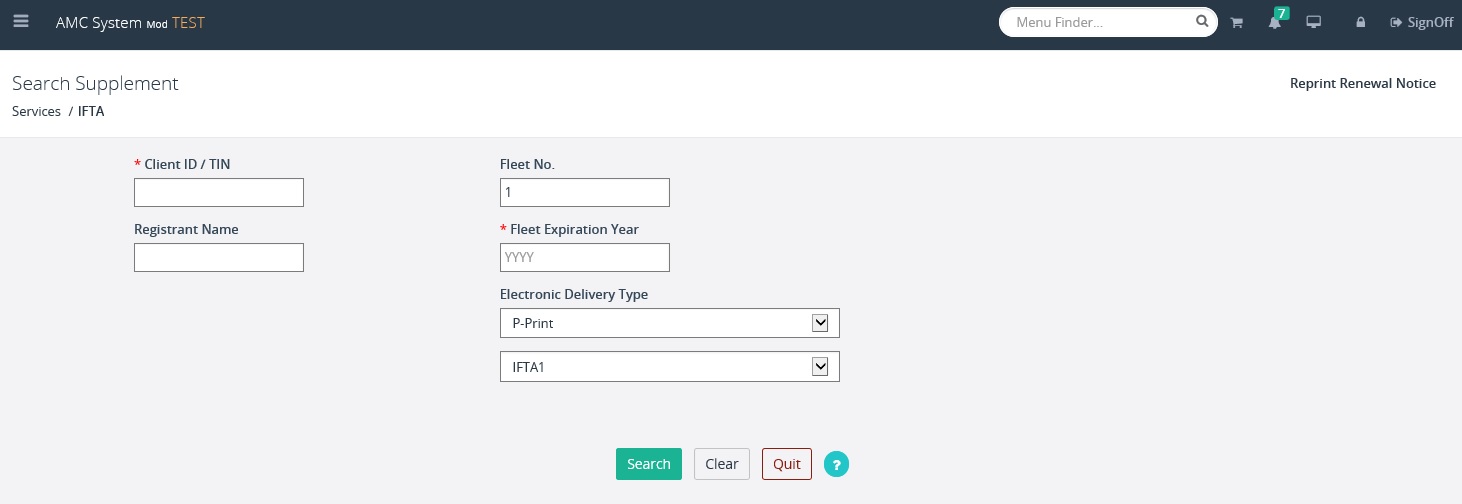

1.3.11.4 Reprint Renewal Notice

To reprint a renewal notice do the

following:

· Select RENEWAL NOTICE from the REPRINT menu tile at the IFTA application

level menu

· Enter the Client ID/ TIN and Fleet Expiration Year (both required),

and Fleet No. if desired

· Select the ELECTRONIC DELIVERY TYPE from the drop down

·

Select SEARCH to display a list search results

then click the print icon of the desired account

To reprint a Shipping Document, do the

following:

· Select SHIPPING DOCUMENT from the REPRINT menu tile at the IFTA application

level menu

· Enter at a minimum the Client ID/ TIN (required) – Fleet No., Fleet

Expiration Year and Supplement No. are also available to narrow the search

· Select the ELECTRONIC DELIVERY TYPE from the drop down

·

Select SEARCH to display a list search results

then click the print icon of the account for which the shipping document is to

be generated

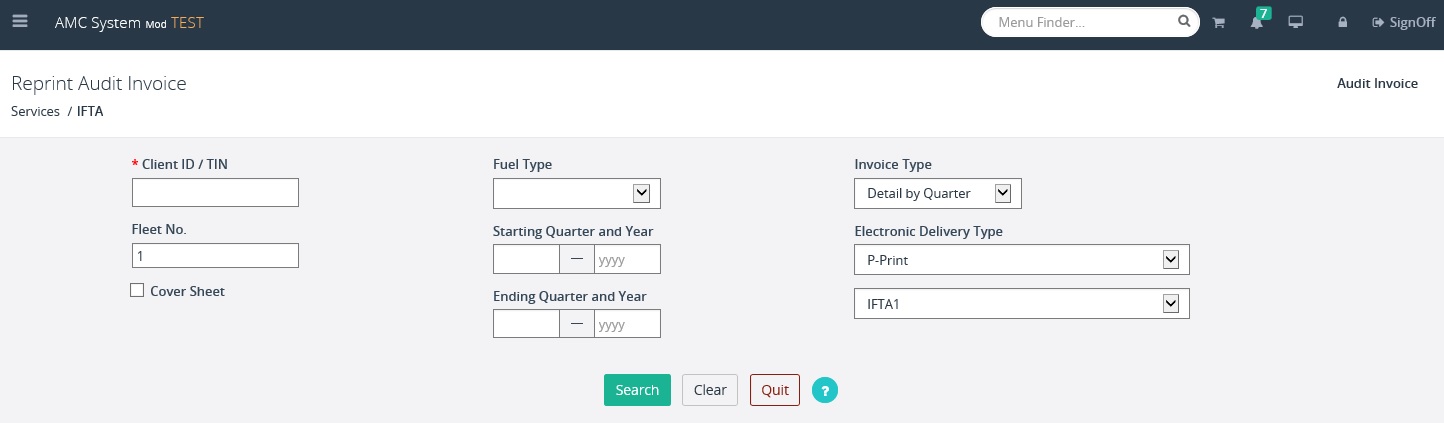

To reprint the Audit Invoice, do the

following:

· Select AUDIT INVOICE from the REPRINT menu tile at the IFTA application

level menu

· Enter at least the Client ID/TIN and additional information such as

Fuel Type and Audit Quarter date range to narrow the search

· Select the Invoice Type from the drop down list

· Select the ELECTRONIC DELIVERY TYPE from the drop down

·

Select SEARCH to display a list of search

results then click the print icon of the account for which the audit invoice is

to be generated

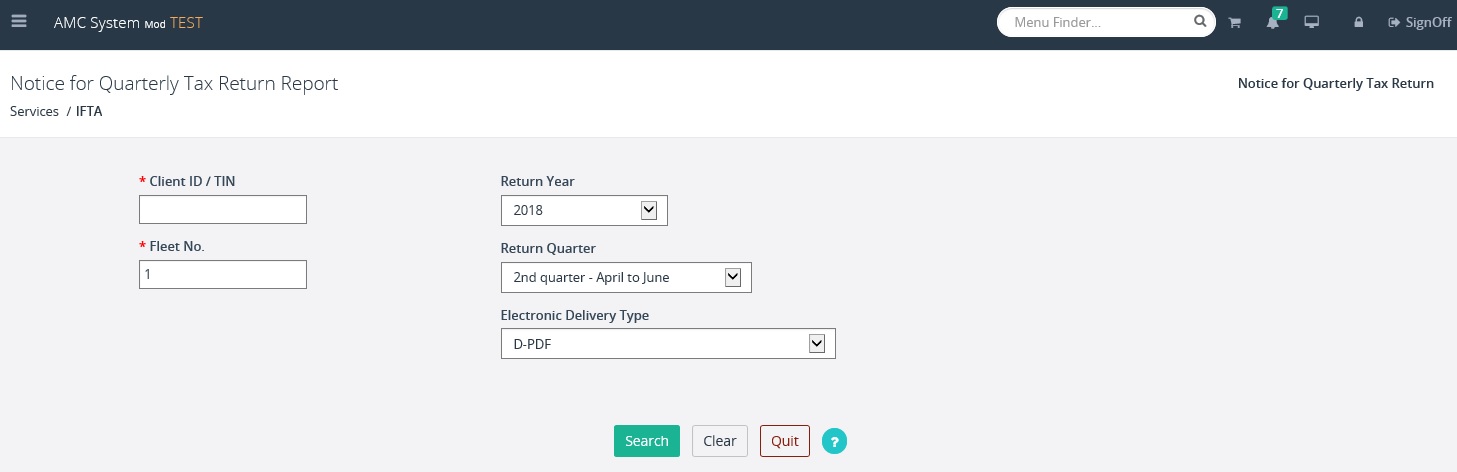

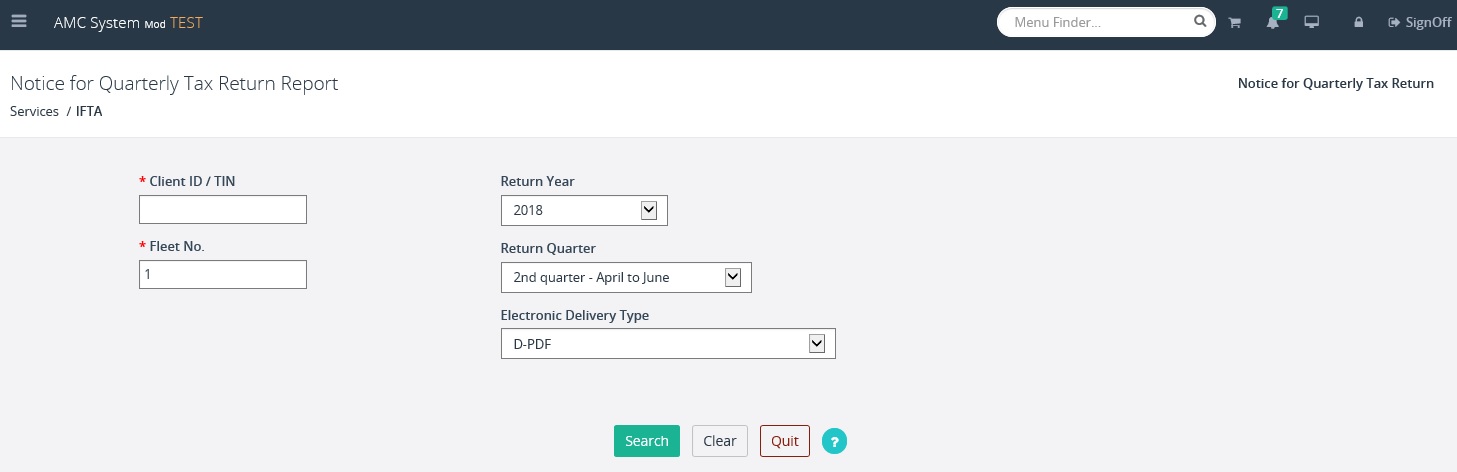

To reprint a Notice for Quarterly Tax

Return, do the following:

· Select NOTICE FOR QUARTERLY TAX RETURN from the REPRINT menu tile at

the IFTA application level menu

· Enter at a minimum the Client ID/ TIN and Fleet No. (both required)

– Return year and Return quarter are also available to narrow the search

· Select the ELECTRONIC DELIVERY TYPE from the drop down

·

Select SEARCH to display a list of search

results then click the print icon of the account for which the notice for

quarterly tax return is to be generated

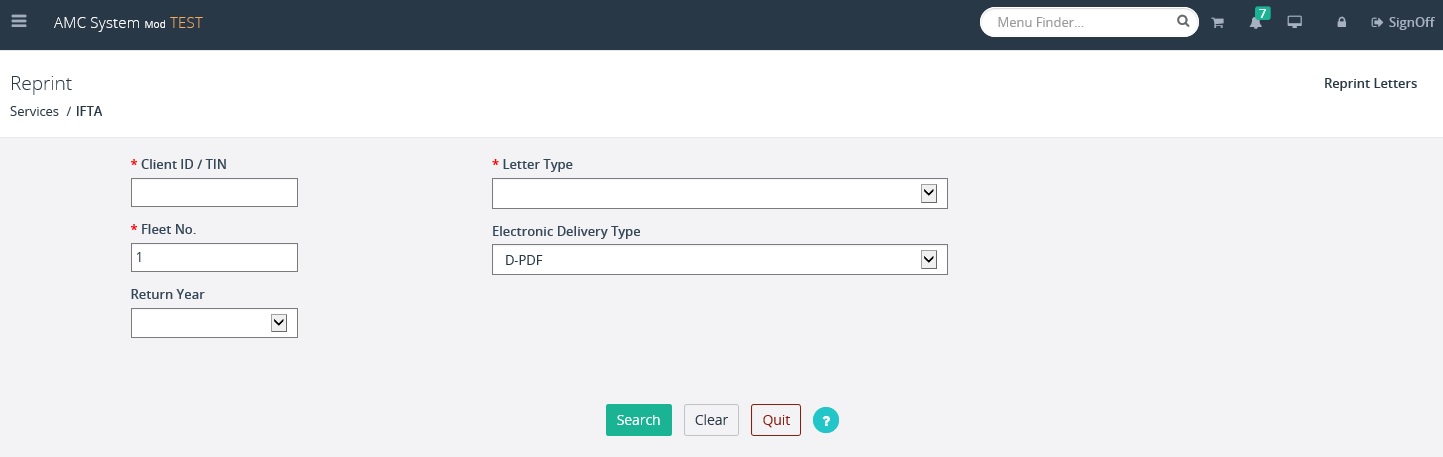

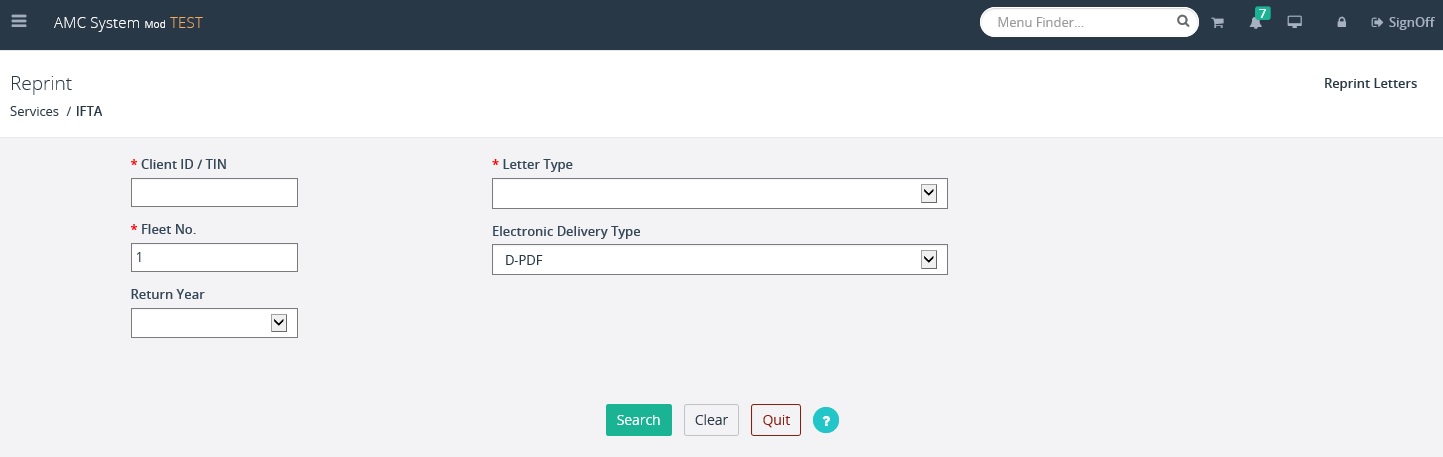

To reprint a Letter, do the following:

· Select LETTERS from the REPRINT menu tile at the IFTA application

level menu

· Enter at a minimum the Client ID/ TIN, Fleet No., Return Year and

select the Letter type – all are required

· Select the ELECTRONIC DELIVERY TYPE from the drop down

·

Select SEARCH to display a list of search

results then click the print icon of the account for which the letter is to be

generated

1.3.12

Administrative Functions

The system provides a number of batch jobs,

all of which have a user interface that provide the following processes:

· Submit the batch process to execute

· Perform inquiries about the status of the execution

· View logs

· View Report/Results

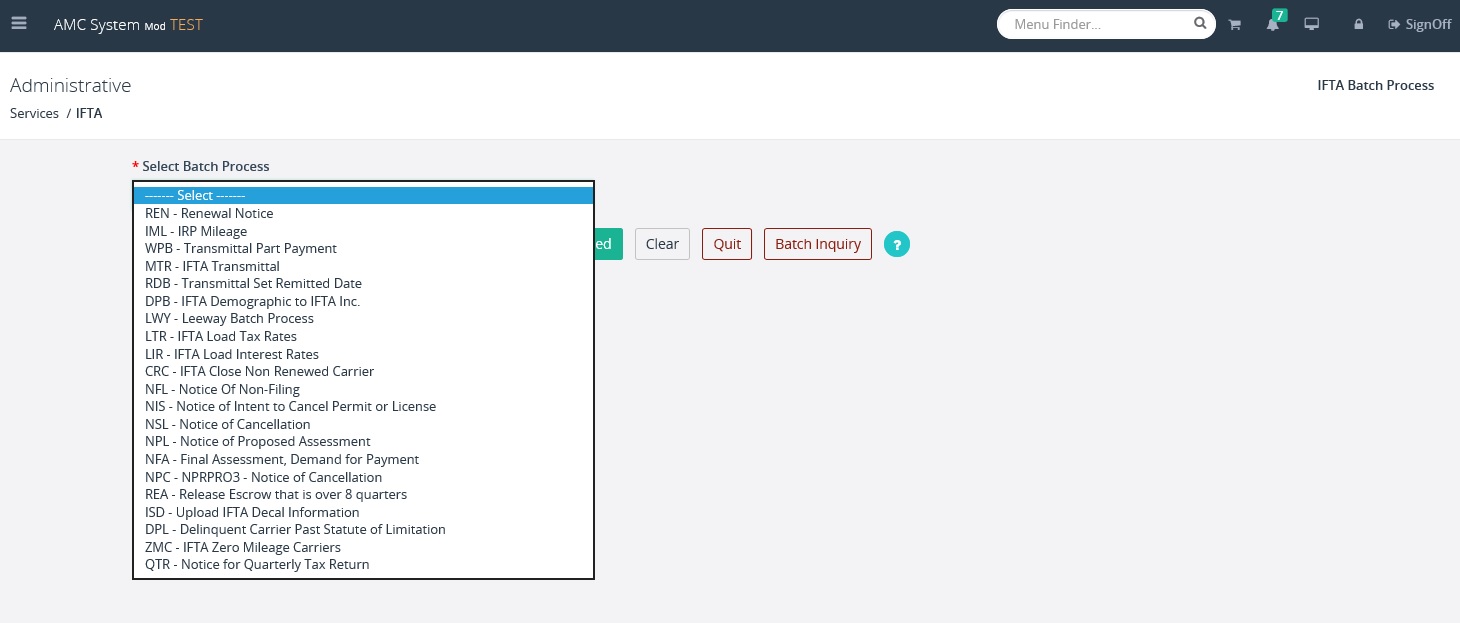

The

IFTA batch options provided include:

· IFTA Transmittal

· IFTA Load Tax Rates

· IRP Mileage

· Transmittal Part Payment

· Transmittal Set Remitted Date

· IFTA Demographic to IFTA Inc.

· Leeway Batch Process

· IFTA Load Interest Rates

· IFTA Close Non Renewed Carrier

· IFTA Notice of Non-Filing

· IFTA Notice of Intent to Cancel Permit or License

· IFTA Notice of Cancellation

· IFTA Notice of Proposed Assessment

· IFTA Final Assessment, Demand for Payment

· IFTA Notice of Cancellation

· Release Escrow that is over 8 quarters

· Upload IFTA Decal Information

· Delinquent Carrier Past Statute of Limitation

· Out of State Distribution

· IFTA Zero Mileage Carriers

· Renewal Notice

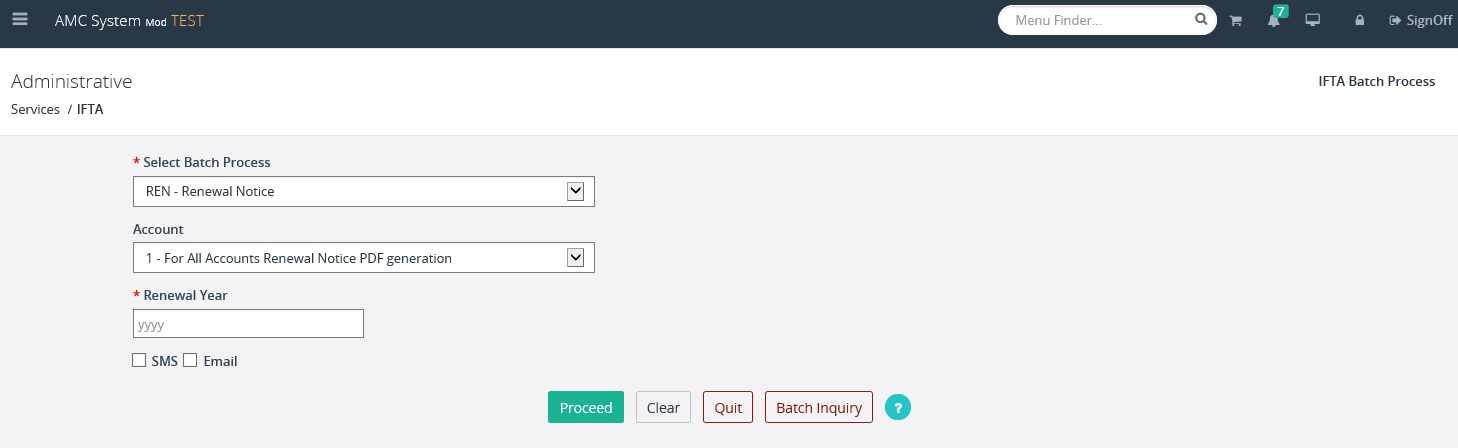

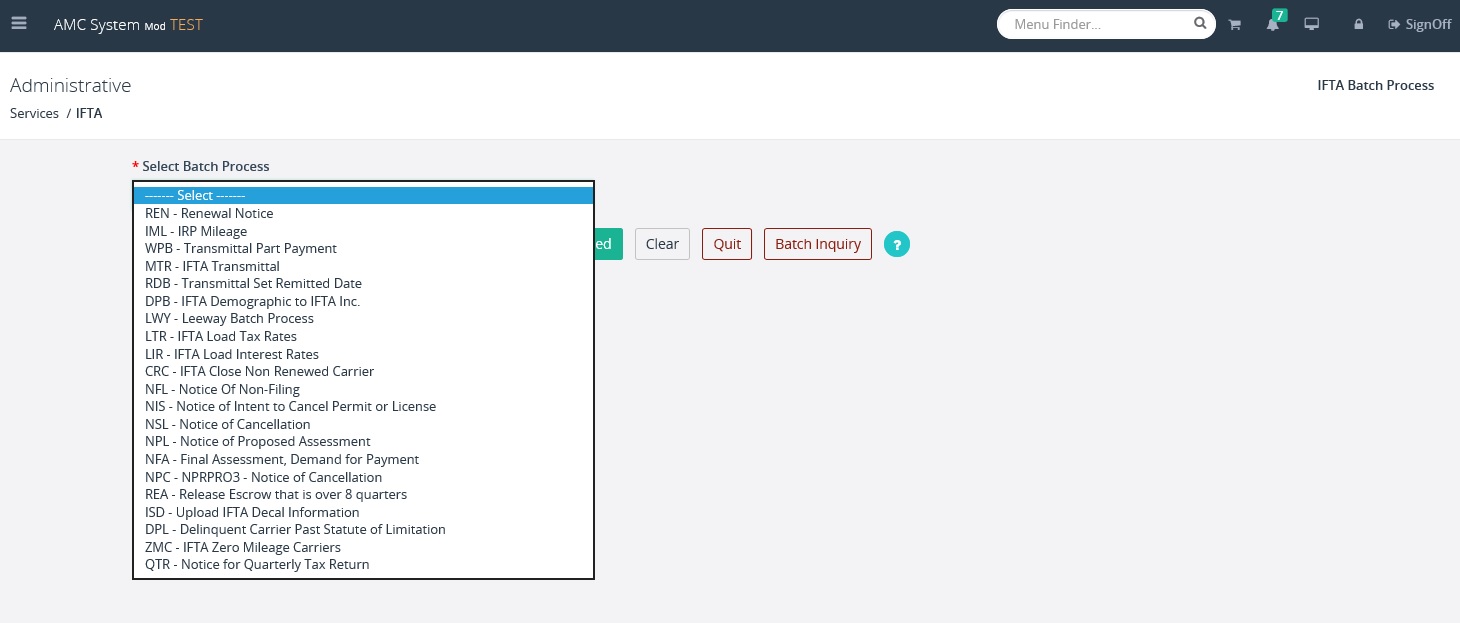

To

access any of the available IFTA batch processes, do the following:

·

Select IFTA BATCH PROCESS from the

ADMINISTRATIVE menu tile at the IFTA application level menu

·

Based on the batch process selected the user

will enter required data and select a process mode (if applicable) to execute

the batch process.

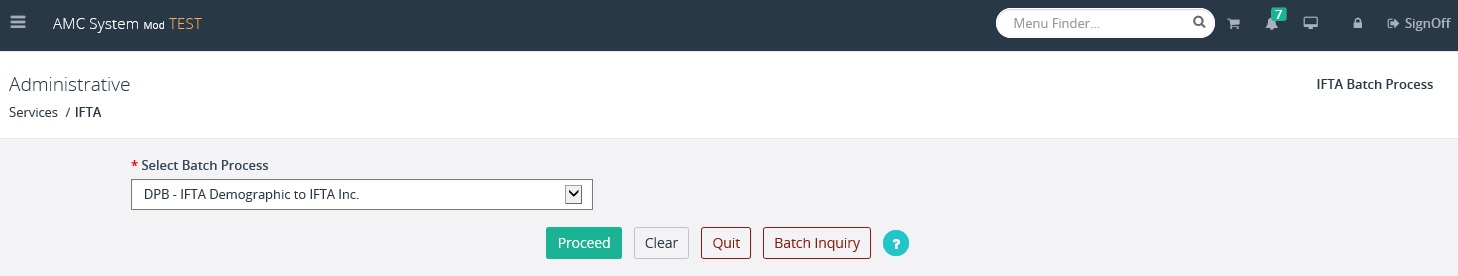

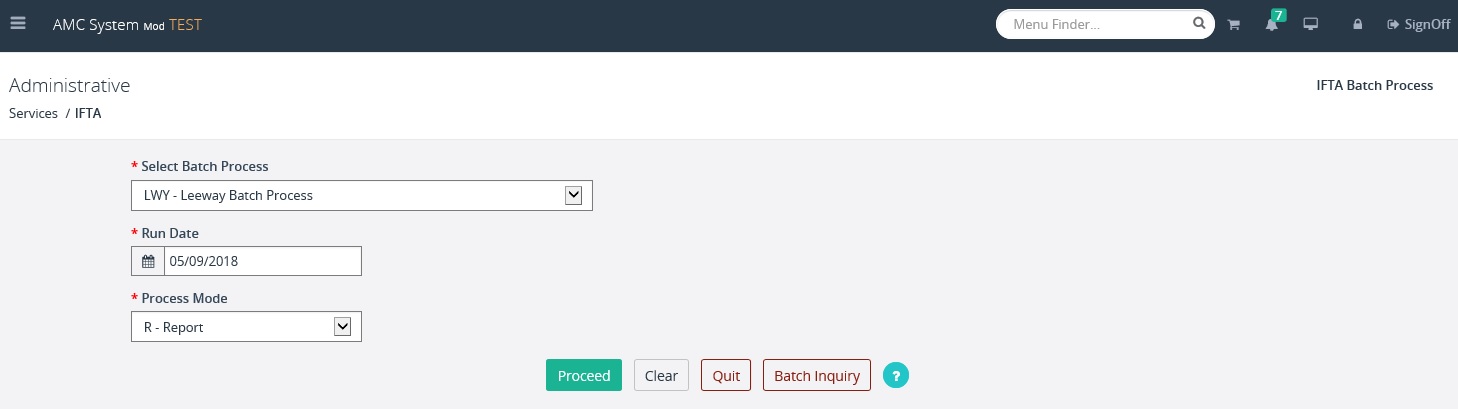

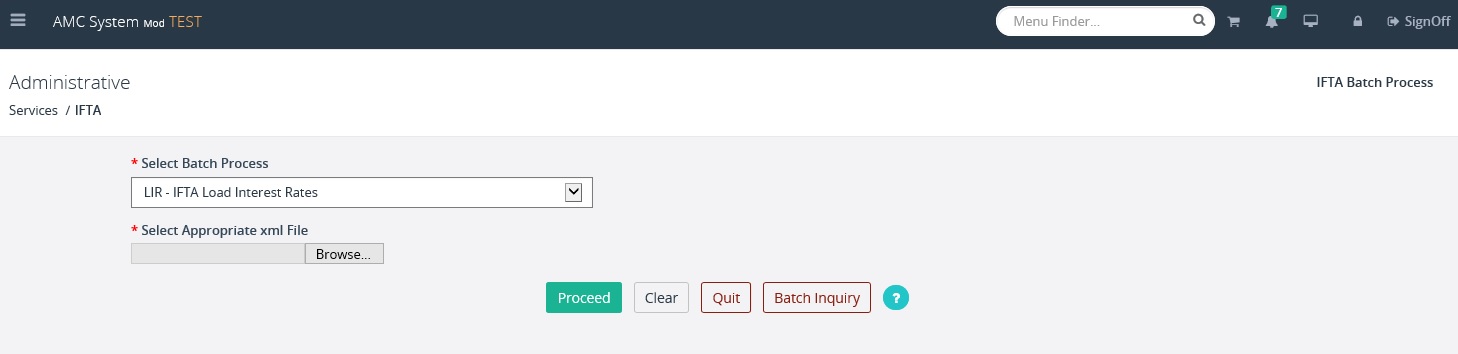

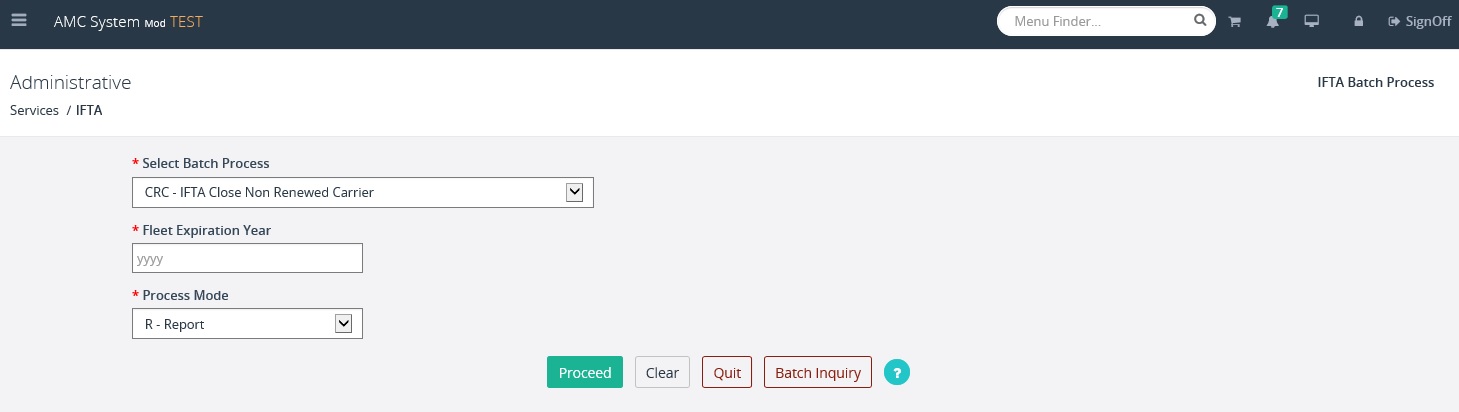

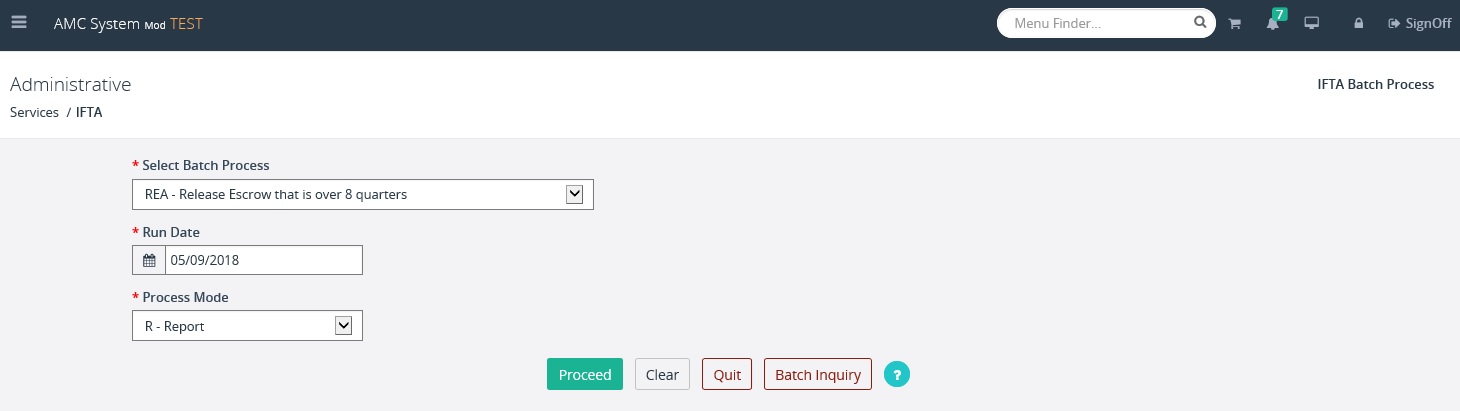

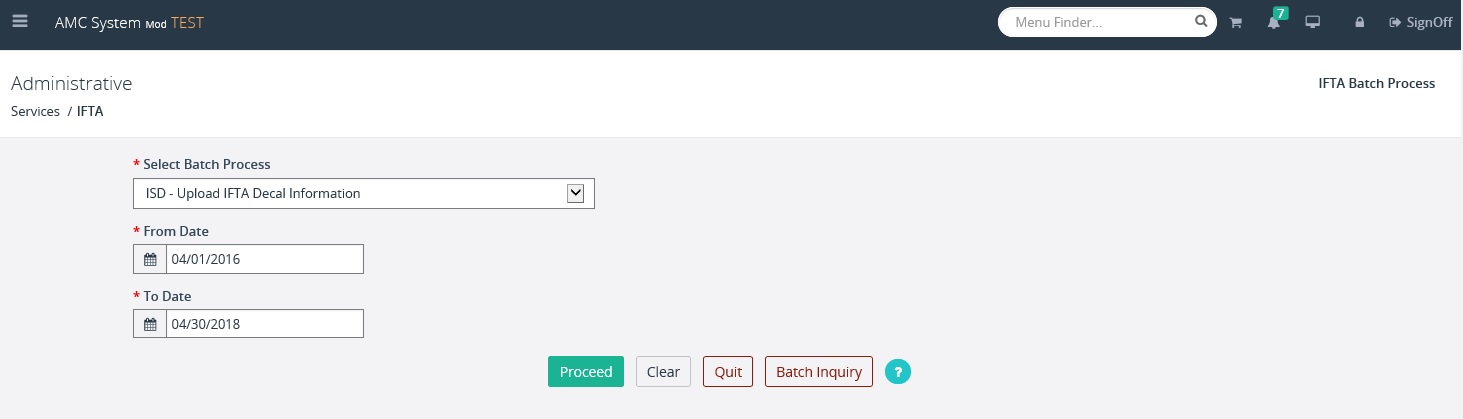

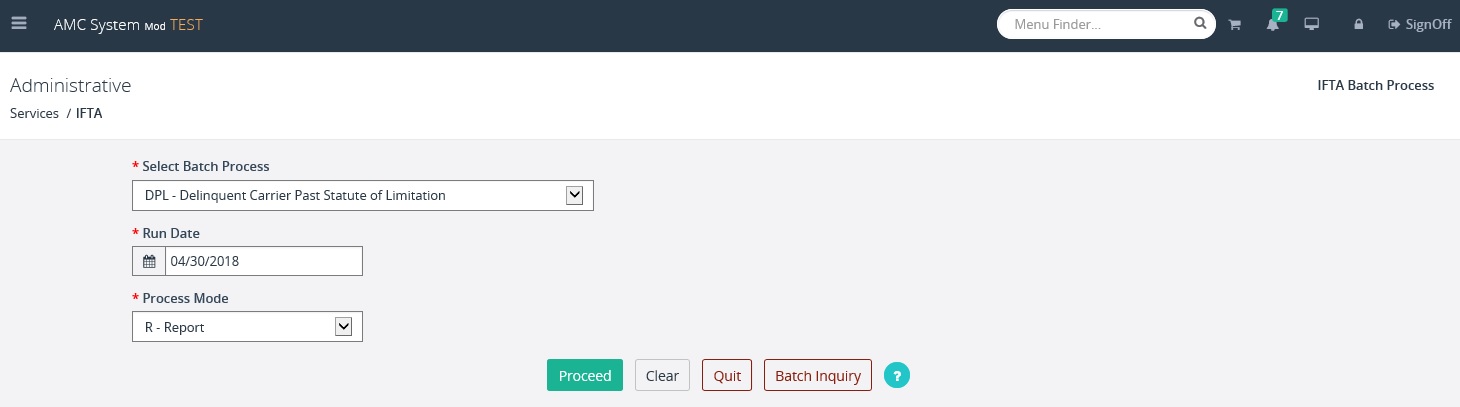

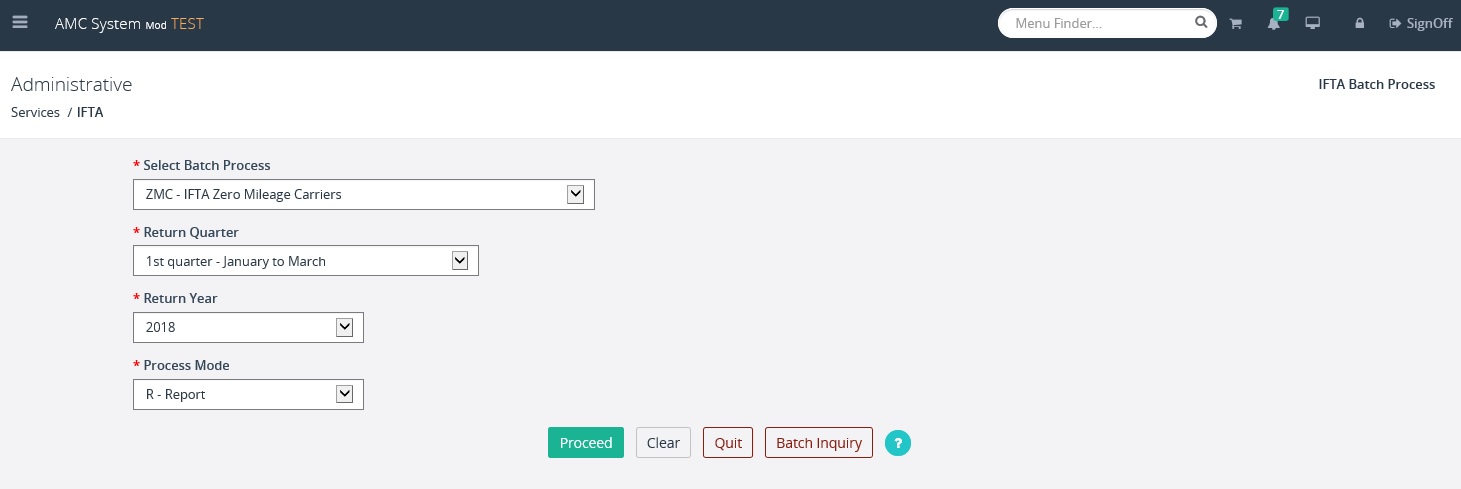

See

the below screen shots to view the required data to execute the batch

processes.

1.3.12.1.2

IFTA Transmittal

Monthly process for creating the IFTA

Transmittal is:

· Create reports

· Balance against the ledger

· Transmittal Part Payment

· Create reports

· Balance using the ledger and Financial Reports and Transmittal Part

Payment Process

· Create IFTA clearinghouse files

· Check Clearinghouse totals

· Set Tax Returns to remitted

OR

· Transmittal Part Payment

· Create reports

· Balance using the ledger and Financial Reports and Transmittal Part

Payment Process

· Create IFTA clearinghouse files

· Check Clearinghouse totals

- Set Tax Returns to remitted

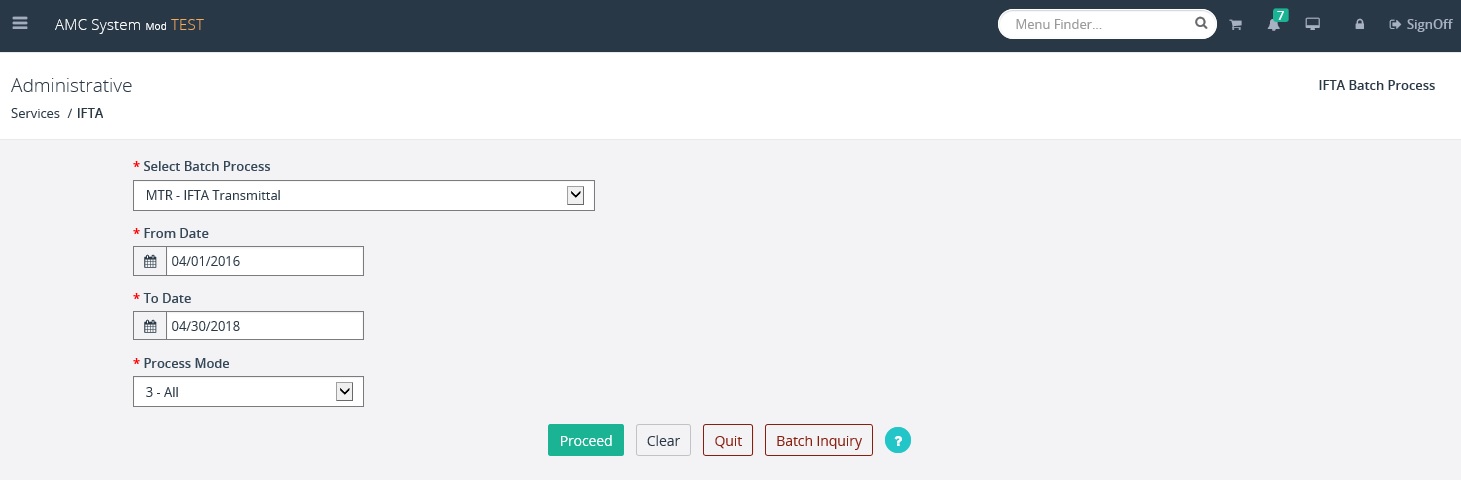

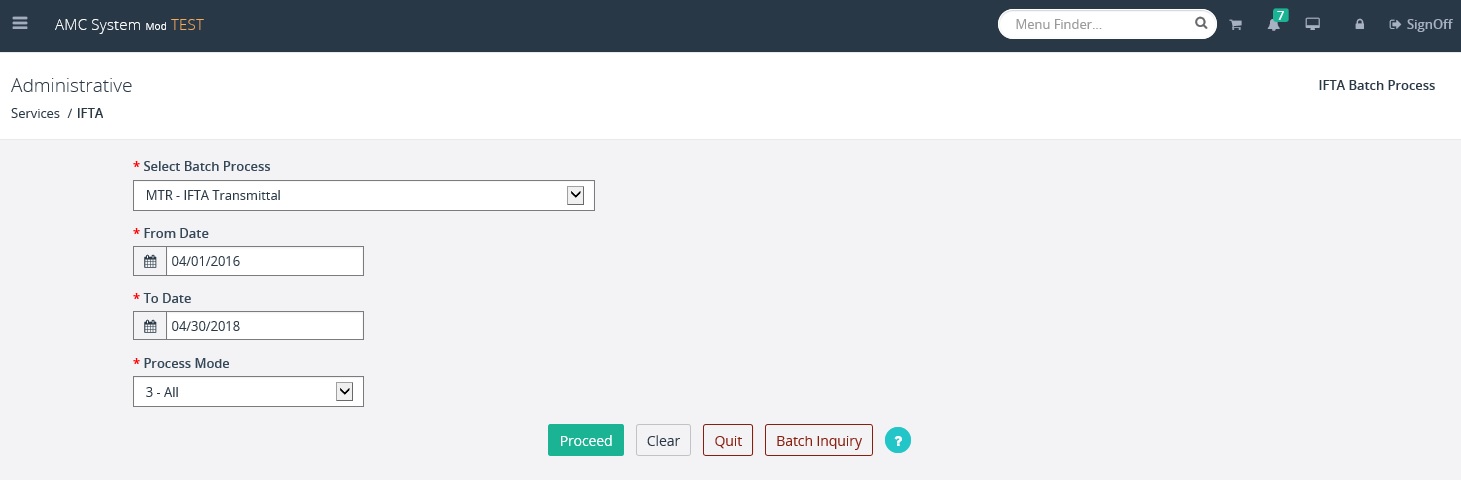

To run the IFTA Transmittal batch process,

do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Transmittal as the Batch

Process from the drop down list

- Enter the FROM and TO Date range

- Select a Process Mode (1-Monthly

Transmittal, 2- Clearinghouse, 3-All)

- Select PROCEED to execute the batch

process

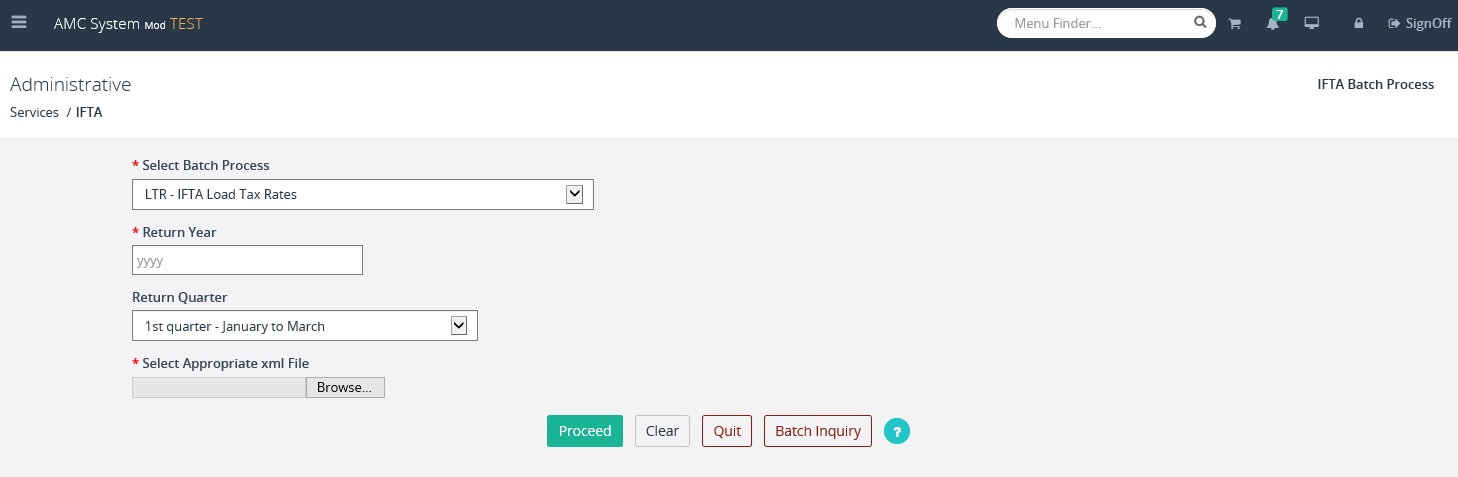

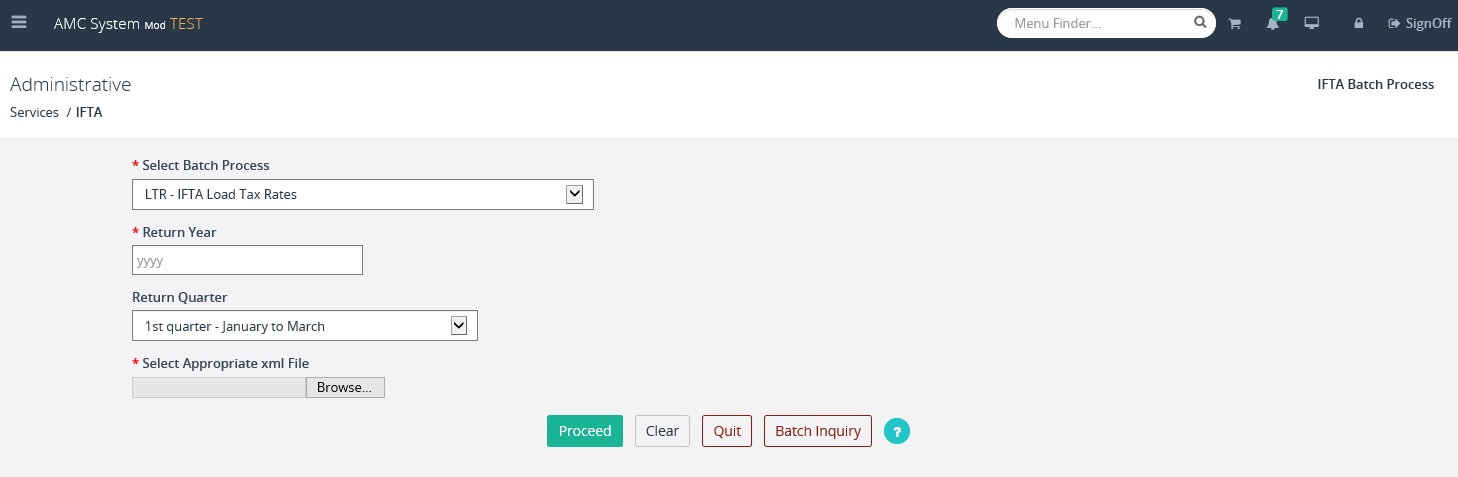

To load IFTA tax rates into the system, do

the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Load Tax Rates as the Batch

Process from the drop down list

- Enter the Return Year and Return Quarter

- Use the ‘Choose File’ button to upload

the appropriate file

- Select the PROCEED button to load the tax

rates

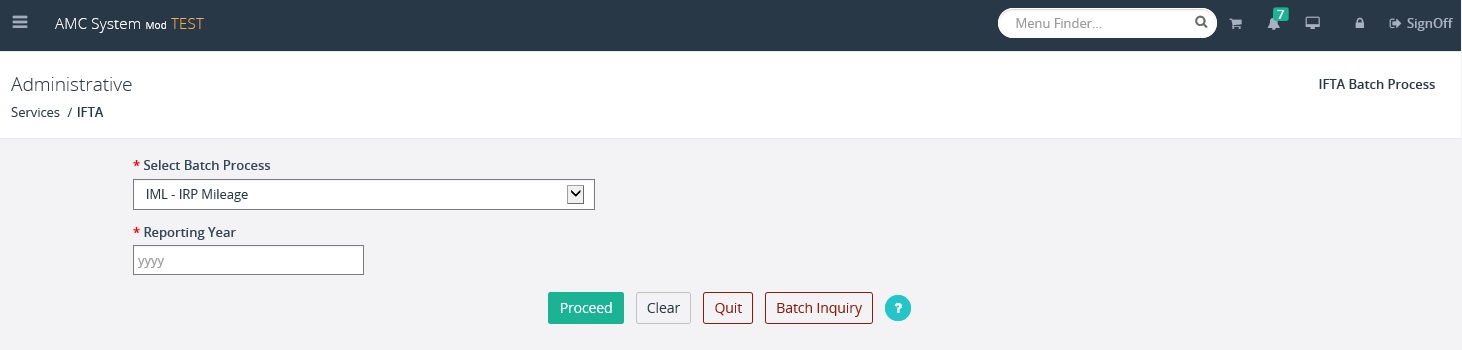

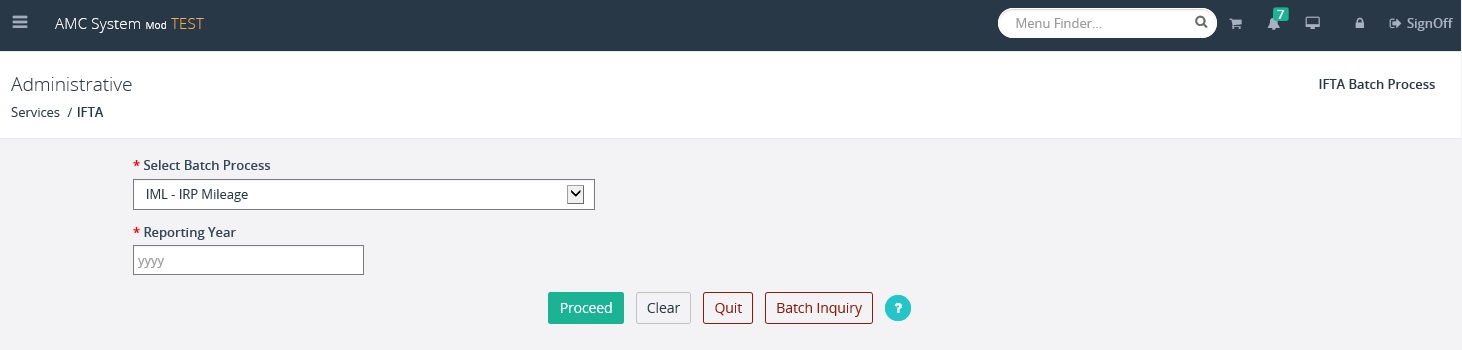

To execute the IRP Mileage batch process,

do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IRP Mileage as the Batch Process

from the drop down list

- Enter the Reporting Year

- Select PROCEED

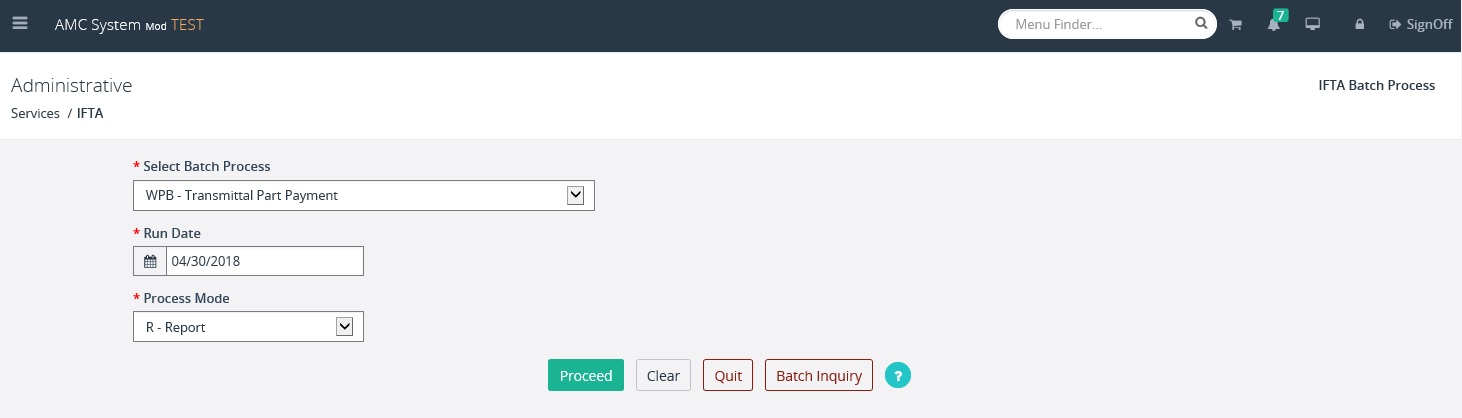

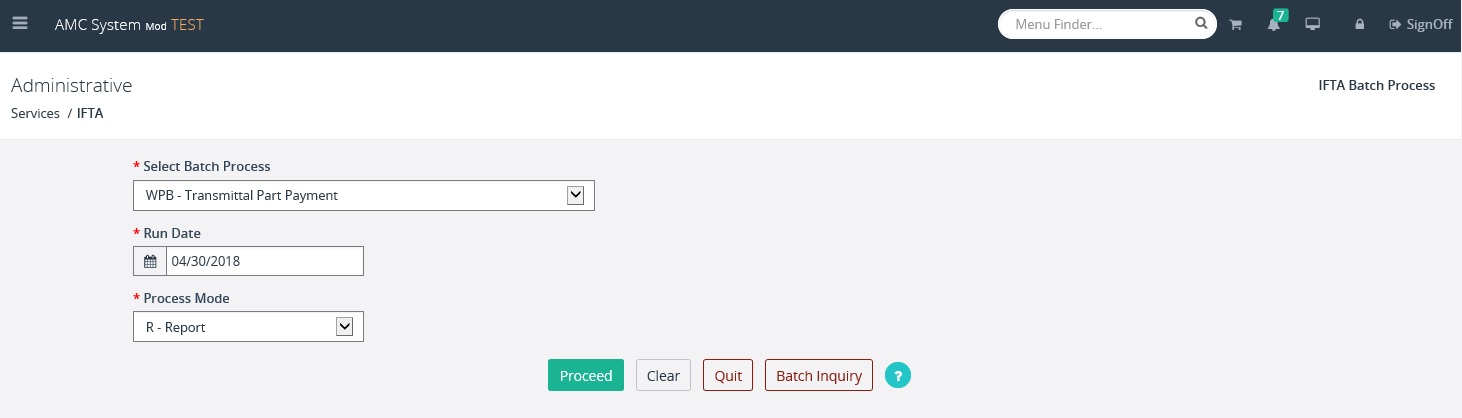

To execute the IFTA Transmittal Partial

Payment batch process, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Transmittal Part Payment as the

Batch Process from the drop down list

- Select a Run Date

- Select a Process Mode (Update or Report)

- Select PROCEED

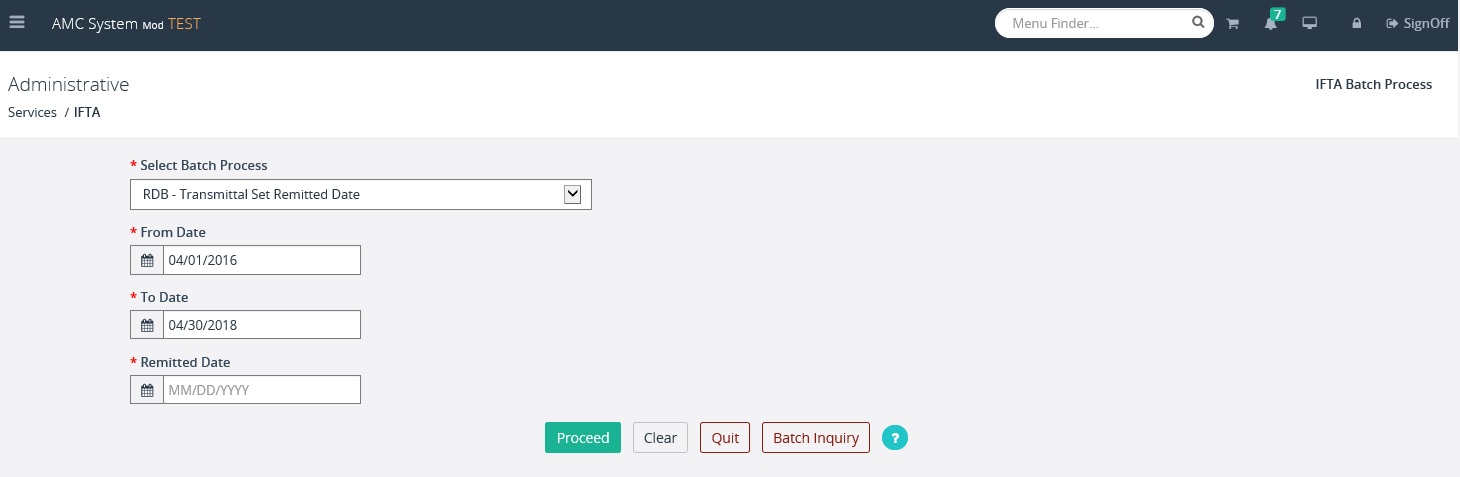

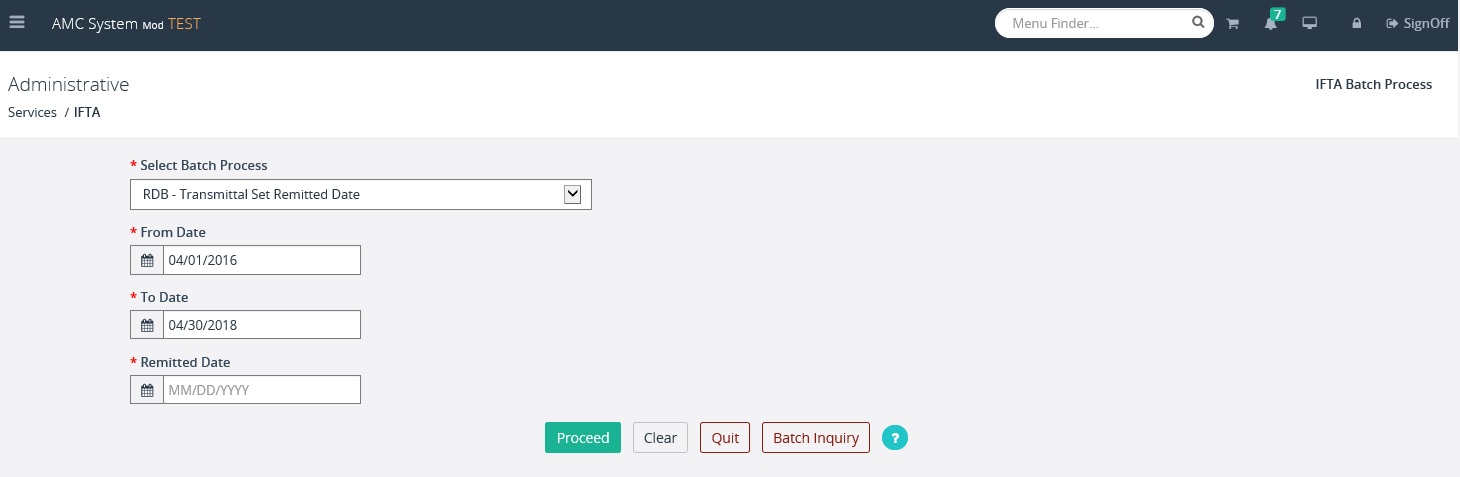

To set the remitted date on the IFTA

Transmittal, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Transmittal Set Remitted Date as

the Batch Process from the drop down list

- Select the FROM and TO dates

- Enter or Select the Remitted Date

- Select PROCEED

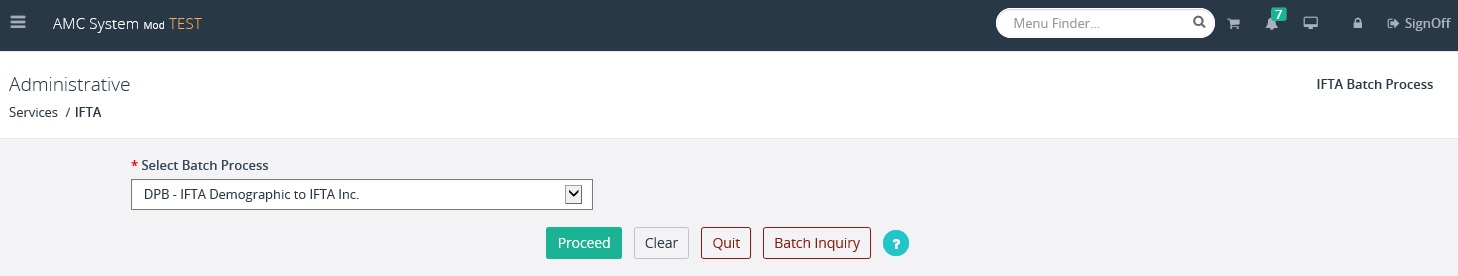

To execute the batch process and send the

IFTA Demographic information to IFTA Inc. do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Demographic to IFTA Inc. as

the Batch Process from the drop down list

- Select PROCEED

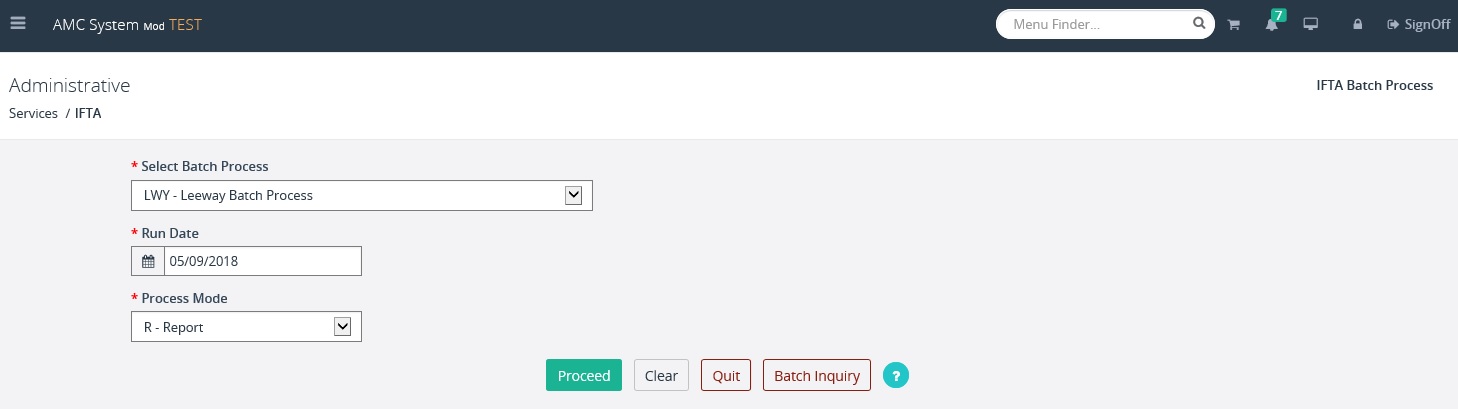

To execute the Leeway batch process do the

following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Leeway Batch Process as the Batch

Process from the drop down list

- Enter the required run date (defaults to

today’s date)

·

Select the Process Mode (Update or Report)

·

Select PROCEED

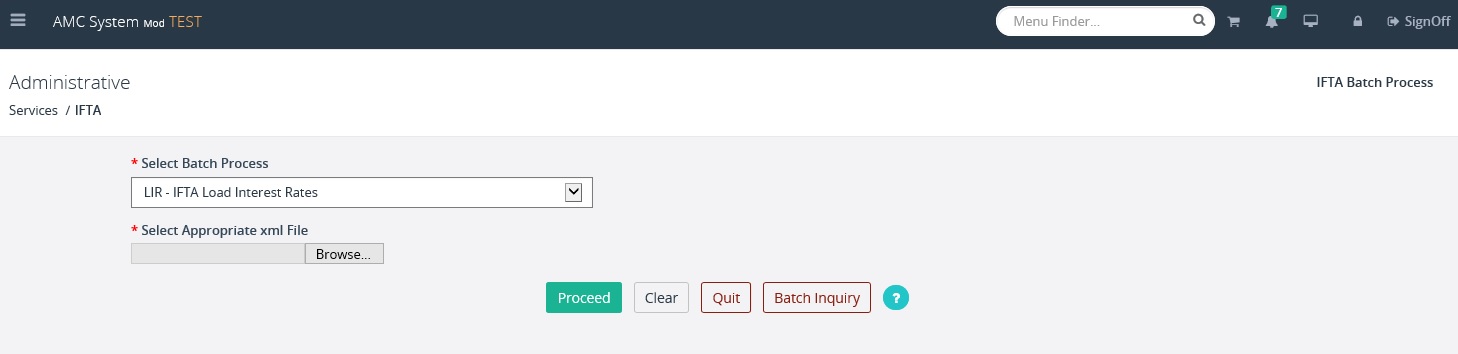

To load the IFTA Interest Rates and execute

the batch process do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Load Interest Rates as the

Batch Process from the drop down list

- Use the ‘Browse’ button to locate the

file to be loaded

·

Select PROCEED

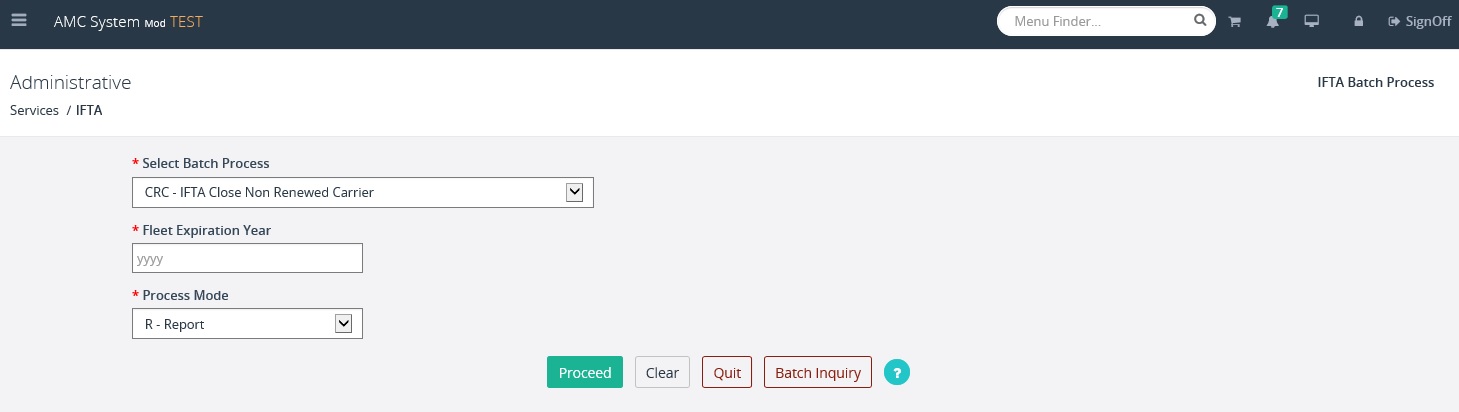

To execute the batch process and close Non

Renewed IFTA Carrier accounts do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Close Non Renewed Carrier as

the Batch Process from the drop down list

·

Enter the Fleet Expiration Year

·

Select the Process Mode (Report or Update)

·

Select PROCEED

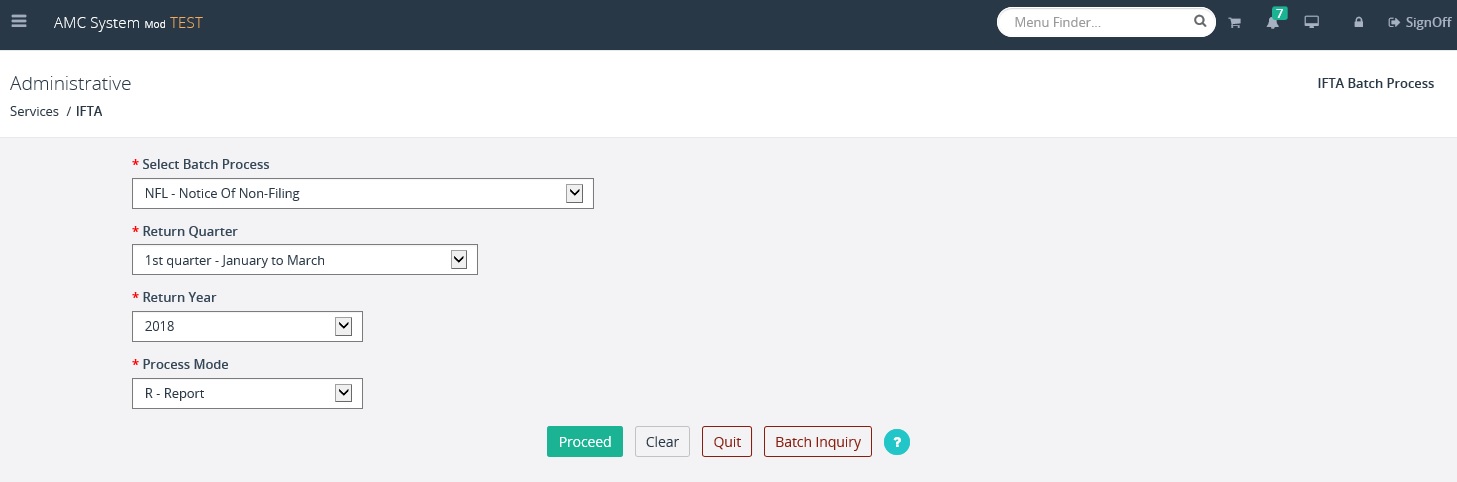

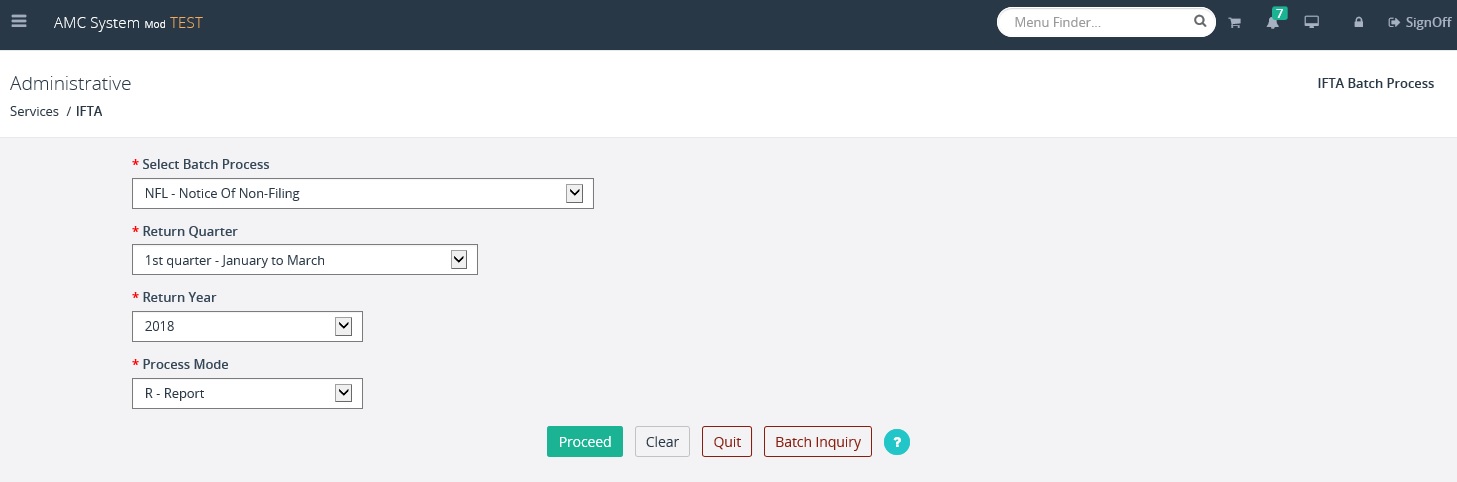

To execute the batch process for IFTA Notice of Non-Filing, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Notice of Non-Filing as

the Batch Process from the drop down list

·

Enter the Fleet Expiration Year

·

Select the Process Mode (Report or Update)

Select PROCEED

To execute the batch process for the IFTA Notice of Intent to Cancel Permit or License, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Notice of Intent to Cancel Permit or License

as the Batch Process from the drop down list

·

Enter the Return Quarter and Return Year

·

Select the Process Mode (Report or Update)

·

Select PROCEED

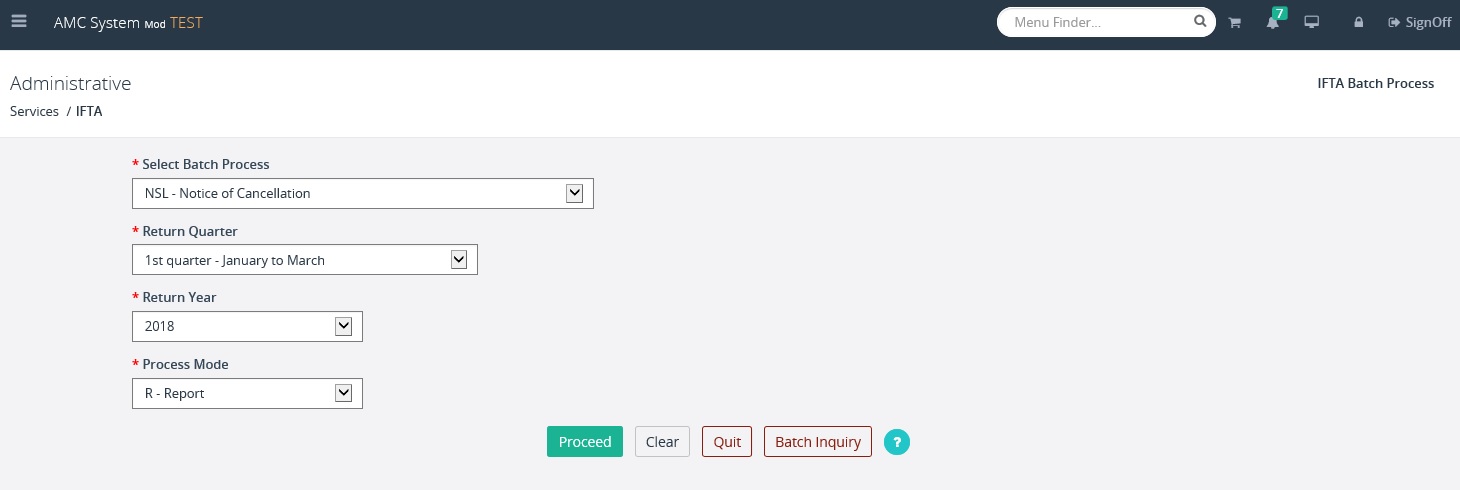

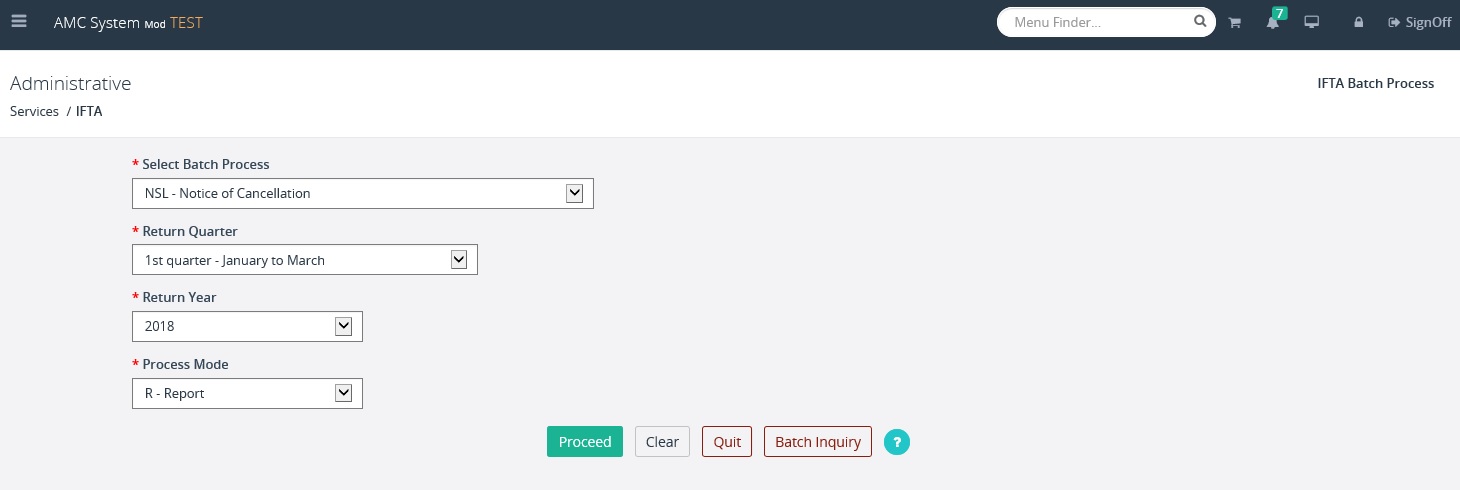

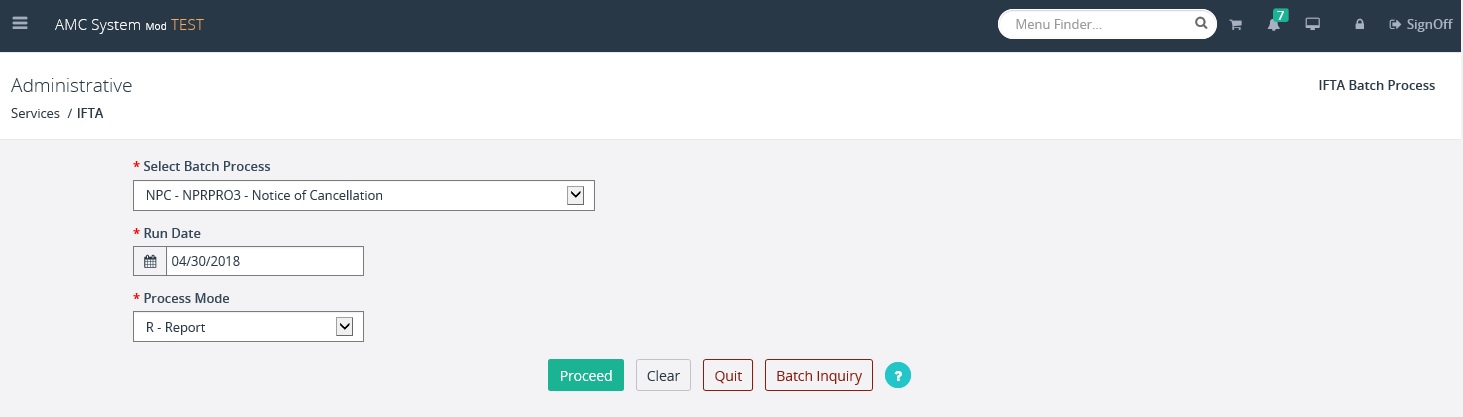

To execute the batch process for the IFTA Notice of Cancellation, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Notice of Cancellation

as the Batch Process from the drop down list

·

Enter the Return Quarter and Return Year

·

Select the Process Mode (Report or Update)

·

Select PROCEED

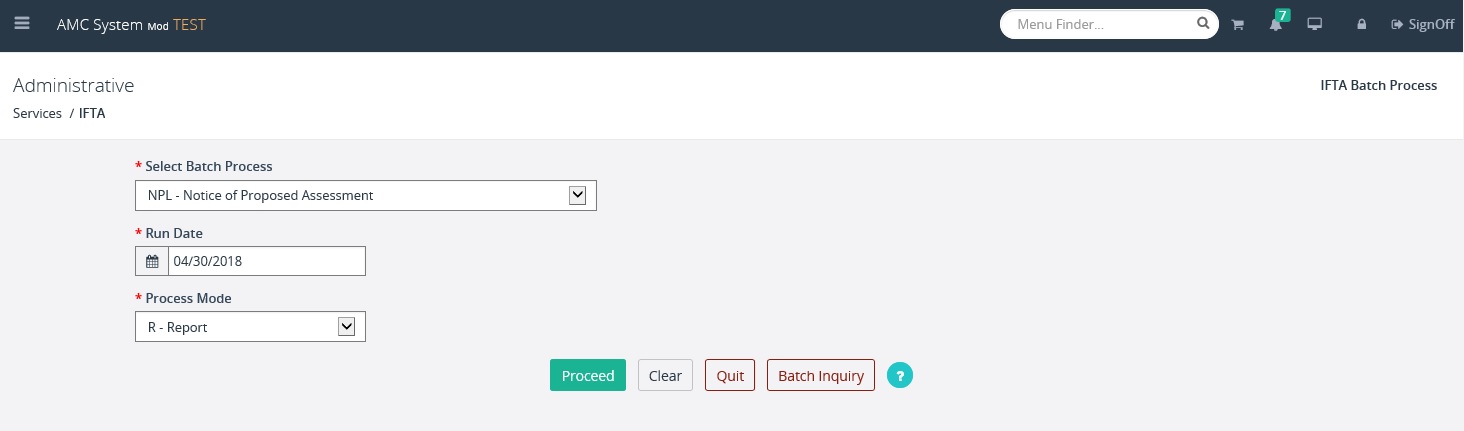

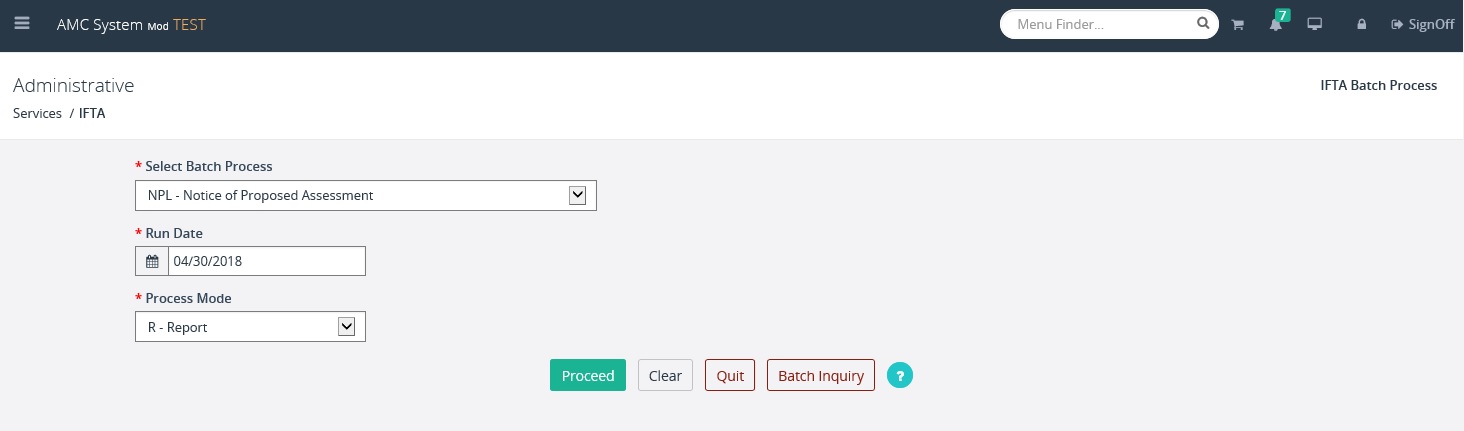

To execute the batch process and generate

the IFTA Non Payer Suspension First Letter do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Notice of Proposed Assessment as the Batch Process from the drop down list

·

Enter the Run Date (defaults to last date of the

previous month)

·

Select the Process Mode (Report or Update)

·

Select PROCEED

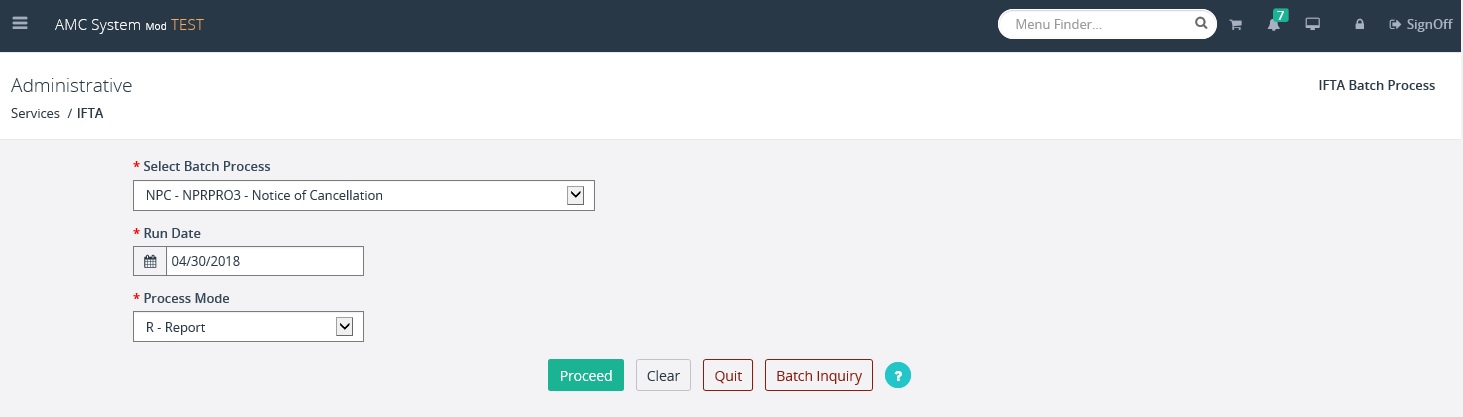

To execute the batch process for Final Assessment, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Final Assessment, Demand for Payment as the Batch Process from the drop down list

·

Enter the Run Date (defaults to last date of the

previous month)

·

Select the Process Mode (Report or Update)

·

Select PROCEED

To execute the batch process for Final Assessment, do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Final Assessment, Demand for Payment as the Batch Process from the drop down list

·

Enter the Run Date (defaults to last date of the

previous month)

·

Select the Process Mode (Report or Update)

·

Select PROCEED

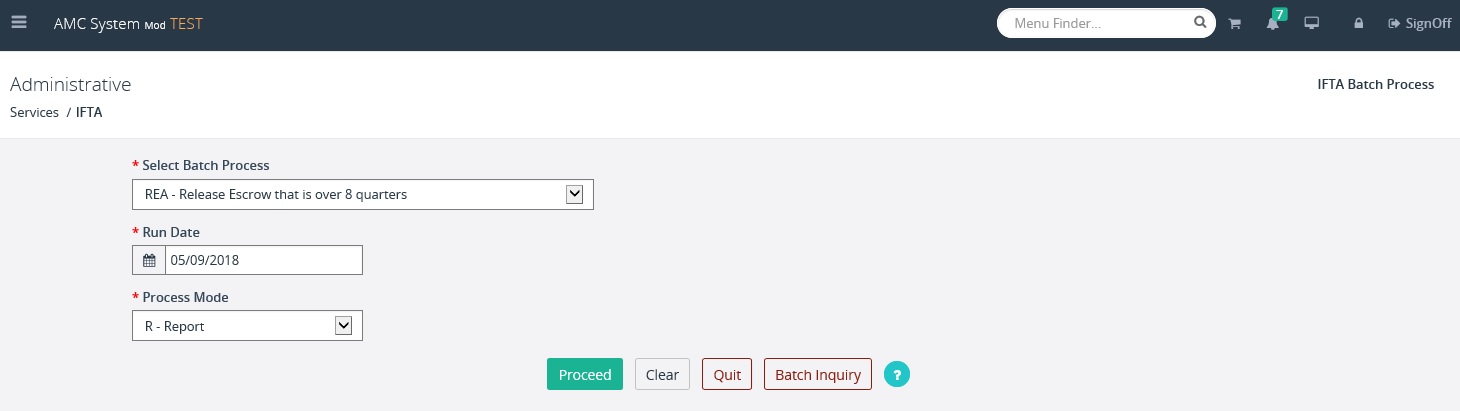

To execute the batch process and Release

Escrow that is over 8 quarters do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Release Escrow that is over 8

quarters as the Batch Process from the drop down list

·

Select or enter a Run Date (defaults to today’s

date)

·

Select the Process Mode (Report or Update)

·

Select PROCEED

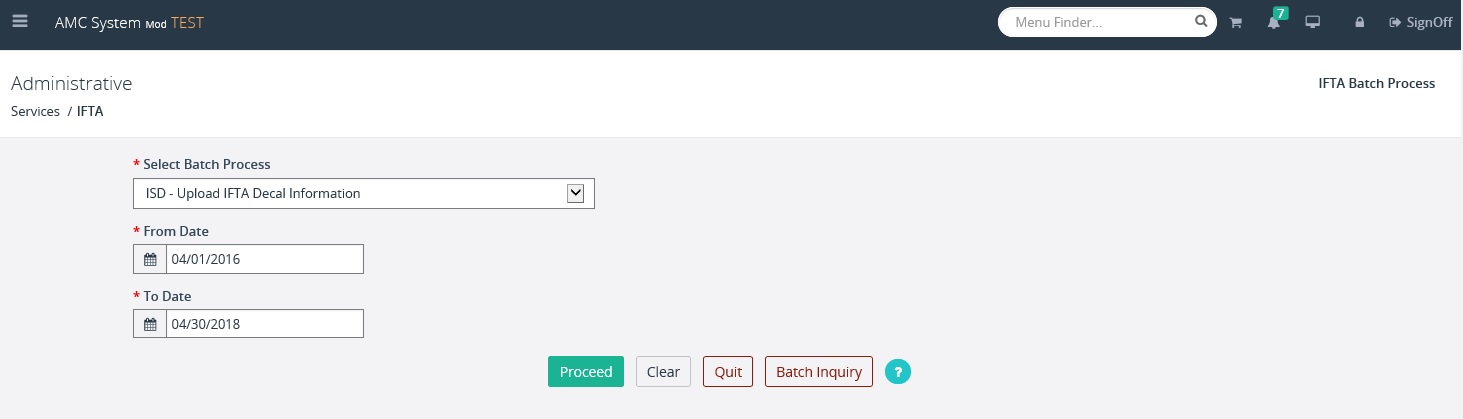

To execute the batch process and Upload

IFTA Decal Information do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Upload IFTA Decal Information as

the Batch Process from the drop down list

·

Enter the required FROM and TO dates in the

appropriate fields

·

Select PROCEED

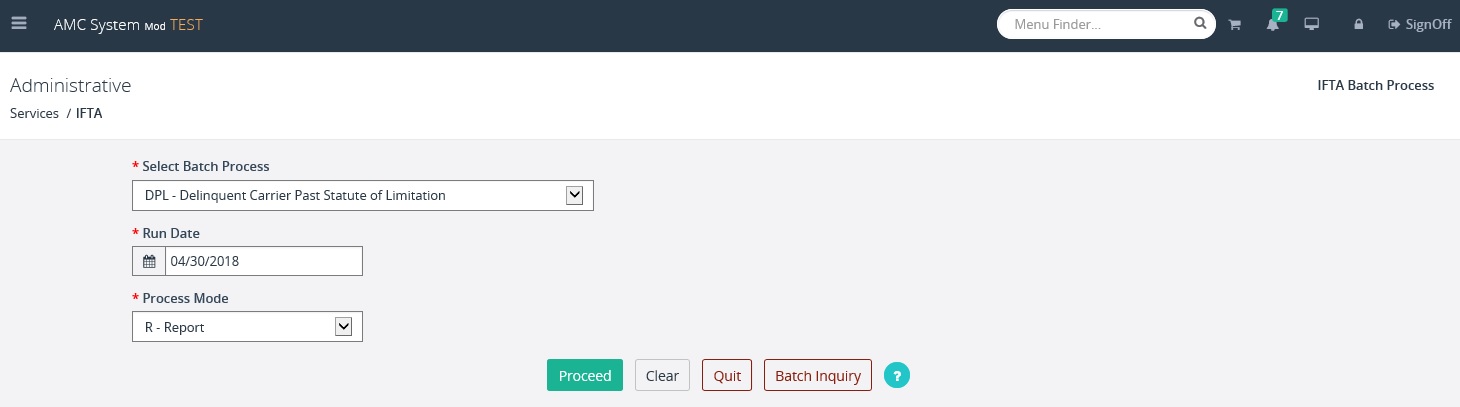

To execute the batch process and identify

delinquent carriers past the statute of limitation do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Delinquent Carrier Past Statute of

Limitation as the Batch Process from the drop down list

·

Enter the Run Date which defaults to the last

day of the previous month

·

Select the Process Mode (Report or Update)

·

Select PROCEED

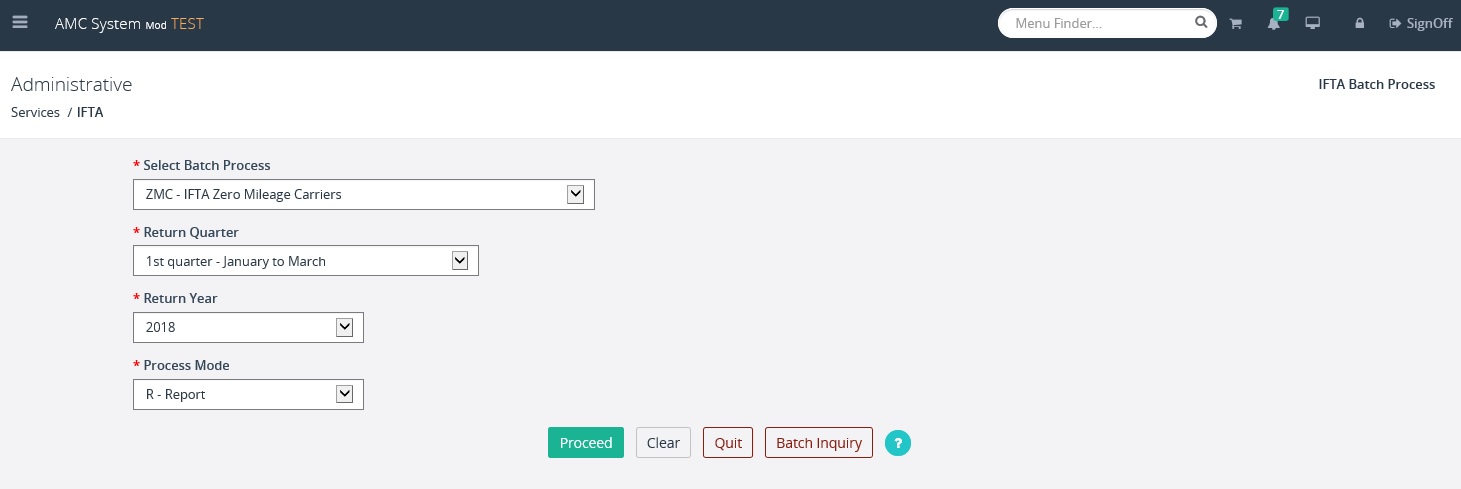

To execute the batch process and display a

list of carries with zero IFTA miles do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select IFTA Zero Mileage Carriers as the

Batch Process from the drop down list

·

Enter the required Return Quarter and Return

Year

·

Select the Process Mode (Report or Update)

·

Select PROCEED

To execute the batch process for Notice of Quarterly Tax Return do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Notice of Quarterly Tax Return as the

Batch Process from the drop down list

·

Enter the required Return Quarter and Return

Year

·

Select the Process Mode (Report or Update)

·

Select PROCEED

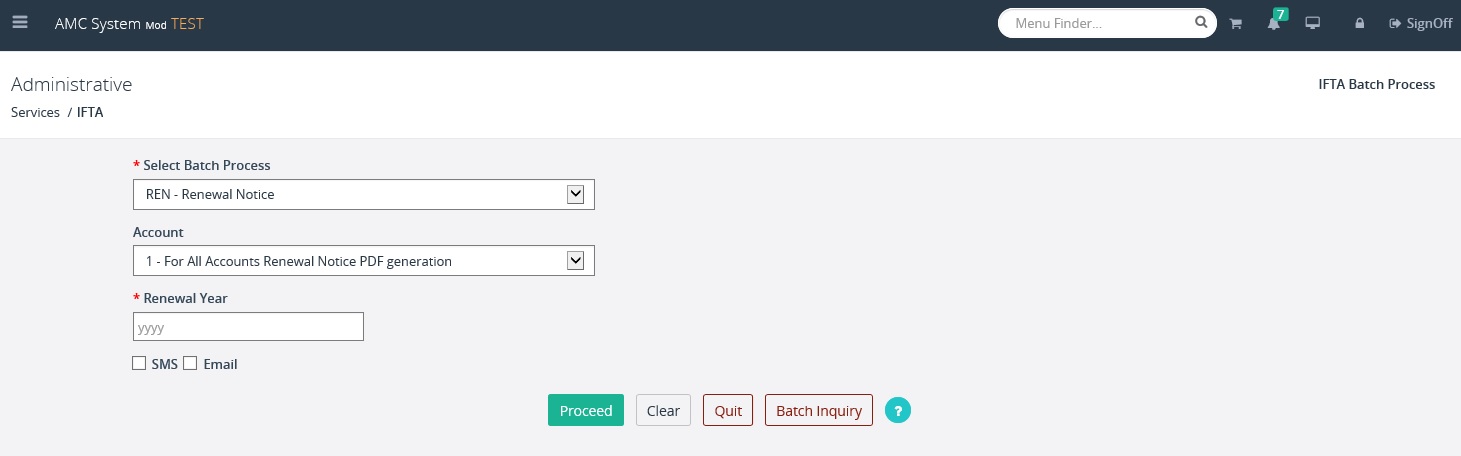

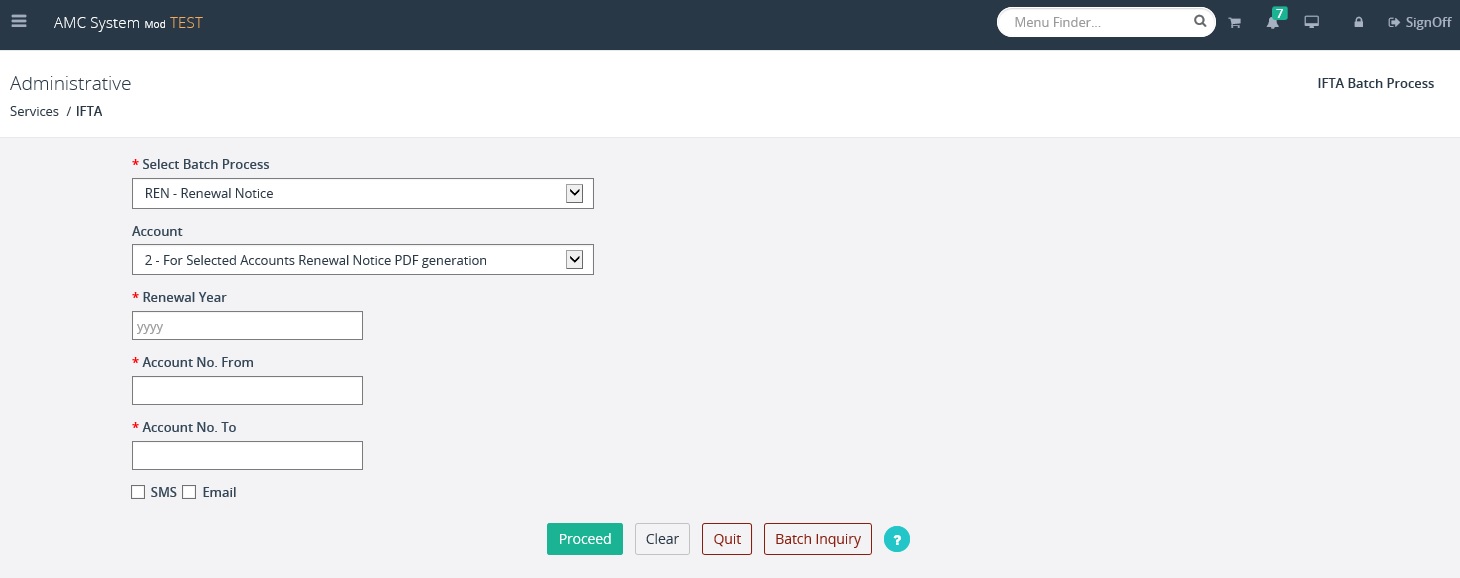

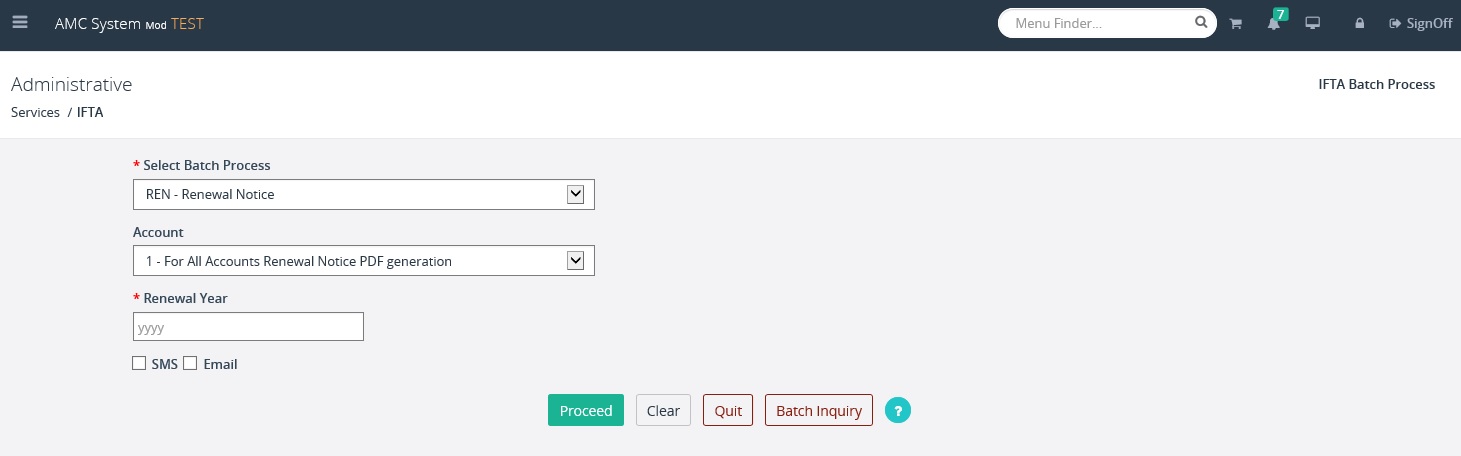

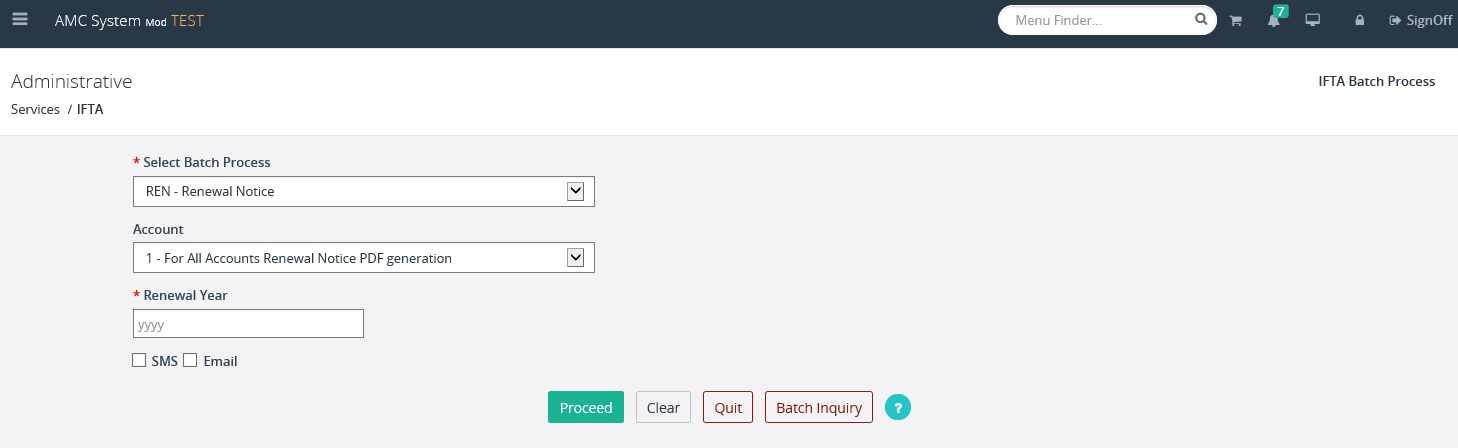

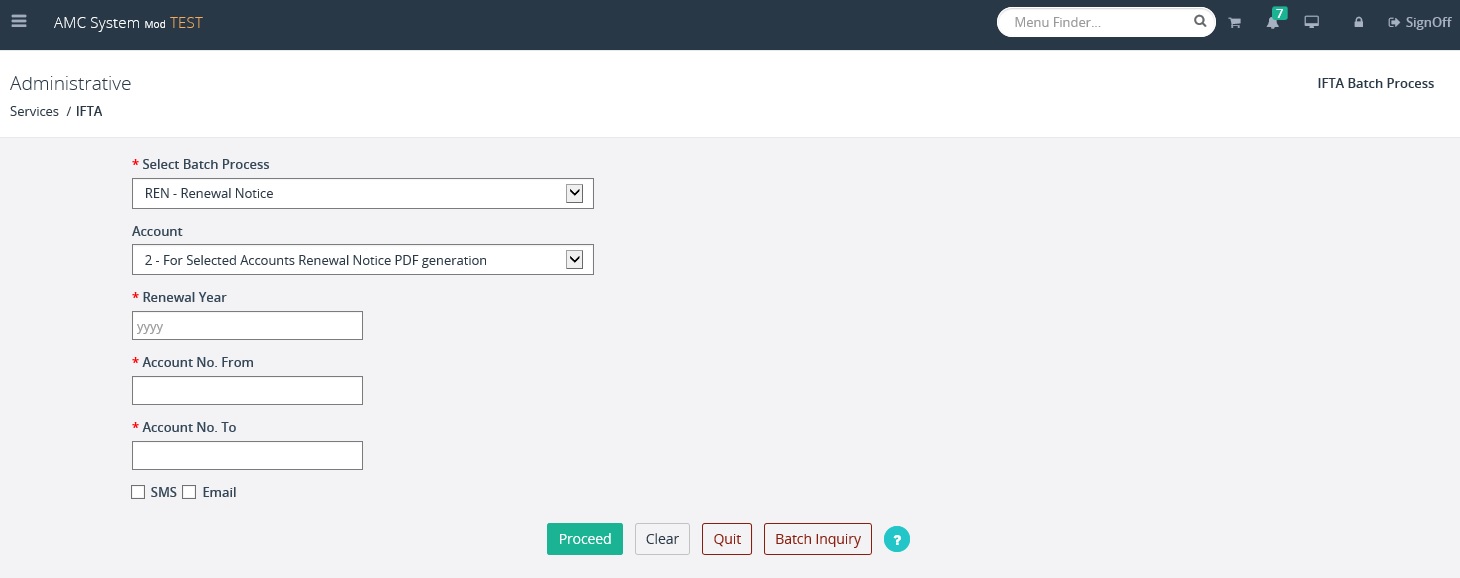

To execute the batch process and generate

the Renewal Notices do the following:

- From the IFTA application level menu,

select BATCH PROCESS from the ADMINISTRATIVE menu tile

- Select Renewal Notice as the Batch

Process from the drop down list

·

Select either All Accounts or Selected Accounts

o

If the Selected Accounts option is used, the

Account No. From and Account No. To fields are required to be entered

·

Enter the Renewal Year

·

A user can choose to also sent the renewal

notices via SMS or Email, just click the appropriate checkbox

To update IFTA tax interest waiver,

perform the following steps:

·

Select UPDATE TAX RATES from the ADMINISTRATIVE

menu tile at the IFTA application level menu

·

Enter the required Return Year and Return

Quarter in the applicable fields

·

Select PROCEED to display the tax rates

·

Check the ‘Waive Interest Flag’ for the

appropriate jurisdiction then select the UPDATE button

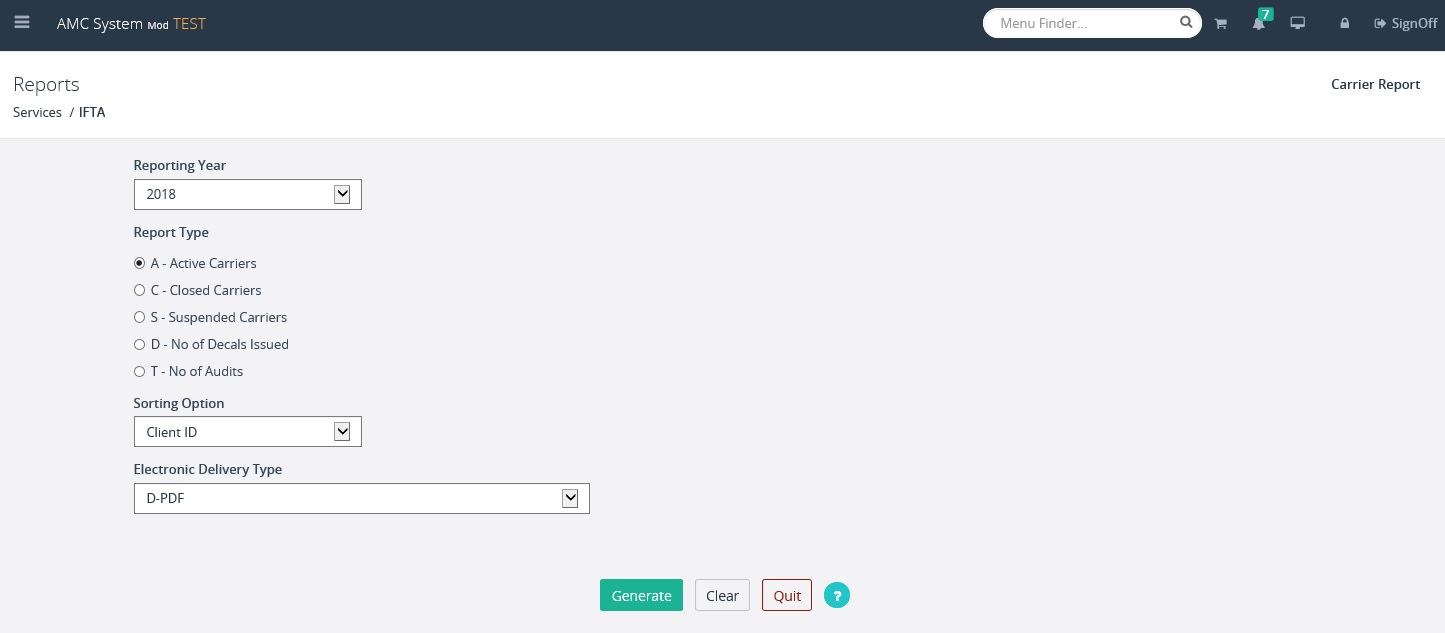

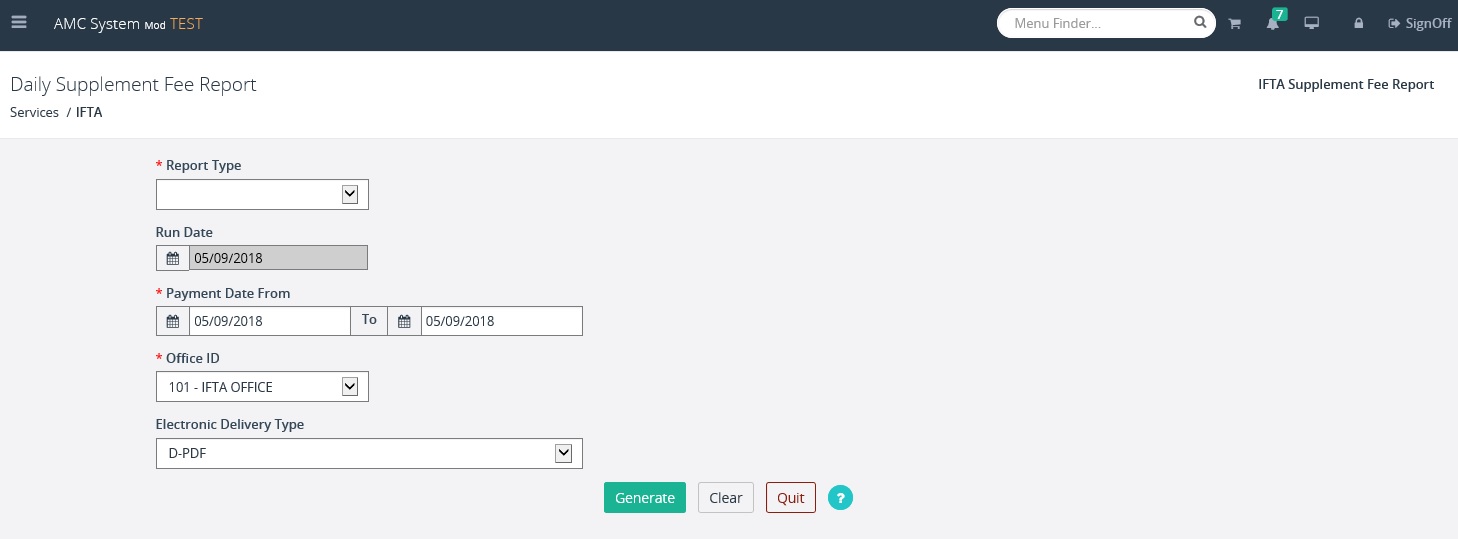

The following is a list of reports and

processes that are available by selecting the appropriate report options from

the REPORTS menu tile on the IFTA application level menu

- Carrier Report

- Supplement Fee Report

- IFTA Report

- FHWA Report

- Return Parameter Exception Report

- Filer Report

- Decal Request Report

- Zero Mileage Report

- Distance Comparison Report

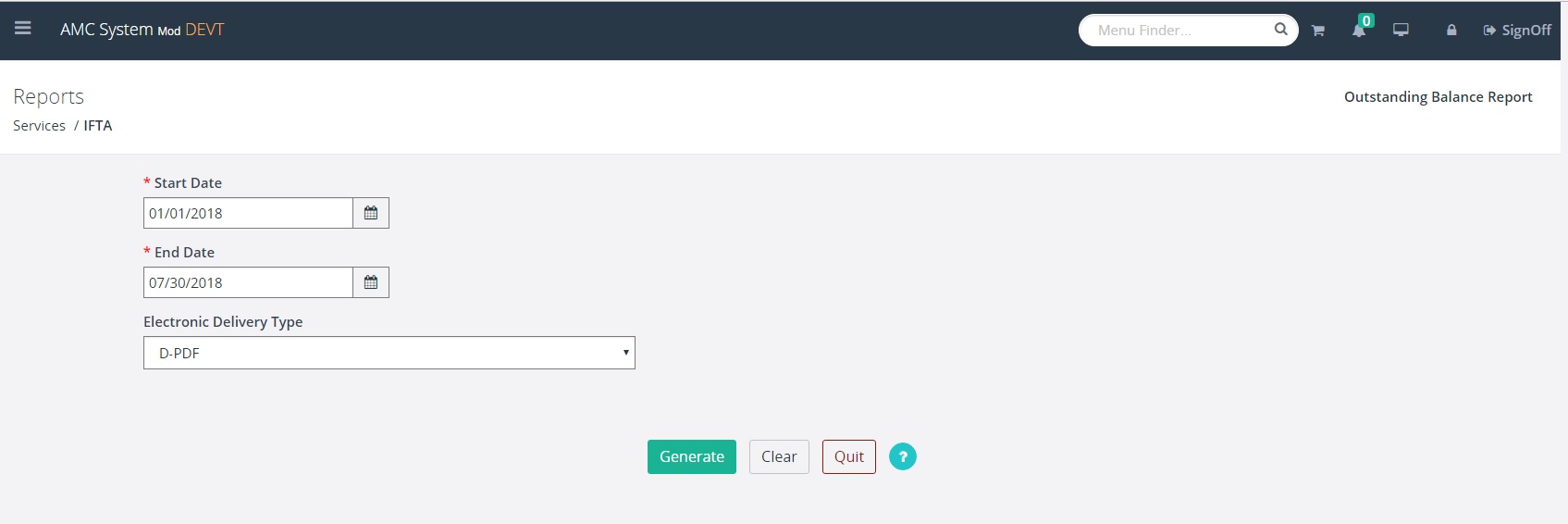

- Outstanding Balance Report

The report processes all provide a

similar initial screen where a date range or quarter and year are required.

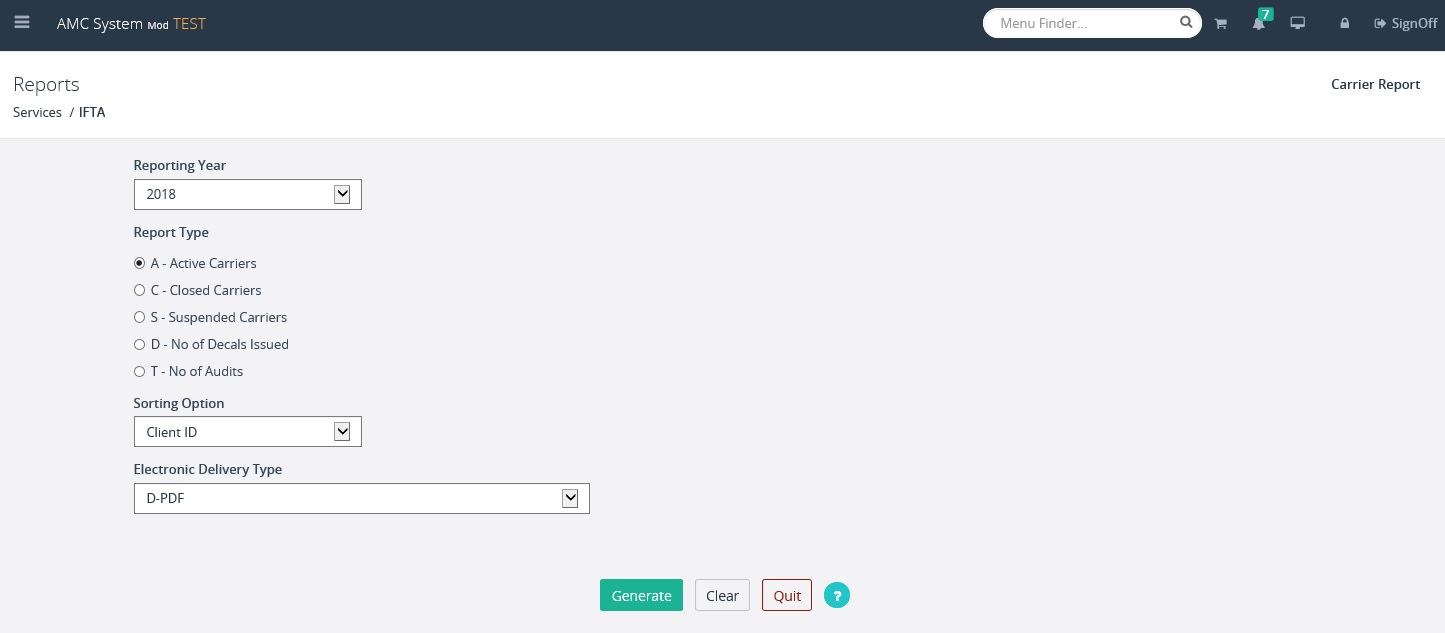

To generate the Carrier Report, the user

must select a Reporting year from the dropdown and select a Report type by

clicking the appropriate radio dial. The user can also select a sorting option

or leave the default (Client ID). Choose the Electronic Delivery Type then

click the GENERATE button to produce the report.

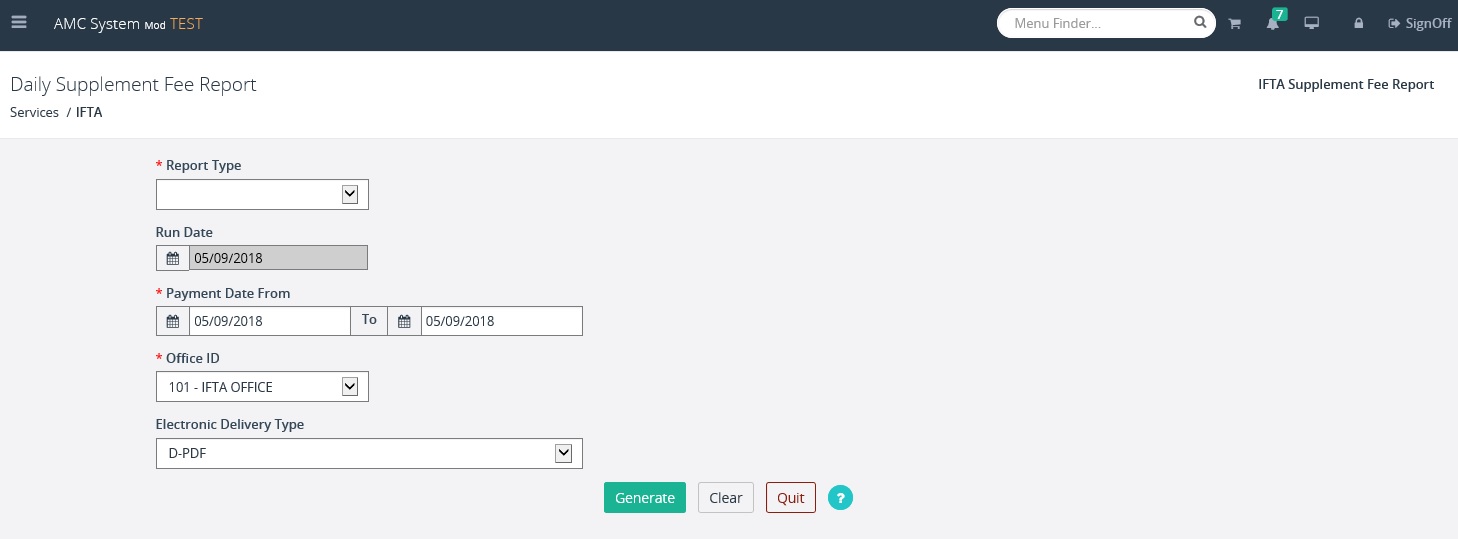

To generate the Supplement Fee report, select

the Report Type from the drop down, Payment date range (from and to), Office ID

from the drop down list, then select the Electronic Delivery Type from the drop

down list then click GENERATE.

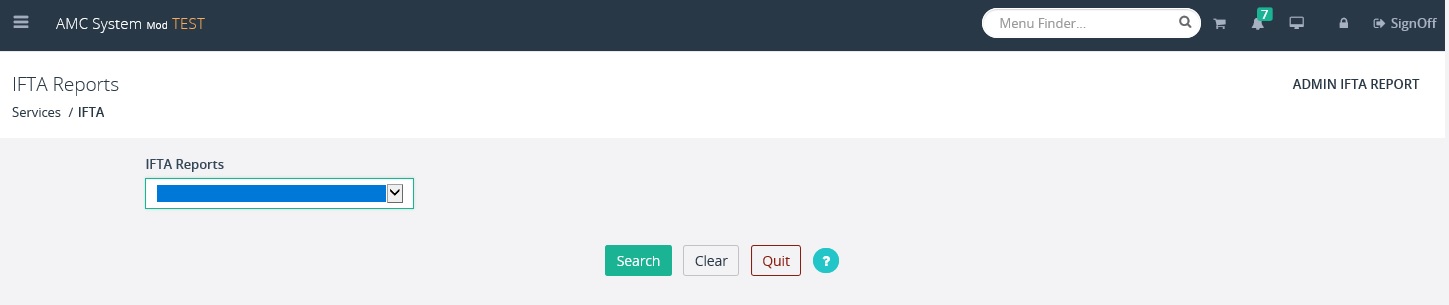

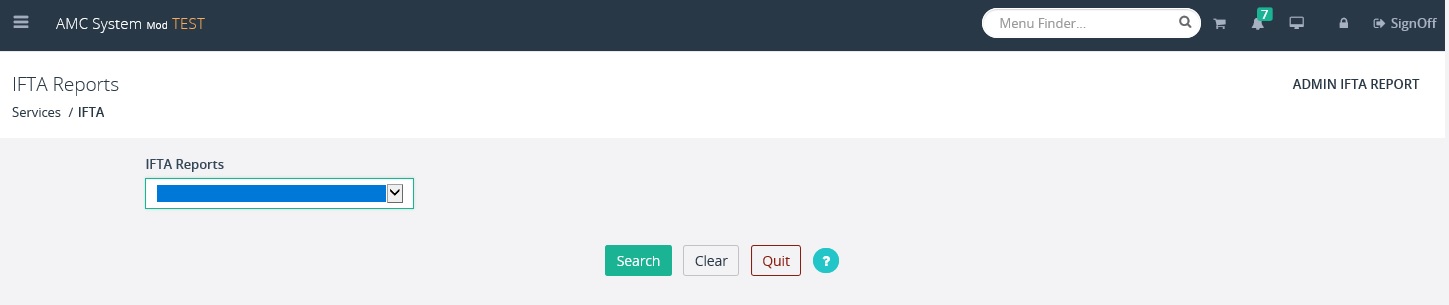

To generate the IFTA report, select the IFTA

Report type using the drop down, Enter or select the FROM and TO date range, and

select the Electronic Delivery Type from the drop down list then click SEARCH

to generate the report.

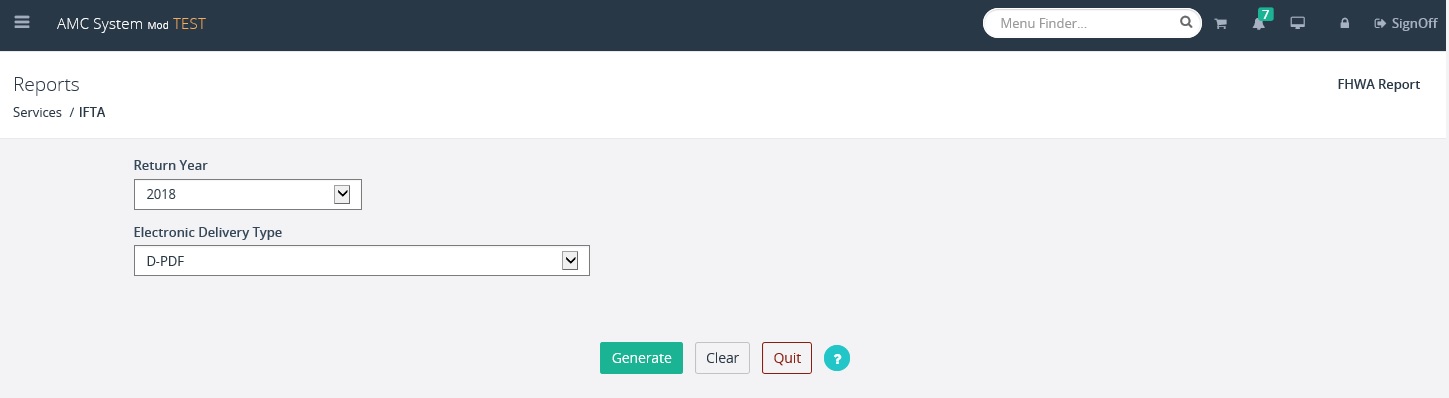

To generate the FHWA report select the Return

Year from the drop down list then select the Electronic Delivery Type and click

GENERATE.

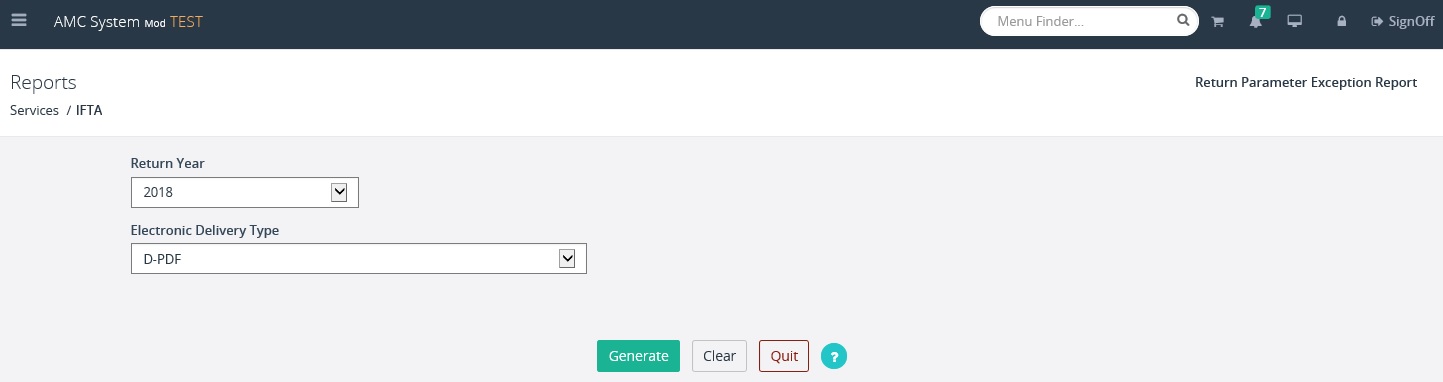

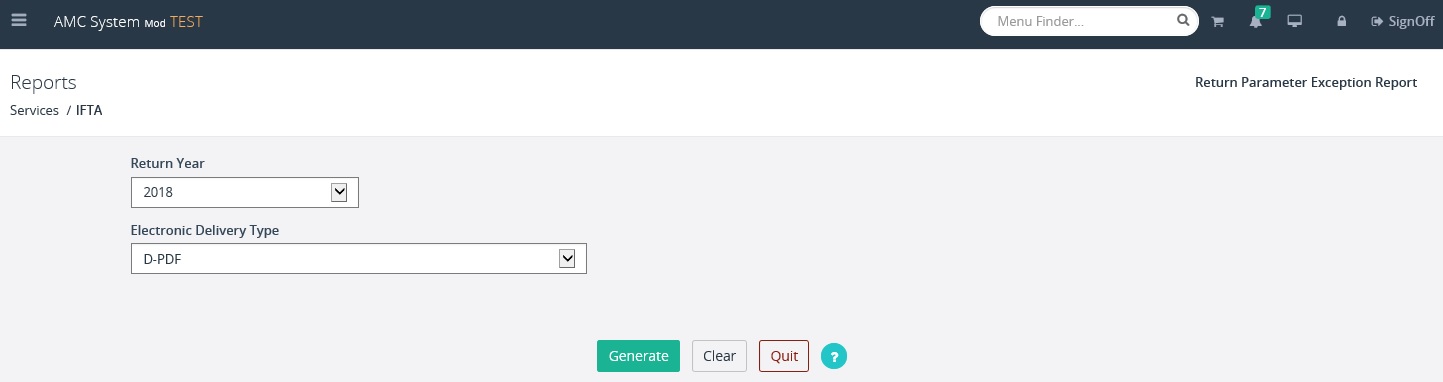

To generate the Return Parameter Exception report

select the Return Year from the drop down list then select the Electronic

Delivery Type and click GENERATE.

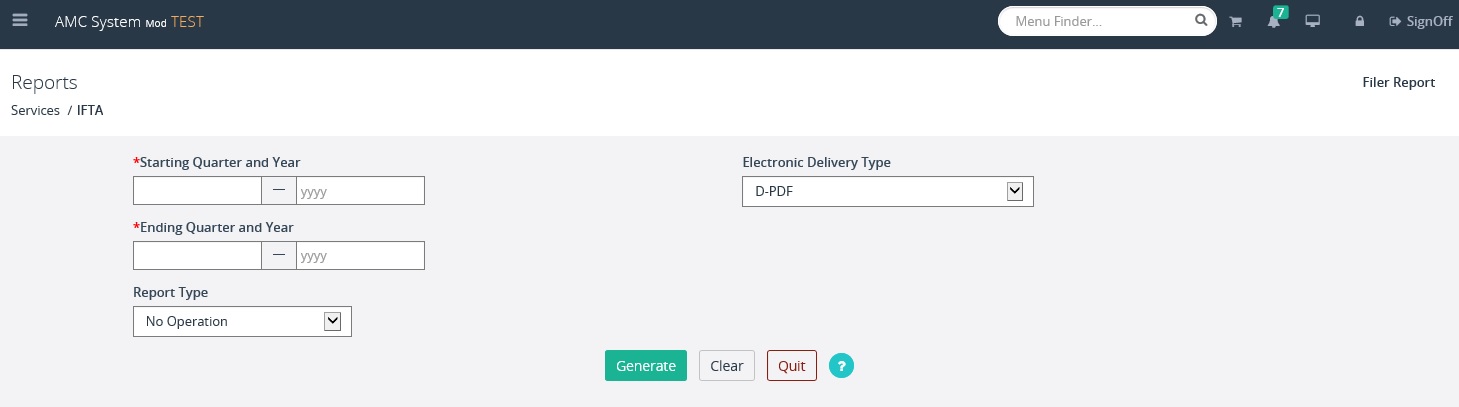

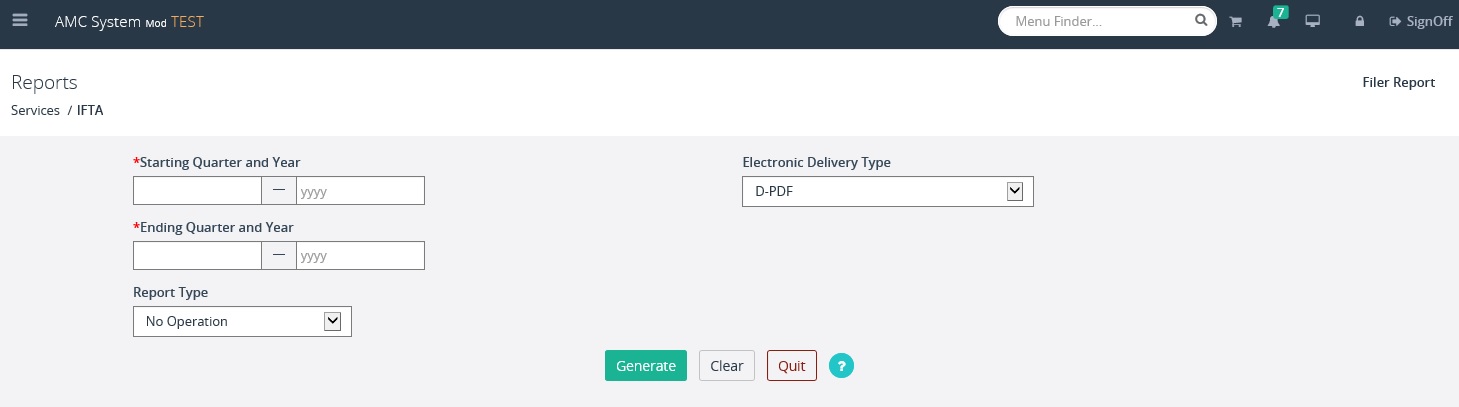

To generate the Filer report enter the

required Starting and Ending Quarters and Years in the appropriate fields,

select a Report Type then select the Electronic Delivery Type and click GENERATE.

To generate the Decal Request report, enter

the Start and End date range and select the Electronic Delivery Type from the

drop down list then click GENERATE.

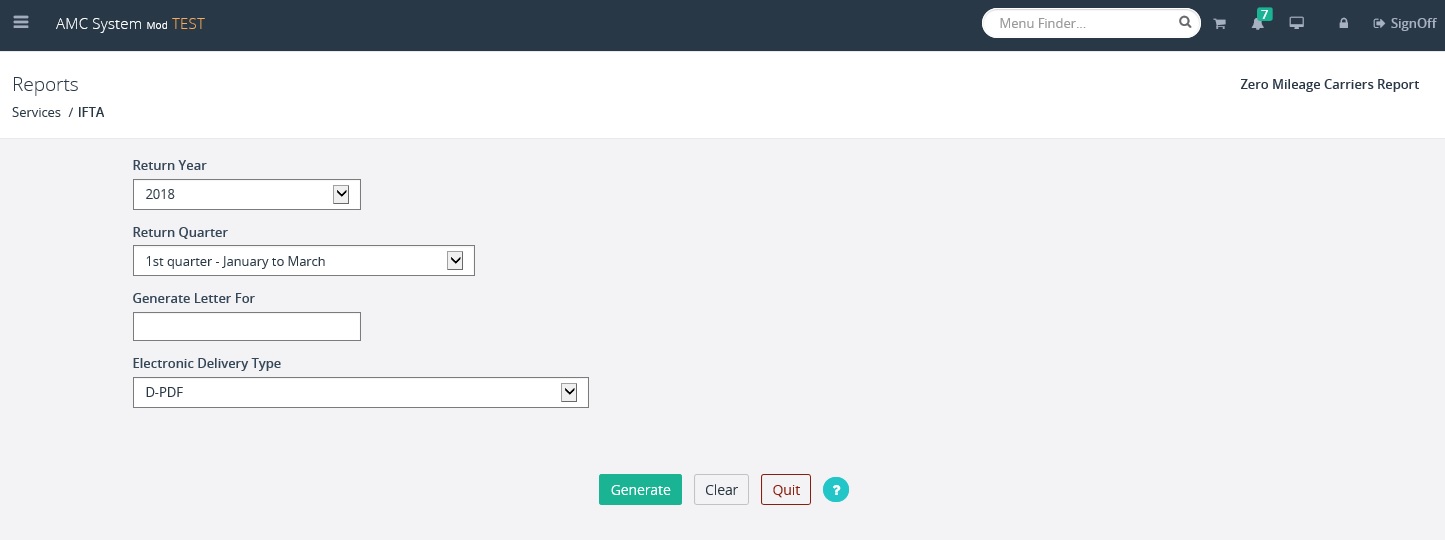

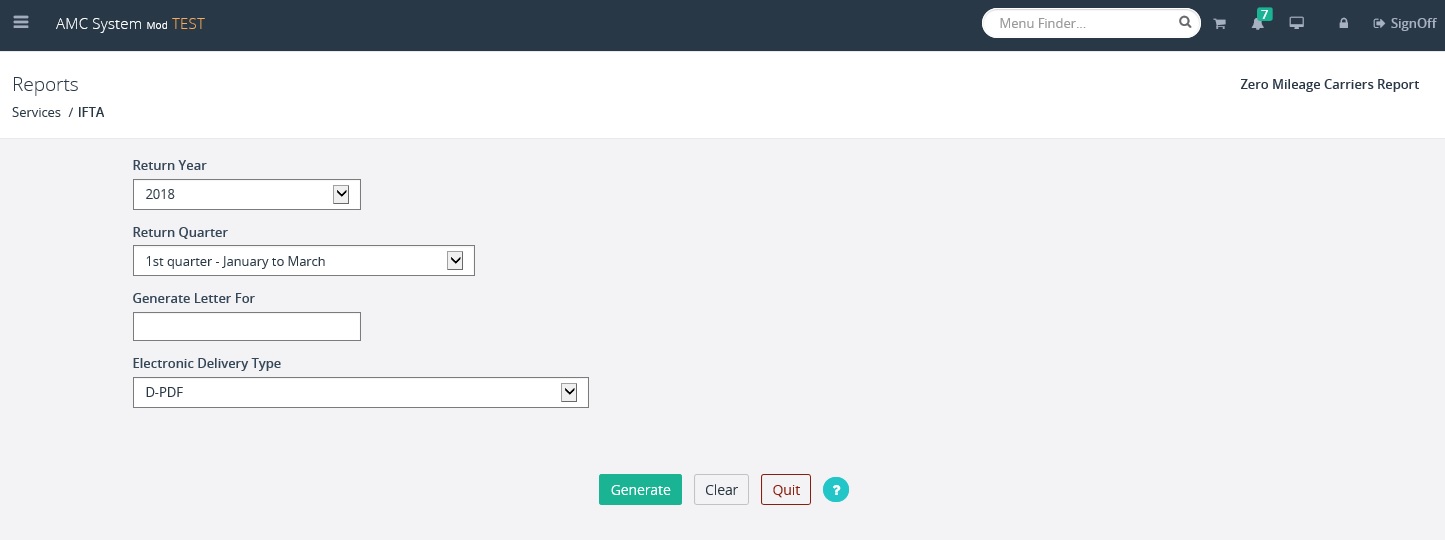

To generate the Zero Mileage Carrier report,

select the Return Year and Return Quarter, enter the Client ID/TIN in the

‘Generate Letter for’ field, select the Electronic Delivery Type then click

GENERATE.

To generate the Distance Comparison report